If you watch the local news, there’s a good chance that it’s not “local” at all.

In fact, odds are good that the news you’re seeing is being broadcast by a company you’ve never heard of.

There’s a media company that started in 1996 with a single station in Scranton, Pennsylvania. It took them nearly two decades to grow to just fifty local television stations.

But over the past few years, they’ve used a simple strategy to reach absolute market dominance in the U.S.: buy everything.

Now, with 197 television stations in 115 markets, Nexstar Media Group is the largest TV station operator in the country. That’s some serious growth.

Their broadcast empire reaches 63 percent of households in the United States.

You’ve seen that kind of consolidation happen before in many other industries: phone companies, dating sites, airlines, gas stations, and oil refineries.

Lots of little companies make lots of little dollars (each of Nexstar’s properties make an average of only $6.5 million a year on ads).

Then someone decides to buy all of the little companies—and make a whole lot of money.

For Nexstar, that’s more than $1.2 billion a year.

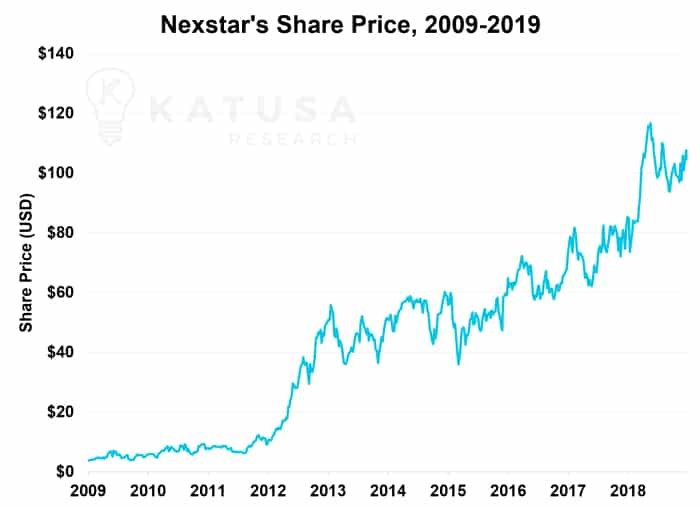

Combine that kind of profit with rapid growth year after year, and that leads to outstanding stock performance.

Ten years ago, Nexstar was sitting just under $3 per share. In early 2020, it traded well above $100 a share. That’s easily thirty-five times your money.

Since late 2009, Nexstar has outpaced Amazon’s returns. It’s the kind of investment you wish you had sunk your entire portfolio into right after the Global Recession.

Nexstar is old news, though. The bulk of their growth is behind them, and they’re content now to sit back and cash in on their mature media empire.

But there’s another company following the exact same playbook.

They started as a single tiny blog in 2011. By 2016, they had a couple hundred thousand users.

And they’re in an industry that’s growing much, much faster than local TV news.

And they’re buying everything.

The Google of Video Games – The Next Nexstar

Remember, video games have some of the fastest growing, most valuable communities in the world.

By 2017, that little blog, which had started in the founder’s parents’ garage, had grown into a community of a couple million video gamers.

In 2018, the company acquired seven more massive video game communities.

In 2019, they’ve tossed a tanker truck full of lighter fluid on their “buy and build” game plan.

Using a brilliant strategy, they’re snatching up valuable new video game properties left and right.

All these purchases mean that their audience is already larger than Nexstar’s—and that’s the company that the FTC barred from growing its viewership any bigger.

- And despite that massive growth, it’s not only the largest—it’s still the fastest-growing online community of video gamers.

Think about that for a second. It’s still the largest AND fastest growing in its industry. Like Google, Amazon, or Apple years ago. Just when you think they’re big, they become even bigger. And the returns are colossal.

This company’s buyouts are all part of a master plan to aggregate a diverse set of profitable video game communities. Together, those sites are set to make a lot of money, no matter what the future of video games is.

For example, one website pulls in six million monthly visitors—who are just there to learn how to master the video games they play.

- Another is ranked #7 in the world for the highest concentration of female visitors.

This makes it extremely attractive to advertisers seeking to reach that demographic.

Altogether, those communities would make for an extremely valuable company with little to no competition.

Only this company isn’t just buying communities…

They are on their way to becoming the largest vertically integrated video game company in the world.

Vertical integration is what makes Apple such a profitable company: they own the hardware, the software, the services, and the stores.

You know the drill… they can control the entire customer experience from start to finish—and make money every step of the way.

This video game company’s current holdings include:

- Half a dozen esports teams,

- Over fifty esports influencers,

- One of the largest gaming expos,

- More than 100 gaming websites, and

- Almost 1,000 gaming YouTube media channels.

Altogether, they’re reaching more than 200 million English-speaking gamers monthly.

And they’re still snatching up as many properties on the board as possible. They make money every time someone does something even remotely related to video games.

They’re winning a real-life game of Monopoly.

Match.com Meets Its Match

Other companies that have tried such a bold consolidation of their sector have run into hard barriers.

Take Match Group, for example. If you’ve used nearly any online dating property—Plenty of Fish, Tinder, OkCupid, Hinge—you’ve made Match money.

At first, people thought no one would be interested in “online dating.”

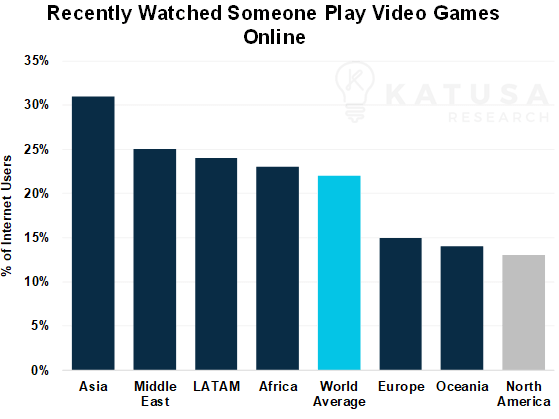

Video games still face that doubt. “Who wants to watch someone else play video games online?” you may have wondered.

The answer is: “Plenty of people.”

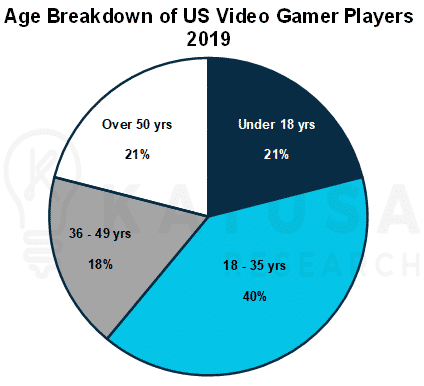

And unlike dating, the pool of people who want to watch video games is not mostly limited twenty- to forty-somethings.

In fact, the video game industry continues to grow by double digits every year. And that’s across almost every demographic, with no signs of slowing.

Match.com ran into another tough obstacle, too. When the product was successful, and people got into a relationship, they quit paying money.

Video games are just the opposite. They follow Warren Buffett’s key metric for long-term value in a company: they’re addictive.

Here’s the deal. Even with all these problems, Match became a $20 billion company.

This video game industry conglomerate, on the other hand, has everything going for it:

- Dozens of avid communities that are dedicated to the product and willing to pay for it in the long-term.

- The ability to use data to precisely target users with highly profitable advertising.

- Synergy across all platforms, enabling it to drive rapid growth across its communities, events, and esports teams.

Here’s the question you have to ask…

If a dating site can get to $20 billion, how big could a video game company get—with no barriers in its way?

You might’ve missed the boat for the consolidation of mobile phone carriers… dating websites… local TV stations. Any of these those would have easily netted you hundreds or thousands of percent in profit.

Don’t make the same mistake with the video game industry. Multibillion-dollar trends only come around so often.

Tomorrow, we’re releasing a report that could allow you to “level-up.”

The company identified by the Katusa Research Team is quickly executing a detailed strategy for absolutely dominating the esports market. This mania is still on the back pages… for now.

This is your chance to get in early on the world’s most formidable gaming enterprise.

Regards,

The Katusa Research Team