In November 2016, Donald Trump’s unexpected win over Hillary Clinton in the U.S. Presidential election shocked the world.This wasn’t just a political upset; it was a seismic event that sent shockwaves through global markets.Before the election, Trump was far behind Clinton.However, on Election Day, his supporters came out in large numbers, leading to one of the biggest political surprises in recent U.S. history.As Trump’s prospects surged late into the night, financial markets braced for impact.

- Volatility skyrocketed. Gold prices whipsawed, swinging by $69/oz, while equity markets took an initial nosedive.

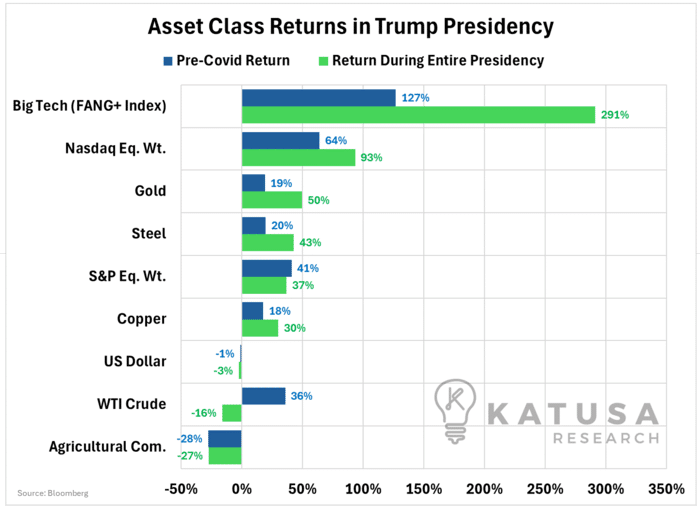

But then, in a dramatic rebound, the S&P 500 surged by 30 points on November 9th, boosting the market capitalization of the index by a staggering $200 billion.This was just the prologue to an ensuing bull market, especially for big tech companies. During Trump’s time in office, the S&P 500 index had increased its market capitalization by over $10 trillion.

The Winners and Losers: Trumps’s Stamp on Market Sectors

Trump’s time as president was known for being business-friendly.He cut taxes and encouraged American companies to manufacture more in the U.S., fostering a robust domestic business environment.

- We looked at how the market did during Trump’s presidency, from his surprising win to when he lost to Biden in 2020.

We focused on two periods: before COVID-19 (Nov 8th, 2016 – Dec 31st, 2019) and the total return from Nov 2016 through Nov 2020.The period before the pandemic is particularly telling…It offers a glimpse into the direct impact of Trump’s policies on various asset classes, unaffected by the global turmoil of COVID-19 and money printing.

- Commodities thrived in this pre-pandemic era.

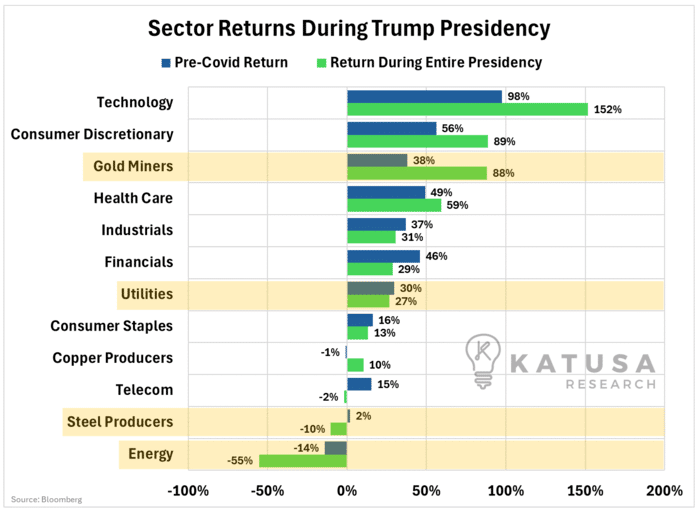

We are not saying he will, nor are we positioning our portfolios, as he will win.But rather, stating which sectors could benefit from a Trump 2.0 administration.Drilling down deeper, we can look at the equity returns by sector…

Relative to other commodities, gold miners fared the best by a considerable margin.Energy stocks were the worst, with raw materials producers such as steel and copper breaking even.

Trumponomics 2025: A New Era in American Economic Policy

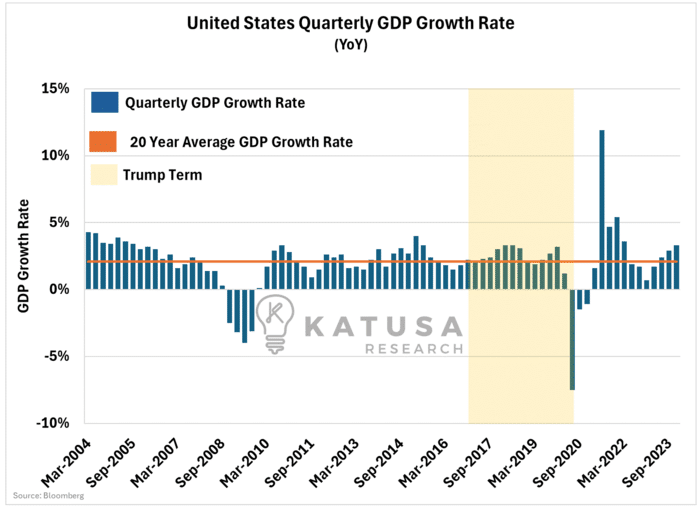

As we venture into 2025, the economic landscape under Trump’s potential second term presents a blend of familiar strategies and bold new policies.Trump’s first term was marked by a focus on boosting the US economy through stock market performance, reshoring American jobs, and lowering corporate taxes.His approach, characterized by tough trade terms and tariffs, increased US GDP growth rates above the 20-year average.

Breaking Down Key Areas for Investors

Monetary Policy and the FedTrump’s relationship with the Federal Reserve has been tumultuous.His first term saw interest rates rise from 0.50% to 2.50%, amidst his vocal criticism of the Fed’s reluctance to cut rates.With Jerome Powell signaling a potential decline in rates in late 2024, and Trump’s intention not to reappoint Powell in 2026, a shift toward more business-friendly, low-interest policies seems imminent.Trade and TariffsDoubling down on his “America First” agenda, Trump plans to implement a system of tariffs on most foreign goods, with penalties for unfair trading practices.His focus is particularly sharp on China, proposing a four-year plan to phase out Chinese imports in key sectors and pushing for a decoupling of the world’s two largest economies.This hawkish stance finds support in Congress, signaling a potential reshaping of global trade dynamics.Energy PolicyTrump’s energy policy revolves around achieving the lowest-cost energy and electricity.

- His plan includes ramping up oil drilling, offering tax breaks to fossil fuel producers, and investing in natural gas infrastructure.

Contrasting with Biden’s policies, Trump’s approach favors traditional energy sources over renewable ones.Climate and Environmental PoliciesRejecting Biden’s climate policies, Trump is likely to rescind energy regulations and exit the Paris Climate Accords again.

- His version of a Carbon Border Adjusted Mechanism could be a strategic move against China, aligning with his broader trade and protectionist policies.

Taxation and the EconomyTrump’s tax policy is expected to maintain the status quo, with a focus on sustaining corporate profits and personal net incomes.His administration’s approach to taxation is likely to continue benefiting wealthy households and small-business owners.

A Second Trump Term…

Could very well usher in another massive vote of confidence in many business sectors (as shown above).Bullish for commodities, tech, businesses and energy… Trump could be attracting voters fed up with rising inflation.On the other side, Trump will attract a LOT of negative attention should he win again.Our job is to cut through the headlines and noise and focus on the data.We broke down our entire Katusa’s Resource Opportunities portfolio into asset classes and sectors, to forecast what Trump 2.0 would mean.And we’ll do the same for Biden (or replacement) 2.0.Click here to get on board with Katusa’s Resource Opportunities, before the fireworks start to happen.Regards,Marin Katusa

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws. By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim. If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.