If Kirkland Lake Gold is Hunting Juniors like an Alligator – Who is on Its Radar?

Kirkland Lake is Eric Sprott’s largest publicly disclosed resource position and its share price is very strong. It’s time Kirkland goes hunting like an alligator.

The Most Important Charts for Your Gold Stocks Right Now

Any investor or speculator that’s been around the resource markets for a couple of years knows the famous line – but wait, there’s more. The share price of individual commodity stocks are highly leveraged to the price of the underlying commodity meaning you can see spectacular gains of 500%, 1000% and even 10,000%.

The Gold Insurance Bet – The Day My Life Changed Forever

Six years ago, my life changed forever. And today, I want to share a few lessons I have learned from personal experience.

This Event Could Cause the Big Blowup of 2018

If you believe you are an ambush predator investor, pay attention. We will have some amazing investment opportunities over the next 6-18 months.

Increase your returns 10-fold or more with these Gold Stocks

Right now, less than 1% of the world’s financial assets are allocated to gold and gold stocks. This laughably small percentage shows the world hasn’t caught on to the new gold bull market that’s already started. What do you think will happen when 0.5% of the world’s financial assets flow towards gold for protection? The sector will be in a once in a lifetime bull market.

Gold is a Sleeping Giant You Can’t Afford to Miss

I showed you why the easy money has already been made and why Bitcoin technology is still years away from revolutionizing money. Personally, I would rather take my chances on the greatest opportunity in gold stocks in the past 50 years.

What Does a Broad Stock Market Correction Mean for Gold Stocks?

I make my living putting money to work in the natural resource markets. And Fed moves impact the broader market equities and impact resource equities alike. Today I take a look at the effect of a general market correction on our resource portfolio.

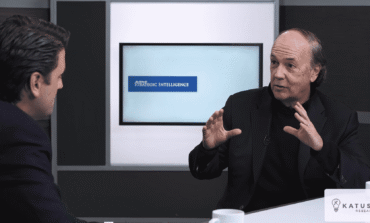

Katusa and Jim Rickards Talk Gold, Bitcoin, and the Next Crisis

Currency and geopolitical expert Jim Rickards and I get deep into what we believe is around the corner for the gold and cryptocurrency investment markets.