They had a chance…Several months ago, I wrote that if China’s economy didn’t improve quickly, then the rest of the world would start feeling the pinch, not just China.Well, here we are, two months later – and things have only gotten worse since we last visited the situation.To recap – for the last 18-24 months, many indicators coming out of China have been negative. Ever since the post-COVID market lows, the Chinese markets have not experienced the same recovery that markets in other regions have, and continue to lag behind in performance:

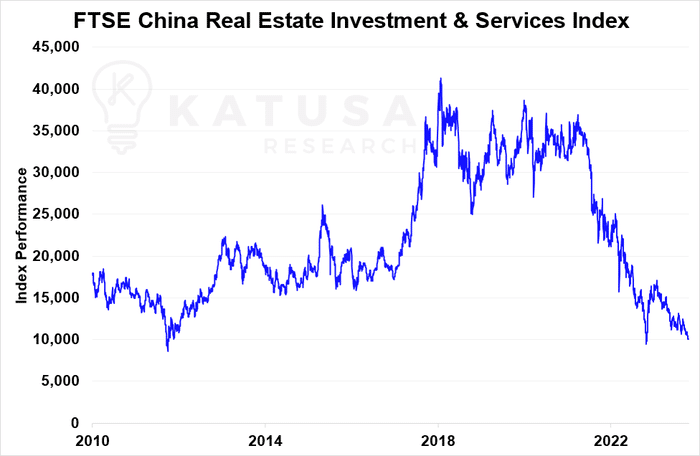

Also of particular interest is China’s property sector, which accounts for a quarter of the mainland Chinese economy.

Chinese Real Estate Signals Don’t Look Good

With several high-profile Chinese real estate developers in trouble, there are significant headwinds for the Chinese real estate market.Last year’s biggest developer by sales, Country Garden, just defaulted on a US dollar bond for the first time last week.

China’s property sector isn’t just down over 70% in the last two and a half years…It’s also lower than it has been at any point in the past decade and a half, except the very tail end of when China’s property market bubble burst in late 2011.It’s important to remember that given how much of China’s GDP is made up of real estate, weakness in Real Estate drags down many other industries indirectly associated. When people aren’t buying homes, nobody needs new furniture, appliances, or renovations. Demand for new utilities and services hookups decline, and related manufacturing and industrial segments suffer.

China Capital Flows

Another major sign of lack of confidence in the Chinese economy comes from looking at capital flows in and out of the country.This past August experienced the highest capital outflow from China since early 2016, a period marked by a major anti-corruption drive and unexpected currency devaluation. According to Goldman Sachs, China saw a $42 billion forex outflow in August 2023. And this was immediately followed in September by another massive jump of $75 billion leaving the country, nearing the record previously set in 2016. Record amounts of money are also leaving the Chinese financial markets…

- Roughly $26.2 billion in direct investments left Chinese shores this past September.

Outflows are bad, inflows are good. China is experiencing major outflows.That’s bigger than the peak in 2016, and the largest outflow seen since this data began getting tracked in 1998 (orange line below).

The Yuan is down 5.7% against the USD this year, and preventing the Yuan from depreciating further is one of the CCP’s top priorities.All these various problems compounded together has led to drastic action on the part of the CCP to keep things stable.

Xi’s Opening Chess Moves

In late October, President Xi visited the People’s Bank of China for the first time since he became president in 2013. He also stopped by the State Administration of Foreign Exchange on the same trip – another first. Though the reasons behind the visits were not publicly announced, Beijing announced a new $137 billion sovereign bond issuance…While also raising its 2023 budget deficit by an additional 26.7% at the same time.While local government debt in China is at an all-time highs of 76% of GDP, central government debt sits at 21%.If those numbers are accurate…Then there would be plenty of room for the government to work further stimulus into the economy.That means even more bond issuances and debt into the system.

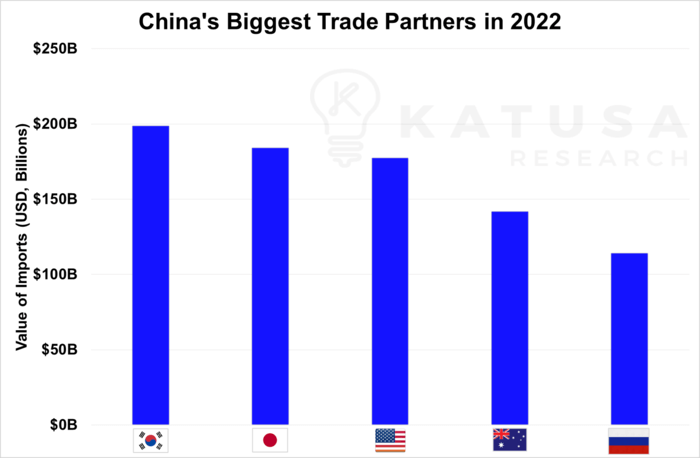

Eyes Wide Open: China’s Trading Partners

So why should you care about what goes on in China?

China is the world’s second-largest economy and largest importer of raw materials.Any slowdown in China will have knock-on effects for the rest of the world.

Not only is China the US’s third largest trade partner, but they’re also the world’s largest importer of copper ore, iron ore and crude oil, to name but a few commodities.And demand for many of these commodities are tied to – you guessed it – the health of their real estate market.Right now, it’s not yet clear whether things will be turning around soon in China.Investor sentiment has taken a big hit in the last two months, and there’s a good chance we haven’t seen the bottom of the property market.If things continue to go south for Chinese real estate, you should expect to see a corresponding drop in demand for iron ore and other raw materials like copper.

- This would negatively impact the resource markets meaning both commodity prices and the corresponding equity prices of producers and explorers will go lower.

As such, we’re keeping a close eye on the situation.And in the recent edition of my premium newsletter, you’ll read about a niche market that’s directly influenced by China every few years.It can lead to many 500-1,000% returns in your portfolio if you know where to get ahead.If you don’t want to wait, you can read about the sector, and a company on my radar in my premium research letter – Katusa’s Resource Opportunities.Regards,Marin Katusa

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws. By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim. If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.