While America focused on the inauguration, Beijing quietly issued an order that sent shockwaves through energy markets.

Chinese state companies must collect 60 million barrels of oil by March.

Most traders will miss the significance of this move, fixated instead on oil’s daily dance between $78 and $80.

But this order reveals something far more significant – a strategic power play that will reshape energy markets for decades to come.

I’ve spent decades tracking energy markets, and I’ve never seen anything quite like this.

Here’s why this matters to your money right now…

The Dragon’s Secret Playbook

On the surface, China’s economy appears to be struggling.

Their energy consumption has plummeted, with official numbers showing a 1.9% drop in crude imports for 2024.

Yet beneath these seemingly bearish headlines, Beijing executes a masterful strategy that most Western analysts completely misunderstand.

Consider this: While China’s reported energy use fell 4.6% in 2022 and another 2% in 2023, they’ve quietly deepened their energy ties with Russia and Iran, securing massive supplies of discounted crude. This is strategic hoarding on an unprecedented scale.

America’s Energy Arsenal: The Secret Weapon China Fears Most

What makes this moment truly extraordinary is America’s position of strength.

U.S. energy producers have achieved independence – and revolutionized global markets. The numbers tell an incredible story that’s still unfolding.

America’s executing a masterful game of chess while Beijing is playing checkers with its oil stockpiles. The take-home message is clear, the USA is weaponizing energy independence.

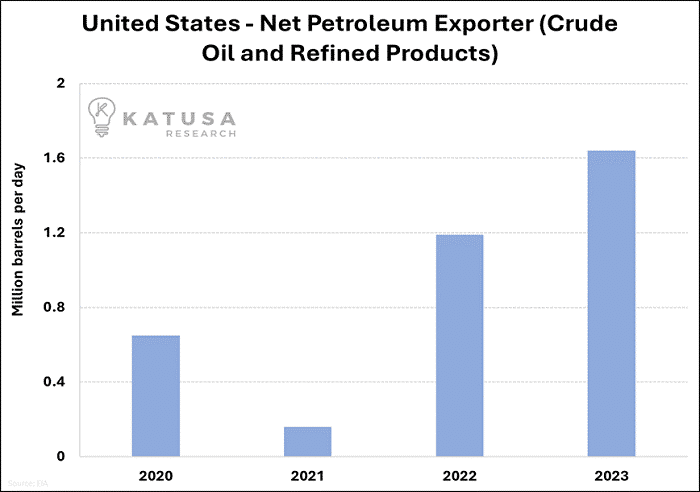

Let these numbers sink in:

- 2020: America exported 630,000 barrels per day.

- 2023: Exports surged to 1.64 million barrels.

- 2024: In 2024, records projecting above 2 million barrels daily.

very barrel America exports is a barrel that doesn’t come from Russia, Iran, or Saudi Arabia.

American allies get it. Mexico depends on our gasoline and diesel.

Europe craves our LNG. Even Canada, with its vast oil sands, needs our refined products.

But here’s what keeps Chinese leaders up at night: While Beijing dumps cheap goods to weaken global markets, America’s energy dominance acts like a fortress wall.

They can flood us with toasters and TVs, but they can’t touch our energy advantage.

Fund Flows: Smart Money on the Move

Look at the Energy Select Sector SPDR Fund (XLE), which controls $35 billion in energy assets including companies like Exxon, Chevron and ConocoPhillips.

While the fund saw $2 billion in inflows during 2024, it also experienced $5.8 billion in outflows. Most analysts view this as bearish. They’re wrong.

The real story? China. The world’s biggest energy consumer has stumbled hard:

- Energy use crashed 4.6% in 2022

- Fell another 2% in 2023

- Barely bounced 2.9% in 2024

Now add looming trade war threats. Tariffs could hammer energy companies, disrupting supply chains and choking off export markets. Smart money isn’t waiting to find out.

I’ve seen this pattern before. Smart investors don’t flee a sector – they reposition before the next big move.

The big players see something coming.

Here’s what they know: When China exports deflation, commodity markets shudder.

But this time, America holds a trump card – energy dominance. The question isn’t if the market will recognize this, but when.

2025 is The Year of The Great Price War

China’s economic struggles have unleashed a deflationary wave across global markets. Everything from commodities to consumer goods feels this pressure.

- But here’s what most investors miss: This price war actually strengthens America’s strategic position.

When gold crosses $3,000 – and it will – you’ll understand why this matters. The same forces driving gold higher are reshaping energy markets in ways few understand.

While copper holds steady around $4 per pound, supported by China’s strategic stockpiling, the real action unfolds in oil markets.

A U.S.-China trade war is inevitable. But unlike previous economic conflicts, this one will play out differently.

America’s energy dominance provides unprecedented leverage, fundamentally altering the balance of power.

Think about this: While China hoards resources and builds strategic reserves, U.S. producers can influence global prices through export decisions.

This dynamic creates opportunities most investors won’t see until it’s too late.

The playbook for this new era requires a different approach.

Instead of chasing short-term price movements, smart investors will:

- Watch China’s strategic stockpiling for early warning signs.

- Track America’s growing export influence.

- Follow smart money flows through key ETFs like XLE.

But knowing what to watch isn’t enough – you need to know how to position yourself ahead of the crowd.

Remember: In markets like these, the obvious trade is usually wrong.

The real money goes to those who see the bigger picture and act before the crowd.

Stay vigilant and prepared.

Regards,

Marin Katusa

P.S. My number 1 energy pick is up over 40% since I first recommended it and reaching multi-year highs. Let our team bring you the analysis of the energy and metals markets every month in Katusa’s Resource Opportunities.

You might like…

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws. By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim. If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.