I know, you probably think I’ve lost my edge or have gone crazy.But let’s think about this carefully for a moment…There are 3 major stages in a cycle. (As I described in my book Rise of America: 1) Boom 2) Bust & 3) Echo.

1. Risk On (Boom) – Reserved for times when the economy is exiting a recession and during strong periods of economic expansion. Just like what we have witnessed since 2009, minus the pandemic.

2. Risk Off (Bust) – This is when the economy has peaked, inflation has begun to rise and the central bank has begun to raise interest rates. Stocks and bonds get crushed in this environment. This should sound familiar as this is precisely what happened over the past 9 months.

3. Pay me to Wait (Echo) – This is the in-between stage. Equity prices have retreated but there is perhaps further pain to come, inflation is still high but there is a speck of light at the end of the tunnel. I believe we are getting close to this phase considering where we are now. Value Investing gets rewarded during the Echo phase.

It is a fine line between the “pay me to wait” stage and the “risk on” stage.This gets muddled further these days as the stock market tends to be very forward-looking.This means it will attribute little value to short-term problems.And focus attention on the rosier long-term picture.Under this forward-looking environment, we’ll likely see equity markets bottom months in advance of total economic recovery.

I Believe We’re Close to the Echo Stage…

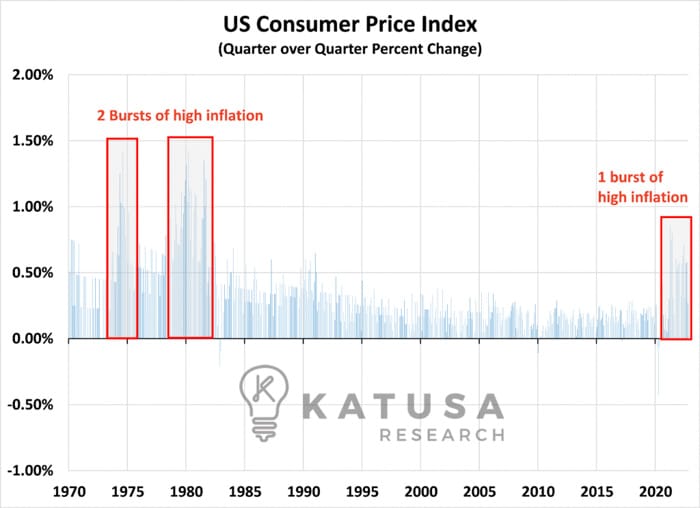

The Federal Reserve continues to push the narrative of higher interest rates and weaker economic growth. I believe this is done on purpose to specifically combat the market being so forward-looking.One of the best historical comparisons I believe is in the 1975-1980 time period.The Fed’s worst nightmare is a “double burst” of inflation…

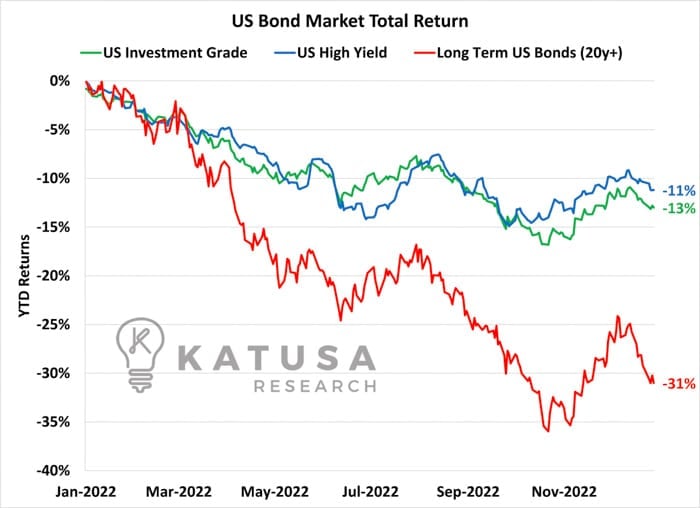

As you can see on the chart above, this double burst ended in an ugly fight where rates went to 20%.An interest rate of that magnitude would be catastrophic for a world that has gorged itself on cheap debt for a decade.I outlined in previous editions that the bond market has faced enormous losses last year.Higher interest rates, combined with expectations for higher inflation and heightened uncertainty of inflation led to a collapse in bond prices.

Drilling Into High Yield

Those taking a close look will look at the chart and notice something strange: High Yield bonds are down less than investment-grade bonds and US government bonds.Why is that?In large part, this is due to the interest rate sensitivity of the bond.Longer-term bonds have greater price sensitivity to interest rate changes than shorter-term bonds.Not to be confused with the length of time, a bond’s duration measures the price sensitivity to a change in interest rates.

- The higher the duration, the greater the price change sensitivity to changes in interest rates.

- The lower the duration, the smaller the price change sensitivity to changes in interest rates.

This hiking cycle is not just impacting the equity markets. The bond market experienced an incredible shake out because of the interest rates rise.

- This has made for one of the worst returning years in the bond market ever.

The US Investment Grade bond market is currently worth approximately $25 trillion. It would make up the majority of anyone’s 40% in the traditional 60/40 portfolio.

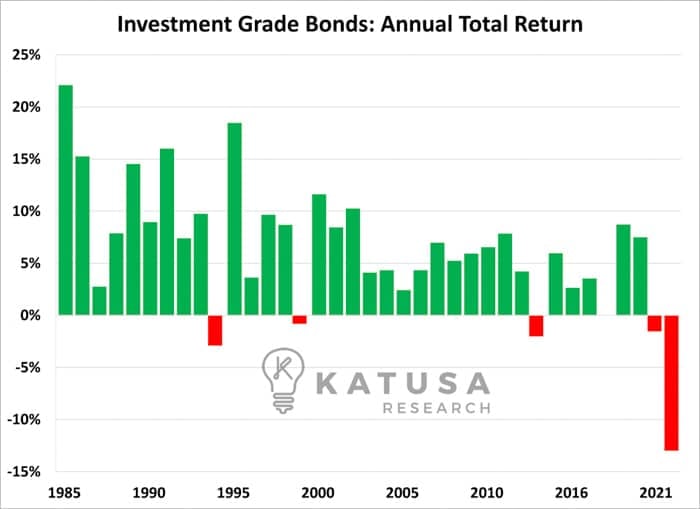

Investment-grade bond investors don’t like risk or volatility…

They want stable, predictable returns typically in the mid-single digits. As you can see in the chart below, last year was the complete opposite.On average, Investment Grade bonds lost 13% last year, wiping out all the gains achieved over the past few years combined.

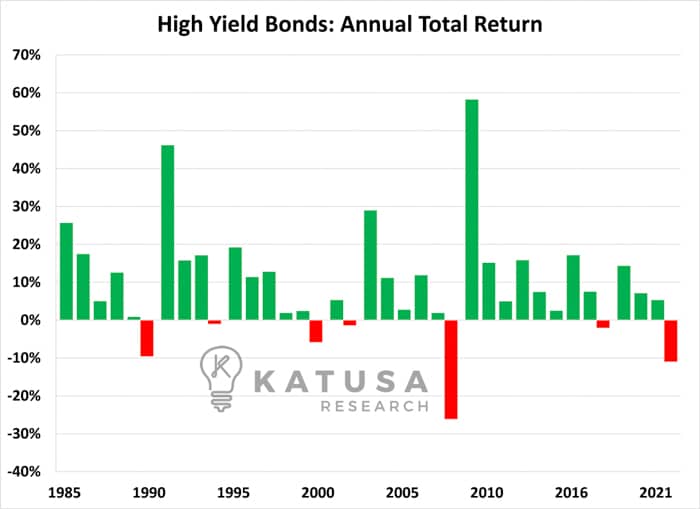

Going down to almost the bottom of the bond market food chain is the “High Yield” segment.These are bonds which are issued by companies that are more cyclical and have more volatile cash flows, which increases the risk of the bond investment.To compensate for this risk, the bond issuer must pay a higher interest rate to the debt holder. Typical companies in this segment are energy companies, materials, miners, and small-mid-cap-sized issuers.2022 was the second worst year since 1985 for High Yield bonds.

Junk Bonds

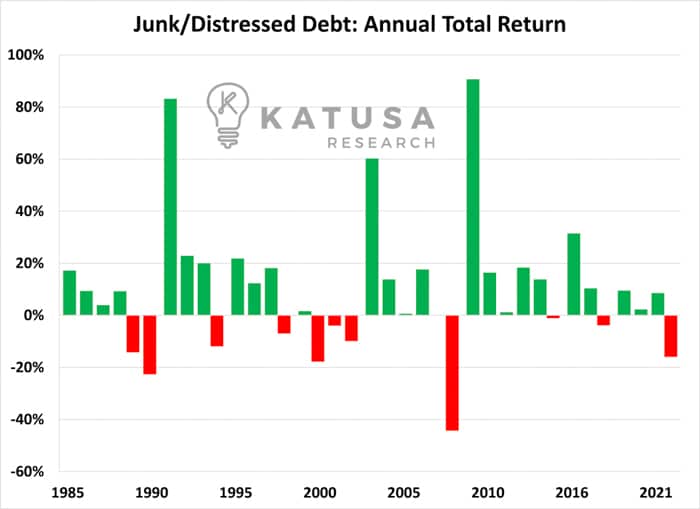

The bottom of the food chain is the junk and distressed issuer debt.These are usually very small, under-capitalized companies which toe the line between solvency and insolvency.Total returns in this segment as you might expect are more volatile, with some very high returning years and others which are very poor as in the case of last year.

Predicting the Bottom for Bonds

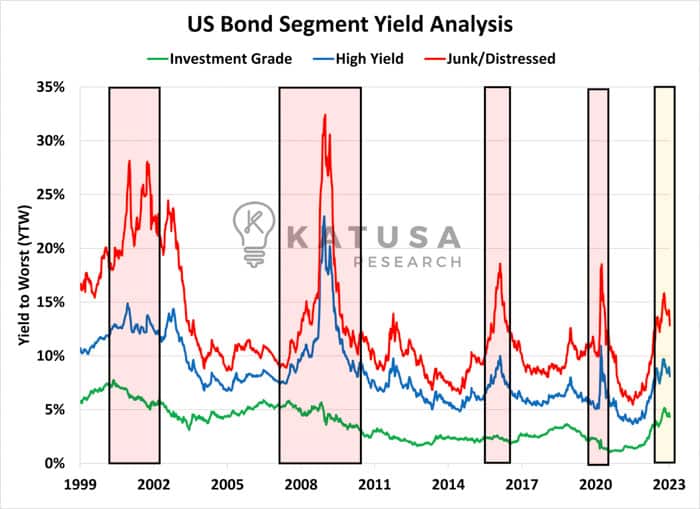

Every crisis and subsequent recovery is different. Let’s use historical bond yields to help paint a picture of where we are today, vs historical bottoms.It’s not foolproof, but it helps paint a picture.Below is a chart which shows the historical yield earned for holding a debt instrument through to maturity or being called back by the issuer. Bond yield is a function of several things, namely the interest rate environment, inflation expectations, and the quality of the issuer.As you can see Investment Grade bonds trade at lower yields than High Yield and Junk bonds.This makes sense as an Investment Grade issuer will be more stable and “safe” than a high-risk small cap.

You can see the cyclicality of the changes in yield. During times of duress, bond prices fall, and yields increase.The yield increases because the issuer must compensate the investor appropriately for the market conditions.

- In good markets, yields are lower,

- in bad markets yields skyrocket.

We can see that firsthand in 2002, 2009, 2016, and 2020. Yields have begun to spike over the past 6 months, but we are still well below all previous peaks put in at the worst times of the economic crisis.This is another sign to me that we have not hit the bottom of the market, but the start of the echo isn’t far away.Regards,Marin KatusaP.S. Bonds are a part of my long-term investment strategy, and we’ve profiled opportunities in my premium paid service, Katusa’s Resource Opportunities. Click here to learn how to get access.

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws.

By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim.

If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.