Pop quiz: What do Norway, Nestlé, and NASCAR have in common?

Or what about Leonardo DiCaprio, President Biden… and JetBlue?

They’re all among the companies, celebrities, cities, and countries that have made commitments to curb their contributions to climate change.

Or eliminate them entirely.

And they’re all using the exact same tactic to do so.

It’s one you’ve probably never heard of…

In fact, it’s a commodity so new that it doesn’t even have an official market yet.

There are no quotes or tickers on Yahoo! Finance, Financial Post or Google Finance …Pricing is almost impossible to find.

But it’s on the verge of erupting onto the world stage.

In a few years, even your Uber driver—will know everything about it.

I’m Talking About Carbon Credits

From here on out, the carbon credit news cycle will accelerate.

And it’s going to happen at a breakneck pace.

The tidal wave of government and corporate money that will create this change will put NASA and every other government body to shame.

It’s going to create enormous, long-lasting change in how investing works.

- This is the type of opportunity that—like clockwork—comes along once in a generation.

You are getting a front-row seat to one of the most incredible emerging opportunities you will ever see.

Once you’re up to speed on how the largest entities in the world plan on fighting global warming…

You’ll be set to profit from them in a big way.

So, let’s get you up to speed on the basics.

I guarantee you will be smarter than any of your friends and colleagues by the end of this missive.

How are Carbon Credits Created?

Carbon credits are generated through emission reduction or direct emission removal.

For example: carbon credits can be earned for a renewable power plant that is used to displace coal fired electricity generation.

- For each tonne of CO2 which is displaced, a credit is earned.

Carbon credits can also be generated through removal of greenhouse gases.

This is known as carbon sequestration.

Carbon removal comes from projects such as forest restoration and avoided deforestation. These are grouped as “nature-based solutions”.

Or credits are created through physical removal of carbon from the atmosphere through technology known as:

- Carbon Capture & Store or

- Bioenergy combined with Carbon Capture Store (known as “negative emission technologies”)

Carbon offset projects which sequester carbon (such as reforestation or avoided deforestation) are a function of opportunity cost.

This means the alternative use for the land is what partially drives the value of the offset.

Land which could be used for agriculture or livestock is therefore a function of crop and livestock prices.

The Trove Intelligence Global Carbon Credit Supply Model indicates that prices in the voluntary market will need to rise by an order of several magnitudes…

To continue to incentivize carbon project developers.

Book a Flight

If you try to look at pricing of flights on google or any online portal, under the price of the flight you will now see the amount of carbon emissions that your one seat is responsible for.

This is done for two reasons…

First, to start making customers aware of the amount of carbon emissions they are responsible for their flight.

Second, it’s to condition customers such that when there is a cost now to negate those emissions, the customers know the reason for the cost.

Carbon Credits are an Emerging International Marketplace

The beauty about the carbon market is that it is global.

Greenhouse gases migrate and emissions from one nation end up in the skies of another.

It requires global acceptance and adoption to solving the problem.

- In the Voluntary Carbon credit Market (VCM), a credit produced in 1 country can be applied against emissions of a company located in another part of the world.

For example, the Bonobo Peace Forest in the Democratic Republic of Congo is one of the largest reforestation projects in the world.

Credits earned from this project can be applied against emissions of a company domiciled in Europe or North America.

This creates an incredible opportunity for an international marketplace for credits.

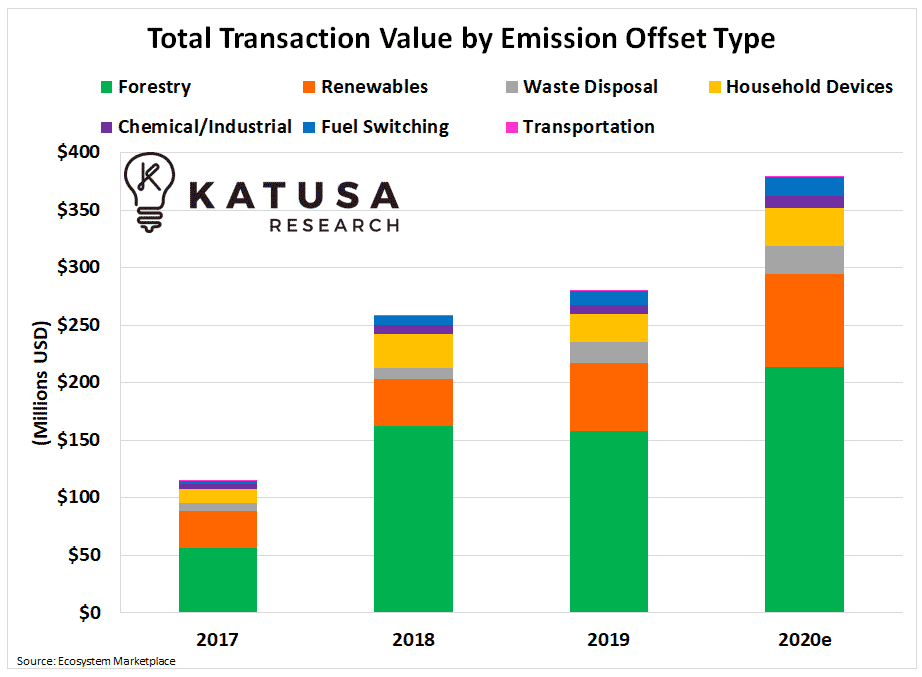

Below is a table which shows the total value of transactions by offset type in the Voluntary market for the past 4 years.

- Total transaction volume in 2020 is estimated to be over 3 times the volume it was in 2017…

And this is exactly what makes it such an exciting place to invest…

All of this is building up a pressure chamber of demand in the VCM that has not yet reached a tipping point.

When it does, there’s a lot of upside to be had.

Because It’s the perfect setup for a long squeeze in the VCM:

- Rising emissions from a growing population.

- Tightening government mandates on carbon emissions.

- Increasing consumer demand for environmental responsible.

- More transparency in emissions reporting.

- Corporate buy-in at every level, even from non-emitting companies.

All together, this is going to result in a desperate scramble for high-quality carbon offsets, of which there are few.

If you thought the rise in the price of lumber was crazy in early 2021…

Just wait until you see the VCM market in five years.

Voluntary Carbon Market Pricing

The bad news is that since VCM is such an undeveloped market, pricing information is hard to obtain.

In fact, the term “voluntary carbon market” is somewhat inaccurate. The market itself purely ad hoc.

This is such a new commodity that there is no real, actively traded market.

And that’s great news.

Because it means very few people are actually investing in the market right now.

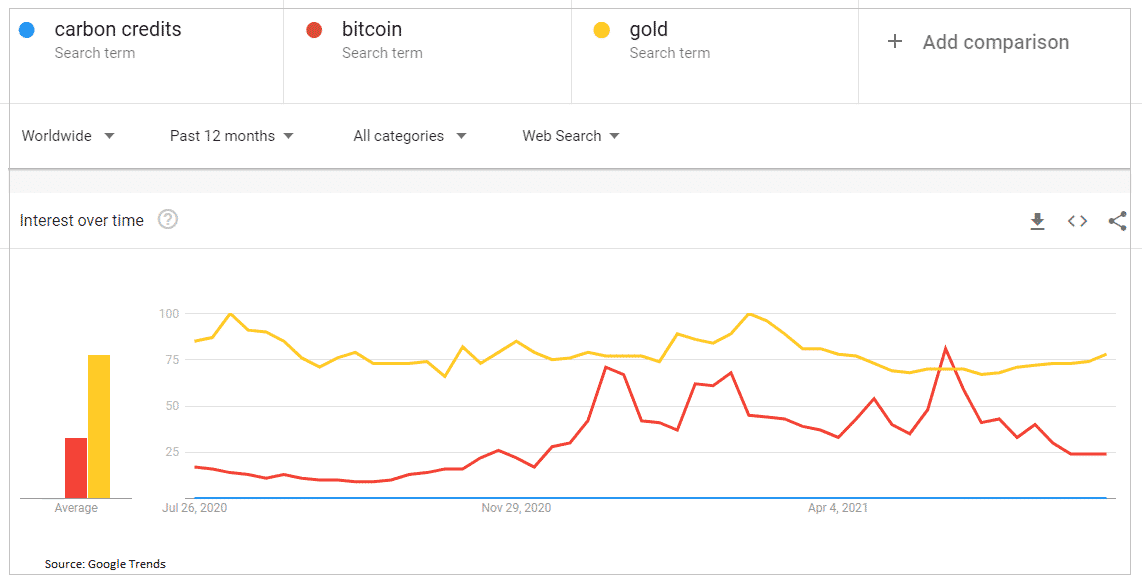

This isn’t even hitting a blip compared to Gold or Bitcoin on Google Trends…

- As an investor, you know that the time to make your bets is when NO ONE else is looking at a sector.

To start shedding light on what carbon offsets could be worth, let’s start by looking at the price floor.

Carbon offsets produced through means such as reforestation have an opportunity cost.

Breakneck Price Acceleration

Based on this, the Trove Intelligence Global Carbon Credit Supply Model indicates that prices in the Voluntary Carbon Market (VCM) will need to rise to continue to incentivize carbon project developers.

Furthermore, how credits are produced gives them different base values.

The table below shows the variation in global carbon credit pricing across different types of carbon offsets in the voluntary market for 2017–2019.

In 2021, prices in the voluntary market have been hot.

Prices have regularly been quoted above $7.50 per tonne and as high as $15 per tonne for high-quality credits.

Catalysts & Opportunities in the Carbon Markets

They key catalysts for the carbon market are…

- Government-led initiatives to promote the carbon marketplace.

These include establishing a global carbon price floor, heavily enforcing the achievement of NDCs, and regulating investment in carbon removal technology.

All of these are heavily bullish for carbon offset prices.

- Corporate-led net neutral and net zero pledges.

Expect to see corporations race to become net zero so that they can remain competitive in the marketplace.

And then watch for additional demand from erasing historical emissions.

- Demand-driven development of reporting and exchanges.

As outlined, this will include Scopes 1, 2, and 3 emissions. In the near future, it will also require highly liquid, transparent exchanges for both the compliance and VCM.

This has always been the trajectory of any new commodity.

Only this time, you know about it before it has achieved anything close to equilibrium.

The Carbon Market is an Incredible Asymmetric Bet

There’s so little downside—climate change isn’t going anywhere—and incredible upside.

Early adopters, project generators, and holders of carbon credits and offsets can earn substantial returns over the coming years.

Very few people know about this brand-new commodity sector… yet.

But everyone understands it immediately once exposed.

And everyone who understands… will invest, because it makes sense and its cheap to do so now.

Of course, you can stay on the sidelines if you want. But before you make that decision, recall one of Warren Buffett’s most famous quotes.

It goes like this:

“Someone’s sitting in the shade today because

someone planted a tree a long time ago.”

Those trees are (literally) being planted today—all across the world.

And I’m here to help you make a profit from it.

To find the companies best positioned to make money from the hundred-trillion-dollar war, you’ll want to become a member of Katusa’s Resource Opportunities.

In my monthly newsletter, I’ll be publishing the best carbon investments that come across my desk.

If you want to be among the first—and only—to know, sign up today.

Regards,

Marin Katusa