Investors had an incredible opportunity to pick up some of the best oil dividend stocks in over a decade. Many U.S. oil companies and especially Canadian oil stocks showed signs of hitting a near term bottom. A handful of oil stocks exploded out of their comas.

One of the keys to success in the markets is to look for value where others don’t see it.

Coming off of the recent attack on Saudi Aramco’s infrastructure, oil prices had a shock move higher. Still, oil prices remain fairly low and attractive for bargain hunting investors.

Some may see low oil prices as a negative and write off investing in the sector. But for a specific group of stocks, low oil prices are a good thing.

Oil Dividends – Stocks in the Juicy Refining Sector

The refining sector loves low oil prices because low oil prices mean low input costs for them. Crude oil is the main ingredient refiners need to crack oil hydrocarbons into new products like gasoline and heating oil.

The best-case scenario is falling crude prices and steady or rising gasoline prices. And because there’s no pure-play producer in Canada, I’m going to focus on the U.S. refining sector here.

There’s an all-encompassing measure of profitability for the refining sector. It’s called the crack spread.

The crack spread represents the profit margin per barrel produced, based on current or future crude oil, gasoline, and distillate fuel prices.

The typical refinery crack is the 3:2:1 crack. It says that for every three barrels of crude oil, you produce two barrels of gasoline and one barrel of distillate fuel.

You can look at the “crack spread” as the profit margin per barrel.

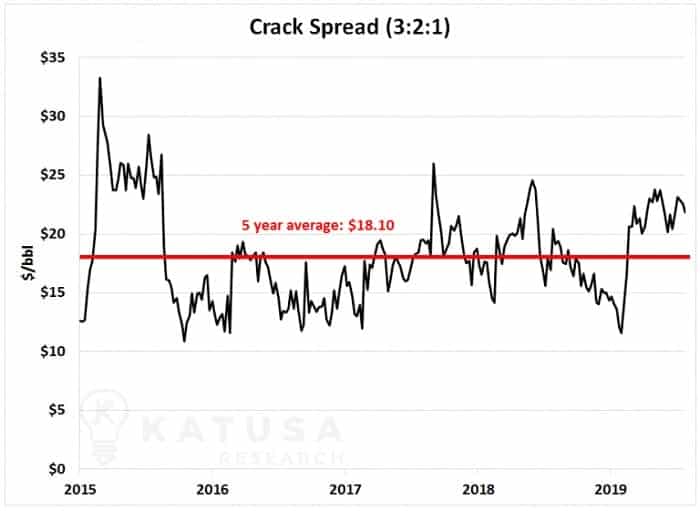

Below is a chart which shows the crack spread for the past five years.

As you can see, the crack spread is well above the five-year average. And it has recently spiked from $12 to nearly $25 per barrel.

- The higher the spread, the more profitable the refiner.

As you can see from the chart, refiners are quite profitable at current price levels. They are currently enjoying low feed-stock costs from low oil prices. Meanwhile, gasoline and distillate fuel prices have remained strong.

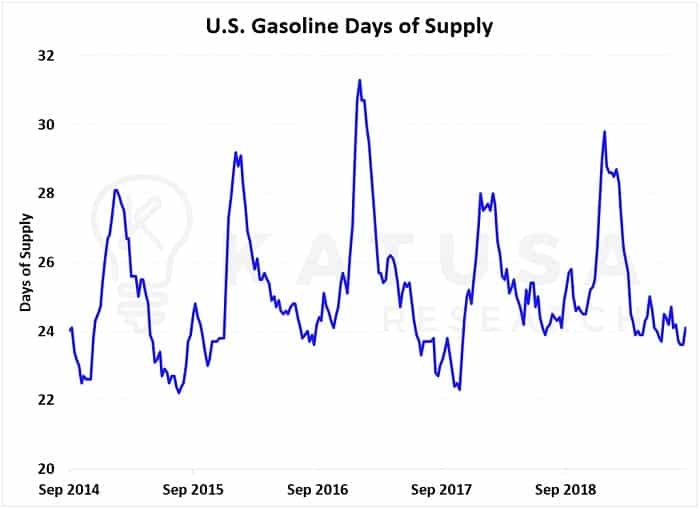

Gasoline is the main by-product of crude oil refining. And it’s very important to watch the inventory levels of these derivative products closely. Just like in the oil markets, high inventory levels are likely a sign of lower prices to come.

I like to take the analysis a step further and use a Days of Supply calculation.

This ratio measures inventory levels versus consumption. Inventories can be high, but if consumption is also high, then in reality the days of supply would be the same.

Gasoline consumption is very cyclical. The recent low in Days of Supply is par for the course.

This means that right now, there are lower gasoline inventories relative to consumption. This is indicative of a tighter market and this is good news for refiners.

If the U.S. economy slows down, gasoline consumption is likely to fall as well. This would be bearish for gasoline prices and refiners. So we need to pay close attention to economic activity.

This is a tricky industry, but one that can be very lucrative for investors if you can time it right. The goal is to invest during a period of strong gasoline prices with weak oil prices.

The Best Oil Dividend Stocks – Who Are The Refiners to Watch?

The United States refining sector is world-class and dominated by a handful of major players. There’s no room for juniors in this arena. Refining complexes can cost $5 billion or more to construct.

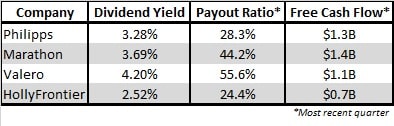

The key refiners I am watching are Philipps 66 (NYSE: PSX), Marathon Petroleum Corp. (NYSE: MPC), Valero Energy (NYSE:VLO) and HollyFrontier Corp. (NYSE: HFC).

All of them just had big share price moves, gaining 15% or more in the past few months.

Personally, I’m going to watch for a pullback and keep an eye on both crude oil inventories and gasoline days of supply. If I see an opportunity to buy either the shares or options of one of the companies, I will notify all subscribers.

Are The Dividends Safe? – Watch These 3 Metrics

Dividend Yield

A high dividend yield will attract investors and funds. But an especially high yield also signals a warning that a dividend cut might be imminent.

Now here’s a word of caution. Don’t get caught up in including the one-time cash distributions as a “dividend”. Look at it as a one time bonus that you don’t include in your analysis.

Most stock screens include any one time payments in their calculations and this is wrong.

Free Cash Flow and Payout Ratio

Free Cash Flow is how much cash an oil stock generates after paying for all its operations and capital expenditures. Think of this as “Money in the Bank”.

This is a very important metric. It’s critical to determine what percentage of the free cash flow is used to pay the dividend. And this percentage is called the Payout Ratio.

Anything above 65% should be a warning that the dividend could be at risk to being lowered, which ultimately means the stock price is also going lower.

Payout Ratio below 30% – suggests that a stock is putting its profits back into the company to grow its operations. The company is more focused on growth at than paying back its owners (shareholders).

Payout ratio between 30-55% – is pretty healthy. This range says that the company is evenly focused between keeping cash to grow the company and paying back shareholders at the same time.

Payout ratio between 55-100% – may look good for investors on paper. But when the ratio is this high it could mean that either the company has no growth plans or that their dividends are unsustainable. Make sure you understand the company’s debt servicing requirements if the commodity price drops.

Payout ratios higher than 100% or lower than 0% – you may be surprised, but these numbers can exist as well. A number higher than 100% suggests that a company is paying out more in dividends than it makes. A number below 0% means that a company is paying out dividends when it isn’t making any money. This means it’s probably not going to stay in business for very long. Both of these tend to be short-term occurrences due to special dividends and other extraordinary events.

Now let’s circle back to some of the U.S. refinery stocks listed above and break down these metrics:

All 4 of these companies are paying a healthy yield. They have reasonable payout ratios. And they have a positive free cash flow.

So is it time to buy?

How Do You Find The Best Oil Dividend Stocks?

The 3 metrics above are a great starting point in your search to add quality dividend payers to your oil portfolio.

But years of experience visiting management teams and operations in this very cyclical market has taught me to use more polished filters.

For that reason, we’ve created an advanced Katusa Dividend Grading System (DGS) at the firm.

An elite vintner separates the finest quality grapes from a vine. Likewise, we have to separate top quality dividend paying companies from the crowd.

We do this by applying a minimum of 5 more advanced metrics in our Katusa Dividend Grading System. And then we compare these metrics in various oil price environments – up, down and sideways. This helps pinpoint good entry points where you can maximize the money you’re making from the dividends. And also reap rewards of future capital gains.

So when the system spits out flashing buy signals for oil stocks in any sub-sector (refining, pipelines, services or production), we pay attention.

For example, our DGS pointed out two specific oil producers in Canada that were becoming excellent value. Each had leading dividend yields (both greater than 7%). And both dividends were sustainable after looking at the simple metrics of free cash flow and the payout ratio.

But that’s not all…

The advanced filters in our DGS came out flashing green. And so we published the detailed analysis for our subscribers to put on their watch-lists. On the back of the attacks on Saudi Aramco, these two companies rose 20% and 40% within 2 weeks.

That’s the true power of picking up quality dividend paying stocks at the right time.

Regards,

Marin