He’s arguably the most powerful man in oil, and made a colossal declaration…

Recently, Saudi Arabian Energy Minister, Prince Abdulaziz bin Salman, vowed to drill “every last molecule” and be the last man standing in the oil world.

It’s a bold statement in a world that has become fascinated with hydrocarbon reduction.

Calling consensus building amongst his OPEC counterparts and Russia a “state secret and art” Abdulaziz has orchestrated an impressive return of oil prices since the 2020 pandemic with prices gaining nearly 40% year to date.

This sent the shares of oil producers rocketing higher, many of which are up 50% or more this year.

- KRO subscribers took double digit profits on one oil stock earlier this year. Click here to learn how to become a member.

Global oil production growth has remained muted, while global oil consumption has continued to improve.

This has led to a tighter oil market which has strengthened prices while stabilizing national and corporate balance sheets.

Designed by Abdulaziz, last year OPEC and Russia implemented a massive 9.7 million barrel per day production cut in an effort to thwart massive declines in oil demand and to support crumbling oil prices.

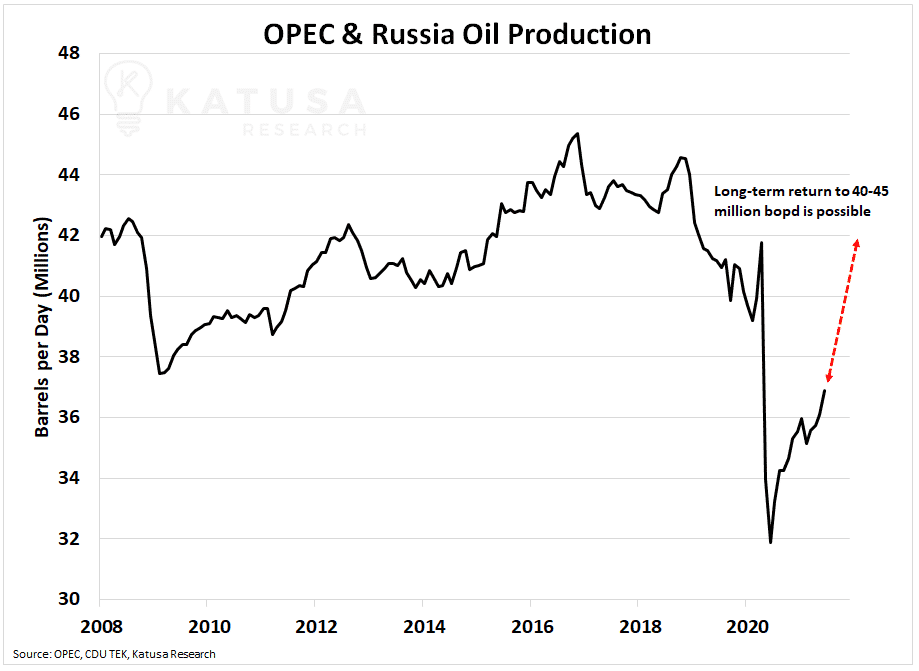

Below is a chart which shows the historical production of OPEC and Russia.

The production cut worked and upon the initiation of global vaccine rollouts, oil demand increased while oil inventories around the world began to decline.

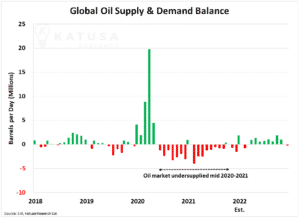

- Today the world is undersupplied by approximately 1 million barrels per day.

It’s a far cry from pandemic demand levels in March-April 2020 when the market was oversupplied by 20 million barrels per day. The chart below shows this dramatic shift in imbalances.

Let’s Look at Oil Inventory…

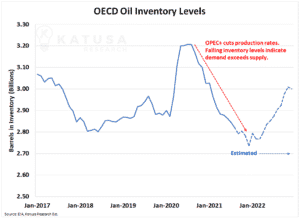

Inventory levels fall when demand is greater than supply.

Barrels normally held in inventory are released to the market to soak up the excess demand.

- Global crude oil inventory levels have declined by over 200 million barrels, and it is forecast that over the next 3-4 months an additional 100 million barrels could leave storage tanks.

Below is a chart which shows this mega build up in global crude oil inventories followed by the subsequent decline after the production cut.

You’ll notice in 2022+ inventory levels are forecast to rise and likely peaking between 2.9 and 3 billion barrels.

Inventory levels in this range indicate a normalized market when compared against demand considerations.

This can be shown through the Days of Demand indicator which is the ratio of crude oil inventory levels to crude oil demand.

Peak Demand + Peak Supply = Peak Nonsense

You will find a lot of extreme sentiment in the oil market these days. It seems that every day there is both “peak demand” and “peak supply” hysteria.

So, who’s right? Probably neither side.

Simply put, if we removed all fossil fuel consumption today, the global economy would crash to a halt. Will we eventually wean ourselves off hydrocarbons?

Absolutely, but it requires slow methodical change, not flipping a light switch. Electric vehicle adoption continues to improve and that is a key driver for future oil consumption.

Though for the next 5-10 years, EVs won’t displace more than a few million barrels per day of demand globally (1-2%).

Don’t Forget: The US Shale Factor

The concept of peak supply is heard just as often. Many questions whether the US shale revolution can continue, or can the Saudi’s really produce enough oil to supply the market? For years I’ve said to never underestimate US shale.

- It takes roughly 6 months to bring a US shale well from initial spud to commercial production.

This creates an incredibly flexible production environment and allows producers to make decisions over much shorter time frames than offshore oil producers or state-owned national oil companies.

Shale is a mature industry now, which means the focus has changed from a “grow at all costs” approach to one of disciplined capital spending and free cash flow generation.

As a mature industry, the years of 20%+ production growth are gone, likely to be replaced with 1-7% annual production growth.

Other segments of US crude oil production will likely tread water.

Alaskan production has not grown in 5 years, while the Gulf of Mexico (GoM) is only up a smidge.

Current oil prices do make economic sense for increased shallow water production in the GoM… but most of this production is controlled by the mega oil corps (Exxon, Chevron, BP, Shell).

As you may know, those companies are under so much environmental scrutiny and forced changes that it is unrealistic to expect large growth in offshore oil.

Thus, it’s unlikely to see the GoM oil production rise significantly.

- Most if not all US oil production growth will come from shale, rather than conventional sources.

OPEC and Russia have considerable excess production capacity which can and will begin to flow back into the markets.

Starting in August 2021, the group will collectively increase production by 400,000 barrels per day. Each month for the rest of the year, the group will add an additional 400,000 barrels per day to the market.

The goal of this slow, disciplined approach is to try to keep oil prices sustained near the $70 per barrel range.

How Much Oil Can OPEC and Russia Bring to the Market?

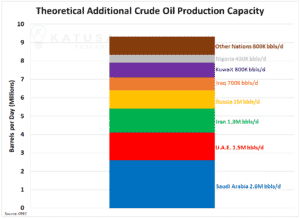

The current OPEC excess capacity is over 8 million barrels.

The largest contributors to future oil supply are Saudi Arabia, Iraq, UAE, and Kuwait. Iran has the capability to also add 2+ million barrels per day of supply but this hinges on their Nuclear deal with the US. Furthermore, Russia has at minimum 1 million barrels of additional capacity available.

Even if you exclude any of the smaller OPEC nations citing poor infrastructure, just the core group of Saudi Arabia, Russia, U.A.E, Iraq and Kuwait provides nearly 6.5 million barrels of spare capacity.

This is enough to satisfy the incremental global demand growth for several years.

Huff & Puff

You will hear a lot about ‘Huff & Puff’ technology in the coming years in the oil patch. Contrary to what many may try to sell you on, it’s not new technology.

In the U.S. you will start to see more oil produced through Enhance Oil Recovery techniques. Specifically, this “Huff & Puff” technology which uses CO2 injection to pressurize the formation and bring oil to the surface.

- This CO2 injection is eligible for a tax credit under the 45Q tax code.

I’ve done a lot of number crunching this and I don’t see (barring some new breakthrough that is many years away) the carbon credit cost being less than USD$40/t in the most optimistic model in oil patch.

That gives us some framework at what price oil companies will be forced to pay for offsets.

And if you’re not factoring that into your investment portfolio yet… you’re going to fall behind.

Subscribers to the KRO – my premium research service know the oil companies I’m targeting and how I’m playing the Net Zero world in a big way.

- I’ve actually found a company that where the CO2 used to produce its oil is equivalent to taking 8 million cars off the road for a year.

Members have the ticker and all the info – click here to get on the list.

Regards,

Marin