In this email:

- Meet David Garofalo

- Katusa Issues Special Situations Alert on GOLD ROYALTY CORP (GROY)

Dear reader,Every now and then you revisit a company and look at how undervalued it is.And then you realize they’re about to hit the tipping point…The market is rewarding companies that are cash-flowing and growing. And the company that’s got my attention today, in my opinion, appears to have both coming.Gold Royalty Corp (GROY.NYSE) is a mid-tier royalty company with a large, high-quality portfolio in excellent jurisdictions with strong organic revenue growth potential.The bigger companies, while they might have great portfolios, need mammoth transactions to really move the needle.They also usually trade at higher multiples.An ideal royalty company—in my opinion—has to be small enough that transactions can have an immediate material impact on the share price.This situation most often is possible in the <$1 Billion market cap range.

That’s Where David Garofalo Comes In

David is the General and mastermind behind Gold Royalty Corp (GROY).His journey to the top echelons of the mining world is no ordinary tale.As the former President and CEO of Goldcorp (top 3 gold producer in the world), he steered the company to its monumental merger with Newmont, creating the world’s largest gold miner.His expertise isn’t just deep – it’s diverse.Having helmed Hudbay Minerals (senior miner in Canada) and served as CFO of Agnico-Eagle (currently the 3rd largest gold producer in the world).Garofalo’s decision to lead GROY isn’t just a career move; it’s a strategic choice by a leader who’s shaped the gold mining industry.The Katusa Special Situations Team has identified this opportunity for MANY reasons:

- It has acquired 244 high-quality royalties in just three years.

- It has 72% of its asset base in Quebec and Nevada, mining-friendly jurisdictions.

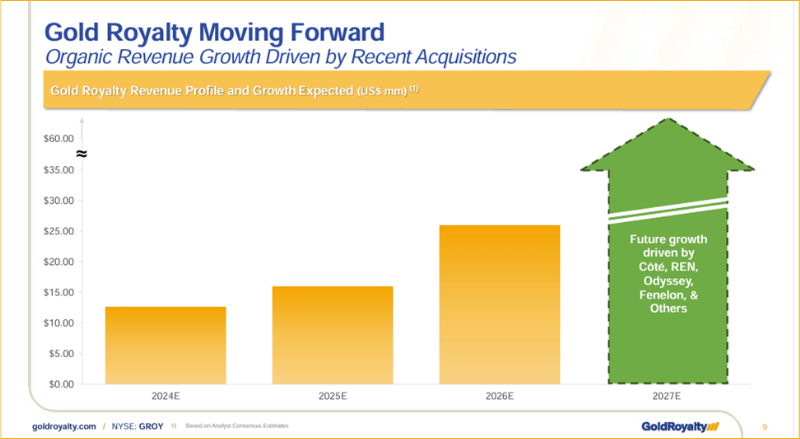

- It is on the precipice of cash flow and growth in 2024 and beyond (you’ll want to hear the numbers the CEO is talking about).

I’m HEAVILY biased, but my money is betting heavily where my mouth is.

Katusa Special Situations Company Alert:

Gold Royalty Corp.(GROY.NYSE)

Note: It goes without saying that this is a high-risk investment. If you have interest, you should definitely review the company’s disclosures under its profiles at www.sedarplus.ca and www.sec.gov for important information regarding the company and its assets.

Gold Royalty’s management has moved at lightning speed over the past three years, snapping up multiple smaller royalty companies and hundreds of royalties.Their aggressive moves – more than a 1,300% increase in total number of royalties since their March 2021 IPO – have moved them firmly toward the mid-tier of the market.Here’s why that’s important:Companies that stay in the low-tier range become zombies. They can’t raise money, and they can’t deploy capital.Meanwhile, mid-tier companies get higher valuations, and it’s easier for them to raise money to buy new royalties.Gold Royalty is trading at a discount to analyst consensus asset values.Its focus on premium asset acquisition has given it an average net asset value (NAV) of $452M on average among all seven analysts that cover it.

- The current share price gives Gold Royalty a 0.45 price/NAV (Consensus NAV) ratio.

And positive cash flow is expected in early 2024 based on the operator’s disclosure of ramping up production.

- Coté is over 90% percent complete and expected to begin operations by Q2 2024.

- Barrick aims to incorporate Ren—the underground extension at Goldstrike—into the mine plan “in the short term.”

These assets provide significant potential for revenue growth for Gold Royalty in the coming years.And that’s not including any “surprises” from future free exploration and drilling.While mining is a risky business, this is why the diversification of Gold Royalty’s portfolio of over 240 royalties is important. Not all assets need to become mines.Gold Royalty Corp’s operating partners invested $200 million in exploration and drilling on their properties last year alone.All of this exploration upside comes at little to no incremental cost to Gold Royalty Corp.Any ounces that may be delineated on royalty grounds through exploration and development, Gold Royalty generally has a royalty interest without contributing additionally for such work.That is the beauty of the royalty model.To review, Gold Royalty has:

- Multiple strong assets in mining-friendly jurisdictions

- Leadership with centuries of combined experience

- Over 240 royalties, with the majority in Quebec, Ontario, and Nevada

- Strong Expected Organic Revenue Growth

- Trading below Analyst Consensus Estimates of Net Asset Value

And that makes this an opportunity I think you should research further.

Click here to read the full Gold Royalty Corp Report

Regards,Marin Katusa and the KR Special Situations Team

DISCLOSURES/DISCLAIMER

IMPORTANT DISCLAIMER: Katusa Research, as a publisher, is not a broker, investment advisor, or financial advisor in any jurisdiction. Please do not rely on the information presented by Katusa Research as personal investment advice. If you need personal investment advice, kindly reach out to a qualified and registered broker, investment advisor, or financial advisor. The communications from Katusa Research should not form the basis of your investment decisions. Examples we provide regarding share price increases related to specific companies are based on randomly selected time periods and should not be taken as an indicator or predictor of future stock prices for those companies.Gold Royalty Corp. has reviewed and sponsored this article. The information in this newsletter does not constitute an offer to sell or a solicitation of an offer to buy any securities of a corporation or entity, including U.S. Traded Securities or U.S. Quoted Securities, in the United States or to U.S. Persons. Securities may not be offered or sold in the United States except in compliance with the registration requirements of the Securities Act and applicable U.S. state securities laws or pursuant to an exemption therefrom. Any public offering of securities in the United States may only be made by means of a prospectus containing detailed information about the corporation or entity and its management as well as financial statements. No securities regulatory authority in the United States has either approved or disapproved of the contents of any newsletter.Katusa Research nor any employee of Katusa Research is not registered with the United States Securities and Exchange Commission (the “SEC”): as a “broker-dealer” under the Exchange Act, as an “investment adviser” under the Investment Advisers Act of 1940, or in any other capacity. He is also not registered with any state securities commission or authority as a broker-dealer or investment advisor or in any other capacity.HIGHLY BIASED: In our role, we aim to highlight specific companies for your further investigation; however, these are not stock recommendations, nor do they constitute an offer or sale of the referenced securities. Katusa Research has received cash compensation from Gold Royalty Corp. in the amount of $250,000 in Nov 2023 and second payment of $250,000 in Dec 2023 and is thus extremely biased. Members of Katusa Research also own shares in Gold Royalty Corp.It is crucial that you conduct your own research prior to investing. This includes reading the companies’ SEDAR and SEC filings, press releases, and risk disclosures.The information contained in our profiles is based on data provided by the company, extracted from SEDAR and SEC filings, company websites, and other publicly available sources.HIGH RISK: The securities issued by the companies we feature should be seen as high risk; if you choose to invest, despite these warnings, you may lose your entire investment. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures.NOT PROFESSIONAL ADVICE: By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim. While Katusa Research strives to provide accurate and reliable information sourced from believed-to-be trustworthy sources, we cannot guarantee the accuracy or reliability of the information. The information provided reflects conditions as they are at the moment of writing and not at any future date. Katusa Research is not obligated to update, correct, or revise the information post-publication.FORWARD-LOOKING STATEMENTS: Certain of the information contained herein and in the Company’s disclosures referenced herein constitutes “forward-looking information” and “forward-looking statements” within the meaning of applicable Canadian and U.S. securities laws (“forward-looking statements”), which involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, performance and achievements to be materially different from the results, performance or achievements expressed or implied therein. Forward-looking statements, which are all statements other than statements of historical fact, include, but are not limited to, statements respecting the Company’s strategies, expectations regarding gold markets, expectations regarding the operations and results of the operators of the projects underlying the Company’s interests and expectations regarding future production and revenues from the Company’s royalties. Forward-looking statements are based upon certain assumptions and other important factors, including assumptions relating to commodities prices and the business of the Company. Forward-looking statements are subject to a number of risks, uncertainties and other factors which may cause the actual results to be materially different from those expressed or implied by such forward-looking statements, including those set forth in the Company’s Annual Report on Form 20-F and its other publicly filed documents under its profiles at www.sedarplus.ca and www.sec.gov. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Company does not undertake to update any forward-looking statements, except in accordance with applicable securities laws.Readers should review Gold Royalty’s public disclosures at www.sedarplus.ca and www.sec.gov for important information regarding it and its assets.