You’ve heard the names…Blackstone, Carlyle Group, Thoma Bravo.But who are they and what kind of money do they put to work?One of the lesser-known market sectors of the investment world, Private Equity (PE) has long been a black box to the public at large.And yet, the tremendous growth in valuations and attention for private equity have dragged it much more clearly into the spotlight.For those of you who aren’t aware…Private equity is an industry very similar to traditional asset management.In its simplest form, private equity is owning either wholly or a stake in a company that’s not publicly traded.

Here’s how Private Equity Works…

1. PE firms will look for deals and acquisitions that they think they can grow the value of.

2. They will then raise money from investors in order to buy said companies.

3. This is done by using a fund, known as a Limited Partnership, as a vehicle. In this setup, the investors who provided capital are then referred to as Limited Partners.

4. These funds are then used to acquire a prospective business. Most commonly, this is done through a buyout deal, though venture capital and growth equity deals are also popular. Some PE funds even specialize in turning around distressed companies or buying deals off other PE firms.

5. Once a purchase has been made, the PE firms will act as General Partners, managing the business and making improvements as necessary. The goal here for the PE firm is to grow the value of their newly acquired business with their expertise and resources.

6. The final step in the process is often an exit for the deal, in one of many ways – most often through an IPO, a secondary sale, or a strategic sale.

In this way, PE firms can be thought of as specialized fund management companies.

The Velvet Cord and Private Equity Size

Private equity investments can be more sophisticated.Investors don’t have the ability to easy exit out of the deal if it goes south.On top of this, PE deals often involve significant amounts of capital.Hence, they are considered higher risk.That’s why private equities tend to be restricted to institutional investors such as large institutional funds or state-owned wealth funds, university endowments, or accredited investors.Those of you who have participated in private placements and financings in the past would be familiar with this concept.What you might find unfamiliar on the other hand is just how big the private equity market is.

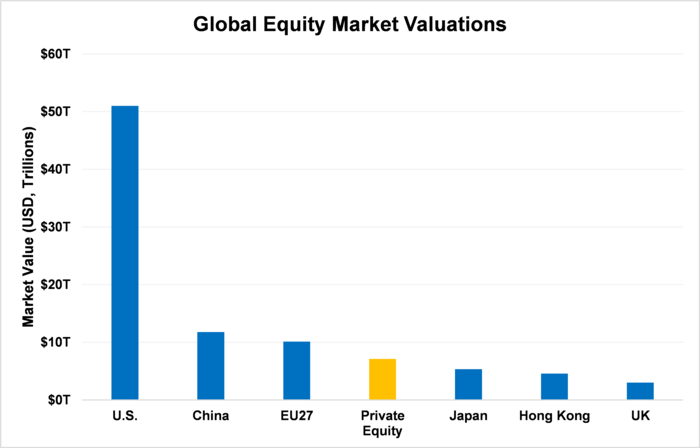

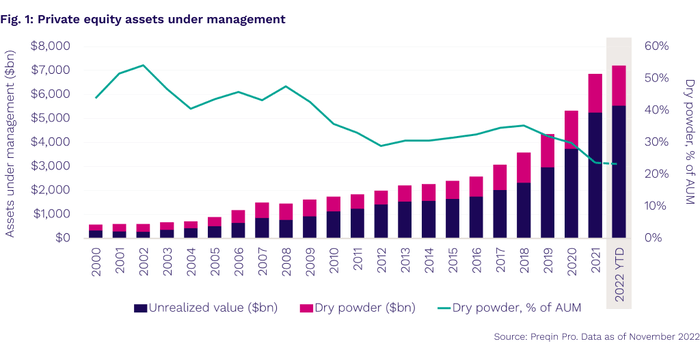

- Near the end of 2022, the total size of the global private equity market was estimated to be worth around $7.1 trillion USD.

The global equity markets are worth around $110 trillion.The private equity markets are worth a respectable 6.5% of that.

- If private equity was a country, it’d be the fourth-largest equity market in the world.

That’s not an amount of money you can sneeze at, as the chart above shows.Who has all this money, and how is it being used?Let’s break down the private equity market.

Making It Rain: Names to Know in the PE Sector

There are a couple different metrics to consider when talking about PE firms.

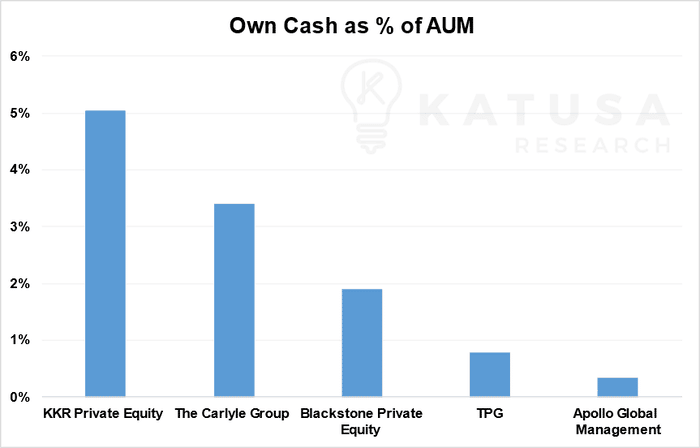

- Two of the most prominent are assets under management and cash raised.

Assets under management, or AUM, should be self-explanatory.Like with traditional funds, larger, more well-established firms tend to have more capital under their umbrella.Cash raised, however, is arguably an even more important metric.Most PE firms don’t actually put up that much cash in their deals.Instead, the majority of their capital comes from their investors (Limited Partners, or LPs).Take a look at some of the largest publicly traded PE firms, and how their own cash positions size up against their total AUM:

These 5 firms are among the largest in the sector in terms of both AUM as well as cash raised.However, as you can see, their own cash positions represent just a small fraction of the total amount of money they manage.

Being able to raise more investor funds from LPs is what allows PE firms to go after the big, multi-billion dollar buyouts they’re so fond of.Without this, PE firms wouldn’t be able to grow the way they want to.

The “Rainmakers”

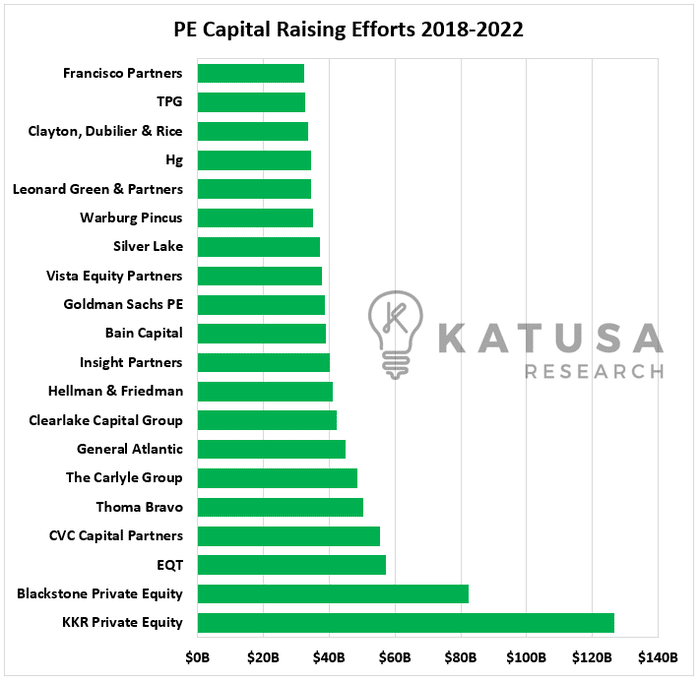

In the PE industry, the ones who are best at raising capital are king – the rainmakers.With that said, let’s take a look at the 20 PE firms who raised the most cash in the last five years:

Though the above companies are ranked by the cash they’ve raised and not their AUM, they still represent around half of the total AUM in the PE markets.Which makes sense – the larger firms tend to be more successful with large raises.

Top 25 control 25%

25 PE firms held 25% of the entire industry’s cash reserves.18 of these companies were American, while the remaining 7 were based in Europe.

However, these record cash levels only tell one side of the story.The other side of the story is that even as cash reserves have grown, cash as a percentage of total AUM has been on a steady decline over the past several years and is at an all-time low of 23%.Put all this data together, and it gives us some clues about PE markets as we start 2023…

PE in a Higher Interest Rate Market

Between low deal activity and large cash reserves, it signals that there are tons of buyers lined up looking for cheap assets.And there are far more buyers than sellers at the moment, given how exit activity has been.Next week we’ll feature part 2 of this private equity series and how it relates to mining and resources.Stay tuned,Marin Katusa

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws.

By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim.

If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.