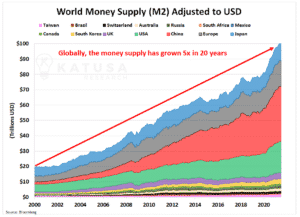

Ultra-low interest rates and non-stop money supply growth are fueling the race to the bottom for global currency devaluation.

Frightening Stats

For instance, did you know that the global money supply has grown by over 5x in the past 20 years?

Here’s a chart that shows global money supply growth over the last two decades:

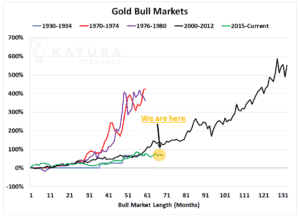

Massive amounts of government stimulus, negative interest rates, and ultra-low bond yields around the world have paved the way for soaring gold prices these past two years… setting investors up for a run at another long bull market.

The exciting part is that there’s still a lot of room left to run…

A major bull market can make any investor feel like an expert because a rising tide usually lifts all boats.

That said, there are always a few boats that rise much higher and faster than the others.

These are the investments that professional investors, fund managers, and billionaire resource speculators target for big wins.

A License to Print Money

In this crazy world we live in, there are few certainties.

Frankly, anyone peddling you a “sure thing” investment should be treated with extreme caution and skepticism.

But there’s one small corner of the market that’s created an incredible margin of safety for their operations, based around their profit margins.

It’s a unique business model that’s been copied by some of the world’s leading companies.

- Recently, Bill Ackman – one of the world’s leading hedge fund managers – raised billions of dollars trying to break into the sector.

What’s this mysterious line of business, you ask?

It’s the royalty business, and it’s applicable across many different industries.

Music, mining, oil and gas, TV shows and movies, and even oil change businesses are just a few of the many industries where you can find royalties at work.

Happy Birthday, Now Pay Up

Have you ever heard the song “Happy Birthday?”

Of course, you have.

But what you probably didn’t know is that the royalties on the song brought in over $50 million to its owners, most recently Warner Music, just from it being used in movies and T.V.

Yes, the Happy Birthday song, the same one you’ve been singing since you were a kid, used to actually be under copyright owned by Warner Music and cost $25,000 each time it was used.

Songwriting brothers George and Ira Gershwin wrote an entire catalog of hits between 1920 and 1937.

- Today, their heirs make around $8 million per year in royalties from songs written nearly a hundred years ago.

More recently, Michael Jackson’s estate was paid $750 million to buy out 50% of his collection of music royalties.

Here’s the strange part of that story: the bulk of the song royalties weren’t even his. Michael Jackson bought the rights to over 4,000 songs, including 250 Beatles songs.

The Royalty Blueprint & Case Study

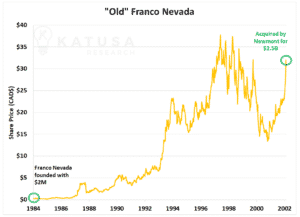

Pioneered in the 1980s by two Canadians, Pierre Lassonde and Seymour Schulich started the first gold royalty company in the world, the original Franco Nevada.

They built the company on the simple framework of “exchange cash today, for a share of tomorrow’s production”.

Below is a chart which shows the “old” Franco Nevada’s incredible rise from CAD$0.21 per share and a market capitalization of CAD$2 million…

To the eventual buy-out by Newmont for CAD$2.5 billion at over CAD$33 per share.

That’s an incredible 15,614% return…

Following the exact same blueprint as the original Franco Nevada, a “new” Franco Nevada went public in 2007.

- Over the last 14 years, the stock has appreciated over 1,100% while gold has gone up 130%.

This should help further highlight the tremendous potential offered by investing in world-class royalty and streaming businesses.

By now, it should be very clear that gold royalty companies make for excellent investment opportunities.

The only question left is: which one to invest in?

Royalties and Streams Are Best Made in Hated Markets

Two years ago, I was pounding the table on a company I was buying a lot of.

It was in a sector (uranium) that was cheap… it was hated… and no investor or media company wanted to go near it.

That’s when alligator investors like me spend MONTHS doing our due diligence. Except there were hardly any other investors.

This worked to my advantage.

Subscribers and I were able to position ourselves in a royalty company that was a first mover in the uranium industry.

- Fast forward 20 months later and my subscribers and I are up over 701% on that investment as of this writing.

Most importantly, this isn’t some illiquid nano-cap—it’s listed on the BIG U.S. exchanges. Primetime.

And the party’s just getting started. That was one corner of the resource sector where there was NO competition.

I get a real kick out of the poser gurus on social media who would send out messages in 2019 saying “Katusa failed” with his uranium play.

To all the haters, just look at the score—and nobody is doing better than the Katusa subscribers. Nobody.

Was it high risk and was patience required, yes. Nothing is ever guaranteed.

But if you’re not a subscriber to my premium research letter, you’re probably wondering what the next big score will be…

Well, you’re in luck.

Imagine if Bill Gates, Jeff Bezos and Elon Musk all backed a company in the tech sector.

How badly would you want to be an early investor? – I know I would.

Setups like this don’t happen often. And they’re definitely not like clockwork, but when you spot them, be prepared to act.

Because – if I’m right again – I’m convinced it will be another big score.

Regards,

Marin