Amazon, Microsoft, Google, and Meta compete viciously for talent, market share, and AI dominance.

But beneath the surface of their rivalry, they’re making identical energy bets and spending billions on nuclear power.

These bitter enemies wouldn’t align their strategies unless something fundamental was forcing their hand. That something is the brutal math of powering AI.

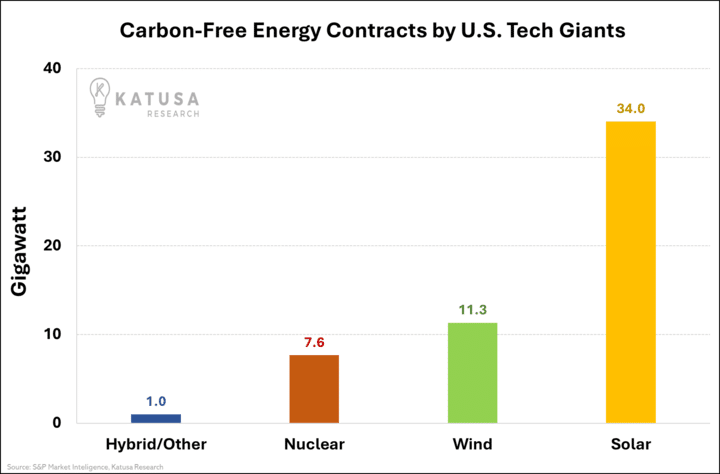

Tech giants have collectively secured 84 GW of total clean energy with the nuclear portion growing from 0% to 14.2% of their portfolios in just 12 months.

While these companies fight for digital supremacy, they’re simultaneously racing to lock up nuclear capacity.

Amazon paid $650 million cash for a nuclear-powered datacenter. Microsoft signed a premium-priced deal to restart a dormant reactor.

When arch-rivals make identical moves, smart investors take notice.

AI Energy Powers: Tech’s $100/MWh Energy Gamble

The top four hyperscalers, Amazon, Google, Meta, and Microsoft are writing checks across 34 states to secure power for their operations. Namely solar, wind and nuclear…

Look at what’s happening:

- The nuclear portion of their energy portfolio jumped from 0 to 7.6 GW in 12 months.

- Microsoft is paying roughly $100/MWh for nuclear power, a 67% premium over typical $60/MWh renewable contracts.

- Amazon’s Talen Energy acquisition secures 960 MW of direct nuclear power, bypassing the grid entirely.

- Datacenter energy demand is projected to grow at 19% annually through 2029, hitting 260 TWh.

For energy investors, this marks a big market shift.

Companies making small modular reactors, nuclear fuel suppliers, and utilities with nuclear assets can now benefit from the growing demand for power.

And then there’s this…

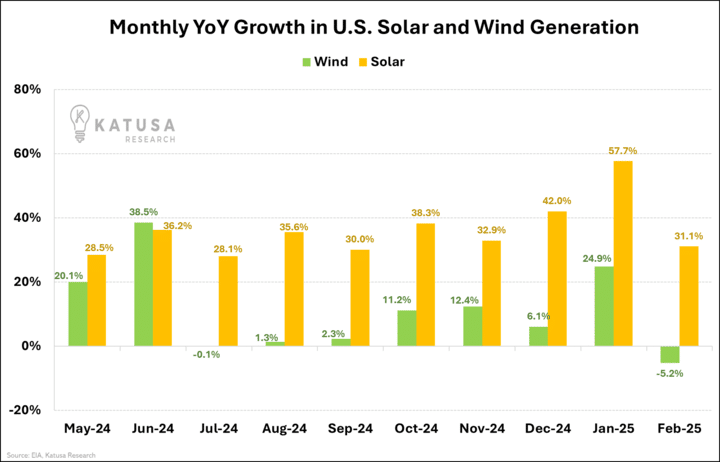

Solar Boom vs. Wind Bust: Money Follows the Sun in 2025

Solar just crushed expectations.

U.S. solar generation surged 31.1% in February while wind tumbled 5.2%.

Your electricity now comes more from panels than turbines. Smart money spotted this shift months ago.

Companies like NextEra and Invenergy are investing heavily in this trend.

They’re racing to finish big projects, such as the 250-MW Skeleton Creek Solar installation, by year-end. Construction is moving fast across America’s heartland.

- The Southwest Power Pool will add a staggering 5,550 MW of new capacity this year – enough to power 1.7 million homes.

This explains why transmission buildout hit overdrive. SPP approved a $7.68 billion grid expansion last October – their largest ever. Each dollar invested returns $8-9 in economic benefits.

- Grid connection times have been slashed from 4 years to just 12 months.

And industry analysts predict AI tools will reduce this further to 6 months by 2026.

“We’re slashing connection timelines from four years to just one,” says SPP CEO Lanny Nickell.

This acceleration directly impacts project completion rates and investor returns.

SPP forecasts a 75% load increase by 2035.

Data centers alone will consume more electricity than entire cities.

Utilities in Texas and the Midwest are rushing to secure capacity. And solar energy is a top priority.

The rise in solar energy links to the nuclear trend. Both sources offer the reliable generation that AI needs to grow.

- The difference? Solar projects can be built in months, not years.

The message to investors is clear: Follow the construction boom in North America. Projects breaking ground today will generate cash flows for decades.

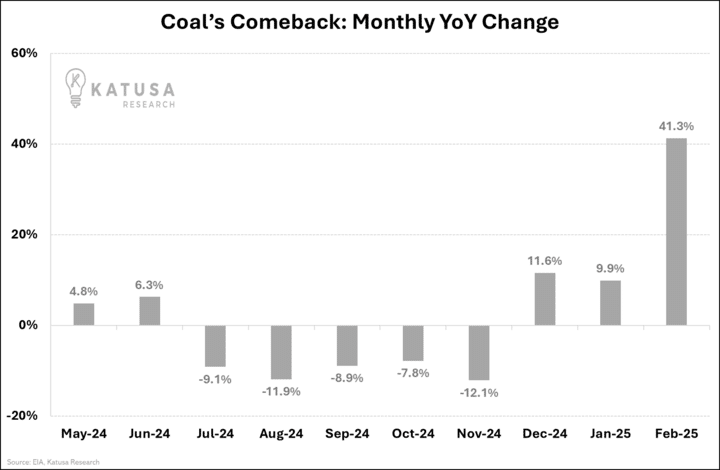

Coal’s Surprising 41% Surge

Coal isn’t dead – it’s making a comeback. U.S. coal-fired generation jumped a shocking 41.3% year-over-year in February.

- Coal now provides 19.6% of America’s electricity in 2025, up from 17.1% last year – defying predictions of its rapid decline.

The numbers tell a complicated story about energy transition.

Coal generation increased to 62.3 million MWh in February while natural gas held steady at 39% of the generation mix.

- Together, fossil fuels now account for 57.4% of U.S. electricity, up from 54.5% a year ago.

U.S. power plants have 121 days of coal stockpiles, which is 8.5% below the five-year average. This shows sustained demand, not just temporary usage.

Coal stockpiles dropped by 6.7 million short tons in February, well above the 10-year average draw of 672,000 tons. Plants are burning coal at a sustained rate.

Companies like Peabody Energy (BTU) and CONSOL Energy (CEIX) are experiencing a current financial windfall, but smart investors believe this as a cyclical opportunity rather than a long-term trend.

The Big Picture: America’s Energy Transformation Is Following Multiple Paths

These three trends—nuclear’s tech revival, solar’s growth, and coal’s surprising strength—show a complex view of America’s energy future.

It’s not just a shift from fossil fuels to renewables. Instead, each sector is evolving at its own pace.

For investors, this creates targeted opportunities in multiple energy segments simultaneously: Uranium, Nuclear, Solar, and Major energy companies.

The companies that will outperform are those positioned at the intersection of these trends…

Particularly those providing the critical infrastructure that connects generation to consumption.

- My biggest energy winner in the portfolio is trading at decade highs and climbing. While paying me handsomely (plus 8% dividend at the KRO cost base) to hold it.

These are the types of opportunities I reveal in detail in my premium research letter – Katusa’s Resource Opportunities.

You can get on the list for the next issue right here.

Regards,

Marin Katusa

Must See TV…

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws. By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim. If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.