It’s been said that if you want to have an enjoyable dinner party, don’t talk about politics or religion.

Conversations about these topics are almost sure to get heated and irrational. They often turn calm, well-mannered people into raving lunatics.

I believe we should add another item to the banned topic list…

Bitcoin vs. Gold

In all my years in the market, I’ve seen few subjects get people riled up like Bitcoin vs. gold does. Some people hate Bitcoin and love gold. Some people love Bitcoin and hate gold. If you want to stir up a storm at an investment conference or on social media, just pick one, say it’s great, and then say the other is stupid. Then sit back and watch the insults and attacks pile up.

But what if zealots on both sides are being stupid?

What if everybody is looking at Bitcoin vs. Gold the wrong way?

I’m about to suggest that is exactly the case.

Regular Katusa Research readers are familiar with the allure of owning gold and its long history as money. People have used gold for thousands of years because it is portable, durable, anonymous, divisible, convenient, and consistent around the world. And most importantly to many people, governments cannot debase gold as they debase paper currencies.

To fans of cryptocurrencies like Bitcoin, those are familiar words. They own cryptos for many of the same reasons. They love the idea of owning money that isn’t controlled by a government.

Because of the similarities between Bitcoin and gold, you’d think their fans would see eye to eye. But that’s not the case at all. Maybe it should be.

How Smart People Think About the World

One of the hallmarks of a truly bright person is the ability to objectively think about two totally opposing sides of an argument. For example, a great investor who believes strongly that an investment will do well can also objectively think about its risks. A great business leader is able to objectively analyze the pros and cons of two different business plans.

With this fact of life in mind, here’s an idea that can offend both Bitcoin zealots and gold zealots, but might make a lot of sense to you…

Why not own both cryptocurrencies AND gold?

You can bet on both horses… so why not do it?

Most people want their investment gurus to be dead certain of things. People want certainty in their lives. They love to follow someone who seems to know exactly where they are going. They want to hear “buy this” and “sell that!”

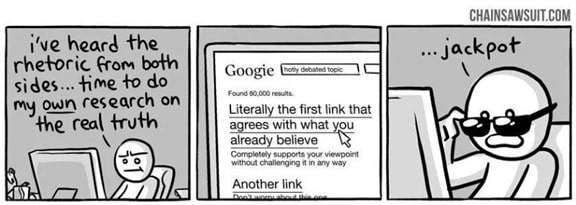

And most of the time, people surrender to their own internal confirmation bias, which leads them to the crystal ball guru they want to hear from. That behavior reminds me of this comic…

The truth is, nobody really knows what is going to happen in the market next week or next year. They don’t know if stocks will boom or bust. Of course, we can analyze industries… balance sheets… and valuations… and make smart bets based on our estimates of probabilities, but in the end, nobody knows for sure what is going to happen in the world.

Nobody knows for sure if a Bitcoin will be worth $1 million or $1 in five years. Nobody knows if an ounce of gold will be worth $8,000 or $800 in five years. Anyone who claims they know for sure is full of it.

That’s why, if you’re worried about the stability of the global monetary system – or simply want to own assets that aren’t correlated to stocks and bonds – it can make a lot of sense to own some gold and some cryptocurrencies. Again, you can bet on both horses.

There are no rules that say you have to make all or nothing bets with your investments. In fact, most people should never make all or nothing bets with their investments. They are far better off staying diversified among stocks, bonds, real estate, gold, and other assets.

When people ask me if they should buy Bitcoin or other cryptocurrencies, I tell them to go for it… but only if they truly understand them… and only if they truly understand intelligent position sizing. I think you’re crazy to own Bitcoin if you don’t understand it. I think you’re crazy to own gold if you don’t understand it. I think you’re crazy if you make any investment without knowing that the key to intelligent position sizing is to not bet the farm on a single trade or investment. (Read our educational piece on this critical subject right here. It could save you a fortune)

And when you don’t bet the farm on single ideas, you have capital available to put into different asset classes… like Bitcoin AND gold. You don’t have to get into name calling arguments on the Internet. You don’t have to freak out when someone says gold is better than Bitcoin or vice versa. You can own two different assets that could both do well if central banks fail to create monetary stability.

As for my own portfolio?

I own some physical gold as wealth insurance. I own real estate. I own some conventional businesses, both publicly traded and privately traded.

I have allocated some speculative capital to a cryptocurrency and blockchain fund that’s done very well and I’ve also invested in a private start-up company called Einstein Exchange. I continue to look at profitable ways to invest in the cryptocurrency megatrend. However, I’m not betting the farm on any of those things. I diversify.

Just as importantly, I don’t get emotionally attached to gold… or stocks… or Bitcoin. I believe people who get emotionally attached to gold or Bitcoin or any other investment are making a huge mistake. Getting emotional about your investments is sure to cloud your judgement. Save the emotional attachment for your kids. They will love you back. Your investments won’t.

***If you want to make great decisions about gold, Bitcoin, and all your other investments, you need the best information. About one month from now, you can get that information at the San Francisco Gold & Silver Summit, which Katusa Research is co-producing with our partners at Cambridge House International.

The show has a long history of success, as it has been running for many decades. This year, it is being held at The Hilton Union Square in San Francisco, California on November 20-21, 2017.

Actually, “gold and silver summit” is a misnomer. This annual conference started out with a focus on precious metals, but it’s grown massively beyond that subject… and become one of the few conferences I make a point to attend.

This year’s speaker lineup is exceptional. Bestselling author Jim Rickards will be there. Jim is an expert on gold, geopolitics, central banking, currencies, and many other things. He’ll provide an insider’s take on what’s happening in Washington D.C… and how it will affect your investments.

My friend Rick Rule will be speaking as well. Rick is one of the natural resource industry’s smartest minds and one of its most skilled financiers. Rick is a walking encyclopedia of resource and business knowledge. He’ll discuss in detail the sectors he sees the greatest opportunities in.

My friend Frank Holmes will be there. Frank is the CEO and Chief Investment Officer of U.S. Global Investors. Frank has had a rockstar-like last 12 months. He is the Chairman of one of the biggest business success stories of 2017, HIVE Blockchain Technologies (TSX: HIVE). HIVE’s status as a pure play on cryptocurrency mining has propelled its stock from 75 cents to $3.50 in less than a month, for a gain of 376%. (Frank is one of the rare guys who can do what I described earlier… think very intelligently about gold and Bitcoin.)

Frank also created the world’s the first airline ETF, symbol JETS, and one of the best gold stock ETFs, symbol GOAU. Frank is one of the most connected people in the markets, and someone you will want to pay attention to very closely. He’ll share his best investment ideas.

I’m also happy to say my good friend and conference favorite Doug Casey will be there. Doug is a legendary speculator and thinker. He’ll share his top ideas at the conference. Doug’s presentations are part history class, part comedy show, part investment analysis, and always entertaining.

I’ll be speaking at the conference as well… along with some of the world’s best business executives and newsletter writers. During panel discussions, I’ll ask investors and executives the hard questions… with a focus on getting the most useful, most actionable information for myself and the audience. I’ll also moderate the debate on Bitcoin vs. gold.

*** One of my goals in founding Katusa Research is to level the playing field in the natural resource sector… to provide individual investors with the insight, resources, and tools they need to compete with large funds and connected players.

Today, I want to provide you with another resource. Because you are a Katusa Research reader, I have arranged for VIP entry into the conference for you.

Tickets to the conference are normally up to $80, but by entering the promo code KRCLUB17, you will get tickets for free.

If you’re interested in attending, you can register right here.

Make no mistake, this conference is about making money. The speakers were chosen with that goal in mind. Which company will be the next 10 bagger like Northern Dynasty, or be taken out by a gold major in a 47% overnight win like what happened to Integra Gold.

Attending the conference will be a tremendous way to arm yourself with the knowledge and connections you need to make the biggest possible returns.

Chances are high that you will hear about the next crop of 10-baggers over the next 12 months at this conference.

I hope to see you there.

Regards,

Marin Katusa