What do many cryptos, cannabis stocks, precious metals stocks, and SPACs all have in common?

The answer might not be obvious at a glance.

But if you’ve personally invested in any of the above before…

Or if you’re familiar with the story of the GameStop short squeeze…

Then you might have a good idea of what the answer is already.

Know Your Risks

When you decide to invest in a particular stock or asset, it’s not enough to simply know what the drivers and catalysts are.

You must also understand the risks.

Risk management is a complicated and in-depth topic.

There are many different types of risks –

- sovereign risk,

- time horizon risk,

- market risks, and many more.

Also important is this: Each investor’s risk profile is different…

The single young investor with stable income and no dependents or mortgage has a much larger appetite for risk than a household’s primary breadwinner with children to take care of, college tuition fees on the near horizon, and a hefty mortgage on the house that needs a major reno.

But setting all of that aside, today we’ll be focusing on a single kind of risk in particular – one that has reared its ugly head time and again to thwart the efforts of many a would-be investor.

I’m Talking About Liquidity Risk…

Quite often, when a particular new sector or asset class hits it big, there’s a massive run-up in prices that causes investors to pile on.

And there’s no sexier story to jump onto than a small-cap company or – lately – crypto ICO.

Small-cap companies are the fresh draft picks on a championship finals team, the underdog stories that everybody loves to cheer on.

Compared to the senior, more well-established companies in their sector, they’re much cheaper, thinly traded, and usually have no analysts following the story… It often means that they have more room for dramatic share price moves if they hit it big.

Apple isn’t going to be providing shareholders with 10x returns in a short time frame. It’s too large, its assets and revenue streams too well understood for that kind of crazy jump in valuation.

But a small-cap biotech company worth pennies? They might just have the idea that’ll turn them into the next Pfizer or Moderna.

Small-cap companies and sh*tcoin crypto’s are a dime a dozen, and many of them never make it past the planning stage.

But when an entire sector takes off, like back during the cannabis and crypto rushes we’ve seen in the last few years, many coins and companies often get lifted up to the top by the rising tide.

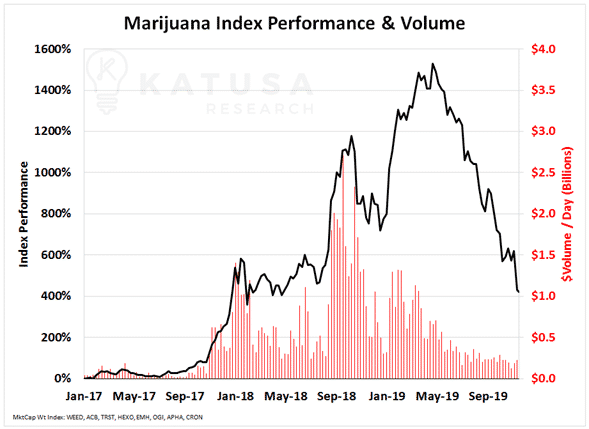

For instance, back three years ago, marijuana was on the up-and-up. With volume through the roof and prices flying high, things were looking good. The bankers were flying, high up on their own smoke clipping fees.

But then the other shoe dropped:

- As you can see, prices collapsed over the next few months… and trading volume dried up alongside the meteoric fall in prices.

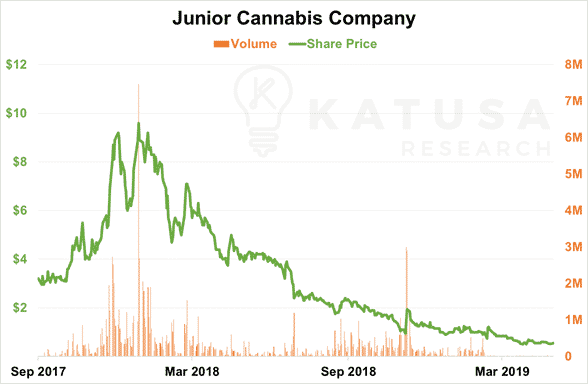

Here’s the chart for a sample junior (small-cap) cannabis company during that same time frame:

Though there was plenty of volume for this stock at the beginning of 2018, you can see that trade volume tapered off rather quickly.

And by mid-2018 it would’ve been very difficult to exit a large position in the stock.

- Be wary of your paper gains evaporating ultra-fast when liquidity (volume) dries up.

And if you’d decided to buy in, or worse, average down, late in 2018 when volume briefly spiked up… you would’ve been left in even worse shape.

Only months later, by the spring of 2019, trade volume had all but completely dried up.

This hard lesson learned by the crowd in the cannabis boom was felt in early 2021 after many tech stocks experienced a liquidity freeze.

Don’t Get Left Holding the Bag

As mentioned earlier, this is a story I’ve seen once too many times – in precious metals, SPACs, and cryptocurrencies, and cannabis, among others.

Don’t fall for a bearded geo with a box of crayons, a map, and a fistful of promises urging you to “double down and average down”.

In the absolute worst-case scenario, a company that needs to raise money will get its share price wiped up during a period of a liquidity freeze. The dilution that will occur to the shareholders will essentially wipe out much of the value you thought you had.

A similar analogue for cryptocurrencies would be coins that aren’t being used or developed any longer – you won’t be able to find any buyers for your failed crypto coins.

All too often, amateur investors experiencing their first big win will ride that paper high. (Dogecoin anyone??).

They’ll look at their account statements and feel euphoric over the big numbers and triple-digit gains they see, without understanding one fundamental fact:

- Until you sell, you haven’t made a single penny.

When it comes to my premium newsletter service, Katusa’s Resource Opportunities, I’m not just about delivering the best stock research and picks to my subscribers.

There are simple rules to ensure you do not experience a catastrophic loss.

When you’re overleveraged, can’t sleep at night because of your position sizes, or hold little cash capital – you’re setting yourself up for the potential of a catastrophic loss.

Unless you have a biblical tolerance for risk in crisis situations, you’ll get crushed.

- Keep in mind that 99.99% of people who can fog a mirror should not use any leverage tools for investing.

Taking a mortgage or line of credit to invest in the markets or cryptos is taking excessive risk in any sector. You will set yourself up for hardship and a lot of personal strain; even if it works out.

If you are jeopardizing your standard of living for yourself or your family, don’t even consider it.

There are many ways to reduce your risk and amplify your upside.

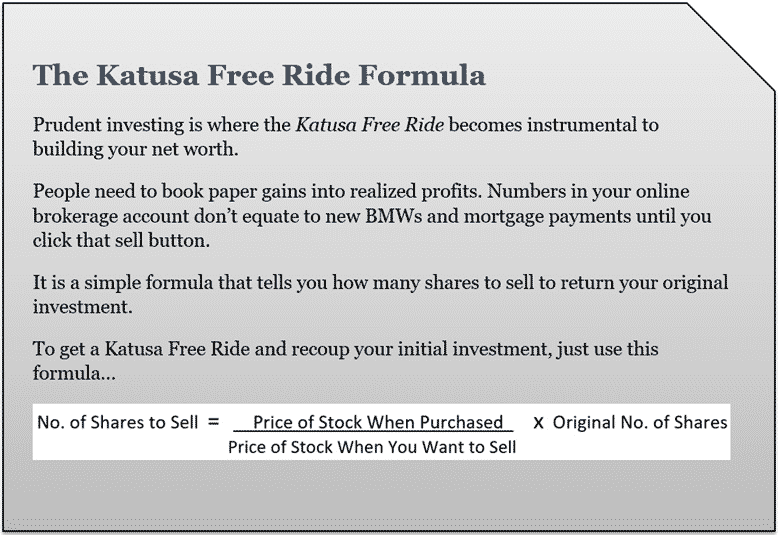

I also want to educate my readers, with best practices like the Katusa Free Ride:

By applying the Katusa Free Ride Formula appropriately…

You can reduce your exposure to liquidity risk – and many other types of risk – simply by taking your initial capital off the table.

Here’s how it works…

To learn more about managing your investment portfolio’s risk, as well as to find out what I believe is going to be the largest wealth creation opportunity of our lifetime, consider subscribing to Katusa’s Resource Opportunities.

It’ll be the most risk-free educational investment course you’ll ever make in your life.

Regards,

Marin