Last weekend, as the media focused on hurricanes and Donald Trump’s immigration policies, two massive stories flew under the market’s radar.

These stories were about one of the biggest economic revolutions of our time… and they have major investment implications.

First, China announced it plans to ban the sale of fossil-fuel powered cars and trucks. No date was given, but China is making it clear that Electric Vehicles (EVs) are the future of the world’s largest car market (which is 35% larger than the U.S. market). China is desperate to clean up its infamous air pollution. Emission-free electric vehicles will play a huge role in the efforts.

Secondly, Volkswagen, the world’s largest car company, announced it plans to design electric versions of all 300 of its models. To achieve this, Volkswagen plans to invest over $70 billion into new infrastructure. It’s going to be a huge shift undertaken by one of the world’s largest, most powerful manufacturing companies.

Regular Katusa Research readers know that I believe the Electric Vehicle revolution is one of the biggest investment themes of our time. For a long time, mass adoption of EVs were an environmentalist’s fantasy. Zero emission vehicles that run on electricity just couldn’t compete with conventional cars on price, quality, and fueling infrastructure. But thanks to incredible advances in technology, massive investments by large car makers, and huge government support, electric vehicles (EVs) are poised to go mainstream.

The news from China (the world’s largest car market) and Volkswagen (the world’s largest car maker) tell me that mass EV adoption will occur faster than most people believe it will… even faster than I believed it would just six months ago.

I believe a big reason the rate of EV adoption will take so many people by surprise because they don’t understand how technological progress is now occurring at an exponential rate. This rate of change is far faster than the kind of “linear change” most people are used to.

Exponential progress is happening now because of the stunning increases in the power and speed of computers. Computing power is the foundation on which our world of technological progress rests on. It’s what makes the Internet, your iPhone, your Facebook account, Tesla cars, Wi-Fi, and thousands of other things possible. After decades of refining and improving computer technology, progress in the field is accelerating. Our computers are getting much faster, much more powerful, much smaller, and much cheaper. The kind of economic shifts that used to take 20 years to play out are now taking just five years to play out… and catching many people off guard. This trend is affecting all industries, no matter how “old school” they are.

Back to China and Volkswagen…

Of course, China’s new policy will have measurable and direct affects in China. Of course, Volkswagen’s new policy will have measurable and direct affects in the company. But just as importantly, these policies will have massive indirect affects across the entire world.

These decisions mean more and more money will be invested into EV research and development. I’m talking about tens of billions of dollars over the short-term and hundreds of billions of dollars over the long-term (over 10 years). More money and more minds will go to work on making EVs better, cheaper, and more reliable. More new ideas will be developed and tested. Many will fail, but some will be world-changing breakthroughs. These breakthroughs will be developed at a faster rate than before. The world’s largest car market and the world’s largest car maker want it that way.

The enormous amount of money and energy devoted to EVs will drive production costs lower. Lower EV production costs will mean cheaper EV sticker prices and increased competitiveness with fossil fuel powered vehicles.

Increased competitiveness means more people buying electric vehicles sooner. More EV sales will signal to automakers that they should invest even more money into research and development. Even better technology will be developed and production costs will go even lower. It will become a virtuous, self-reinforcing cycle.

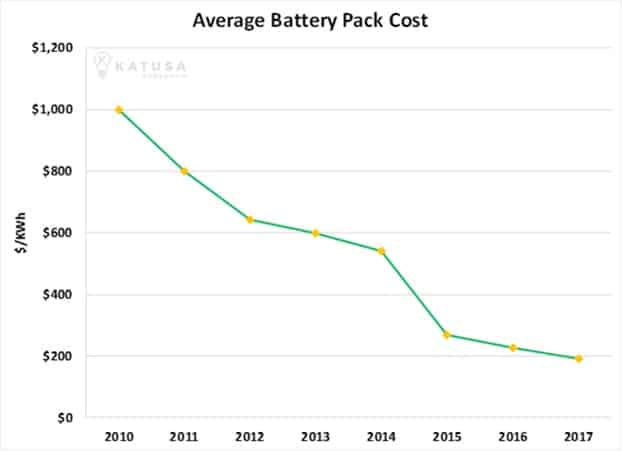

Perhaps the best way to showcase how increased investment has cut costs in the EV sector is by looking at the cost of lithium-ion batteries used in EVs. The chart below shows the dramatic cost reduction from 2010 to 2017.

Personally, I believe the best way to profit from the electric vehicle revolution is not by investing in EV makers, but by selling EV makers the materials they must all consume in huge quantities for decades in the future.

The average electric vehicle with a 65 kwh battery pack will require over 100 pounds of copper, 20 pounds of cobalt and 100 pounds of lithium carbonate.

Remember how I mentioned Volkswagen wants to make electric versions of all 300 of its models. Below is a chart which shows the quantity of metals demanded by Volkswagen to go 100% electric, relative to the current annual production. These numbers are not exact. There is going to be variance depending on battery type, however the numbers are staggering enough as is.

The supply chain for electric vehicle inputs is already strained. China’s policy change is only going to strain it further. This is a good thing for paid members of Katusa Research, who are acting as EV material suppliers. Under supplied markets mean high prices and big profits for companies that can supply product to the market.

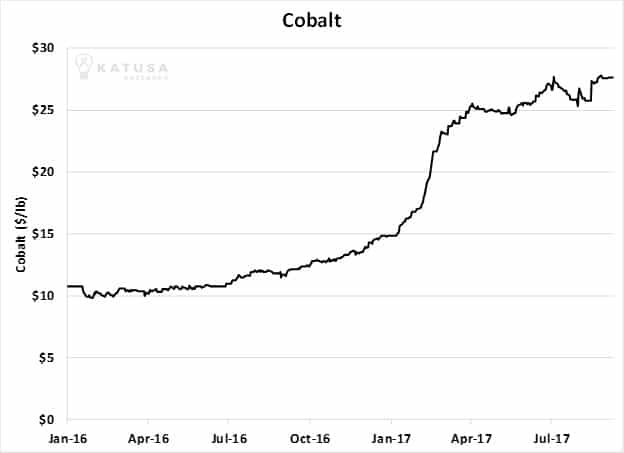

The price of cobalt, a crucial material in the Lithium-Ion battery has soared from $12 per pound to over $25 per pound in 18 months. Below is a chart of this EV-driven bull market.

The world’s largest lithium producer, Albemarle, said on a recent conference call that it is sold out of lithium for the next five years. The spot price for battery grade lithium has rocketed from $3.60 per pound to over $10 per pound since April 2015.

And of course, you probably know my thoughts on copper. The EV boom is very bullish for copper demand. Years from now, the world is going to want a lot more copper… but the industry simply can’t supply it at $3 per pound. Copper prices will need to be much higher than they are now. You can read by research on this situation here and here.

It’s estimated that nearly 1 million new EVs will be sold globally in 2017. Early this year, the respected Bloomberg New Energy Finance team estimated that there will be 8 million electric vehicles sold annually by 2030, and 65 million sold annually by 2040. I believe the huge news from China and Volkswagen could lead to these targets being hit sooner than expected.

The virtuous self-reinforcing cycle is coming… and it’s very good for EV market suppliers. Invest accordingly.

Regards,

Marin