The best mob movie of all time in my opinion is Goodfellas.The movie isn’t for everyone (a lot of swearing and gruesome killing; rated R/18A). But Robert DeNiro, Joe Pesci, and Ray Liotta are great in the movie.Here is the Goodfellas business mindset scene that sums up the movie… Business bad? F*** you, pay me. Oh, you had a fire? F*** you, pay me. The place got hit by lighting? F*** you, pay me.I believe there’s a substantial chance that this is a long, drawn-out recession. And in between superstar opportunities, I want to get paid to wait.

Mr. Market, Pay Me to Prepare & Profit

In the United States, there have been 2 quarters in a row of negative GDP growth.Commodity prices have softened, which can temporarily ease cost inflation.However, interest rate shocks take longer to work through the economy. It seems highly likely that we will see minimal economic growth over the coming quarters.A recession can be crippling to the unprepared investor.If you have no cash to deploy near the bottom of the market, it will be very difficult to ride the future waves higher.

- Building on the narrative in last and this month’s edition of Katusa’s Resource Opportunities (KRO), incredible opportunities are possible for those who are prepared.

Resource stocks are incredibly cyclical, and most are highly sensitive to economic conditions.Thus, in a recession, resource stocks can fall to incredibly low valuations.But on the upswing, they can rise tremendously.

- The KRO has taken Katusa Free Rides on as many of its holdings as we have had the opportunity to do so on.

Note for Novices: A Katusa Free Ride reduces your risk, returns your principal, and allows you to capture any future upside.We’ve maintained the position for years to have and build a cash position to deploy when the market falls.

Portfolio Preparation 101

I’ve long stated that two-thirds of a resource portfolio should be investments. Those are businesses with significant cash flows and the ability to pay a dividend.Expanding on this, we want diversified cash flows.This means that income earned by the company should be derived from multiple mines and from multiple commodities.Simply put, diversification lowers but does not eliminate risk.Picking up cornerstone investments in market troughs is crucial to preserving and generating wealth from resource investments.Recessions give investors the once-in-a-decade type of opportunity…

- To buy multiple tranches of world-class companies…

- At massive discounts to traditional valuations.

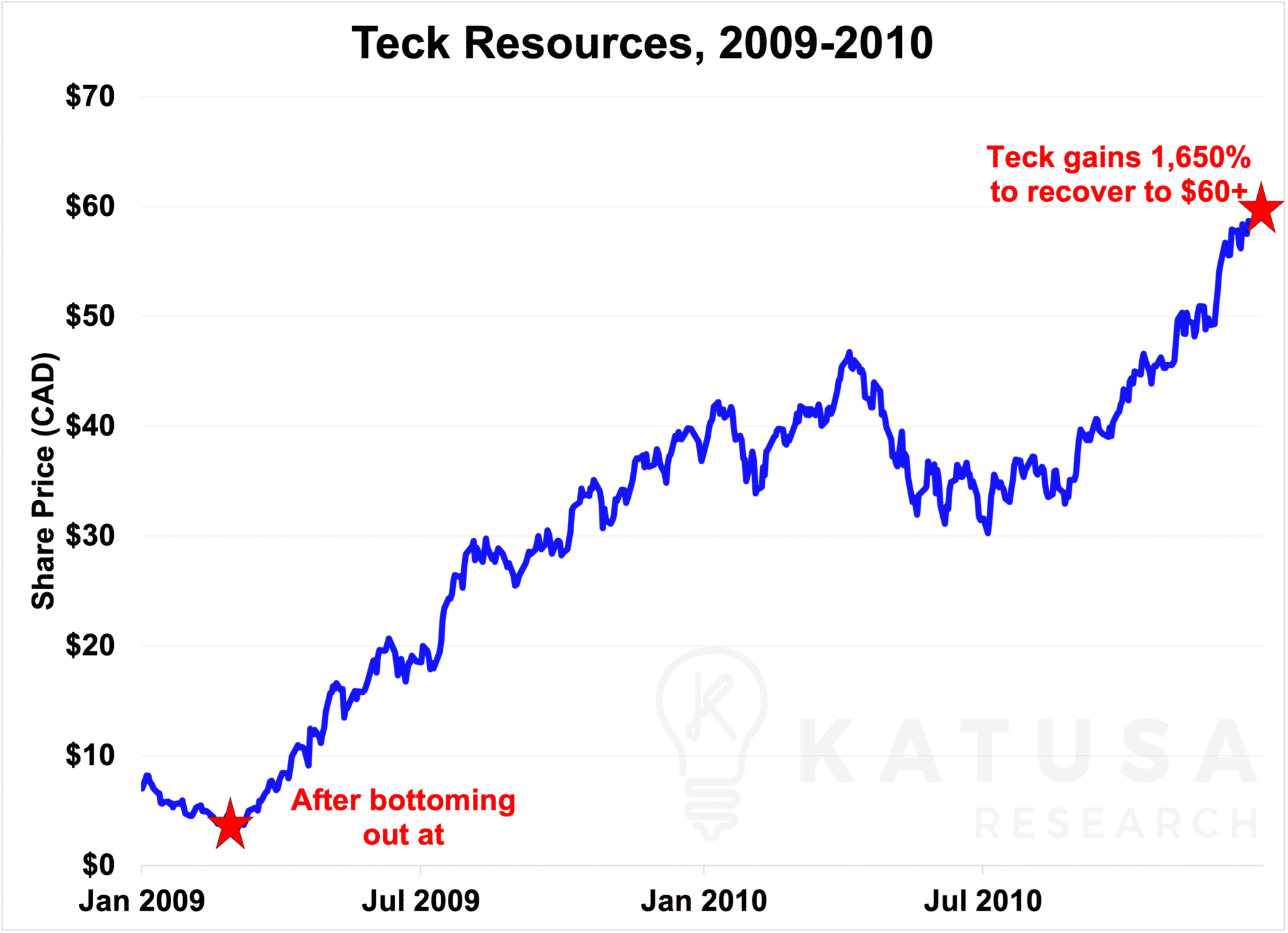

For example, in the depths of the Global Financial Crisis, Teck Resources, Canada’s largest diversified miner traded below $4 per share.On a Price/Cash Flow multiple basis, this represented 0.5x annual cash flow. Prior to the GFC, Teck was trading at $50 a share and 7x annual cash flow.Moving forward a few years, Teck rocketed to new highs above $60 a share and 8x annual cash flow.

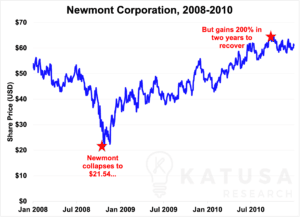

Newmont, one of the world’s largest gold miners showed a similar pattern.Prior to the crisis, Newmont shares were selling for $50-$55, valuing the company at 10-12x annual cash flow.In the financial crisis, shares fell to near $20, compressing the valuation to less than 5x annual cash flow. By 2010 Newmont was back north of $60 a share.

We’re not trying to feed confirmation bias and pick our favorites; we’re letting the numbers and data do the talking and see where the chips lie at the end.Now, let’s review the blueprint.

World Class Resource Company Checklist

- Diversified asset base across multiple commodities

- Assets are in multiple jurisdictions, with emphasis on +SWAP line nations

- Dividend payer and/or ability to unlock shareholder value in creative ways

- Ability to generate $1B in free cash flow from current assets or fully funded organic development projects

- Survived the previous market downturns or demonstrated longevity within the sector

- Low debt relative to company size and cash flow generation

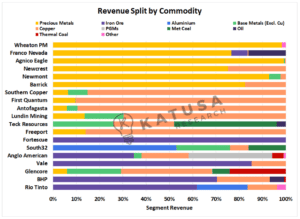

First, let’s break down the largest companies in the world by commodity.Each color represents that specific commodity’s contribution to a company’s total revenue. At the top of the chart, you will see gold-focused producers like Newmont, Barrick, and so on.In the middle, base metal producers like Teck Resources and Freeport-McMoRan. Followed by the global diversified miners, BHP, Rio Tinto, etc.

Mr. Market, Pay Me for Patience: Free Cash Flow Analysis

One major way to recession-proof your portfolio and pass the time – is that in a recession, we want to be paid to wait.

- It’s the same thesis we used when we bought Brookfield Renewables and Pembina Pipelines in the March 2020 correction, which led to dividend payments and solid gains of 31% and 52%, respectively.

- Both became Katusa Free Rides. Subscribers and I continue to hold free shares, at a no-cost base, and collect dividends in world-class companies, with no capital at risk because both are Katusa Free Rides.

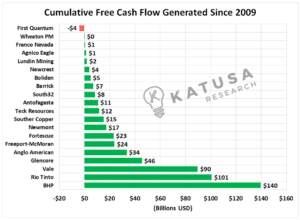

To be paid to wait, companies must generate free cash flow.This means cash inflows from mining activities must be greater than the capital required to operate them and to develop new projects.Below is a chart that shows the cumulative free cash flow of each company above since 2009.

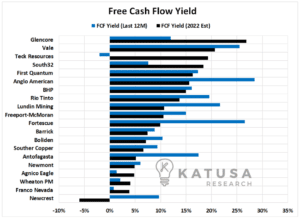

As you can see, BHP stands head and shoulders above the rest.That doesn’t mean you should go buy BHP today. There is more to buying a stock than just a few analytical comparison charts.Now let’s do an apples-to-apples comparison and look at Free Cash Flow Yield. Free Cash Flow Yield compares the Free Cash Flow generated by a company to its market capitalization. The higher the free cash flow yield, the better.

These types of apples-to-apples comparisons allow us to see discounts on a relative basis.Vale trades at a very high Free Cash Flow Yield, which we know is due to its Brazilian risk.On the other hand, look at a company like Franco Nevada which trades at a very low free cash flow yield relative to the rest of the group. This shows the market assigns a very high “premium” to Franco Nevada.

Crippled Corporate Cash

High debt levels can cripple a company or even bankrupt it. And this becomes even more challenging as interest rates rise.Higher interest rates mean any new debt issued is likely going to be at a higher cost than any debt issued in the past 5 years.We take this analysis a few steps further – and do all the heavy lifting for you – so you don’t have to.All the major mining companies were put through stress tests and the ring of fire in the Katusa’s Resource Opportunities.Before you buy any resource stocks, find out who will barely survive a recession– and who will thrive.And get to know the companies that I’m buying personally, and which ones are on my radar.That’s how you invest like an alligator.Regards,Marin Katusa