In the stories of ancient mythology, Atlas – the Titan of endurance – was fated to bear the heavens upon his stooped shoulders.He was a solitary symbol of resilience, standing strong amidst a world spiraling into chaos.Fast forward to the modern-day, a stark parallel emerges in the stock market…

- A group of seven ‘Tech Titans’ – Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta, and Tesla – now bear an Atlas-like burden.

Unlike the celestial sphere of the tale, their load is the weighty S&P 500 index, held aloft by their collective might.Yet, there is a sense of balance, a teetering dance with fate that echoes the Greek Titan’s difficulty.This week we peel back the layers of this Digital Atlas tale…It probes the outsized influence of these tech Titans and uncovers the potential repercussions if their shared balance were to falter.

Market Breadth and the Tech Titans

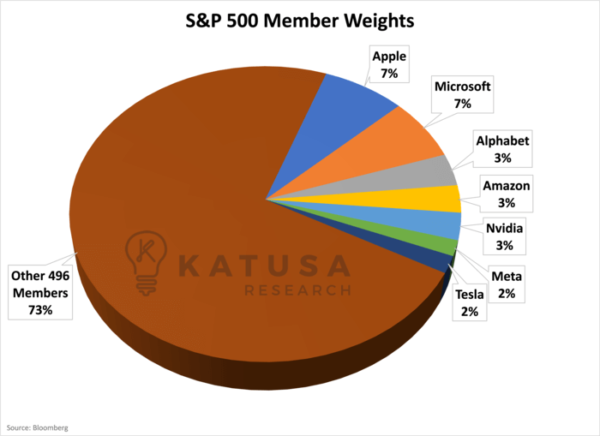

The healthiest market is one where gains are built through most stocks in the index going up, rather than by a select few.Broad market participation in a market upswing signifies strength in the economy as all cylinders are firing well.Right now, we are seeing the complete opposite.The S&P 500, with its unique construction, assigns greater weight to larger companies within the index. As such, the return of the index is primarily influenced by the performance of these dominant corporations.This leads to a self-fulfilling prophecy as larger stocks go up in value, they become increasingly heavier weights within the index.Seven stocks have been driving S&P 500 performance this year: Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta, and Tesla.

- Together, these seven stocks represent 27.0% (of the $38.1 trillion market cap for the S&P 500).

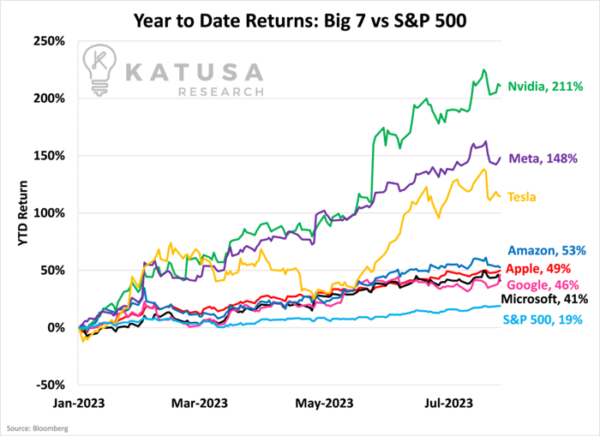

On average, share price returns for the group of seven is up 95% for the year.

- The S&P 500 index is up 19%, which means that the members forming the other 73% of the index are massively underperforming.

The next chart shows the year-to-date returns for the Big 7 versus the S&P 500.

Equal Weight

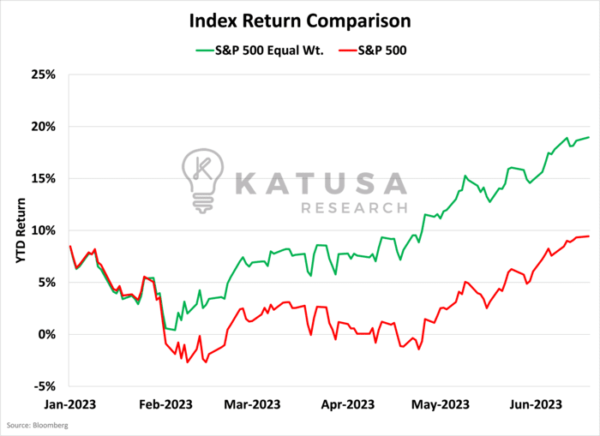

Now let’s compare the S&P 500 index with a hypothetical variant where all companies hold equal weight.The chart below presents the S&P 500 on an equal weight basis, where each company has the same influence. That’s in contrast to the actual S&P 500 which varies weights based on the size of the companies.

As you can see, on average, the average large-cap company is not faring nearly as well as the Big 7.

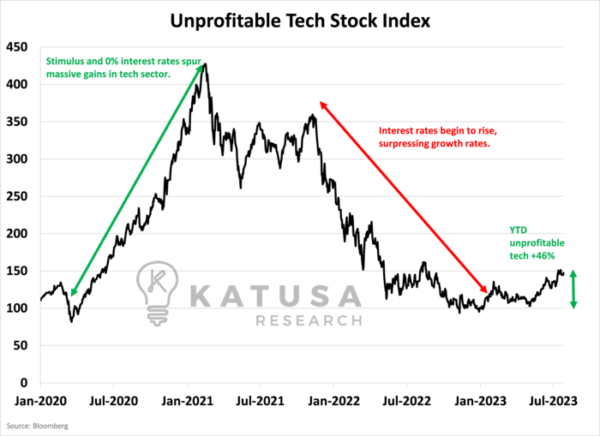

The Companies With No Profit

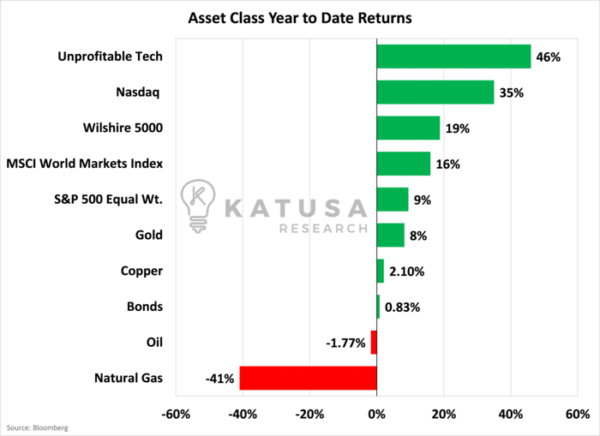

Another index we like to use as a proxy is an index composed of “unprofitable tech companies”.It can provide a unique contrarian perspective given they are the highest-risk investments.We can see in the post covid environment, the index soared massively on free money stimulus, only to fall precipitously once interest rates began to climb. Now in 2023, the index is up nearly 45%.

Below shows the returns year to date for a variety of asset classes and equity types.

Winners Win: The Big 7 Outperformance Watch is On

The Nasdaq is another index which is also market capitalization weighted.All 7 of those “Big 7” tech companies above are listed on the Nasdaq which is what is driving the Nasdaq return outperformance.

- An equal-weighted Nasdaq Index would be returning 24% year to date, nearly half of what the actual Nasdaq return is this year.

The key takeaway here is that most of the market returns generated are coming from a very small group of companies from a specific industry. It’s not a wide swath of companies from a diverse set of industries leading the pack.To me, this indicates that the market is very fragile and likely heavily levered to those 7 stocks.If momentum fades, the balloon will pop quickly, and we could see a very sharp correction as longs quickly unwind. It’s something to prepare for.While possible, given the projected rise in interest rates, it is hard to see the rest of the pack playing catch up to these few market leaders.Many stocks in the index are caught in one particular market cycle right now.Next week, I’ll tell you why we’re in a critical phase of the market cycle where investors can make serious money.Regards,Marin Katusa

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws. By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim. If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.