Hydrocarbons have been a pillar of economic growth for the last century.And you can argue that the pace of globalization could not have occurred without oil and gas.Love it or hate it, oil is a lifeline to international trade. In turn, it provided incredible economic growth and investment opportunities around the world.While I am pro-decarbonization, I am not suggesting that we eliminate all oil and gas production immediately.

- The world is not ready for a 100% oil and gas-free world.

One day, yes. But not today and not any time soon.Oil and gas producers are under fire to change, especially the largest integrated oil and gas companies.Seemingly every week there is a new headline about Shell, Exxon, Chevron, or one of the others either facing new scrutiny or under fire from another ESG group.(And they’re paying major money to de-carbonize by purchasing and investing in decarbonization projects).This week, we’re putting that to the test.So, if you own oil and gas stocks, you’ll want to pay close attention.We’re in the first inning. And this report is just the tip of the iceberg.

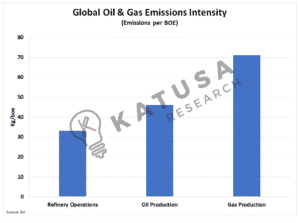

Back to Basics: Emissions Intensity for Oil, Gas, and Refinery operations.

Here’s a chart that shows the amount of greenhouse gas produced per barrel of oil equivalent produced or refined.You can see that natural gas production emits the highest amount of greenhouse gas; methane is a key reason for this.

Now let’s get deeper…

Integrated Oil Company Analysis

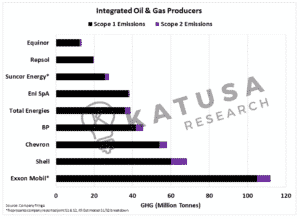

The largest emitters in the oil and gas world are the world’s integrated producers.These companies extract oil and gas from reservoirs, refine it into everyday use products like gasoline and petrochemicals.Then they sell those refined products further downstream or to end-users.

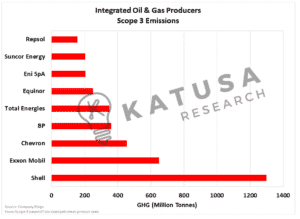

- The next chart shows the Scope 1, 2, and 3 emissions for the world’s largest integrated oil producers. (Click here to understand scope 1,2,3 emissions quickly).

You’ll recognize many of the names in the charts as they are some of the world’s largest oil companies.

We’re focusing mainly on the Scope 1 and 2 emissions because these are the most quantifiable today.But, if you note (now in red) the enormous Scope 3 emission levels of Chevron, Exxon, and Shell you see the complete emissions picture – and how massive it is…

Intuitively this makes sense. These companies provide enormous amounts of oil and refined products combusted in gasoline, used in petrochemicals, and burned for power generation. All of which are applicable to Scope 3 emissions.So how does a net-zero world affect the bottom line of these companies? Glad you asked…

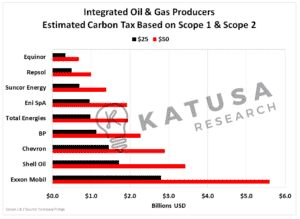

Let’s Apply our Carbon Tax to These Scope 1 and Scope 2 Emissions…

If you’re going to take home anything here, take this:

- You will see the annual carbon tax liability is in the BILLIONS for most of these oil companies.

Several of these companies use internal carbon prices of $25 to $50 per tonne, which assists in long-term capital planning decisions. For consistency, I used the same.

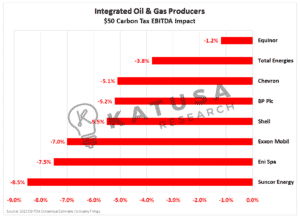

No question, these are big bills. To put this in perspective, let’s compare this tax hit to earnings.We can use the annual carbon tax paid relative to EBTIDA (Earnings before Interest, Taxes, Depreciation & Amortization). Because this is easily measurable across all companies.Below is a chart that shows a $50 carbon tax liability as a percentage of forecasted 2022 EBTIDA for the integrated group.

- With the exception of Equinor (who has been well ahead of the curve in emission reductions), a $50 carbon tax would be a considerable hit to company earnings.

Suncor is the big loser in the group and will be most impacted by a carbon tax.Canada’s carbon tax is already $50 per tonne and going higher, this is bad news for Suncor.

Key Takeaways

I don’t know if we will see a global carbon price (we should it would accelerate the process) but I do believe national carbon taxes will become the norm.Due to rising carbon prices (we follow price action here) and carbon taxes, expect many companies to revise cash flow forecasts and asset values.

- Be smart with allocating to countries that do not have a carbon tax yet.

This may lead to unfortunate surprises for those who have not modeled a carbon cost.We’ve done a deep dive on many major commodities and companies – including what their carbon liabilities will be.Many will find it difficult. Few are positioned to thrive.As an investor, if this is not on your radar, it needs to be quick.Regards,Marin KatusaP.S. Subscribers to my premium research service – Katusa’s Resource Opportunities – are aware of how big we expect the Carbon sector to become. And how to steer clear of not just oil, but gold, silver, and base metal companies that will be hit with major carbon liabilities. Do yourself a favor and check it out.