Last week we brought you up to speed on Private Equity firms.This week we’ll look at the deals they made. And how that can affect mining.2022 was a tough year for public stock markets, but Private Equity firms kept themselves busy.

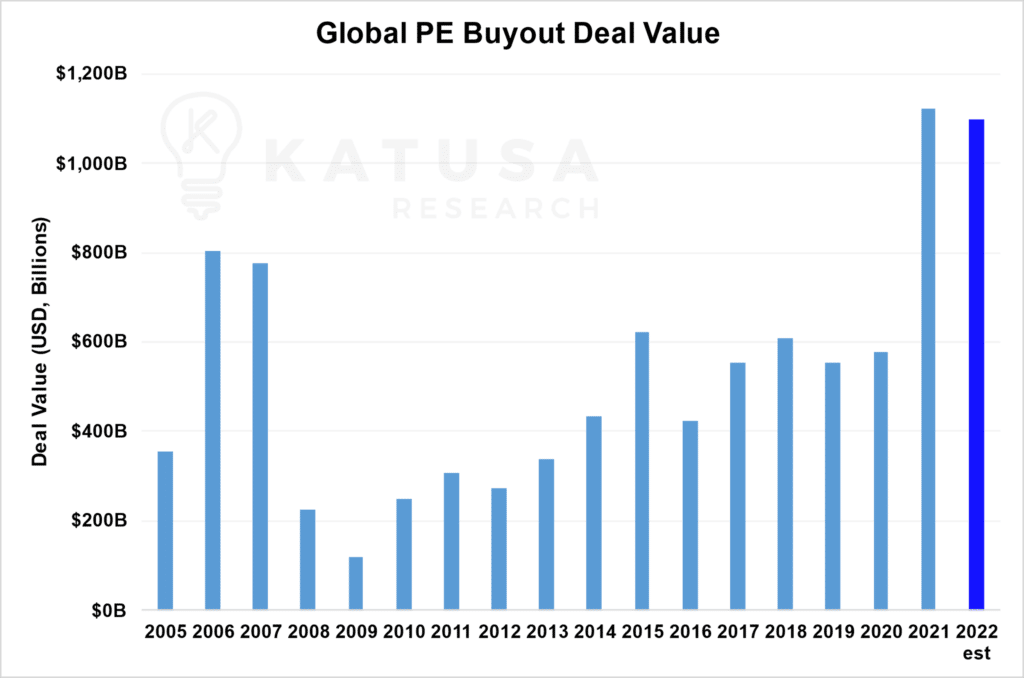

- PE deal values stayed healthy through the first two quarters of 2022, seeing $539 billion worth of activity:

Even though deal count was up 3.7%, Q3 saw a robust $280.6 billion worth of PE deals (down 20.4% versus the same quarter in 2021).

- This put the total value of PE deals for the first 3 quarters of 2022 at $819 billion

That passed the total deal value of any previous year besides 2021 (which was a record year for PE deals).Deal volume fell off sharply through Q3 and activity in Q4 2022 stayed depressed instead of bouncing as it did in Q4 2021.Overall, deal volume is estimated to be down in 2022 over 2021.All the usual suspects were in play here: inflation, rising interest rates, elevated valuations in the first half of 2022 eating into cash reserves, weak debt markets and geopolitical issues.

Show me the Money!

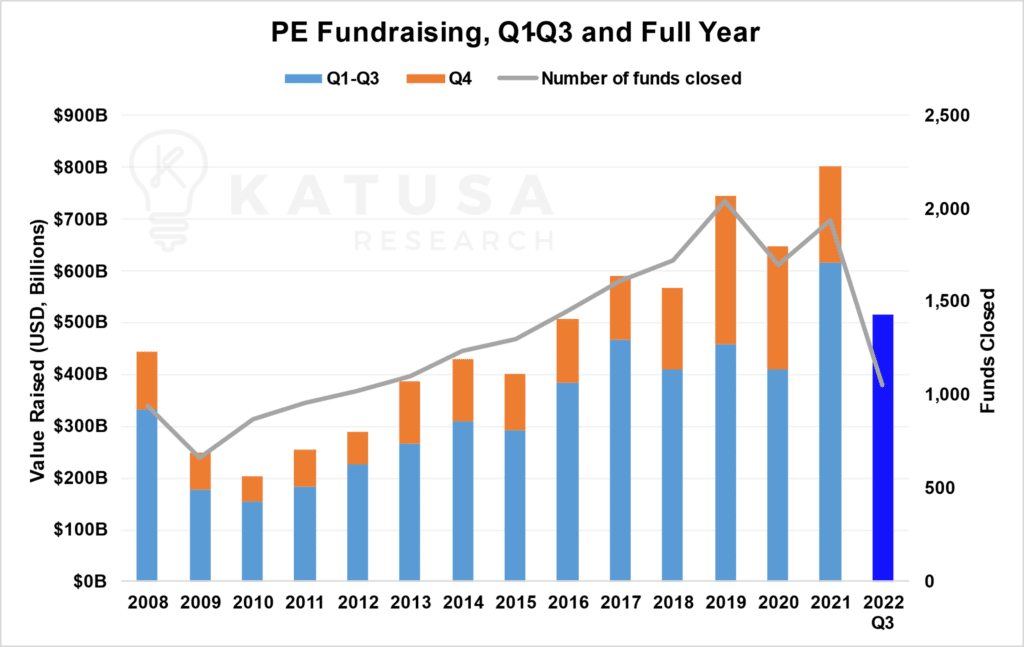

Speaking of weak debt markets…Look at this chart and you’ll see the falloff in PE activity was mirrored on the fundraising side:

Fundraising was down 16% through Q3 of 2022 when compared to the previous year in terms of capital raised.Fund closures (funds that finished raising sufficient capital and stopped taking new money) were down 30.5%.More funds stayed open for longer, extending their timelines beyond their initial requested periods.Exit activity similarly suffered…

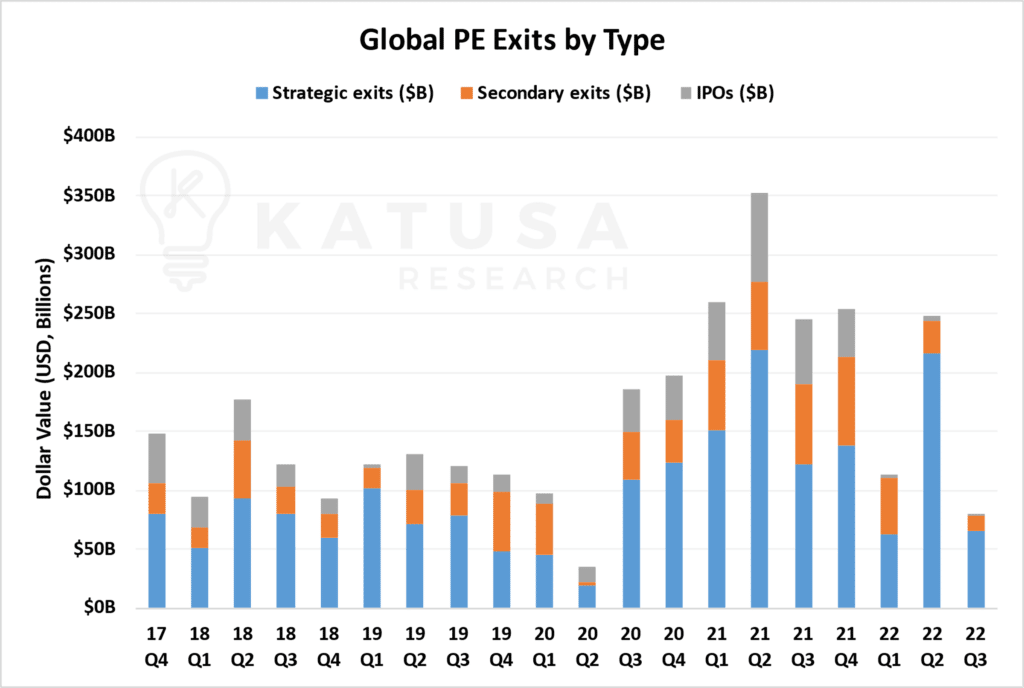

- PE exits were down a whopping 67% in Q3 of 2022 compared to the prior year:

Cooler Heads Hit IPO Mania…

IPO activity almost completely dried up in 2022.It was the worst year for IPOs on record since the turn of the millennium.Heading into 2023, PE firm dry powder was at all-time record highs.

- An estimated $1.96 trillion in cash on hand was ready to deploy in the global PE markets, with $1.08 trillion, or 55%, of that belonging to U.S. firms.

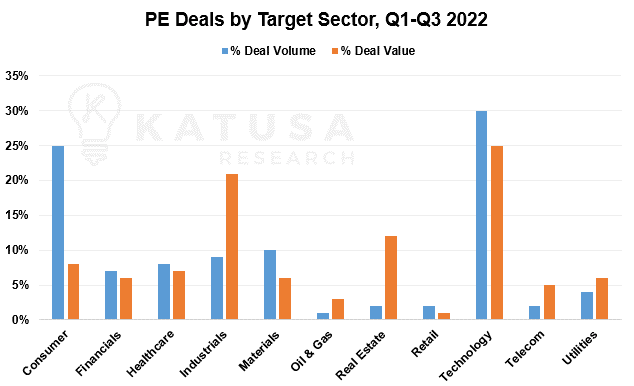

Now let’s break it down by sector…The chart below shows the breakdown of the data we have for the first three quarters of 2022 across different market sectors.

Breaking down 2022 PE deals by sector gives us even more details to work with: both by deal count and dollar value.

- The tech sector was still the hottest destination for PE deals last year.

- The next most notable sectors were the industrials in terms of dollar value, and consumer discretionary and staples by deal count.

While tech deals are a major focus for PE firms, we can’t discount the mining sector (which falls under materials) just yet.It may not be as sexy as cybersecurity or enterprise software, but critical minerals mining projects are still catching the eye of many PE firms.

Private Equity Players in Big Mining

There are several PE firms that specialize in the metals and mining industry who fully buy out assets, like Orion Mine Finance.It has about $7.8 billion in total assets under management spread over a few different closed-end partnerships (think funds).Other names that buy pieces of public companies in either equity or debt include the Energy & Minerals Group, Appian Capital Advisory and Resource Capital Funds, among others.Due to the nature of deals in the PE industry deal values aren’t always disclosed.

- Thus, our lower bound on mining industry deals with PE firms involved on the buy side is estimated at $1.96 billion across 51 deals over the last twelve months.

The largest six of these deals were valued at over $500 million and the top 6 represented over two-thirds of the total PE mining deal value:

We can clearly see that there was a big focus on rare earth mining deals.That’s no surprise as rare earths are critical to electronics manufacturing (like smartphones).Mining tech deals rounded out the list, with the first company, KoBold Metals, focusing on AI-driven mineral prospecting and exploration.And the second company, Jetti Resources, developing a low-grade copper extraction technology.As you can see, there’s still interest in the mining sector from PE firms.But there is a noticeable shift towards more tech-oriented deals like rare earths and battery metals.

The Alligator Fund: Is the KRO Bigger Than Most Mining PE Firms?

A staggering takeaway from the analysis of data is that…

- Katusa’s Resource Opportunities subscribers, over the last 3 years, would be second only to Orion when it comes to the amount invested into mining.

Think about that for a moment…A “collective” of like-minded investors led by myself as the lead order are a dominant player in the mining sector.So, what does this mean moving forward?The private equity returns have not met the returns of the tech sector over the last decade.In fact, KRO returns have outperformed the other PE mining-focused firms.To put things into perspective, The KRO over the last 24 months invested almost 25% of the total PE invested in the last 12 months – and three of our deals were above $100 million.Mining investment will struggle for the following reasons:

- Crossflation—the onsite inflationary pressures have increased at a higher rate than the commodity price

- Increased government taxes and royalties

- Geopolitical risks

- PE capital Return to investors from mining over the last decade has not beaten the S&P500 over the same period

- Unions and COLA commitments—I don’t want to get into a debate about unions, but the fact of the matter is, mining has been an area of growth for unions globally.

- Within those contracts are the embedded COLA commitment (Cost of Living Adjustment) which is a double whammy for the miners the year after. And for most mines, labor is one of the big costs (at 25% of total costs).

The PE and Mining Takeaway

With interest rates rising, investor expectations and hurdles will rise.In addition, mining companies will be the last to benefit from disinflation on the balance sheets, meaning higher costs of production are here to stay for a while.A little dirty secret of the mining PE-focused funds is that they have not returned positive returns to their unit holders because of the delays in permitting, construction and higher cost of production combined with lower valuations of the projects.With everything I just presented, this means the KRO Alligators are major players in the mining sector.And we can be patient for the right product where the upside outweighs the downside on a risk-adjusted basis.Alligators don’t chase every prey they see.They are apex predators.Our criteria are the same, apex financial exposure.The one big difference is that very few of the managers of the PE groups are on the same “skin in the game” as their investors.I am.Stay tuned, it’s going to be worth it for your portfolio.Regards,Marin Katusa

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws.

By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim.

If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.