Even I have to admit that some old cliches might need an update…There’s no rush like a gold rush might have met its match in the new generation of social media and instant gratification.As there seems to be no bull market fever quite like Bitcoin bull market fever.Moonshots, computer coins, meme coins and $25 billion market cap dog currencies are now normal.Colorful charts with dots and lines indicate everything from $1million target prices to antiquated stock-to-flow models (which I’ve broken down why it doesn’t work with Bitcoin, here).The fact is cryptocurrencies are widely adopted, traded, liquid and their price rises… until it doesn’t.But that day is not today.

- There are 109 cryptocurrencies with market caps over $1 billion right now.

In the halls of the global crypto markets is one of the highest stakes bets and players making his mark, that’s incredibly fun to watch.And it reminds me of a cautionary tale…

Saylor’s Bitcoin “Infinite Money Glitch”

Michael Saylor’s MicroStrategy is playing a high-stakes game, reminiscent of the Hunt Brothers’ infamous silver market gamble.This narrative isn’t just about accumulating wealth through Bitcoin; it’s about challenging the conventions of traditional finance and investment.His approach could either set a new precedent or serve as a stark reminder of the dangers inherent in market speculation.Michael Saylor has transformed MicroStrategy into a Bitcoin behemoth, adopting a strategy that’s as daring as it is unconventional.

- He’s not just acquiring Bitcoin; he’s leveraging the company’s future on its ultimate rise and success.

By using their assets as collateral, MicroStrategy aims to purchase additional Bitcoin, hoping the cryptocurrency’s value will surge enough to not only cover their debts but also propel the company to new heights.Here’s how it works:

1. Debt for Bitcoin: Saylor takes on debt for MicroStrategy by using its Bitcoin holdings as collateral. The borrowed funds are then used to purchase additional Bitcoin.

2. Stock Value Increases: The strategy hinges on the expectation that Bitcoin’s value will rise. If it does, the value of MicroStrategy’s stock (MSTR) will increase correspondingly, given the company’s substantial Bitcoin investments.

3. Debt Repayment: The plan is to repay the borrowed funds as the stock value escalates, potentially at a premium, given the expected rise in Bitcoin’s price. The repayment is facilitated through the issuance of more MicroStrategy stock, not by selling Bitcoin.

4. Continuous Cycle: This cycle of borrowing, investing in Bitcoin, and repaying with appreciated assets is intended to continue, leveraging the potential upward trajectory of Bitcoin’s value.

5. Recent Acquisition: Illustrating his commitment to this strategy, Saylor recently acquired an additional 12,000 Bitcoins.

Yet, this approach is fraught with immense risk and reward, given Bitcoin’s notorious volatility.

Familiar Sounds: The Hunt Brothers’ Silver Play

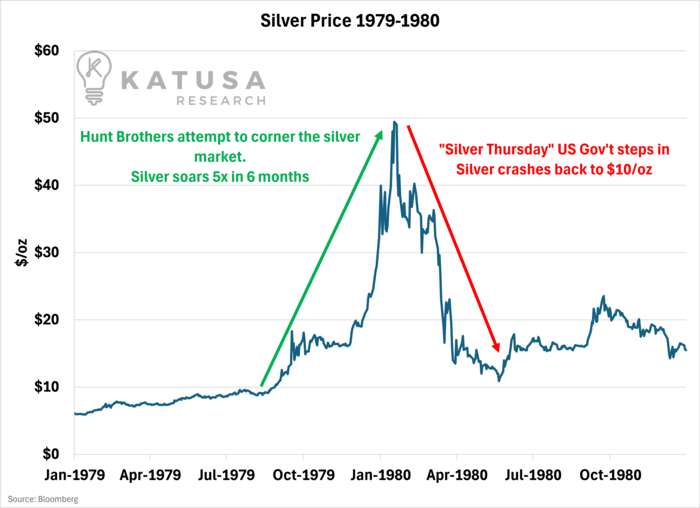

Ever heard of the Hunt Brothers?After inheriting their father’s fortune, Herbert and Nelson Hunt invested heavily in silver, believing it would be a safeguard against inflation.Their silver market saga provides a valuable lesson for Saylor’s Bitcoin strategy. Their blueprint was simple yet audacious…Buy as much silver as possible to control the market.

- At their peak, they held one-third of the world’s silver supply, betting that inflation would skyrocket the value of their holdings.

Sound familiar?They accumulated a vast amount of physical silver and futures contracts, aiming to control the market.Their actions drove silver prices to unprecedented heights.

The Marc Rich Zinc “Cornering”

Cornering is a risky venture, and you can get burned big time.For example, in 1990 the late Marc Rich famously tried to corner the zinc market. It backfired big time and he ended up losing over $200 million and the controlling stake in his company.That company eventually evolved into what is known as Glencore today.Enter the Regulators…The Hunt Brothers and Marc Rich strategies backfired when federal regulators stepped in with new rules to prevent market manipulation, leading to a dramatic collapse in silver prices. The Hunts faced severe financial repercussions, including bankruptcy and hefty fines.This historical episode underscores the risks of heavily investing in a single asset, particularly when the strategy involves significant market manipulation.It’s nearly impossible to corner a market like gold or silver because the government will always intervene.My theory is simple, the government will never allow the collapse of the many for the gain of a few.Will Bitcoin be any different?

Backfire Beware: Lessons and Implications

While Saylor’s strategy with Bitcoin is not a direct market manipulation like the Hunts’ with silver, the high concentration in one asset and the use of leverage mirror the inherent risks.

- If the price of Bitcoin’s falls, MicroStrategy could face a predicament similar to the Hunts’ ordeal.

- Saylor is betting on Bitcoin’s long-term value and broader market acceptance, unlike the Hunts’ reliance on controlling market supply.

This narrative serves as a cautionary tale about the perils of speculative investment, highlighting the thin line between visionary strategy and reckless gambit.Saylor’s bold maneuver with Bitcoin is a testament to the allure of digital currencies but also a reminder of the volatility and unpredictability inherent in these markets.Saylor has cojones, no doubt.And it’s fun to watch.But whether his bet will be a landmark in financial innovation or a footnote in a history of speculation remains to be seen.Regards,Marin Katusa

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws. By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim. If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.