It’s no surprise that silver has felt pressure lately.It may be a surprise, but in times of heightened volatility…Safe haven assets which are traditionally supposed to be uncorrelated to the market actually become highly correlated.It can lead to a situation where all safe havens and broad market equities can rise and fall together.We have seen that this year.As a combination of higher interest rates, slowing global growth and inflation rates, and instability in financial markets have weighed silver down.But here’s the kicker – more and more of the downside is becoming priced in.And as investors and speculators…One must be ‘roundabout’ (meaning: don’t focus on what’s currently priced in, but what will be later).That’s why silver bugs believe the metal is highly attractive here.Because as both market perceptions and monetary policy reverse, silver could be re-priced higher.Let me show you why. . .

Silver: A History of Heart Palpitating Booms and Busts

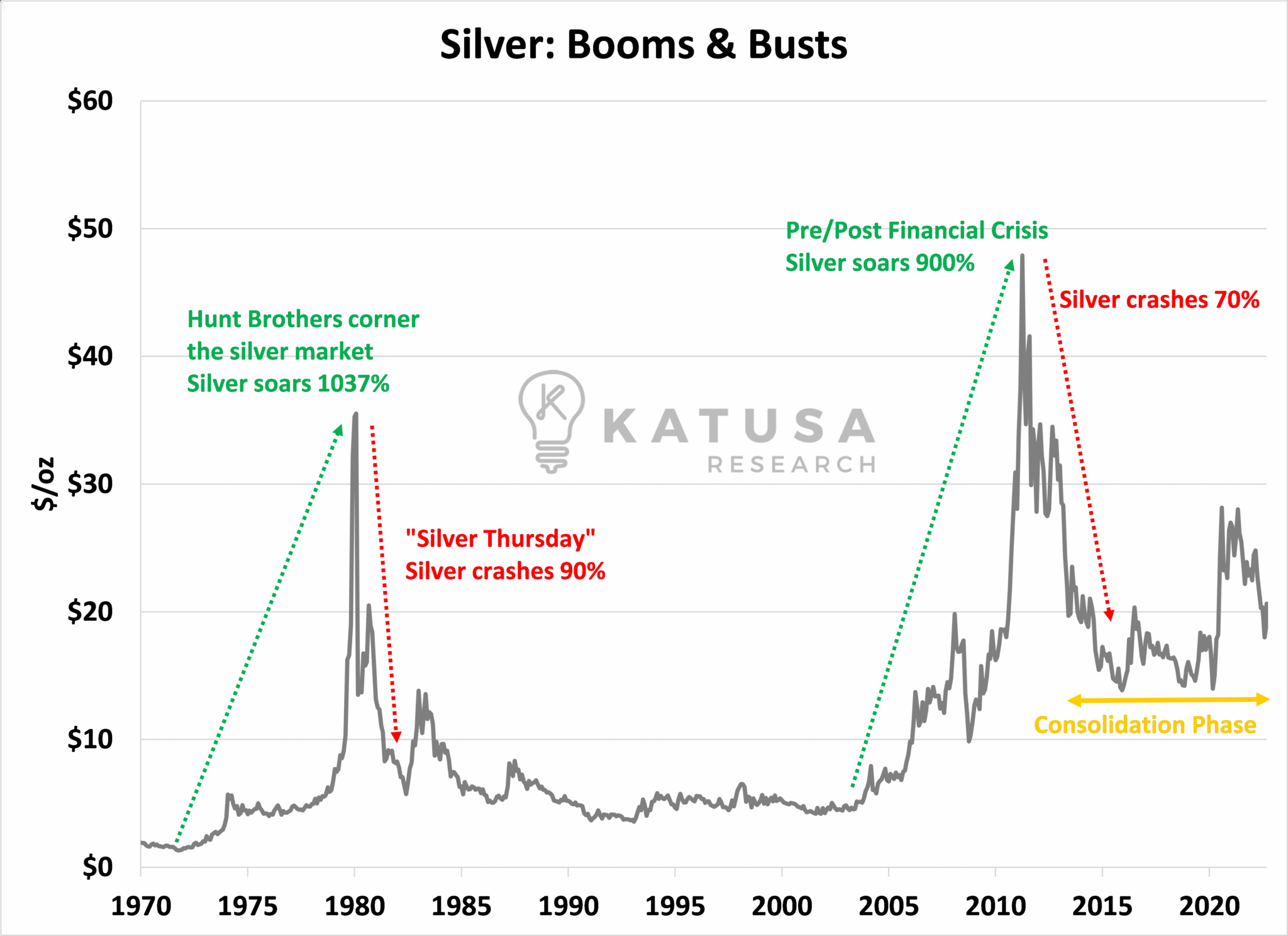

The booms and busts of silver have been truly exceptional over the last few decades – putting the testicular fortitude of even the strongest silver bugs to the test…

The reason that silver can make such massive moves so quickly is because the global market cap is tiny.Thus, any marginal increase in silver buying or selling tends to send prices into a frenzy.Putting this into perspective, take a look at this chart comparing the silver market to other major asset classes and well-known companies.

- As you can see, the entire silver market is a blip relative to these other sectors

And this creates massive leverage for silver because of its small scale.Remember how violent the rise in the tiny crypto-currency sector was once capital flowed in?Exactly – scale is key for massive gains.

The ‘Big’ Silver Lining

Things are changing in the macro-economy that could directly lift the silver price.The “anything it takes to tighten” policy that central banks and governments around the world adopted in late-2021 has significantly shaken things up across all investment assets.But still, silver outperformed.For instance, since March 2020, silver is one of the top-performing precious metals. Even outperforming gold by a wide margin.

Again, can’t stress enough the scale that silver offers relative to other precious metals and assets.What this means is, it could be easier for silver to double from here than it will be for gold or platinum.Now that we understand the upside torque silver offers – what’s next?

What Gives Silver Strong Legs?

Silver depends on its own supply-and-demand fundamentals (which are increasingly bullish). But silver also depends on the U.S. Dollar’s value.Why?Because global commodities are priced in US Dollars.And as the USD begins to weaken (after hitting multi-decade highs in 2022, courtesy of Federal Reserve tightening), asset prices all over the world could see a sharp rise.To give you some context – here is the last two-decade correlation between the US Dollar Index and Silver futures…

As you can see, when the U.S. dollar rises (blue line) in value, silver (red line) takes a hit.But when the dollar sinks in value, silver outperforms.It’s also important to note how impressive it’s been that silver prices have held up so well in the face of such a strong dollar.For perspective, the last time the dollar was this strong, silver was less than five dollars an ounce.This just shows us how strong silver demand is.That’s why – facing both a weaker dollar and robust demand – silver upside on a multi-year time frame is only now beginning.

Will Silver Stocks Follow Silver Bullion and Take Off?

Lucky for investors, silver stocks haven’t soared – yet.But even if silver stays where it’s at – silver miners still have significant upside.The following chart shows the comparisons between silver bullion vs. silver miners over the last two-and-a-half years.And as you can see – even though silver bullion has outperformed gold – silver miners have lagged considerably…

But – looking back in history – when silver miners finally move, it tends to move violently.Just look at the large silver producers between 2009 and 2011 – during the last big silver run…

- You’ll see that while silver surged 300%, silver producers soared 500% or more.

- Even Fresnillo – the world’s largest silver producer – was up over 500%.

- And several small caps were up over 1,000%. . .

You can see how the right silver stocks can produce mind-boggling leveraged gains compared to the price of silver. When the time is right.And as always in natural resource speculations:

- You need to be invested in the right projects and management teams or you and your investment will be left in the dust.

So – who are the largest silver producers?

Well as mentioned above, Fresnillo – the pride of the Mexican mining industry – is the world’s largest silver producer.The company is solely focused on silver production. But as you’ll see in the list below, many of the other largest silver miners are in fact gold and base metal producers.Key Fact: Most silver is mined as a by-product of other metals – especially gold and zinc and lead.Thus, many might find it odd that a ‘gold’ producer churns out significant silver ore – but it’s true.Here’s a chart showing the top six-silver producing companies.

Even as a by-product, a rising silver price will directly influence these firms’ cash-flows.Which will ultimately lead to higher valuations.

“A Lightning Rod”: What’s Next for Silver?

Keep in mind that silver is useful both as an industrial metal and as a store of value.This has the potential to be a double whammy for prices when things heat up.Hence why the hyper-aggressive easing policies global central bankers have used since 2008 are positive for silver’s industrial use and monetary use.It’s not far-fetched to think that silver will catch a bid. And soar.Remember – it has in the past.Regards,Marin KatusaP.S. If you want to see the companies I’m investing my own money into – and what prices I’m buying. Click here to learn more about Katusa’s Resource Opportunities.

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws.

By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim.

If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.