Over the last decade I have written a lot about OPEC. I have interviewed senior, high level OPEC officials and was one of the few analysts who stated in the fall of 2014 that OPEC would NOT cut oil production.

Here is what will happen next with OPEC.

With the weaker OPEC players pounding the table for a production cut, the US shale producers became uneasy and released Investor PowerPoints with $75 oil economics.

The Saudis insisted they wouldn’t cut production even if oil reached $20 per barrel, and oil plummeted lower. Investment banks called for sub-$50 oil, while US shale E&Ps released continuing revisions to their Investor PowerPoints, with $65 and then $50 economics. It was almost oil Armageddon. The global markets were once again firmly in the Saudis’ grasp.

OPEC will NOT cut oil production on June 5, even though there is much media speculation that it will.

Fortunately for OPEC and the rest of the world’s oil producers, we haven’t hit that $20 per barrel figure.

As I stated last year, innovation out of necessity will result in lower shale oil costs, and that view was the basis of a famous debate in November between myself and another well-known resource figure at the New Orleans Investment Conference, held by my buddy Brien Lundin. I was right, and Goldman Sachs just published a report talking about how shale oil production costs have dropped by about $20/bbl since last year, to an average of $60/bbl.

US shale producers, Russia and the Saudis have kept their oil pumps going and have increased production since the 165th OPEC meeting.

However, one should think of the increases very differently.

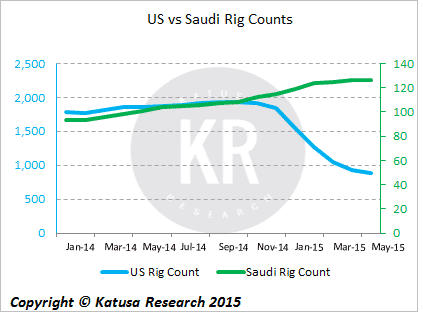

The Saudis have increased their rig counts and production from a fairly stable base.

The US shale producers, on the other hand, have grown production exceptionally fast. Despite declining rig counts, US production remained strong—even though there are thousands of wells completed but not producing yet, which is called the fracklog.

OPEC’s production target is 30 million barrels of oil per day (bopd).

As with any cartel, everyone cheats, and OPEC is no different.

The last OPEC production level was 31.4 million bopd (May 2015).

Since Q3 2014, OPEC has increased production by 900,000 barrels per day, an increase of 3%. Of this amount, the Saudis alone are responsible for 78% of the growth, over 700,000 bopd.

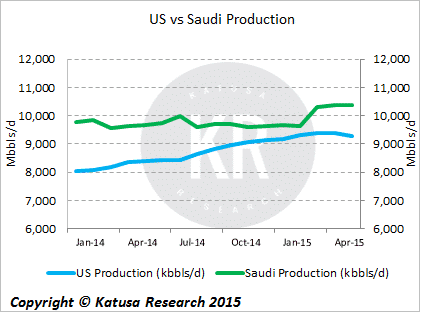

The Saudis, since November 2014, have increased oil production by 8%.

The US has only increased production 2%.

Furthermore, on a year to date basis, the US production is up 1.7%, while Saudi production is up 7.8%. This shows the true tenacity of the Saudis in increasing their market share. They’re making a run at the international market share and will not let up until they win. On their side, they have the best and lowest cost oil deposits in the world.

The Saudi production growth is far more sustainable than in the US, as the Saudis have developed an incredible oil infrastructure and have conventional oil wells with low decline rates.

US shale oil wells’ decline rates—as much as 75% in the first year—are exceptionally high. That is bad.

Unless new oil wells come online, production will decrease at much higher rates than that from conventional oil wells like the Saudis’. However, bringing new wells online is tough in the current low-price environment.

Katusa Research has gone through the entire US E&P space capex forecasts and guidance. Conclusion from all of that research: the goal for almost all these producers is to grow production by approximately 7-15 percent this year.

How will this be achieved?

By producing enough oil to offset the decline of their Q3 or Q4 production level. The key takeaway point is not to compare 2015 vs. 2014 annual production on a January to January calendar. If you approach it on a November 2014 to November 2015 basis, it will be unchanged at best.

Therefore, in reality, the US shale players are only treading water, while the Saudis are already onto the next lap of the race.

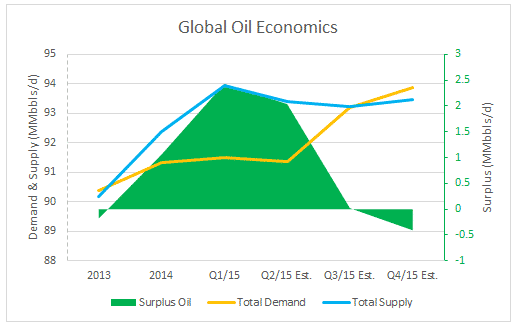

OPEC forecasts global demand for crude oil to increase from 91.32 million barrels per day to 93.89 million barrels per day by the end of 2015. Crude oil demand throughout Asia has been exceptionally strong over the first quarter of 2015, as the Chinese refineries increased both run rates and strategic reserves.

In April 2015, the trading arm of the Chinese National oil company, PetroChina, purchased a record 55 cargoes of Middle East crude in the open market, up from a record of 47 cargoes in the previous month. Chinese refineries have been averaging 10.5 million barrels per day in March, while Singapore refineries increased utilization to 98% compared to 96% in the previous month.

Supply of course is a big wild card.

The US E&P “fracklog” is very real, and as of February 2015 there were 4,731 wells that remained drilled but not completed.

This is likely to cause a price overhang in the WTI market and subsequently will discourage significant well completions over the second half of 2015.

OPEC as a group has increased production on a monthly basis over the course of the 1st and 2nd quarters. This move by OPEC has squeezed out the high cost OECD and non-OECD players and allowed the OPEC group to regain market share.

Non-OPEC production is forecast to contract from 57.75 million barrels per day in Q1 2015 to 56.97 million barrels per day by the end of Q4 2015. If we use the OPEC forecast and assume OPEC leaves their production numbers unchanged for the year, which is likely a safe assumption, we’ll see a surplus at least through Q3 2015. If the Saudis continue to push the expansion of their market share, the oil supply surplus will increase and suppress the price of crude oil further and continue to squeeze out the high cost producers.

The Bold and Smart Kingdom of Saudi Arabia

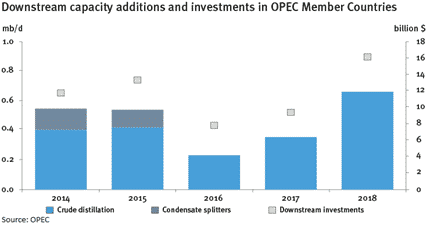

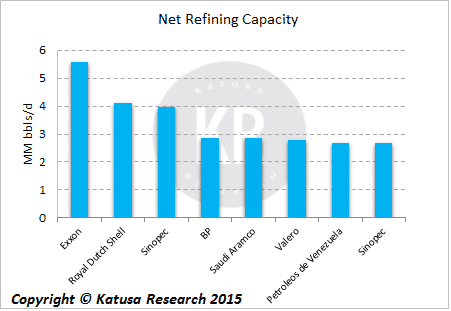

Saudi Arabia clearly has some brilliant strategic advisors at Saudi Aramco, as they are doing all the right things for Saudi Arabia. This is a bold and smart move by the Kingdom. The ability to diversify vertically along the entire value chain from E&P up to refined products creates both a hedge against low prices and allows them to compete across the globe in every product category. The Saudis are a force to be reckoned with.

Do not think for a second that they will not put their interests ahead of the global oil markets. The Saudis will continue to push the “no cut” mentality, citing that the crude market is recovering and demand is strong. They will continue to further push the envelope for the rest of the year, snapping up market share from other high cost producers, while their refinery business will continue to benefit from the low input costs. A double victory for Saudi Arabia.