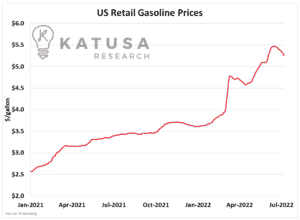

Everyone wants a magic bullet.Especially when there’s a monster around – and anyone who’s filled up their car has seen what’s lurking behind the pump…

What happens when the average price of a gallon of gas tops $5?

Mr. President, Do Something!

As we have recently seen, ordinary people get angry.Then the pressure builds on politicians to “DO SOMETHING”, and there’s a general sense of urgency.The most famous example was during the 1970s.

- Stagflation saw wages flatten while inflations soared. Inflation topped 11% in the US. In the UK, peaking at over 20%.

Much of the crisis was due to the infamous oil embargo of 1973-74. In response, the US created the Strategic Petroleum Reserve, the world’s largest emergency supply of petroleum.Now we’re in a similar situation, with inflation reaching 8.6% in the US in June.The United States Petroleum Reserve, aka the ‘SPR’, holds hundreds of millions of barrels of crude oil in case of an emergency.With sky-high prices at the pump, this begs the question where’s the SPR? Why not open it up?That’s a good question. But in fact, the SPR taps have already been opened.Over 129 million barrels of oil have been released from the SPR over the past 12 months.

3 CRITICAL Facts Investors Must Know About the SPR…

And they all lead to the same conclusion:The Strategic Petroleum Reserve won’t save consumers from high prices.Here’s why.1. The SPR doesn’t solve long-term structural issues.First and foremost, the SPR is a temporary supply-side solution. It was never meant to function as a price control over the long term.The SPR works by providing an alternate source of petroleum supplies. If supply drops in one area – say, another oil embargo from Arab nations, as in the 1970s – the SPR can be used to keep the oil flowing.And by providing extra supply, the SPR can – in theory – keep prices slightly lower.2. The SPR supplies the same fuel to companies that set the prices.The SPR is actually “open” now, with President Biden authorizing the release of a million barrels a day from the reserve. And the most recent numbers reflect that – 25.2 million barrels of oil left SPR sites in June, just a bit under the one-million-barrels-a-day target.But who gets that oil?Marathon, Valero, et al. – the oil refiners that supply most of the US with fuel for the pumps.After all, the SPR sells crude oil, not refined gasoline. If there’s a bottleneck with the refineries, then the SPR isn’t the solution. And of course, the SPR has a limited supply, in part because of another fact that’s often ignored.3. The SPR: Congress’s dirty secret.It’s the Strategic reserve; like a fire alarm, don’t open it unless there’s an emergency.So how did the President of the United States get away with opening the SPR now?Turns out, he’s not the only one who has tapped the SPR early.From 2015 to the present, no fewer than six bills in Congress – several of them bipartisan – have used SPR sales as a source of funding.Need some extra cash to fund infrastructure? To pay down the deficit? To fund tax cuts?Just plan some SPR sales sometime down the road, and boom. Easy money.So if Congress is already abusing the SPR, why get mad when someone else does, too?As an investor, here’s what’s happening:

- You’ve got a reserve that was never intended to control prices

- All releases go to the same supply chain that’s already having issues

- Both Congress and the President aren’t using the SPR as initially planned.

The SPR won’t solve the current price shock. It can’t.

- The SPR isn’t meant to control prices; it’s meant to add a supply for the US in an emergency. Tiding things over till supply chains are restored.

But what is the rest of the world decided to tap in?

The Global Strategic Reserve?

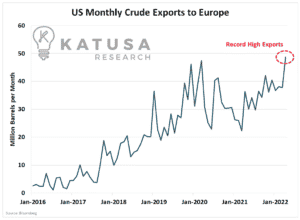

US oil exports have skyrocketed over the past few months. In weaning itself off Russian oil and gas, the EU is buying up all the supply it can find.

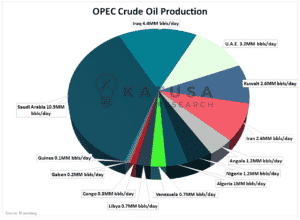

Over the past few months, the SPR has been releasing nearly 1 million barrels of oil per day. This would rank the SPR as the “9th largest “producer” if you compared it to recent production from OPEC nations.

It is somewhat ironic, that just a few short years ago, in the depths of the pandemic, we were concerned about the SPR and oil storage overflowing due to demand destruction. Now we have the exact opposite problem, too much demand and not enough supply.

What Happens if the SPR Runs Dry?

Don’t wait till then to reexamine your portfolio. There are plenty of opportunities out there, even in a bear market plagued with uncertainty – as long as you know where to look.I do.At Katusa Research, all my subscribers know my thoughts on the market, and where I’m putting my investment dollars to work. As a fund manager for 25+ years, I’ve learned the hard lessons in tough bear markets.I’ve got my wish list handy, and I already know what price I’d be willing to pay for each company on it.With Katusa’s Resource Opportunities, you’ll be able to see exactly which moves I’m looking to make in the energy and commodity markets – with the exact analysis I use to make the decision.Regards,Marin Katusa