The Canadian energy sector suffered yet another black eye this week.

Facing major regional political headwinds, Kinder Morgan Canada (KML.TO) put a stop to work to the permitted expansion of the Trans Mountain pipeline.

It’s another example of a major Canadian energy project blocked by short sighted politicians garnering for individual attention of their own party, rather than the benefit of all. Other cancelled mega projects include the Energy East pipeline and the Keystone XL pipeline (thanks in large part to President Obama).

The Canadian energy sector is a big piece of Canada’s economy.

Currently the Canadian energy sector accounts for 10% of Canada’s GDP and employs over 800,000 Canadians. Most of these jobs are skilled, high paying roles. And oil and gas royalties brought in $19 billion per year over the last five years.

This is another failure on the part of the Canadian Federal Government to act in the nation’s best economic interest.

Over the last 5 years, international oil companies like Chevron, ConocoPhillips, and Petronas have all abandoned Canada as a place to invest.

Why?

Because Canada is not a competitive place to do business anymore. Companies like Chevron invest in a region with the expectation to be there for decades at a time. This requires billions worth of infrastructure investments.

Right now, Chevron is expanding oil production in areas like Nigeria rather than Canada. Nigeria is place where thieves drill holes in oil pipelines, fill canoes with stolen crude oil and float the canoes down river to illegal refineries. It sounds crazy but it’s true and happens regularly. Yet to Chevron, this is a better place to do business than Canada. Canada wake up!

And investors recognize this.

While major crude oil benchmark prices are trading at 3-year highs, most Canadian oil companies are trading lower. Money is attracted to places that offer high levels of return. Canada keeps making headlines to scare away energy investors (and companies).

Canada is blessed with one of the largest hydrocarbon resources in the world. But the political landscape needs to change significantly if Canada wants to attract big investments in the oil and gas sector.

On April 4th, 2018 the Canadian federal government put out a tender notice for a study on the competitiveness of Canada’s upstream oil and gas industry. The government indicates it will pay $280,000 for this study.

The government could save a bundle and sign up to Katusa’s Resource Opportunities to see my detailed research on the Canadian oil and gas industry.

The government should save the $280,000 in tax payer money and simply ask Kinder Morgan why it backed out of the Trans Mountain expansion project.

I’ll save the feds the embarrassment of asking Kinder Morgan. Kinder Morgan’s answer would be “there is too much red tape, hoopla and bureaucrats on power trips to economically build a pipeline. Not to mention the uninformed NGO’s who are swaying the uninformed citizen with propaganda. Does Canada even bother to see who the NGO’s are funded by? Its no secret they are US groups who prefer to not have to deal with the competition of Canadian oil. ”.

The Trans Mountain pipeline project is an expansion of an existing pipeline. It runs from Edmonton, Alberta to Burnaby, British Columbia.

The pipeline was first built in 1953. It carried 150,000 barrels of oil per day. Current pipeline capacity is 300,000 barrels per day. The expansion project focuses on “twinning” the original line to achieve total capacity of 890,000 barrels per day.

Currently, Trans Mountain is the only pipeline which transports oil from Alberta to the west coast.

And every month there is more demand than space available on the pipeline. This month (April 2018) the pipeline could only take 56% of the total volume nominated for the pipeline.

Since the beginning of this year, the pipeline has seen demand exceed supply by over 30%. According to a Canadian National Energy Board 2016 study, demand for pipeline capacity on Trans Mountain has far exceeded supply.

Before building the Trans Mountain Expansion, Kinder Morgan hosted (what’s known in the industry as an) “Open Season”.

Open Season allows crude oil producers to bid for space on the pipeline. These bids represent a 15 to 20-year contract between the producer and the pipeline company. These bids represent the “anchor” tenants. The Trans Mountain Expansion had 13 anchor tenants which represented 80% of the pipelines total capacity. The maximum allowed by the Canadian National Energy Board.

The Trans Mountain Pipeline is not just required, it’s mission critical to the Canadian energy industry.

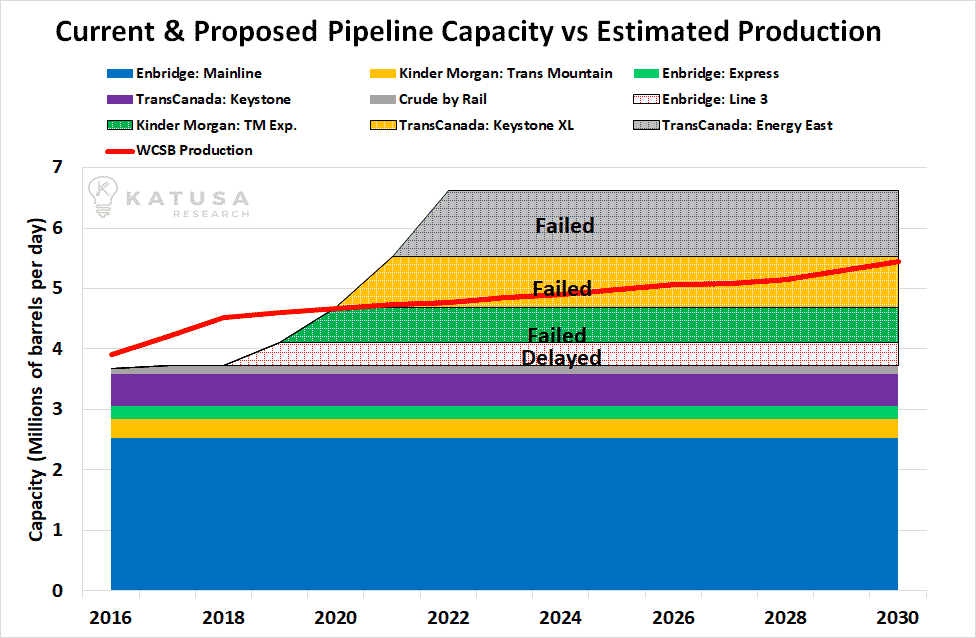

The Canadian National Energy board estimates that by 2030, Canadian oil production will exceed 5.4 million barrels per day. This is an increase of nearly 40% from 2016 production levels.

Most new production will come from Western Canada. This means billions in additional tax and royalty revenue for provincial and federal governments. (Note that B.C., Alberta and the Canadian Government all run budget deficits!). However, these tax and royalty windfalls cannot be realized if there is not suitable pipeline capacity to move the crude oil to the global markets.

Existing pipelines used for exporting crude oil from Western Canada are currently at or near capacity. The nameplate design capacity is 4.0 million barrels per day. However, the estimated available capacity for Canadian crude oil exiting Western Canada is only 3.3 million barrels per day. This accounts for maintenance, downstream constraints, and capacity allocated to refined petroleum products.

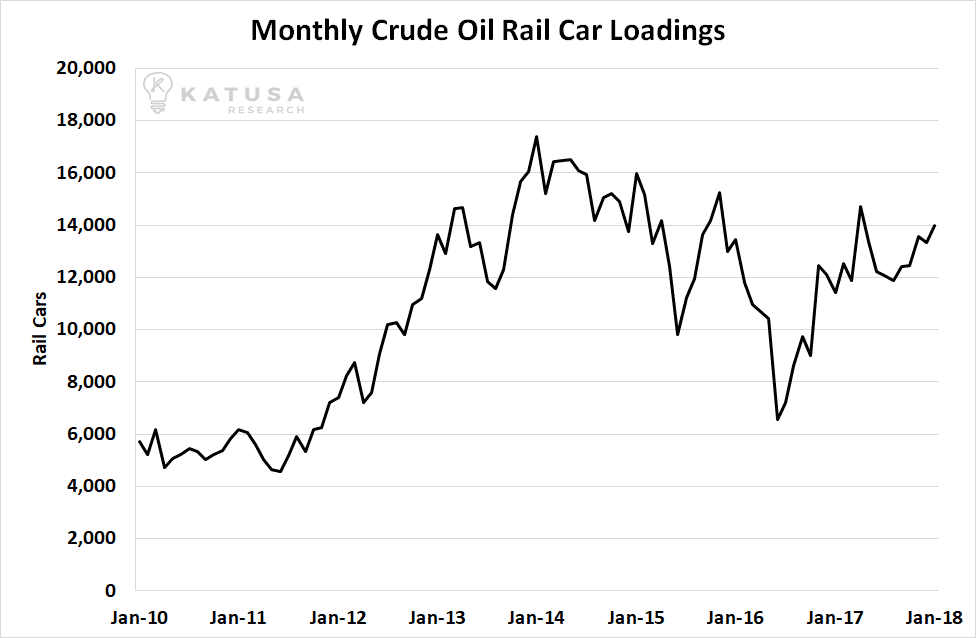

The second option to move oil is by rail.

More rail loadings mean higher environmental risk. Based on the 2017 Fraser Institute study on Intermodal Safety for Oil and Gas Transportation, pipelines were 2.5 times less likely than rail to result in a release of product when transporting a million barrels of oil. Not only that, only 15.9% of pipeline incidents take place in the actual line pipe. Over 84% of incidents occur in a facility, such as a compressor station or storage facility. All of these facilities are required by law to have secondary mechanisms or catchment basins to make sure crude oil does not cause any damage. In fact, only 1% of all pipeline incidents cause environmental damage.

Let’s not forget the Quebec Lac-Megantic rail disaster, which killed 47 people and damaged 30 buildings in the town center.

Regardless, crude oil producers have been forced into using the rail alternative. Crude by rail increased from below 100,000 barrels per day to 150,000 barrels per day last year.

Below is a chart which shows the current and proposed pipeline capacity out of Western Canada, versus estimated production.

As shown in the chart above, current production from Western Canada is and will continue to exceed current pipeline capacity.

But take a look at all the failed and delayed pipelines. This means that Western Canadian crude oil will be trapped. Trapped oil leads to more oil on rail cars.

Below is a chart which shows the monthly rail car loadings of crude oil. Rail car loadings for crude oil have more than doubled since 2010.

Rail car loadings are expected to remain high, since there is no more pipeline capacity for oil producers.

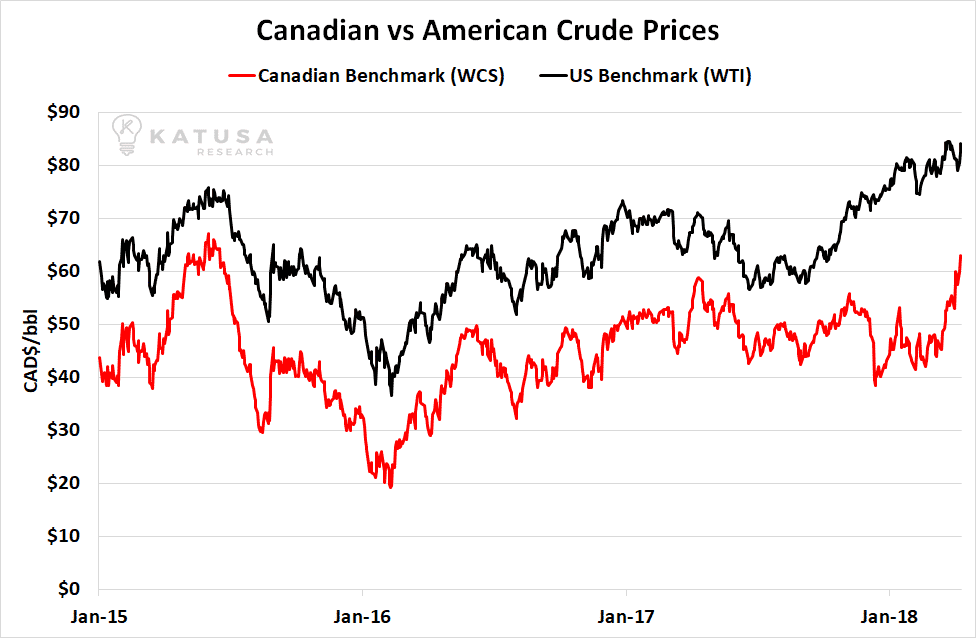

Below is a chart which historical prices for the Canadian heavy oil benchmark, Western Canadian Select (WCS) and the U.S. light oil benchmark West Texas Intermediate (WTI).

Western Canadian Select has always traded at a discount to its US cousin.

This discount is composed of 2 parts. First, WTI is a lighter, sweeter crude that requires less energy to refine. So part of the discount is attributed to quality.

The second and larger component of the discount is caused by the lack of pipeline capacity.

Once pipelines hit maximum capacity, crude producers are forced to undercut each other for any available space on the pipeline. Basic economics tells us that when supply exceeds demand, prices go lower. This is what is happening for crude oil producers in Canada.

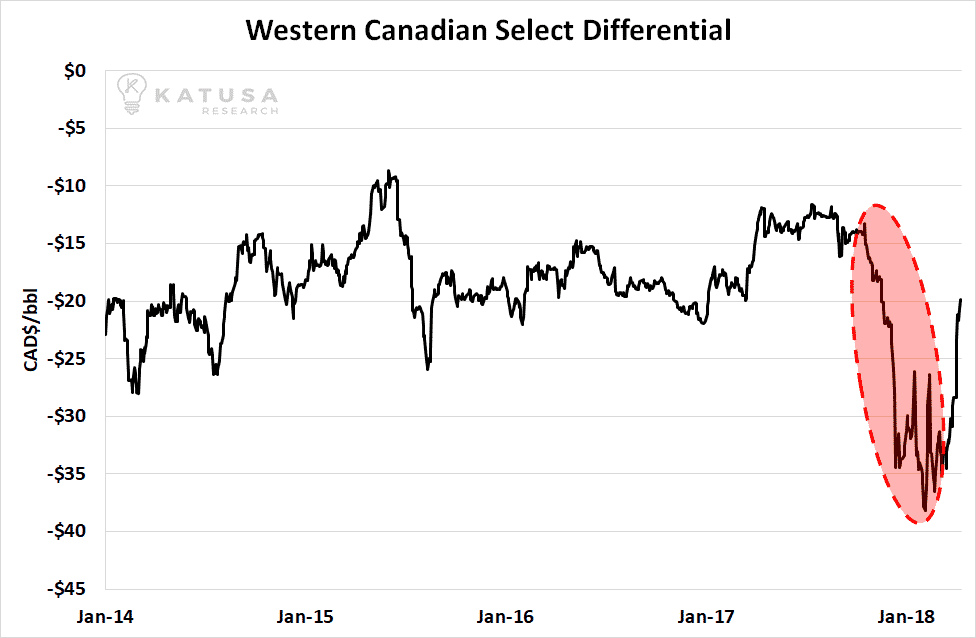

To further show the difference in crude pricing, a chart showing the WCS differential is below. This differential is the pricing difference between WCS and WTI. The differential has bombed out considerably this year. This is due to increased production and limited pipeline capacity.

How can Canada make itself more competitive on a global scale?

First: Make yourself open for business.

I’m not sure that will happen under our federal government whose leader is a trust fund baby. Yes, its true. Canada’s Prime Minister, for all he is trying to make himself a social justice warrior is a TFB (Trust Fund baby) who is worth hundreds of millions of dollars because his grandfather was a very savvy Quebec business man. Hmm, maybe that’s why Canada’s Prime Minister likes his costumes (yes, he is known as Mr. Dressup now globally), because he is probably uncomfortable in his own skin knowing his followers despise TFB’s yet, he is one Canada’s blueblood TFB’s. But I digress. Back to the basics.

It’s crazy that a regional government and a town mayor can crush a $7 billion project that has been in the works for years. The Canadian federal government should have stepped in a long time ago but it has not.

The lack of understanding has cost the nation one of the most important infrastructure projects of the decade.

These recent government actions are a huge disincentive to any major resource company who wishes to pursue a project in Canada. It shows the government is not willing to act accordingly, even if project is in the national best interest.

Second: Improve current pipelines and fast track construction on 2 pipelines.

The two pipelines are: The Enbridge Line 3 replacement, and the Trans Mountain Pipeline. Trans Mountain will provide the pipeline necessary to increase crude oil exports to the rest of the world, while reducing dependency on the United States. The Line 3 replacement will increase pipeline capacity to the east coast.

What many people forget, including our government officials, is that a significant portion of our existing pipeline infrastructure is ancient.

The Enbridge Mainline has been in service since 1950 and Trans Mountain since 1953. Sure, there have been updates and quick fixes, but the current system needs a serious overhaul.

Safety by Design: New Technology and New Materials

Pipeline corrosion is the cause of 52% of pipeline leaks. With today’s technology, leaks can be detected faster and more affordably than ever before.

Now there are Pipeline Inspection Gauges ‘PIGs’ which are used to push stagnant fluids, slush and buildup out of pipelines to prevent internal corrosion. Pipeline incidents in Alberta are down 44% in the past decade because of new detection technology and pipeline coatings.

I find it ironic that the B.C. provincial government would rather keep the current antique pipeline going, than a new build with the latest technologies. This is what I meant by the uninformed protesters. You are actually increasing the risk to the environment. Think about that for a minute the next time you hear about an oil spill.

The third way for Canada to improve business: Improve and subsidize upgrades for Eastern Canadian refineries.

Canada’s refining complex is 10% of what the U.S. has.

Canada can process about 2 million barrels of crude oil per day, while U.S. refineries are over 18 million barrels per day.

And U.S. refineries are far more technologically advanced. American refineries can process the Canadian heavy crude with ease. In fact, many have built expansions designed specifically for refining heavier crude.

On the other hand, Canadians have old, antique refineries which cannot efficiently process Canadian heavy crude. Yes, you read that correctly. A country with a problem getting its oil out of the country, can’t even process their own heavy oil that they produce. These refiners are forced to import 600,000 barrels a day of light crude oil from the United States.

How does that make sense!?

The Katusa Solution

I debated the founder of Green Peace many years about exactly this situation. And if you watch the clip right here, you will notice my solution hasn’t changed and would prevent the big disasters that are at risk, yet all of the regulators have missed.

Replace old, antique pipelines Canada relies on today with modern, state of the art pipelines that will not just improve the safety of all citizens, but also the environment. Basically, as I stated in the debate, get the oil companies to put up bonds, remove the old pipelines, but in return they get to build their pipelines.

Build all three options, which means Canadian crude has access East, South and west, rather than depending solely on the US markets.

Upgrade refiners with bolt-on expansions which can process heavy crude oil. Once upgraded, the refiners can process heavy crude from Alberta.

This solves Canada’s 600,000 barrel per day import problem on the east coast. This increases revenues for Canadian oil and gas companies, which in turn increases royalties and taxes for the government.

Prime Minister Justin Trudeau has the ability to put Canada’s energy sector back on the map. He’s got the ability to increase government revenue, create jobs and foster new foreign investment in Canada.

Do the right thing Justin.

And by the way, you can send the $280,000 cheque to Greater Vancouver Food Bank in lieu of paying Katusa Research for giving you the answers to the current conundrum.

In 2014, I was asked to be part of Justin Trudeau’s pre-election think tank regarding energy policy by one of his senior advisors. I was pitched hard at a lunch in downtown Vancouver by this former high ranking Liberal MP.

I didn’t accept because I openly thought Justin Trudeau was unqualified to be Prime Minister. If his last name was Furman or Smith or Chang he wouldn’t have the support of the Liberal party with his track record or credentials.

I was wrong, Justin won.

It’s now time for Justin Trudeau to step up and prove that he deserves the Prime Ministers office, because right now sir, your current legacy can be defined in one word “Mr. Dressup”.

And to all politicians of Canada, a friendly reminder that the resource sector has given back greatly to the community (far more than any other private industry in Canada), from building hospitals to social programs in communities across Canada—it’s time Canada remembers its source of wealth.

Regards,

Marin