At the time, the book was ground-breaking.

Back in 2007, Nassim Taleb published a book called The Black Swan: The Impact of the Highly Improbable.

He promoted not to try and speculate or predict wild, outlier type events… but to prepare and plan for them.

The 2008 Financial Crisis launched Taleb into infamy as Black Swan event after event hit the newswires.

The AIG fiasco. Fannie Mae. Freddie Mac. Lehman. Bailouts. TARP. The world was ending and black swans became normal.

Fast forward over a decade and volatility and associated Black Swan events have been negligible.

…Until the most shocking oil move in 30 years happened over the weekend.

This past weekend, the oil markets were rocked when rebel militia from Yemen attacked the Saudi Arabian Abqaiq oil facility.

Every day at Abqaiq, 5 million barrels of high sulphur Saudi crude oil is converted to low sulphur crude. This low sulphur crude oil is then sent to oil refineries which make petroleum products.

Make no mistake, the Abqaiq facility represents 5% of global oil supply. And it’s a key piece of global oil infrastructure.

The effect was felt immediately as oil prices soared over 10% just minutes into the trading day in London. It was the biggest 1 day rise in the history of the oil markets.

Monday’s move in oil and oil equities was simply incredible.

Share volume for Canadian and American based energy stocks were 3 to 5 times what they’ve normally traded the last few months.

But…

Were you surprised that the spot price of gold barely reacted to the attack on the Saudi oil fields?

I was more shocked that gold didn’t rocket higher.

Let’s investigate why the spot price of gold yawned at the biggest ever attack on a major producing oil field.

Gold Returns During Oil Spikes

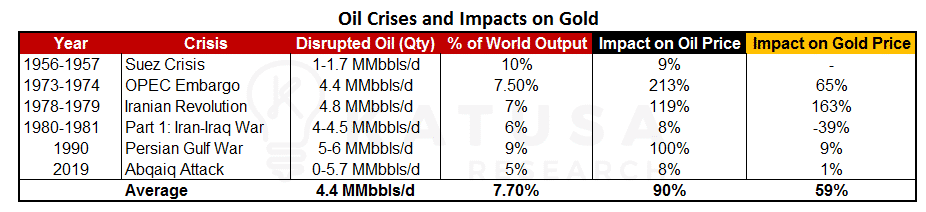

History never repeats, but it does rhyme. So let’s look at the five largest oil crises since WW2 in the table below.

The first global oil crises post WW2 was the Suez crisis in 1956 and lasted 6 months.

During the crisis, 10% of global oil supplies were restricted and the price of oil popped 9%.

Gold was still under a fixed price by the U.S. government and therefore had no price movement.

But the first major price pop in the spot price of oil happened during the OPEC Embargo in 1973.

7.5% of the global output was restricted and the price of oil increased 213% because of the OPEC Embargo. During that same time, the price of gold rose 65%.

Two years earlier, Nixon closed the gold window. And the price of gold increased slightly over 40% the 12 months that followed.

- But it was the OPEC Embargo that caused the price of gold to break over $180 for the first time.

However, that wasn’t the biggest pop ever for gold due to an oil crisis. That happened during the period of the Iranian Revolution in 1978…

Gold surged 163%, while oil rose 119% and 7% of global oil output was restricted.

This time around, gold yawned and barely moved on the news that 5% of the world’s oil supply was just attacked by a terrorist group.

The oil prices moves on the production halts in Saudi Arabia also seemed to take the news as moot point within a few days. This meant that the global markets expect Saudi Aramco to bring production back online quickly.

The Oil Markets Believe Saudi Aramco

There was a lot of speculation within the first 48 hours on the time it would take Saudi Aramco to bring back the oil production.

The speculators based this on blurry photos and satellite imagery. And the “talking heads” were speculating that the damage would keep 5% of the global oil production off for a long time.

Aramco’s CEO, Amin Nasser, stated the facility is currently processing 2 million barrels per day and expects to hit 4.9 million barrels per day (pre-attack levels) by the end of the September.

The spot price of oil moved back to the price range just before Bolton was removed from his post as U.S. National Security Advisor.

It’s obvious now that the oil markets are taking Saudi Aramco at their word that they have the damage under control.

- I’ve proven for over a year that there is no shortage of oil.

The price action we just witnessed, considering the magnitude of the event, confirms that position.

Should Gold Be Higher?

Gold has made a significant +15% move in the last 90 days.

Combine this with the expected 25bp cut by the U.S. Fed that was priced in…

And the fact that the Saudi’s have a solid grip on bringing back the production within a few months…

…there can be an argument that gold is digesting some profit taking,

Not only should gold be higher, but it will be a lot higher. Gold is consolidating and will continue to do so.

Thus, even though the impact of the attack on the Saudi oil field was massive, it’s understandable why gold didn’t react.

Oil’s price shock was short lived. And perhaps the lack of movement in the gold price was a price predictor on what was going on Saudi Arabia.

We Sure Live in Exciting Times…

And the biggest drama in Canada right now is not oil pipelines or gold consolidation…

It’s that a drama teacher in 2001 put on brown face make up for a school party.

But that’s not even the most surprising part.

The surprising part is how did a drama teacher ever become Prime Minister of Canada. Don’t expect things to change much in Canadian politics.

We are too polite not to forgive a drama teacher for playing a pretend Prime Minister.

Regards,

Marin

P.S To see all the stocks that I’m watching, buying and selling for a profit in this current gold market, consider becoming a subscriber to Katusa’s Resource Opportunities today.