Tesla is one of the darling stocks in the world. Nearly every new investor to the market either owns it or wants to own a share, and that bodes the same for investment funds and managers. And who wouldn’t, after hitting a low of $24 per share in the March 2020 lows, the stock soared to $400 before resting at its current price of $240 today. All told that’s nearly at 17x return in a highly visible stock. But there’s a Corvette that blew past the Tesla you might now know about. The price of this Corvette soared 85x in just 2 years. In fact, this Corvette is a major reason Tesla cars even run on the road today. There’s one major lesson to learn in investing you need to know… When there’s a tech rush happening, sell the power to the techies and you could see mind-boggling returns.

The Lithium Heist of the Century

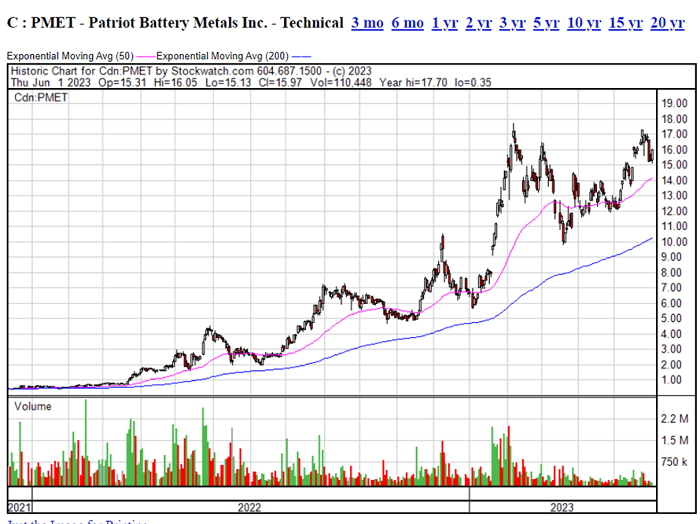

In 2021, a well-known mining company sold a small patch of land in Quebec for just $1 million to an upstart exploration company called Patriot Battery Metals. It was called the Corvette property and had nothing to do with the gas-engine American icon sports car. But instead, had everything to do with exploring for the element powering the batteries of the fastest quarter-mile cars on the planet – EV’s. Looking back on this purchase, it can only be described as the lithium heist of the century. I’m not going to lie, this was one of my biggest regrets of the past couple of years – passing on the deal that became Patriot Battery Metals. Here’s why… Initial drill results on the Corvette property were promising and then the company hit the jackpot – a drill hole featuring 1.25% lithium over 97m. That extending the size of the project and got the attention of the street and the market – and sent the stock price into overdrive. Drill hole after drill hole revealed incredible lithium numbers. And when a “step out” hole gets high-grade results, then EVERYONE takes notice.

The stock went from 20 cents per share in June 2021 to over $17 per share in early 2023. For those counting, that’s an 85x stock price return in under 2 years.Even more incredible…That Corvette property that was originally bought for $1 million grew to a market cap of over $1.7 BILLION.

The Right Lithium Stocks Can be Explosive

This is especially true if the exploration stock can hit the motherload, which is incredibly hard to do. In fact, right now there are hundreds of lithium small caps just like Patriot Battery Metals exploring and developing lithium projects.But the right projects, in the right countries – are especially important.Tesla, GM, and Toyota are not going to buy lithium for their EV batteries in countries where you see AK-47’s in the streets or deal with a government that will nationalize a project for their selfish interests and jeopardize supply chains.Electric elements and their supply will be critical. Are they close to roads, power lines, rail, shipping lanes?And is the grade high enough for a profitable mine to be built.

If Lithium Prices Go Up, A Few Will Become Big Winners

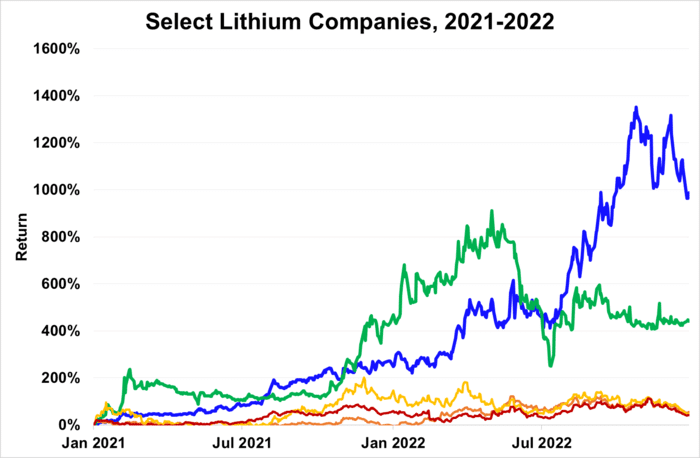

Although a surge in lithium demand doesn’t guarantee a corresponding rise in prices, it’s undeniably a potential outcome.Consider this: heightened EV sales, which drove lithium demand, played a crucial role in creating last year’s lithium market frenzy.If there’s even a hint of lithium prices escalating, look no further than the lithium miners—the bedrock of the lithium industry.Take a look at what happened to lithium mining companies during the big runup in lithium prices between 2021 and 2022:

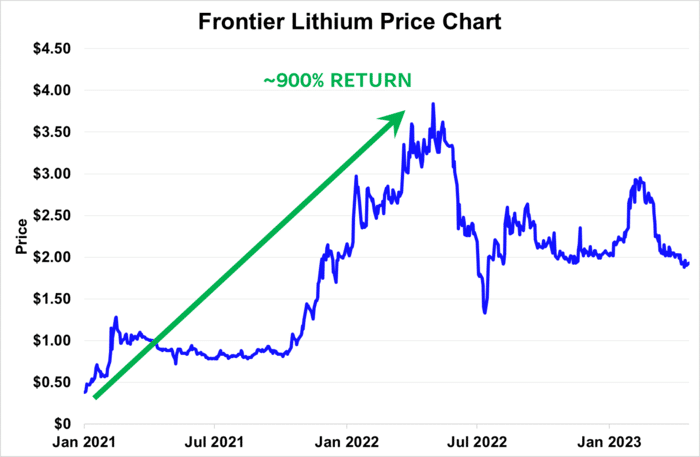

As you can see, each company at least doubled (delivered over 100% returns) at some point during the cycle… but that’s just for starters. Frontier Lithium delivered in excess of 900% returns…

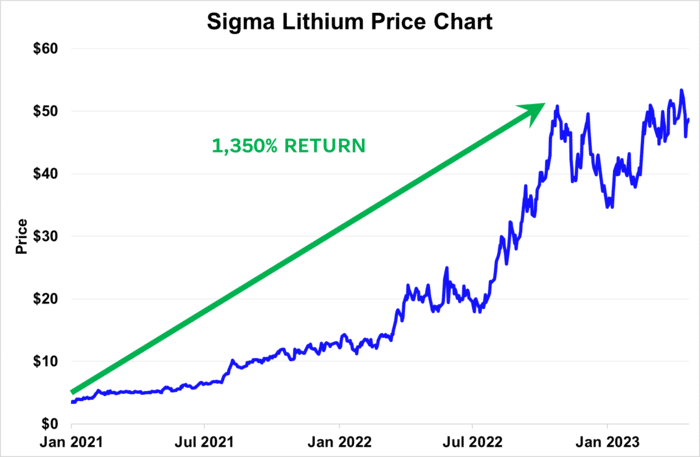

And Sigma Lithium even went up by a whopping 1350%.

Another company, Millennial Lithium, was trading under 60 cents in the wake of the COVID-19 pandemic…

- It was bought out at a valuation of USD$3.72 per share at the height of the lithium price runup early in 2022… over 500% returns for investors who picked the right time to buy.

Things may be quieting down for the moment in lithium… but don’t count on it to stay that way for long.All signs point towards a massive influx of lithium demand over the coming years, and the supply to keep up with it will have to come from somewhere.What’s the next Corvette that’s going to provide mind-boggling returns?Where could Tesla, Toyota, BMW, GM, and Ford be sniffing around to look for their next supply of North American lithium?The lithium markets are set for massive growth in the years ahead.And these companies know it.So when the lithium markets take off again, you won’t want to pass up the opportunity for another ride.Regards,Marin Katusa and the KR Special Situations Team

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws. By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim. If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.