If you fail forty-three times in a row, it might be time to give up. Especially if your company is rapidly running out of money.That’s exactly where business partners Seymour Schulich and Pierre Lassonde found themselves. They were sick and tired of paying for gold exploration and coming up empty-handed. But they desperately wanted a steady stream of cash for their new company.On a whim, they decided to take a page out of the oil & gas playbook, bringing its ultra-successful royalty model to the gold industry. Their new mission was to find a project owner who didn’t have the funds to take a mine all the way to production. Then, Schulich and Lassonde would trade up-front capital for a percentage of the potential future revenue or profits from mining.

The Idea Was Simple…

- Other people would have paid to establish a mineral resource.

- They’d only have to provide funding to try to get it out of the ground.

But Schulich and Lassonde were the first to try this new concept. So finding someone to go along with it was not easy.Eventually, a geologist contact found a classified ad in a Reno newspaper for a land package being sold by a Texas company. Lassonde and Schulich took more than half of their remaining funds—$2 million—and bought the whole 3,416-acre package. With ONE BIG exception that changed everything…They didn’t actually purchase the land—what they bought was the rights to 4% of any gold mined on the land.As it turns out, their investment was successful, and the property was home to a gold mine called Goldstrike.

With That Purchase, the Men Had Struck Gold

And identified what I and many others think is one of the best business models in the gold world.

- That one $2 million purchase for a 4% royalty has created A LOT of revenue.

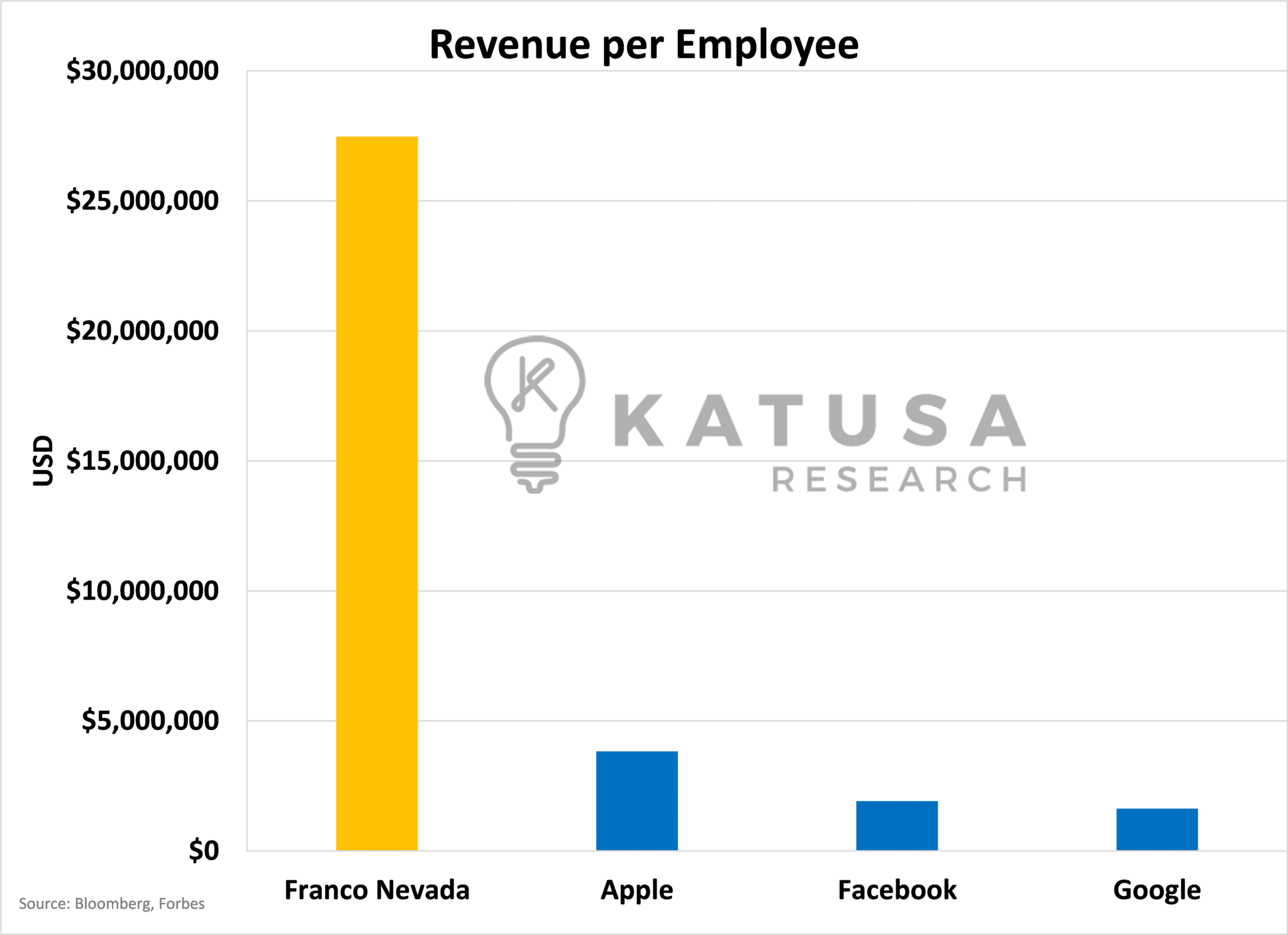

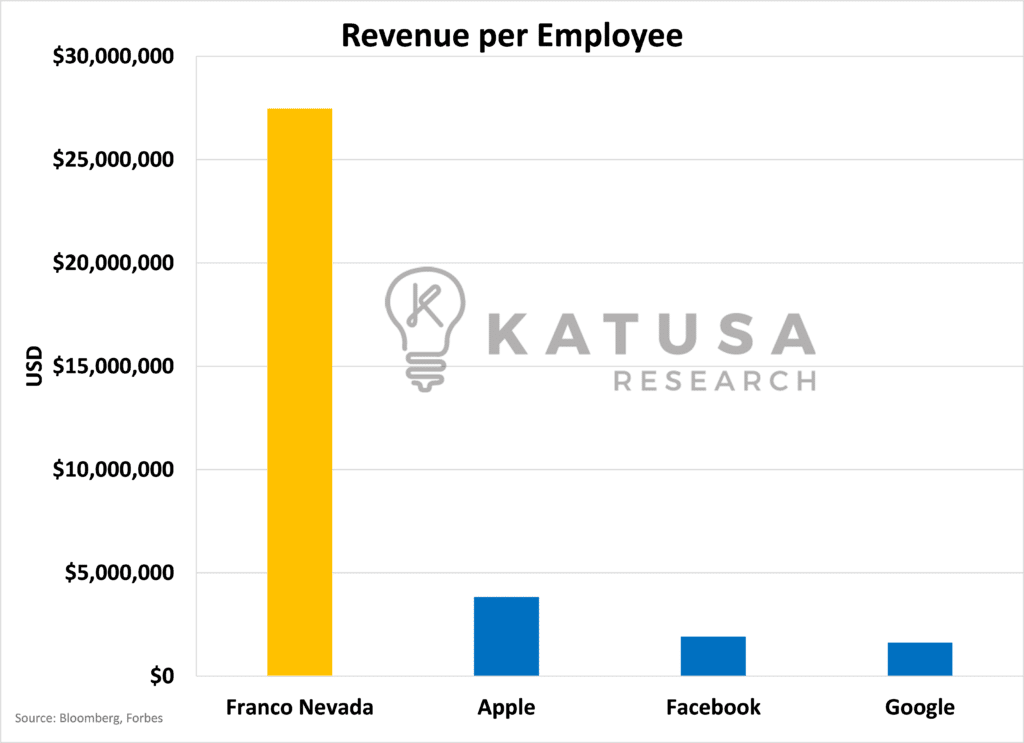

Their company, Franco-Nevada, still doesn’t do exploration. They don’t run mines. They do zero mine operations.They just try to put their money where the gold is. And, in their case, it paid off tremendously for Franco-Nevada.Today, Franco-Nevada makes more revenue per employee than Apple, Facebook, or Google, in fact, more than those three combined!

While Franco-Nevada is one of the best success stories in the mining sector, and its results are obviously not indicative for every company in the royalty sector…I think it’s a good example to show just how great a model the royalty business can be. Gold royalties are generally less risky than gold mining itself—and far more profitable. Let me explain why.

As Good as Gold – but Better

The largest gold miners in the world, like Newmont or Barrick Gold, have less than 20 operating projects.If the mining environment in a single country changes for the worse, or if a single site gets shut down, it can be a major blow to profitability.But typically, since gold royalties pay 1-3% of the production value of a mine to the royalty holder, royalty companies can hold hundreds—of royalties. Franco-Nevada, for example, has more than 100 revenue streams.That high level of diversification means very low risk across the entire royalty portfolio.It gets better…Most royalties have three crucial letters attached: “NSR.” That indicates that a mine owner must pay the royalty holder a percentage of whatever they get for the unrefined gold, less customary expenses and deductions to get to that point (i.e. “net of smelter”).But here’s the BEST part in my opinion…

The Best Kind of Surprise

Usually, the upfront payment is for the whole life of the mine. If an operator invests more capital to increase production, a percentage of the additional profit goes straight to the royalty holder provided that the royalty covers the area of production.Even better, deposits tend to grow organically over their lifespan due to exploration. Any expansion in the mine reserve on the same royalty ground, royalty companies get an upside. Recall, Franco-Nevada’s Goldstrike investment. It was originally a small gold deposit. Three years after the investment, though, a new discovery took the reserves from 600,000 ounces to more than 20 million.

- Since then, Goldstrike has produced more than 50 million ounces—and the royalty is still kicking off $20 million a year.

Again, Franco-Nevada and Goldstrike are a huge success story and it doesn’t mean every royalty or royalty company will generate revenues or have similar results. Because remember: The mine is responsible for capital expenses, operating expenses, and exploration expenses. That makes royalty companies relatively efficient, with a small handful of employees handling operations. The operations consist normally of finding, acquiring, and managing these passive royalty interests. In my view, it’s the best kind of business…That is, if you can get it and identify paying royalties or royalties with good operators that are ramping up into production.Because of course, there’s a catch. Over the decades, Franco-Nevada has grown into a behemoth. It, along with two other massive companies, represents 80 percent of the value of all gold royalties.In my opinion, there’s little upside left in their overweight, $20B+ stocks. They’re trading at huge multiples (2-3X book value) that imply they have lots of growth left—but they are more than fully valued.So where can you find a deeply undervalued royalty company…With lots of growth runway, set to cash flow in 2024…?You’ll want to circle your calendar for Monday, February 12th.Regards,Marin Katusa and the KR Special Situations Team

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws. By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim. If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.