I’m glad you’re joining me for one of the most important events of the year … The Bitcoin-Gold Connection.

Remember, my emergency market briefing starts at 12PM Eastern Time on Thursday, March 22nd, 2018.

You’ll receive a few emails the day of the event that contains the links where you can access the briefing. All you need to do is make sure to join a few minutes early and sit back and relax.

This event will be closed to the public and only accessible to current Katusa Research readers. Today, I want to answer a very important question in the Bitcoin-Gold Connection.

How did we get here?

Believe it or not, a good place to start is thousands of years ago in ancient Rome.

When a Roman general returned from a successful military campaign, the city held a “Triumph” through the streets to celebrate his victory.

Interestingly, a slave would ride beside the general in his chariot.

The slave’s job was to whisper into the victorious leader’s ear “Remember, thou art mortal.”

The Romans did this to keep their leaders grounded and realistic.

Something the Bitcoin boom could have used last year when prices soared to near $20,000.

But this is how all bubbles form, like Tulipmania that gripped Holland in the 1630s.

Tulip prices soared 20-fold in four months, before plunging 99% in just two…

And the Tech Wreck of the late 90’s when the NASDAQ crashed 80%.

An elaborate sounding domain name was enough to drive your stock price to the moon.

Or the last housing bubble when a bank account and a pulse got you a mortgage to flip real estate.

Bitcoin is no different.

Folks have even run up their credit cards or taken equity out against their homes to try and get a piece of the pie.

Uber drivers give their passengers hot “insider” tips on which coins to buy next.

Teenagers meet in online Bitcoin trading forums with dreams of Lamborghinis and yachts.

Simply put, before the bubble, Bitcoin investors bet on the price of Bitcoin rising, not on the actual value of it.

Which is why in the first month of 2018 Bitcoin plummeted over 64%.

The warning signs were there.

True market experts were screaming into the ears of Bitcoin investors.

Yale economics professor Robert Shiller, who won the Nobel prize for his work on bubbles, was asked early last year…

“What are the best examples now of irrational exuberance or speculative bubbles?”

His answer – Bitcoin.

Nouriel Roubini, a professor of economics at New York University who famously predicted the 2008 global financial crisis warned Bitcoin was “the mother of all bubbles.”

Even a Harvard study titled “Bubbles for Fama” mathematically guaranteed a massive crash.

The researchers defined a bubble as a sharp price run-up over a two-year period followed by at least a 40% drop over the following two years.

When the price run-up is 100% or more, they found the probability of a crash becomes 50%.

A run-up of at least 150% and that probability becomes 80%.

As price run-ups become even bigger, a crash becomes “nearly certain.”

Bitcoin’s runup over the last two years is nearly 2,500%…

That’s more than 10 times greater than the threshold the researchers found was associated with a “near certain” subsequent crash.

I want to make something clear.

I believe in the long-term use of Bitcoin and blockchains.

The potential to revolutionize the financial system is inarguable.

But, my job is to find the best opportunities… the ones that will make you the most money… right now.

The easy money was made in Bitcoin and if you’re looking to hit the jackpot you’re going to be disappointed.

You see, most investors aren’t looking at Bitcoin correctly.

Bitcoin acts like a currency but needs to be valued like a technology as well.

Because whether or not Bitcoin becomes a standard means of exchange isn’t the same as the dollar or the euro.

It’s based on how well the hardware and software work.

Things like security, network speed, and mining efficiency.

When you view Bitcoin as a technology, the recent boom and bust make sense.

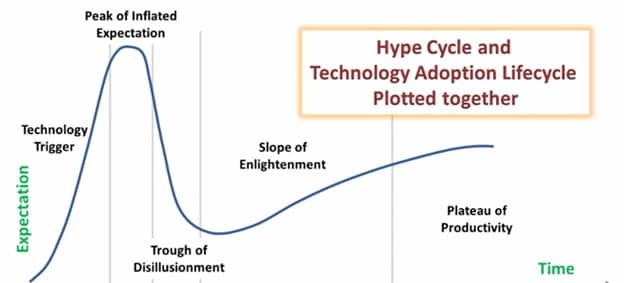

Because new technologies follow a very predictable curve.

Also known as a “Hype Cycle.”

Basically, what these cycles show is that a market tends to overestimate the effect of a technology in the short run.

But underestimates the effect in the long run.

The Bubble Blueprint

It works like this.

After spending years in bedrooms of Silicon Valley techies and hobbyists, Bitcoin finally broke into the spotlight.

Suddenly, you couldn’t read the newspaper, turn on the TV, or go on social media without seeing Bitcoin headlines.

Everyone wanted a piece of the pie.

Psychologists call this “A Desire for Newness.”

I call it a Fear of Missing Out (FOMO).

Humans want what few people have, as a way to show social status.

We want to be able to know what others don’t.

So then we can hold court at cocktail parties and feel like the smartest person in the room.

Even the actual brightest minds (Sir Isaac Newton, in this case) succumb to the mania of a bubble:

It’s very difficult to resist the social pressure to become involved.

As Charles Kindleberger, a historian of bubbles, wrote: “There is nothing so disturbing to one’s well-being and judgment as to see a friend get rich.”

At a certain point, Bitcoin became synonymous with winning the lottery.

And… the bubble popped.

Bitcoin plummeted over 64% in just weeks.

Now that the hysteria has somewhat subsided, Bitcoin will have to prove to the market it can actually work for the reasons it was created:

A safe haven from the dollar… a hedge against the government… and a universally recognized form of wealth.

But that could be years or even decades when you look at the current state of Bitcoin.

Crypto Exchanges and Wallets are still incredibly vulnerable to hackers…On January 26th, 2018, Coincheck was hacked and robbed of about ¥58 billion ($532 million) of its holdings… surpassing the previous biggest hack of $480 million from Bitcoin exchange Mt. Gox in 2014.

Governments aren’t trying to lose power over their monetary control anytime soon… the biggest markets in the world like China, Russia, India, Korea and more are banning crypto or making it extremely difficult to grow.

Banks are Banning Bitcoin Purchases…including major institutions like JPMorgan Chase & Co., Bank of America Corp., Citigroup Inc, Capital One Financial Corp. and Discover Financial Services.

Markets are Vulnerable to Manipulation…The U.S. Commodity Futures Trading Commission just opened an investigation on a popular coin exchange, Bitfinex, for a massive rigging scandal.

The Social Science Research Network journal just found that at one point, 600,000 Bitcoins valued at $188 million were fraudulently acquired by just two computer bots.

Worthless “alt-coins” can be created and then used to buy Bitcoin…artificially pumping up the price.

The Technology Is Still Extremely Flawed…

Just as gold bars are lost at sea or $100 bills can burn, Bitcoins can disappear from the Internet forever. According to new research from Chainalysis, 3.79 million Bitcoins worth over $33 billion have been lost into digital purgatory.

It takes 78 minutes to process the average Bitcoin transaction, but this has recently spiked to as long as 1,188 minutes (almost 20 hours) during peak volume times.

Fees are high—the average transaction costs around $28 and can reach $100.

Like I said, I believe in Bitcoin in the long term.

But right now, if you want to make crypto like profits… there’s a better opportunity in the gold markets.

That’s what my “Katusa’s Keys” are telling me.

This is the same investing strategy that’s turned out gains like…

1,480% on Primary Metals…

1,450% on Ryan Gold…

1,250% on Ventana Gold Corp…

903% on Rare Earth Metals…

452% on Hathor Exploration…

1,901% in Midas Gold…

420% on Reservoir Minerals…

862% on Energulf Resources…

1,200% on Laramide Resources…

185% on Newmarket Gold…

And many more… without using options, futures, or even buying on margin.

During my emergency market briefing on Thursday, March 22nd, 2018, you’re going to learn why this is actually the best time to buy gold in the last 50 years…

The single best way to play this under the radar rally… for potential Bitcoin-like gains.

And I’ll reveal the three gold stocks my Katusa’s Keys are signaling could be the next millionaire making plays…

Handing early investors 10, 20 even 30-times their money or more over the next 12 months!

But, we have work to do…

Tomorrow, I will be revealing crucial details behind why gold stocks have quietly been setting up for a massive run.

Please be sure to read ALL of my material to make sure that you are fully informed and ready to profit from the Bitcoin-Gold Connection.

Best Wishes,

Marin Katusa

Founder

Katusa Research