There’s no shortage of deals and opportunities that cross our desks at Katusa Research.

- A promising copper exploration play in a South American country

- A new lithium extraction technology in the USA

- Hydrogen technology from a consortium between Japan and Canada

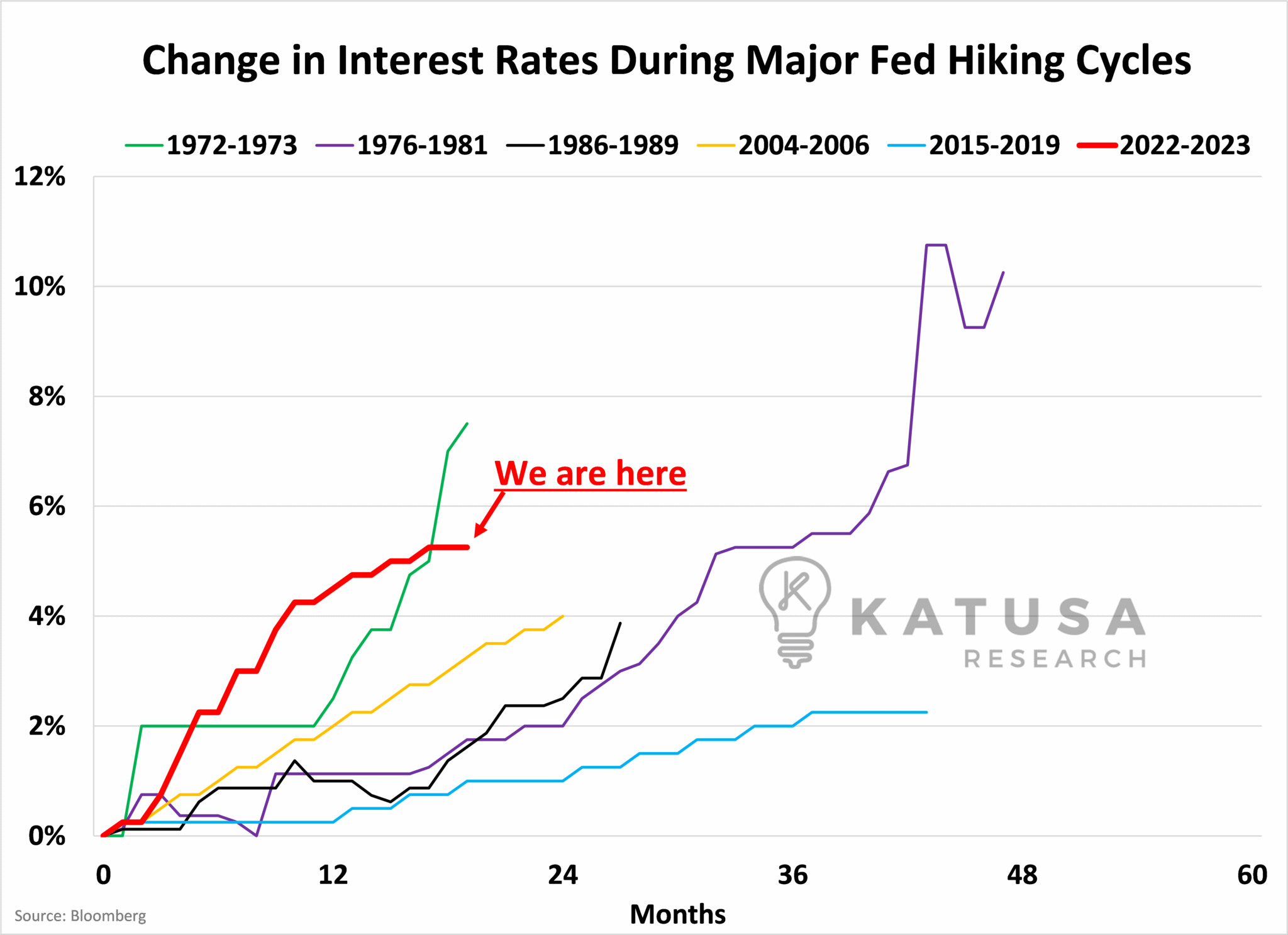

But the question I ask immediately is this…Why is this better than me making 5.15% every month for doing NOTHING?In a zero-interest rate world, capital is pushed to far reaches of the risk/reward spectrum to earn a return.Now that rates are the highest in a generation, that has flipped in what feels like overnight.As you can see in this chart, we are amidst one of the fastest hiking cycles in modern economic history.

As we find ourselves amid historically high interest rates, understanding the concept called Cost of Capital has never been more crucial.The US 2-year is currently yielding an astonishing 4.98%, with the 30-year not far behind at 4.69%.For anyone, from the individual homeowner to the multinational corporation, this shift and interest rate has implications.But what does the ‘cost of capital’ truly mean, and why should it matter to the everyday American?The “Cost of Capital” might sound like jargon reserved for Wall Street insiders or those with a finance degree.Yet, at its core, this term pertains to something inherently simple: the cost required to make a particular investment.

The Real Price Tag of Doing Business

Think of Cost of Capital as the price tag of using money.Whether you’re borrowing to buy a house, a business owner taking a loan for expansion, or a massive corporation weighing investment risks, there’s always a cost attached to the capital you use.This “cost” isn’t merely about the actual dollars you’re putting to work. It’s a comprehensive figure that factors in lots of parts.At its foundation lies the risk-free rate—essentially what you’d expect to earn from a completely safe investment, like a US Treasury Note.And right now, every major cashed up investor and corporation are sitting with dilemma.To understand this, let’s travel back a few decades.In a world of relatively stable and low-interest rates, businesses and individuals became accustomed to cheap borrowing.Affordable loans encouraged everything from ambitious corporate projects to the American dream of homeownership.

However, as the tides shift with soaring interest rates, this landscape is rapidly changing. Borrowing is no longer as cheap, and the repercussions are felt far and wide.

- For homeowners, this might mean re-evaluating the decision to refinance or even enter the property market.

- For the rich individual, this could translate into re-assessing their investment portfolio, ensuring that the returns they’re hoping for align with the increased costs.

- Businesses, both big and small, might find themselves rethinking expansion plans, scrutinizing the feasibility of projects in light of these heightened costs.

- For large-scale operations, like mines, the evaluation becomes even more intricate, with global markets, job opportunities, and local economies hanging in the balance.

By understanding the intricacies of the cost of capital, individuals and enterprises stand in a position of strength.

Generational Times for the New Nouveau Rich

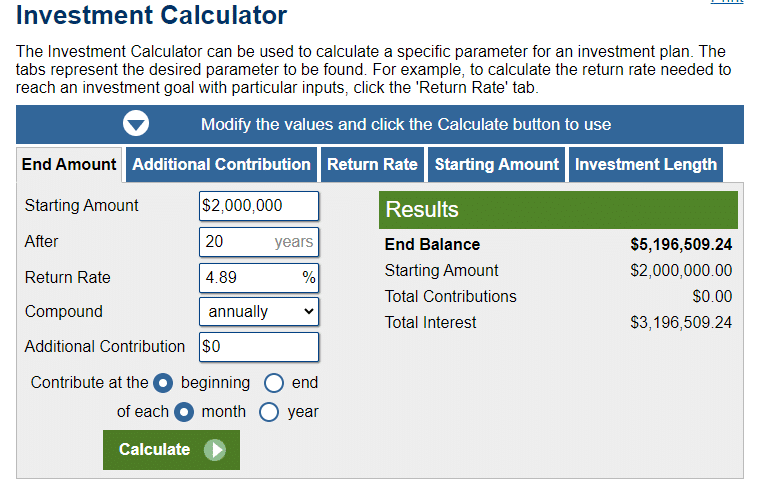

Consider Samantha, a high-net-worth individual with a diversified investment portfolio.In an era of historically low interest rates, Samantha enjoyed impressive returns from equities as companies benefited from cheap borrowing and robust growth.Like many investors, she follows the 60/40 rule and thus she also had a sizable portion of her portfolio in bonds, often considered safer investments.Now, with interest rates on the rise, the cost of capital for companies has surged. This might mean some of the companies she’s invested in could see reduced growth or might have to cut back on ambitious projects.Concurrently, the value of her existing bond holdings has decreased as rates have risen.Now, as a wealthy person, Samantha might frequently engage in leveraging—borrowing money to invest, hoping the returns exceed the interest.With higher interest rates, the cost of such leveraging rises, making it crucial for her to reassess her strategy.It’s not just about potential returns now, but the increased costs associated with achieving them.And right now, Samantha could take her $2 million liquid, invest it in 20 year US Treasuries paying 4.89%.Then wake up in 20 years with her kids entering college and over $5.2 million in the bank.

Every decision a rich investor like Samantha makes is pitted against this.That’s the cost of her capital right now.

Large-Scale Operations: The Mining Example

On a grander scale, consider a multinational mining corporation, SilverRock.Such a company requires significant capital to fund new projects, often relying on a blend of equity and debt.In a world where capital is costly, project evaluations become stringent.Imagine SilverRock evaluates a new mining site.The potential yield of the mine looks promising, but the upfront costs are hefty, not to mention in an inflationary world, the true operational costs have also soared in recent years.In times of low-interest rates, SilverRock could have taken on debt relatively cheaply to fund the project, expecting that the returns from the mine would easily outpace the interest.Now, however, with interest rates hovering around 5-6%, the scenario is different.This is because, even a multinational company like SilverRock will be paying upwards of 10% or higher interest rates on newly issued debt.Relative to the 3-5% money just a few years back, this has a dramatic impact on project cash flows.The project’s feasibility would need rigorous reassessment.

- Will the yield from the mine, after factoring in the higher borrowing and ongoing operational costs, still promise a good return on investment?

It’s not just about the raw potential of the mine anymore; it’s also about the cost of the capital required to tap into that potential.Moreover, the broader economic implications of higher interest rates could mean reduced demand for commodities, as businesses scale back expansion plans.If SilverRock anticipates a drop in silver demand, it might decide that the new project isn’t viable, regardless of the site’s potential yield.These are exactly the numbers and mindset we run simulations, cash flow forecasts and analysis on – leaving no stone unturned.We’ve just done a deep dive on a critical energy company – and going into detail on another one – I want to add to my portfolio, based on higher interest rates and the cost of capital.You can see my method of picking companies and adding them in my premium research service – Katusa’s Resource Opportunities.The Cost of Capital is critical in this new era of interest rates.And many wealthy investors won’t move a muscle or pay you any attention, until they know they’re getting more than 5% return.Regards,Marin Katusa

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws. By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim. If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.