Solving inflation is not a quick fix.Investors and the United States Federal Reserve are finding this out in real-time.Participants who were “hoping” for a deceleration in inflation this month were met with a surprise this week.

- Inflation remained stubbornly above 8%. And this paves the way for additional rate increases.

It’s becoming the norm in Jerome Powell’s toolkit.

No Slowdown at Inflation Station

Participants were hoping for a slowdown in inflation which in turn could lead to a smaller rate increase at the November Fed meeting.This would buoy equities and lead to a weakening of the US Dollar. You would think, at least.

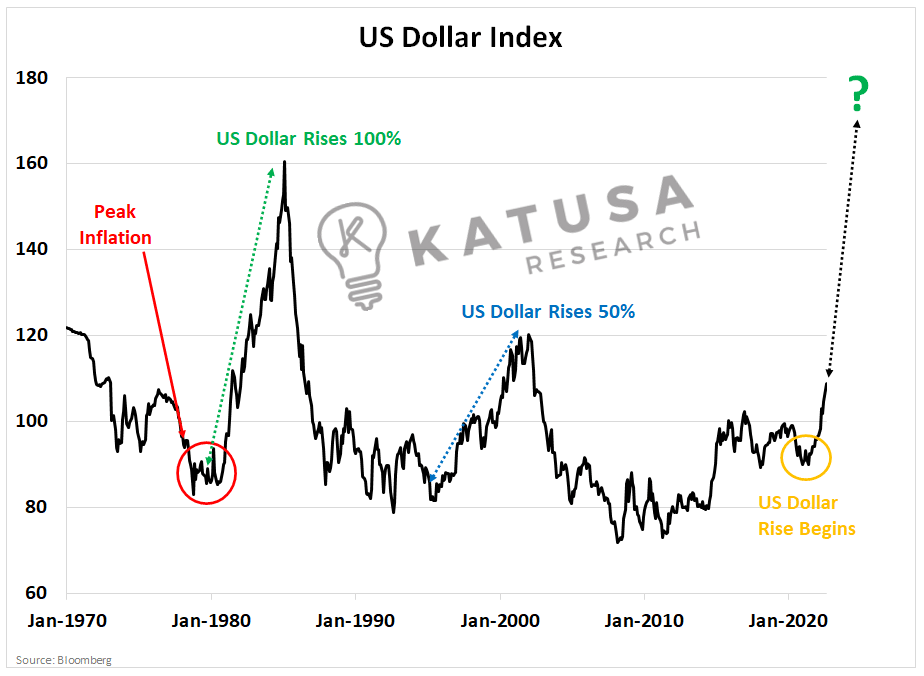

- However, the early 1980s which is the last time we had a serious inflation saga…

And this was actually just the beginning of a 100% rise in the value of the US Dollar versus major currency pairs.Don’t believe me? Look at this chart.

History Rhymes: What Should You Do?

This goes 100% what you are led to believe in the day-to-day headlines, where most pundits suggest that slowing inflation leads to a weakening dollar.Now, why did the dollar rip during that 1980-1985 period? 2 reasons

- Tightening monetary policy – Fed Chairman Volcker aggressively raised interest rates for 2 years.

- Expansive Fiscal Policy – government spending under US President Ronald Regan spent more money than it generated from tax receipts.

The trigger effect of the government spending aggressively to stimulate growth…Combined with high-interest rates…

The Meeting in New York That Changed America

So, what led to the cratering of the Dollar after 1985?

- The Plaza Accord was a summit in New York attended by the most important central bankers and government officials of the time.

The United States, France, Germany, Japan, United Kingdom.During the summit, the officials enacted the ability to conduct coordinated central bank intervention and agreed to lower the Dollar by 10-12% over the coming 6 weeks.Why would the US vote in favour to devalue its own currency?Officials believed that the expensive US Dollar would lead to less competitive American industries and could trigger mass unemployment.

The key underlying challenge in the United States was a simple issue of capital mobility…

At the time, the world was not nearly as well connected as it is today.Globalization wasn’t a thing yet back in the early 1980s.Today, capital can move from regions of low return potential to regions providing higher potential returns on capital with ease.Capital mobility plays an integral role and is a key reason why I believe the United States (and U.S. Dollar) are not set up for a massive crash as others may suggest.No matter how you shake the tree – it is truly difficult to see a world where the US Dollar doesn’t retain its world reserve status.And remain strong against its peer group.We must remember…

- We are in the very early innings of a major attempt by Central Banks and governments to deleverage.

Deleveraging means taking money out of the system, which is a situation we haven’t experienced in decades. Some countries haven’t even started yet.The US is leading the pack, and as the strongest economy in the world, it makes total sense that they go first.Don’t get me wrong, there are massive structural issues to be sorted out in the United States. But there are even more structural issues abroad.

- Do U.S. have an energy crisis? Where industries and citizens pay 10x their average utility bill every month? No.

- Is there a massive lending crisis going on? Is household debt to disposable income at all-time highs? The answer remains no.

Now, that does not mean this is a 1-way trade.There will absolutely be bumps in the road as investors attracted by short-term returns flock to other currencies. However, over a much longer period, I believe the US dollar will remain a stalwart for the global economy and in my portfolio.As interest rates go up, expect further declines in the equity prices of most publicly listed companies.

Same Old Song and Dance…

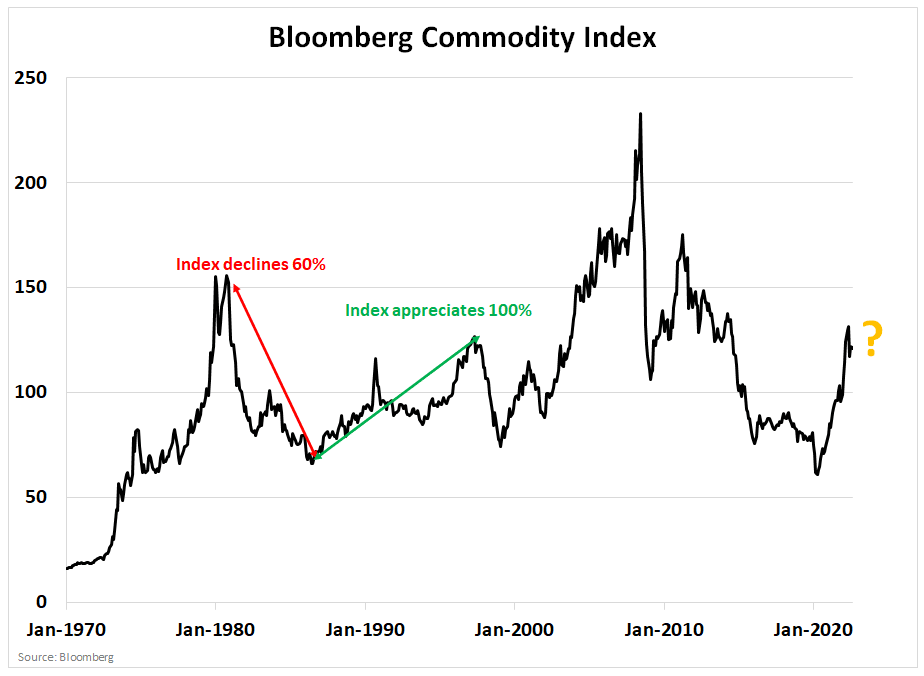

In the aftermath of the Volcker inflation era, Regan stimulus, and Plaza Accord, commodities took an absolute beating.The commodities index, measured by Bloomberg fell over 50% from 1981 through 1986, only to appreciate nearly 100% over the coming decade.It was a choppy ride, however, filled with many months with minimal returns and a few high return months scattered in.As you can see the commodity market didn’t truly begin “trending” again until after the Tech Bubble bust in 2000.

This is why one of my boldest ideas, detailed in full to my subscribers is actually based on a soft or weakly trending market.

- If my investment thesis can reward me well in a lousy market, when commodity prices do trend strongly higher, it should perform exceptionally well.

If you’ve followed me for some time, you know that I eat my own cooking.You’ll also know that a key part of my 2-decade success as a professional fund manager in the natural resource space, is that I am rarely part of the herd mentality.The investment ideas found within the Katusa Resource Opportunities reports are unconventional.If you want a newsletter to feed your confirmation bias, this is not for you.I challenge myself continuously to come up with the best ideas that no one has written about.Regards,Marin Katusa