In this report:

-

- The Massive Hidden Value of “Project Yellowknife”

- Katusa Issues Special Situations Alert on Li-FT Power Corp (LIFFF.US and LIFT.TSXV)

LEGAL NOTE: Please read important disclaimers at the end of this email.

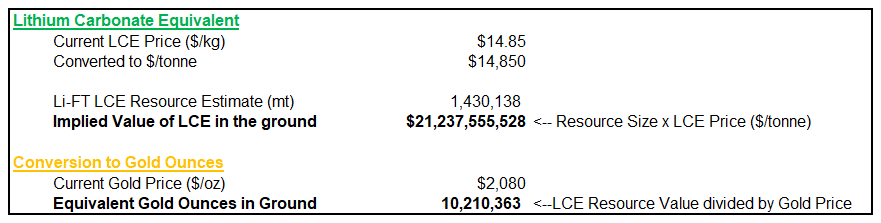

I just made a big bet on a small-cap lithium stock.And I’m going to share it with you today before anyone else.It may be a small-cap stock—but it has a huge deposit.We’ve mainly invested in gold, copper, and uranium in my premium newsletter, Katusa’s Resource Opportunities…So, to show you how impressive I think this deposit is…I wanted to put it in terms of gold.Here’s how we translate its worth into gold, a universal store of value:

- We multiply the current price per tonne of lithium carbonate equivalent by the resource size.

- We divide this value by the current gold price to arrive at the equivalent number of gold ounces.

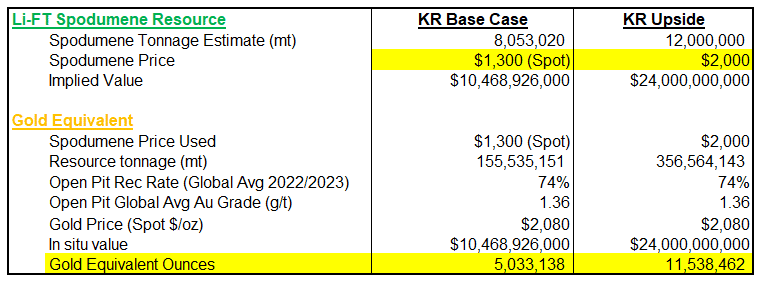

Answer: This deposit could hold the same value as an estimated 10.2 million ounces of gold.To put this into perspective…Out of 2,500+ gold deposits globally, only 109 host a resource greater than 10.2 million ounces.Now let’s fine-tune this calculation for all the mathletes reading this.If spreadsheets make you dizzy, just skip to the bold lines below.We can use global averages for open-pit gold mining grades and recovery rates to identify the number of ounces required to generate a similar in-situ value of a spodumene resource.

This refined calculation demonstrates the incredible significance and potential scale of this deposit.A gold deposit of 5M+ ounces in Canada would be highly sought after by any mid-tier or major gold producer.The upside case shows an equivalent value to a 10M+-ounce gold deposit.Almost as important, this deposit would come in at almost 2.5g/t gold, which would be about 3x the global average for open pit gold mines of this size.If the price of lithium goes back to where it was just a year ago…The grades would be equivalent to almost 5g/t gold for an open pit gold mine is unheard of, and higher than the average grade underground gold mine.

This is a Special Deposit

Again, this is shown for comparison purposes only, based on our internal calculations.The market cap of Li-FT today is only about USD$180M—a steal for a major or mid-tier mining company.Simply put, it will be a cash cow for whoever puts it into production.But that’s not the only reason this company could quickly attract M&A attention…I’d expect the required capex to build a spodumene operation at this kind of deposit would be substantially less than for a 5 million-ounce gold mine.And our internal analysis projects production costs of $600/tonne.At current depressed lithium prices, that yields profit margins comparable to open-pit gold mines (53% spodumene vs. 55% gold, using today’s prices).Let’s recap:

- Cheaper to build than gold.

- More profitable to operate than gold.

Every major mining CEO in the world will want to get in on that action.I have bet big (I’ve invested over $1,000,000 personally) that’s the case. So I am fully biased.And that’s why I’m issuing this rare Katusa Special Situations stock alert.

KATUSA SPECIAL SITUATIONS STOCK ALERT:

Li-FT Power Corp.

(LIFT:TSXV or LIFFF:US)

Besides the deposit, Li-FT has a world-class team:

- The president and director of Li-FT company formerly led Millennial Lithium, which sold for $400M.

- CEO Francis MacDonald is a workhorse—he’s the kind of guy who answers every call and returns emails at all hours of the night. He’s going to do what it takes.

The founding team has access to capital to bring the project to production, having raised more than $70M so far.And they’ve done that while keeping an extraordinarily tight share structure: founders, management, and institutions still own 77% of shares.That means the stock is thinly traded on the TSX-Venture and the U.S. OTC markets—so when the bids come in, it’s absolutely ready to pop.Now…With the rules around U.S. EV subsidies changing on January 1, 2024, and the third lithium uptrend just beginning, this company could move far and fast with any rise in lithium prices.You’ll want to be ready.Imagine unearthing a treasure so vast, it rivals the grandeur of a 10-million-ounce gold deposit.In the world of resource mining, a discovery of this magnitude happens once in a generation. That’s the staggering potential of our Li-FT discovery.Now, there’s a lot to prove in terms of economics and feasibility to get there.And that’s the risk I’m willing to take.To help you profit from this opportunity, the Katusa Special Situations Team has put together a comprehensive, in-depth report on Li-FT Power Corp.

Click here to read the full Li-FT Power report

Don’t wait—M&A in the lithium sector is heating up fast…

- ExxonMobil declared its intent to become a lithium major in 2023, committing over $10 Billion to the sector and planning on making “Mobil Lithium” a global player. That name should ring a bell for you.

- Koch Industries, owned by the billionaire Koch family, has dropped $350 Million on two deals and plans on investing in others.

- Last week we told you about “Iron Lady” Gina Rinehart’s multibillion-dollar vise grip in the Australian lithium sector.

- Mercedes-Benz announced a raw materials office in Canada where they “are going… directly to the mine here to secure materials.”

Car companies, tech companies, billionaire magnates, and entire countries are all in an all-out battle to secure this critical metal.To get a monster payback from all of this, you need to find a monster deposit.And Li-FT Power wants to make a killing off of proving one.Regards,Marin Katusa and the KR Special Situations TeamP.S. This developing opportunity could accelerate as news from the company rolls out. Take a moment to read the report now.

Details and Disclosures

IMPORTANT DISCLAIMER: Katusa Research, as a publisher, is not a broker, investment advisor, or financial advisor in any jurisdiction. Please do not rely on the information presented by Katusa Research as personal investment advice. If you need personal investment advice, kindly reach out to a qualified and registered broker, investment advisor, or financial advisor. The communications from Katusa Research should not form the basis of your investment decisions. Examples we provide regarding share price increases related to specific companies are based on randomly selected time periods and should not be taken as an indicator or predictor of future stock prices for those companies.Li-FT Power Corp has reviewed and sponsored this article. The information in this newsletter does not constitute an offer to sell or a solicitation of an offer to buy any securities of a corporation or entity, including U.S. Traded Securities or U.S. Quoted Securities, in the United States or to U.S. Persons. Securities may not be offered or sold in the United States except in compliance with the registration requirements of the Securities Act and applicable U.S. state securities laws or pursuant to an exemption therefrom. Any public offering of securities in the United States may only be made by means of a prospectus containing detailed information about the corporation or entity and its management as well as financial statements. No securities regulatory authority in the United States has either approved or disapproved of the contents of any newsletter.Katusa Research nor any employee of Katusa Research is not registered with the United States Securities and Exchange Commission (the “SEC”): as a “broker-dealer” under the Exchange Act, as an “investment adviser” under the Investment Advisers Act of 1940, or in any other capacity. He is also not registered with any state securities commission or authority as a broker-dealer or investment advisor or in any other capacity.HIGHLY BIASED: In our role, we aim to highlight specific companies for your further investigation; however, these are not stock recommendations, nor do they constitute an offer or sale of the referenced securities. Katusa Research has received cash compensation from Li-FT Power Corp as reported in their Jan 9, 2024 news release and is thus extremely biased. Members of Katusa Research also own shares in Li-FT Power.It is crucial that you conduct your own research prior to investing. This includes reading the companies’ SEDAR and SEC filings, press releases, and risk disclosures.The information contained in our profiles is based on data provided by the company, extracted from SEDAR and SEC filings, company websites, and other publicly available sources.HIGH RISK: The securities issued by the companies we feature should be seen as high risk; if you choose to invest, despite these warnings, you may lose your entire investment. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures.NOT PROFESSIONAL ADVICE: By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim. While Katusa Research strives to provide accurate and reliable information sourced from believed-to-be trustworthy sources, we cannot guarantee the accuracy or reliability of the information. The information provided reflects conditions as they are at the moment of writing and not at any future date. Katusa Research is not obligated to update, correct, or revise the information post-publication.FORWARD-LOOKING STATEMENTS: Certain information presented may contain or be considered forward-looking statements. Such statements involve known and unknown risks, uncertainties and other factors which may cause actual results or events to differ materially from those anticipated in these statements. There can be no assurance that any such statements will prove to be accurate, and readers should not place undue reliance on such information. Katusa Research does not undertake any obligations to update information presented, or to ensure that such information remains current and accurate.