“It takes character to sit with all that cash and do nothing.

I didn’t get to where I am by going after mediocre opportunities.”

– Charlie Munger

I started with nothing.

Granted, I was blessed to have an incredibly supportive family. But with regards to wealth creation, I didn’t have much to lean on.

While most of my buddies were out chasing girls or watching football games and drinking beer in University and in our early 20s, I spent almost all my spare time searching for “more”.

I didn’t know exactly what that “more” was but I stumbled along for many years in the early 2000’s searching for “it.” I devoured any and every book on investing and wealth creation from stocks to real estate to medical instruments.

Once I came across “it”, I knew it was the start of the most exciting journey of my career.

My mindset completely changed.

And here’s the thing, so can yours.

You see, by 2005 I had already established myself in the resource sector working with some very well-known names. Learning the craft was a steep learning curve, but what I will share today definitely brought the most important dimension to my investment framework.

I First Read It in 2005…

This book really helped me understand the thought process of Charlie Munger.

It’s called Poor Charlie’s Almanack: The Wit and Wisdom of Charles T. Munger.

It’s over 400 pages of brilliance in a fun and easy format. I’ve read this book more than any other book. Including my New York Times Bestseller, The Colder War which I re-read countless times as I wrote it and then during the editing process.

At the end of the book, Charlie Munger provides a list of his favorite books. His kids think he’s “a book with a couple of legs sticking out,” so you know that books he recommends will be good.

Once I got to the list, I jumped on Amazon right away and ordered every book. Not one of them disappointed.

When he says you should ignore mediocre opportunities, waiting for great ones instead—you should listen to him.

In a recent interview, Charlie Munger was asked…

“Do you expect the next 10 years to have lower returns than in the last 10 years?”

In one word he answered point-blank, “yes”.

And he went on to say…

“The frenzy is so great, and the systems of management, the rewards systems are so foolish, that… I think in real terms, the returns will be lower.”

This is one of the best investors in history, ever.

He’s navigated through many bull, bear, and echo markets and became a Billionaire. He is Warren Buffett’s guru.

Is He Just an Old and Out of Touch Grandpa?

No way.

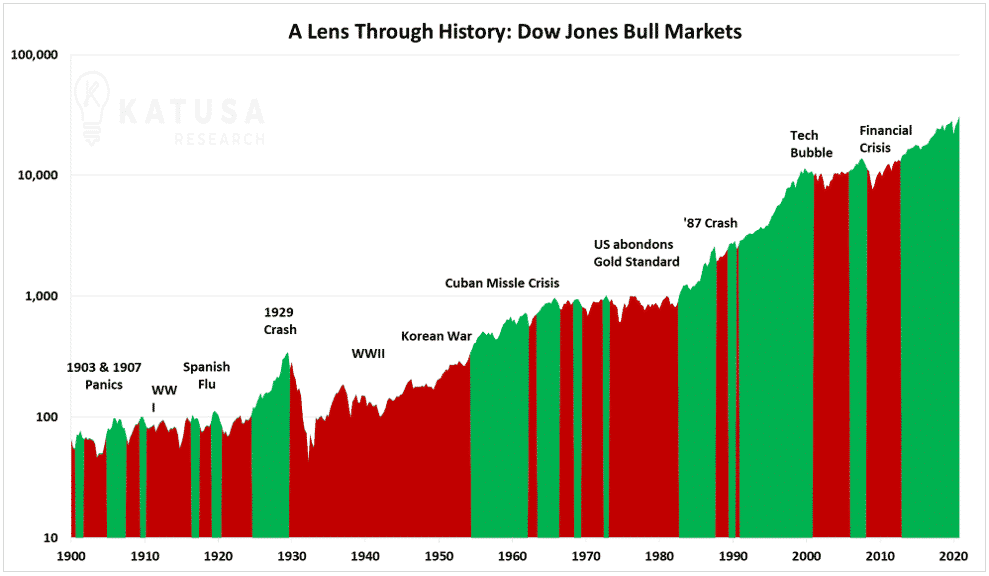

Back in February 2020, he warned of “Wretched Excess”. And his warnings were blistering.

Now, even though I am very bullish on resources and commodities, with gold and our gold stocks in particular, I am stressing everyone to be patient and not chase any stocks.

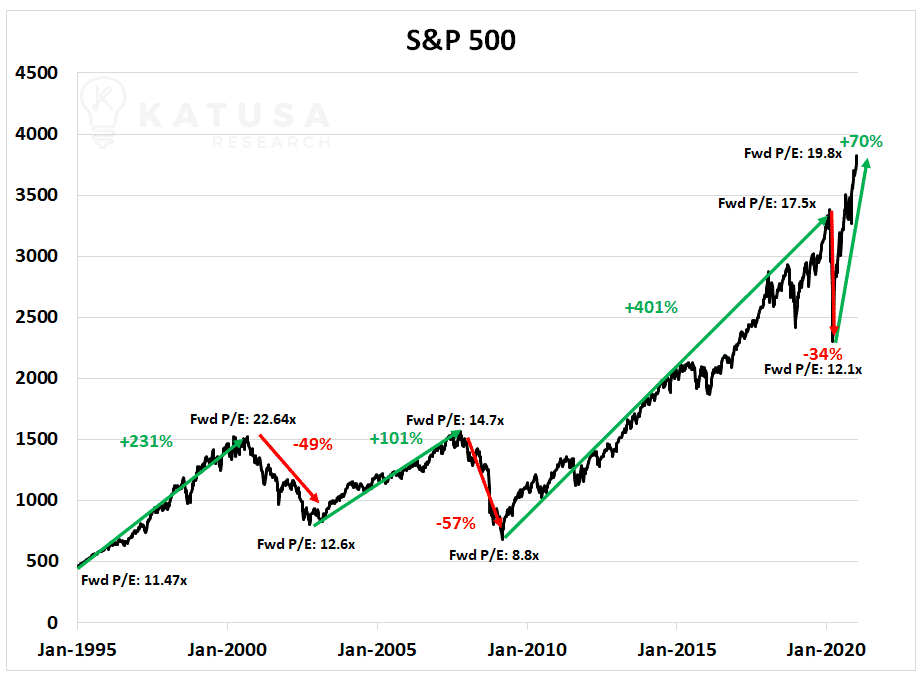

Right now, stocks in the S&P 500 are the most expensive they’ve been in 25 years, except during the 1999-2000 Tech bubble.

The tech world has gone parabolic over the past year as Fear of Missing Out (FOMO) has taken hold.

SPAC, IPO and Deal Flow Bonanza

The enormous amount of capital flooding into SPACs and IPOs is unparalleled.

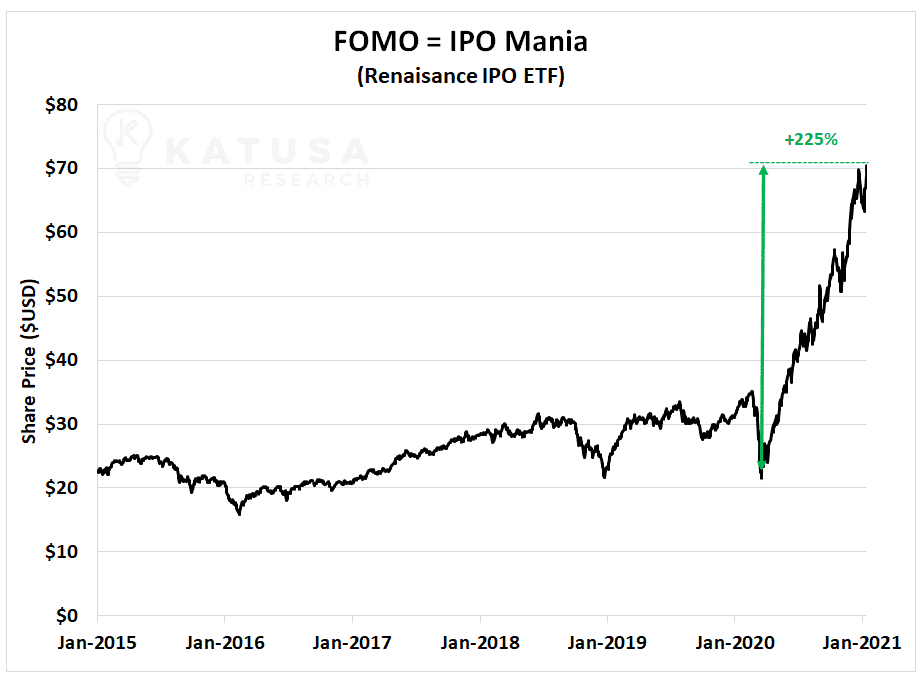

To show this IPO mania we can use the Renaissance IPO ETF as a proxy. You’ll see it has skyrocketed over the past 12 months soaring to new highs.

I find it ironic that companies going public in 2020 post-pandemic would demonstrate more robust revenues and cash flows than any time during the past 6 years. After all, that should be why the IPO ETF is at record highs.

Clearly, that’s not the case.

The world economy shuts down yet IPOs trade at record valuations? Call me old fashioned, but that seems like a stretch to me…

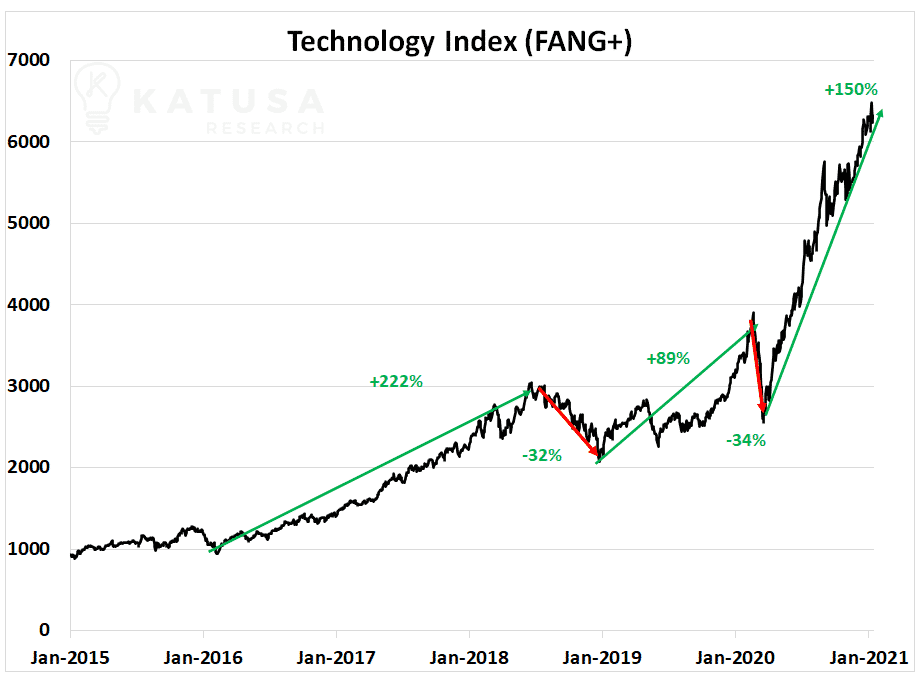

Let’s not forget about the FANGs index, which is composed of the largest technology companies. It has soared 150% over the past 12 months.

However, as the saying goes “the market can stay irrational longer than you can stay solvent”. So I’m not shorting the market, that’s not my area of expertise.

I stick to what I know and have the top-performing track record in my sector by sticking to my framework.

- The disconnect between the real economy and the stock market has led to many subscribers and readers wanting additional protection.

I still believe that there is considerable uncertainty in the world. And the valuation of the global equity markets is vastly different than what the current economic situation suggests.

While most equity indices are at or near record highs, euphoria continues to soar.

We can measure this in different ways…

One way is to look at a chart and see share prices at record highs. That’s obvious.

We can also measure it using various indicators that measure the number of advancing stocks minus number of declining stocks.

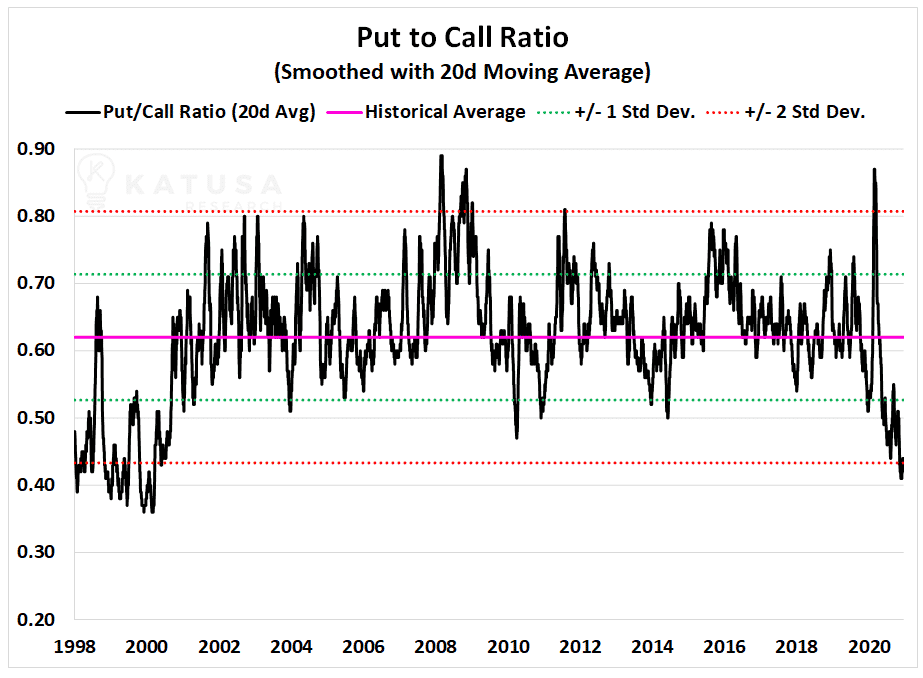

A third way, which is more forward looking and can really show the true euphoria or “FOMO” (Fear of Missing Out) factor is through a ratio called the “Put to Call Ratio”.

The FOMO Indicator

The Put to Call ratio measures the number of Put options purchased relative to Call options purchased.

Investors who are optimistic will buy a call option, which gives them the right to purchase a stock at a specified price at a specified time.

A put option works the opposite way, investors who are negative will buy a put option.

- A put option gives the owner the right to sell at a stock at a specified price by a specific date.

If we use this approach for every stock on the NYSE, it provides a good indication of which way future money is leaning.

When call buying exceeds put buying, the ratio is below 1. When put buying exceeds call buying, the ratio is above 1.

This ratio can be calculated every day, week, month etc.

Shown below is the daily put call ratio from 1998 to today, but we’ve smoothed it using a moving average to remove outliers and help show a clearer picture with a more general trend.

Recall from above, the lower the ratio, the more call option buying exceeds put option buying. This means investors are very bullish.

For the math fans, if you look closer at the chart, you’ll see I’ve calculated the mean, which is 0.62.

But I have also calculated 1 and 2 standard deviations away from the mean. You will see that we are more than 2 standard deviations away from the mean.

- We’ve only been this far away once before in the 20+ years of this data set.

With such overwhelming positivity and confidence in the market going higher, my alligator senses really start to tingle.

Risk Mitigation and Protection

I am not saying a selloff is going to happen tomorrow, or next week. It may not happen in 2021, but it’s our duty to be prepared for one.

If there is a panic selloff, we need to be protected.

What goes up, must consolidate to go higher.

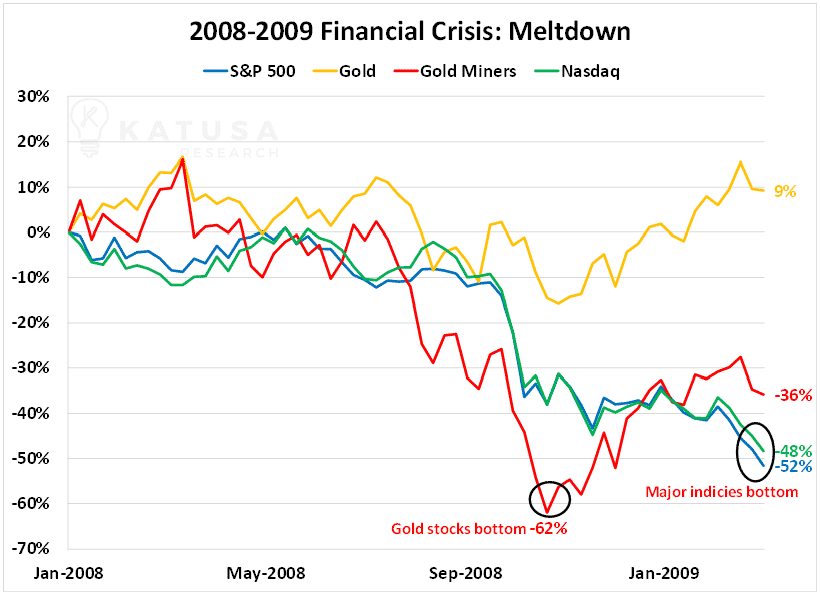

Don’t get fooled by all the goldbug media. Gold stocks are just like any other asset class in a panic and will sell off. In fact, they could sell off harder than regular blue chips. The reason is, investors rush to sell winners to pay off losers or margin calls.

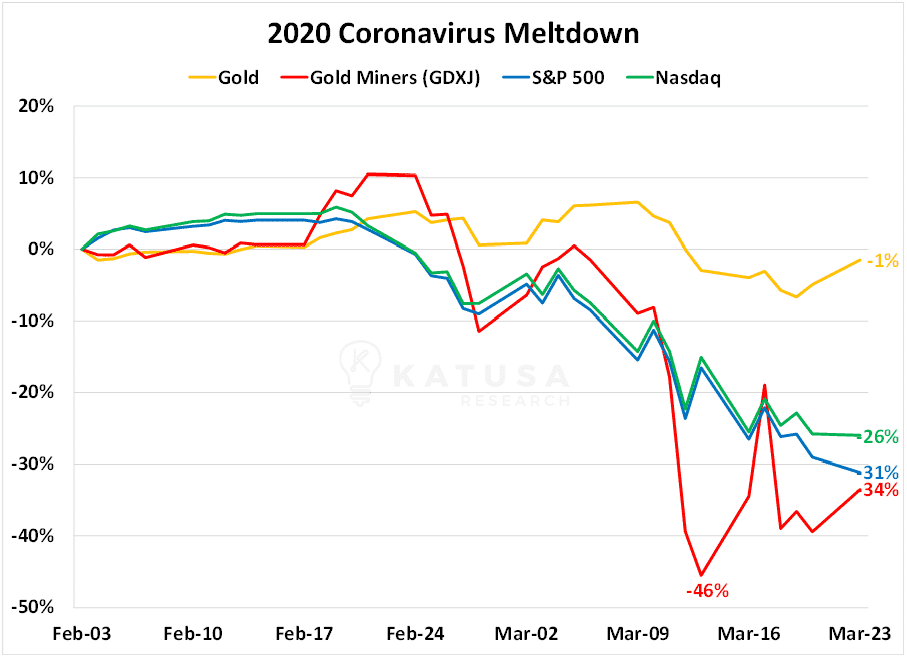

So, we could actually see the precious metals stocks selloff harder on a relative basis than the generalist S&P 500. We saw this phenomenon in both of the recent market selloffs (2008 & 2020).

In 2008, gold stocks bottomed out down 62%, the equity markets bottomed several months later, down roughly 50%.

It was the same situation during the March correction in 2020, where gold stock stocks outpaced tech and the S&P 500 losses. Gold stocks were down 46% and bottomed several weeks earlier than the general market indices.

Whether Charlie is right, and this decade will be a loser in real terms, is something that will take time to play out.

Over the next 6-12 months, we should begin to see the impact of stimulus packages on inflation expectations both domestically and abroad.

- I believe the Katusa’s Resource Opportunities portfolio has positioned itself incredibly well to take advantage of the markets over the next 12-36 months.

Our growing watchlist of companies will provide us with targets if there is a correction, while my specially designed “insurance” play could more than offset any market declines.

We’ve already hit two of our watchlist buy targets.

As always, I am on the hunt for new unique opportunities that I share with my subscribers and invest my own money in at the same terms.

And we have some very, very exciting prospects in the pipeline.

There is one company that’s at the top of my radar right now. And I’m weeks – or even days away – from sending out an alert to my subscribers.

It’s a brand new company that I will be putting a significant amount of money into and making it a staple in my precious metals portfolio.

Chances are you’ve never heard of it.

And you won’t until it’s too late.

- The last time I alerted readers to an opportunity that was imminent like this, I had to close down subscriptions to Katusa’s Resource Opportunities.

As my subscribers know very well – to get in the deal, you have to be in the room, ready to act.

If you are looking to give yourself an edge in the resource sector, my premier research service might be for you.

Regards,

Marin

P.S As a thank you to all of our viewers and subscribers from our YouTube Channel and website, I’m announcing the Katusa Fellowship, where I’ll be giving away an annual subscription to my premium research to two lucky readers. Click here to learn more.