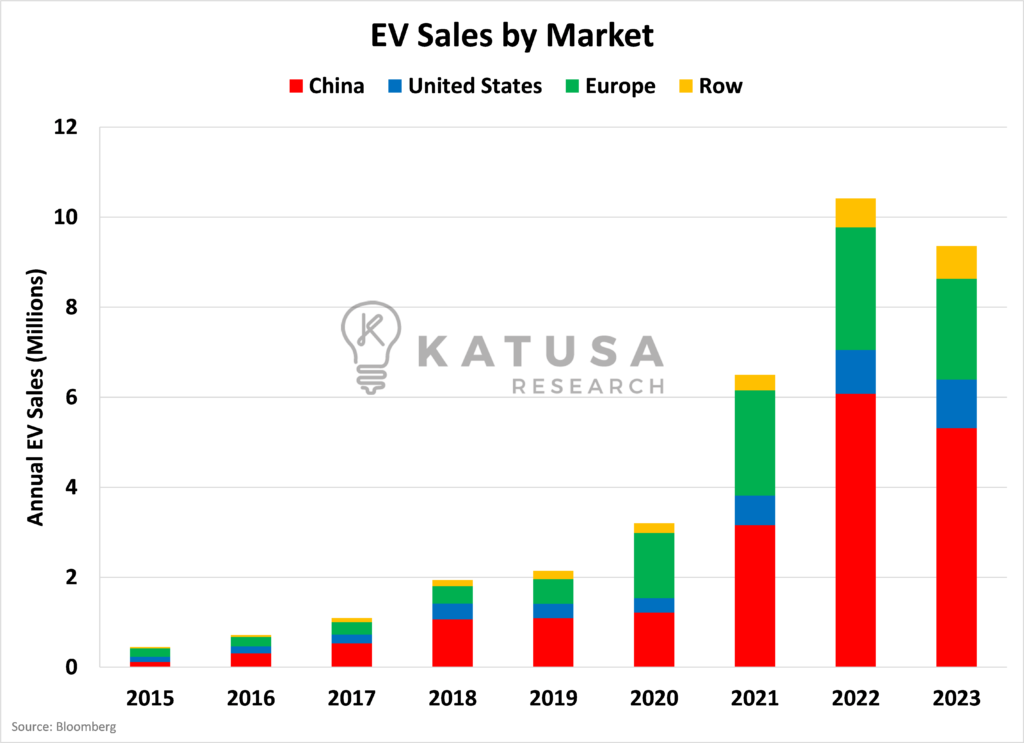

Dear Reader,Four years ago, a Tesla Model 3 was $10,000 more than the average new car in the U.S. That made it a difficult decision for new-car buyers.Today, an improved Tesla Model 3 is $5,000 less than the average new car in the U.S.And on January 1 this year, the $7,500 tax credit for EVs will change to a simple discount—making it effectively a coupon on the car’s price.In total, that makes a new Tesla 25% cheaper than the average new U.S. car.It also makes the U.S. the next big EV market.The EV market has been predominantly driven by China, where market penetration surged from 5.7% in 2020 to 33% by 2023.That incredible move was due almost entirely to subsidies that put EVs at price parity with gas cars.

Now, the United States is in exactly the same position as China in 2020: just over 5% market penetration… and targeting 50% within six years.2023 was the inflection point. It was the first year more than one million EVs were sold in the U.S.—with more than 1.3 million EVs sold.And the next two years are set to take it to 30% EV penetration.Which is why the Inflation Reduction Act (IRA) introduced massive EV subsidies. The $7,500 is the most famous one, but there are others that really matter to car manufacturers like Tesla.

- If Tesla hits its target of 1.5TWh of battery production in 2030, IRA credits are worth more than $60 billion a year.

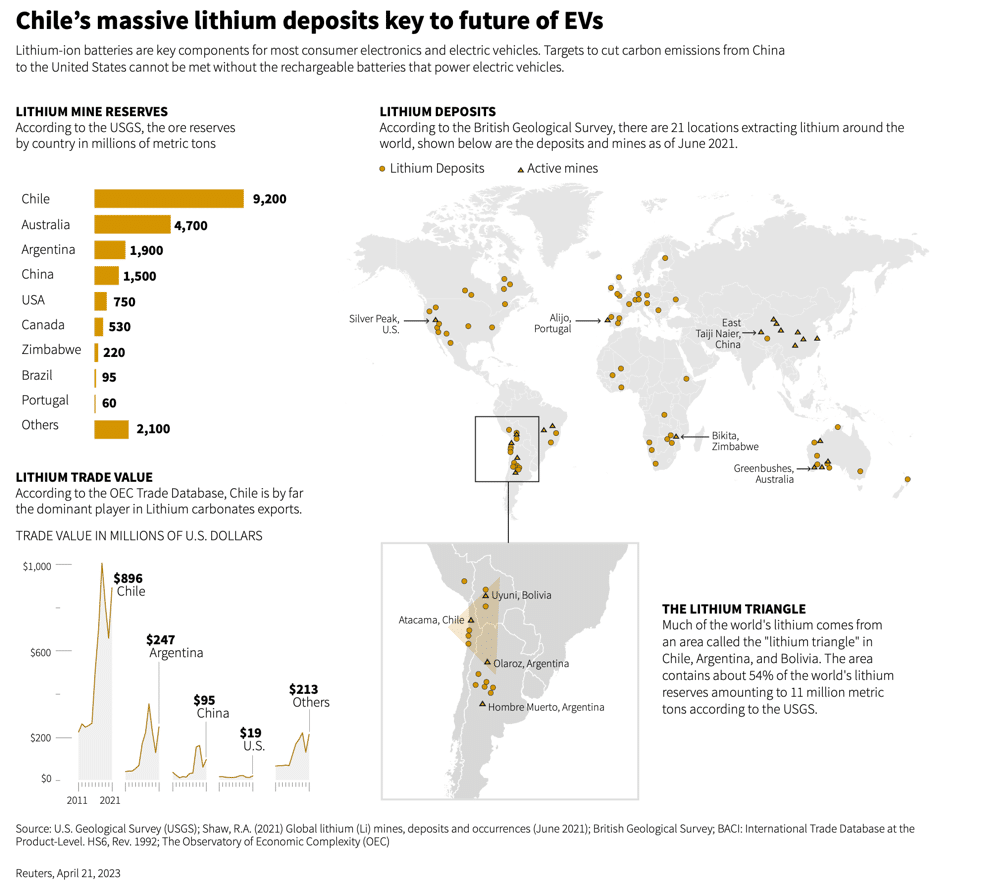

Tesla is extremely confident that they will be able to capture all those incentives, making them one of the lowest-cost manufacturers.The problem is that those incentives come with one giant string attached: the lithium cannot be extracted or processed by a “foreign entity of concern.”In other words, NO CHINESE LITHIUM. The only problem is that China has its hands in nearly every pot of lithium in the world.It’s China All the Way DownChina is the third-largest producer of lithium in the world, but a distant third when it comes to lithium reserves, at only 15%.So in the late 2010s, it began scouring the globe, snapping up any lithium mine that would take its money.Other than China, there are really only two places in the world with producing mines: Australia, and the so-called Lithium Triangle, which contains Chile, Bolivia, and Argentina.

Chile, with the world’s largest lithium reserves, was an obvious first target.During the last lithium cycle—from 2016-2018—China purchased a $4B stake in SQM, Chile’s lithium mining giant. And almost more importantly is involved in the management and at the board level of SQM. That makes Ford and Toyota, which both have lithium supply agreements with SQM, ineligible for credits on their EVs.It was a shrewd purchase, as SQM purchased a 50% stake in an Australian lithium mine in late 2023. That both gave China access to the largest resource of lithium in the world, AND removed access from U.S. manufacturers.And even after nationalizing its own new lithium supply, Chile let China make a $250M investment to set up a lithium plant inside Chile.Bolivia has the largest resource of lithium in the world, but it has had difficulty producing any. So CATL, China’s battery manufacturing giant, gave it $1 billion—just for infrastructure development around lithium projects.Not even Australia has retained the ability to freely mine, refine, and sell its own lithium: China also directly purchased a stake in Greenbushes, the largest lithium mine in Australia.But it’s not just where lithium is now—China is even going to where lithium will be in the future.In early 2023, Africa’s first Chinese-owned lithium plant started up initial production in Zimbabwe.Namibia is the next country on the take-over list, with Chinese exploration companies already having mined raw lithium and shipped it back to China.

- Out of the eleven major lithium products in Africa, seven are backed by China—and two are undecided.

The story is the same anywhere you go:

China flexing its lithium muscle is not a matter of if, but when.China’s Ore War In mid-2023, China surprisingly decided to limit exports of graphite, another key battery material.China, of course, refines more than 90% of the world’s graphite, and Chinese graphite is in nearly every EV battery in the world. It has complete control over the flow of the metal.The decision wasn’t surprising—only the speed with which China moved.

If graphite can’t be used in an EV battery, it takes nearly twice as much lithium.The move was a warning to all global car manufacturers: China intends to slowly squeeze the supply of vital EV metals.It’s Only A Matter Of Time Until China Tightens Its Fist On Lithium…

Which is why demand for North American lithium is skyrocketing.

- The United States is projected to need 40x more domestic lithium in six years than it does today.

And EV manufacturers are quickly realizing that they will need to procure subsidy-safe, non-China lithium for themselves.

With the global lithium supply under a Chinese lockdown, U.S. EV manufacturers are finally moving to secure supply.The obvious places to look are the small pockets of Chile and Australia untouched by China—but those are becoming increasingly restricted, too.This is just getting started.And is setting up for a sizeable opportunity.Regards,Marin Katusa and the Special Situations Team

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws. By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim. If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.