You’ve probably seen, or at least heard of, the movie The Big Short.

It tells the story of the global financial system collapse in 2008—and of the people who made hundreds of millions predicting it would happen.

Right now, we’re on the verge of another Big Short.

This one’s in an entirely different industry. But the playbook is exactly the same:

Reduce the margins of safety, and hope nothing goes wrong. Just like in ‘08, most people think nothing will ever happen.

But eventually, someone reduces the margin a little too much—and something goes very wrong.

For the few people that are paying attention this time around, it could be 10x more profitable than the last time around.

This story begins with something called: PJM Interconnection.

This is a giant organization that coordinates the electricity transmission across thirteen states, including Virginia.

If PJM runs out of power, it’s lights out for the Northeastern U.S.

Power Warnings

Last year, PJM issued a warning that dense construction of power-thirsty data centers in its region was driving unsustainable growth in energy demand.

The warning was mainly the result of one thing: exponential, unexpected data center growth in Northern Virginia.

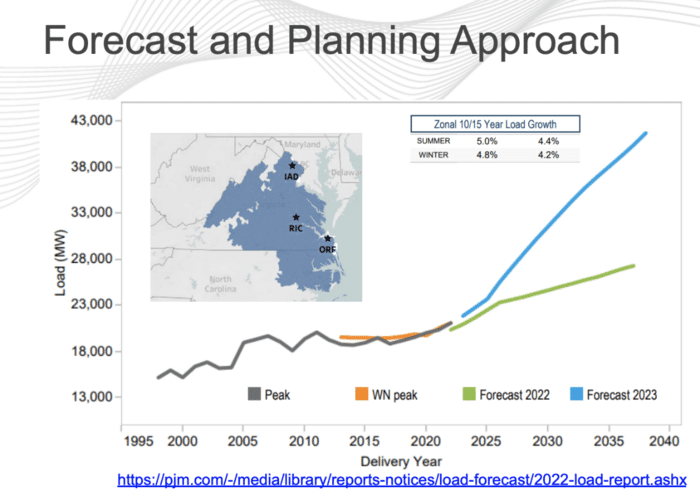

PJM’s 2022 projections showed little peak load growth in that region.

But in its updated 2023 projections, the organization tripled its peak load growth forecast based on a projected doubling in the data center capacity in the region.

That added 10GW of power to its 2030 forecast—like adding another New York City to an already-overloaded, “unsustainable” system.

It’s a significant amount of power to get online in a short amount of time.

But surely PJM is planning to get new power generation and transmission capacity online, right?

Wrong.

And it gets worse.

Margin of Error

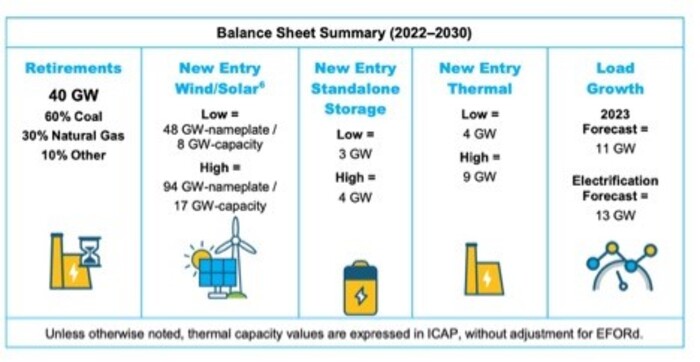

Because while it’s tripling its peak load forecast, PJM also plans to retire 20% of its power generation.

Look at PJM’s balance sheet summary through 2030:

PJM projects 24GW of new power generation by 2030, but with 40GW of retiring capacity and 13GW of added demand, the region faces a 29GW deficit.

That’s equivalent to 30 nuclear reactors—nearly impossible to add within six years.

Further compounding the issue is the intermittent generation of renewables, relative to the baseload coal that is being retired.

Like it or hate it, coal and natural gas-fired facilities are always on, solar only works if the sun shines or you have utility-scale battery storage. What PJM really needs to consider is whether the newbuild megawatt hours (meaning actual generation) will meet the required consumption of the region.

Pay close attention to PJM’s reaction to the power deficit…

For a utility company, what matters is whether power is available when demand is at its highest—hence “peak load demand” forecasts.

So organizations like PJM maintain an “installed reserve margin”.

That’s a fancy way of saying power generation capacity in excess of the projected peak load.

Right now, that margin is set to ensure no more than one day of power outages per ten years.

But for the first time in decades, PJM is letting that reserve margin drop—a lot.

Just like the banks did in 2008.

Let me show you what I mean.

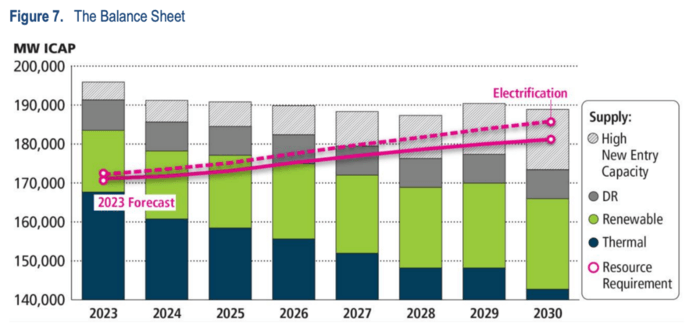

Including new installations, PJM’s installed capacity is projected to drop from 195 GW in 2023 to 186 GW in 2028. Meanwhile, demand is projected to rise from 173 GW to 182 GW.

PJM’s reserve margin, the buffer against outages, is set to drop from 12% in 2023 to just 3% by 2028—a 75% reduction.

And that’s the best-case scenario…

If all the power generation it projects comes online at exactly the right time.

According to PJM and independent sources, however, it’s likely to be much lower.

Just like banks in 2008, PJM is one major event away from failure.

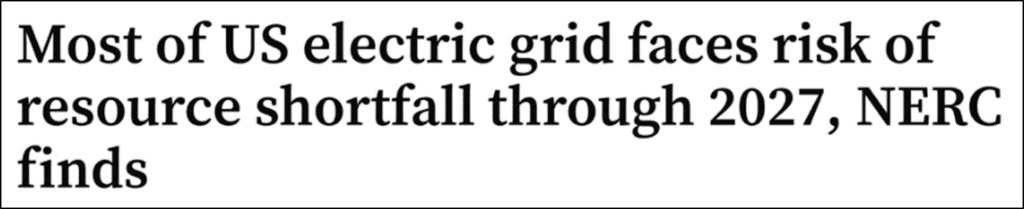

This power crisis isn’t just in PJM; it’s a nationwide issue.

The U.S. is on the verge of widespread power shortages, driven by surging data center demand and shrinking energy reserves.

It’s setting the stage for a prolonged period of the worst blackouts in U.S. history.

It’s Coming Earlier than Expected

The number of major power disruptions annually has risen 750% since the turn of the century.

And it stands to be the greatest threat to AI and data center developers yet.

So utilities, grid operators, tech companies, and governments are all working urgently to solve the problem.

Mark my words: Those that identify and implement a solution first will make billions, just like the Big Short.

I believe that solution has already been identified, and it’s well on its way to being implemented.

I hope you’ll join me—before the lights go out.

Regards,

Marin

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws. By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim. If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.