|

In this week’s Investment Insights you’ll see:

|

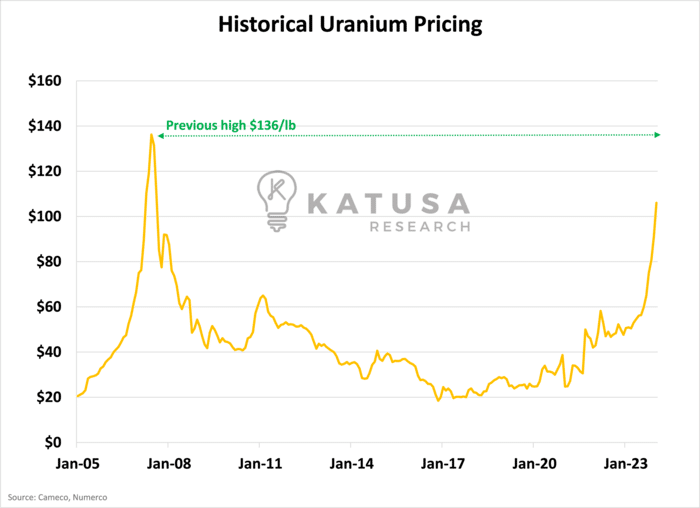

Let’s get into it…In the investment world, few sectors sizzle like uranium right now.With its price skyrocketing to a 17-year high of $106 per pound, uranium has become the poster child for dramatic market shifts.

This meteoric rise has catapulted uranium exploration and production companies into the spotlight…Marking a significant turnaround from the sector’s previous struggles.

- RELATED: You can monitor uranium prices here.

The Contrarian’s Bet Pays Off

That is the key point—it has already paid off (more on how much later).I am going to make a very controversial statement here, like the same controversial statement I made five years in the uranium sector.For the next phase of the uranium cycle, you will only want to be exposed to:

-

-

- Companies with real assets

- Real people

- In real jurisdictions

-

Five years ago, in 2019, I penned a faux ‘Short Report’ on the sector, showing the worst-case scenario for uranium.But most non-subscribers missed the whole point of the report as the conclusion was for subscribers only.If you can make an investment in the worst possible scenario and that company would do well, then you have a winner on your hands.And that’s exactly what happened.Looking back, that report caused so many “hate emails” from both longs and shorts.The longs hated that I wrote a “short report” without reading that it was not a short report.Many actually believed I was shorting uranium while in reality, I was the largest uranium financier globally at that time. I was, in fact, poking fun of the shorts.And the shorts, well, they hate anything the longs produce.But the best part was that my subscribers and I made an incredible amount of money on that company (both from open market buying and the financings available to myself and the Katusa subscribers).

180 Degrees of Uranium and Nuclear, Then and Now

I recently reviewed the report again and it was interesting how we covered many of the topics that came to fruition, such as:

1. Global Plant Shutdowns: The nuclear sector was racing against time, with aging plants facing costly upgrades or shutdowns, threatening to slash global uranium demand.

2. Price Plunge Risks: A scenario where low uranium prices would strain even the most efficient mines, potentially stagnating the industry.

3. The African Challenge: Despite rich deposits, Africa’s uranium mines grappled with infrastructural and operational cost issues, making them less viable.

4. Market Apathy: A growing disinterest in uranium investments threatened to curb the sector’s growth and innovation.

5. Geopolitical Tensions: Uranium’s role in global politics, especially among key players like Russia, the USA, and China, added layers of complexity to the market.

After 20 years in the uranium sector, I’ve had the benefit of traveling around the world to most of the real uranium assets and during that time, getting to know most of the management teams.The two big differences I have seen between now and the last bull market is the lack of institutional participation in the junior explorers.The large funds will avoid most of the small-cap explorers for various reasons.But the point is the big liquidity event for the small-cap sector last bull market was the big capital inflows of the institutions.

The Uranium Retail Run

Another difference between the last bull cycle and the current one is the number of anonymous social media accounts, with large followings that are promoting certain companies with zero disclosures.Liquidity and Legitimacy are important and will be even more so moving forward.At the most recent large retail resource investment conference, the uranium panel was packed. Gold, copper, and lithium?… not so much.Another sign of the current reality in uranium, retail is engaged.Fortunes have and will continue to be made from uranium.And if you understand the importance of liquidity, legitimacy, and access to capital with a pathway to monetization, you will do well.It’s not luck that the #1 performing uranium stock in the world post-France’s ejection from Niger (which really kicked off the most recent uranium leg of the bull market), is in our newsletter portfolio.

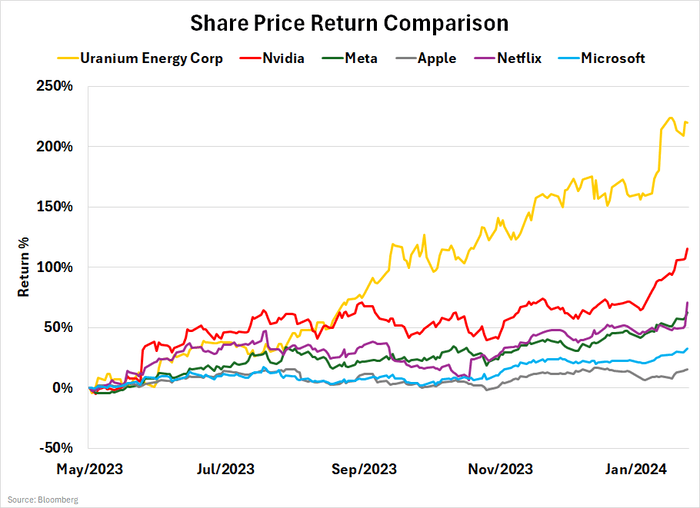

✓ That uranium stock is up 220% in our portfolio in the last 9 months.

That beats out Nvidia (116%), Meta (63%), Netflix (71%), Microsoft (33%) and Apple (16%).And I expect that company to continue to outperform its uranium sector peers because of:

-

-

- Liquidity,

- Legitimacy,

- Access to capital,

- With a clear pathway to monetization.

-

Subscribers got two major uranium picks, both deep in the green with profits, in my premium newsletter.And in the next issue of Katusa’s Resource Opportunities…We are going to publish an in-depth on which commodities (including uranium) will do in 2024 and how each will be affected by the US election later this year.Play it smart and be safe.Regards,Marin KatusaP.S. Congratulations to those who followed our KR Special Situations Alert on UROY.NASDAQ last September/October and have profited nearly 30% from our profile on the company.

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws. By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim. If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.