Click here if you’d like to watch this week’s KII in video format.

This pie is huge…

And there will be a piece for everyone.

The Green New Deal is a congressional resolution that lays out a framework for weaning the United States off fossil fuels and lowering greenhouse gas emissions.

The end goal sees the United States sourcing all of its electricity from renewable and zero-emission power sources.

In addition, it’s aimed to guarantee new high-paying jobs in the clean energy sector.

If you think this program sounds expensive… you’d be correct.

To quote the Electric Power Research Institute, changing over America’s outdated electric grid could cost $500 billion.

That number’s probably on the low side, and here’s why…

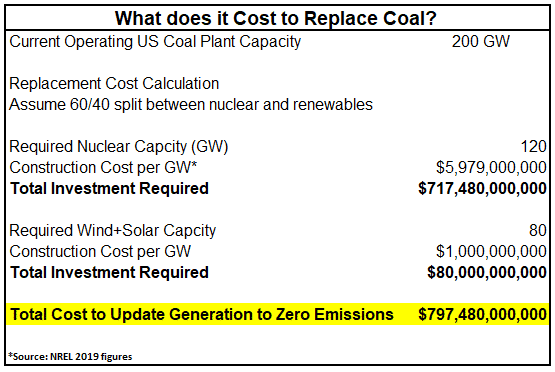

Currently, the United States has approximately 200 GW of coal-fired capacity. And let’s assume this all gets replaced with zero-emission power sources.

Now, coal is baseload power… which means it runs 24/7.

The only true zero-emission power source which can be baseload power today is nuclear power.

Nuclear power is one solution championed by the nouveau green…

But by no means is it a quick solution. It takes a decade to permit, finance, and build a nuclear reactor.

The reality is, no significant new nuclear power will be added to the U.S. energy mix over the next decade.

Hydro can be an excellent source of renewable baseload power as well. But with hydro, your choice of locations is very limited.

And not every state has the right geography to make it a significant contributor.

Wind and solar will play a significant role in the coming years to complement this baseload power. But the storage technology to make them 24/7 power sources isn’t there yet.

It will come, but it will take time.

And when it does, the ultimate profit for investors will happen.

Dying Industries and A Stunning Turn of Events…

During the 20th century, the world relied almost exclusively on “dirty” fuel to produce electricity.

For example…

- The burning of coal was previously responsible for more than 50% of U.S. power generation.

It was also the source of power for most of the electricity generated in countries like China and India.

“Dirty” fuel was attractive because it was cheap.

Burning coal and other fossil fuels produced incredible amounts of energy for the cost.

This cheap energy fueled amazing economic growth. It powered factories that built refrigerators, cars, trucks, computers, and televisions. It lit up hundreds of millions of homes around the world.

But, as many argued, at what cost?

According to the World Health Organization, over 150,000 deaths occur annually due to climate change.

Agree with it or not, those are the numbers making the headlines.

And an estimated 7 million people die every year from air pollution, making it one of the leading causes of death worldwide.

Moving to a greener world will be good for both the planet and us.

According to the University of Princeton’s Net Zero America study…

- The air quality benefits obtained from going green will avoid 200-300 thousand deaths in the U.S. over the coming decades.

It will also prevent $2-3 trillion in estimated damages.

What Will it Really Cost to Go Green in America?

In short, it’s going to be a big number.

Below is some rough math on what it would cost just to replace the electricity currently provided by America’s coal plants…

You’d also need to develop thousands of miles of new high voltage power lines.

Think of these as “electricity highways” which would transmit power across the nation.

Chris Guerin, the CEO of Nexans – one of the world’s largest cable manufacturers – believes that there will need to be 20,000 miles of new high voltage cabling laid in the United States.

On top of that, let’s say you also want to change all the U.S. Postal Service trucks to electric vehicles.

- Currently, there are roughly 140,000 trucks in the USPS fleet. At $50,000 to electrify per truck, this contract is worth $7 billion.

Now tack on state and municipality government vehicles…

You can begin to see how these costs add up quickly. It’d be hard to argue that this Green New Deal will cost less than $1 trillion all-in.

If I were a betting man, I’d be taking the over…

When was the last time you saw a government project come in on time and under budget?

As I showed in the math above, the power generation sector will see the largest dollar amount invested.

But there are many other angles to cash in on the sector – electric vehicles and batteries, fuel cell technology, carbon and emission taxes, and many others that are yet to be discovered.

These industries will be the greatest benefactors of the government stimulus.

There’ll be no shortage of money to go around.

Coal’s Curtain Call

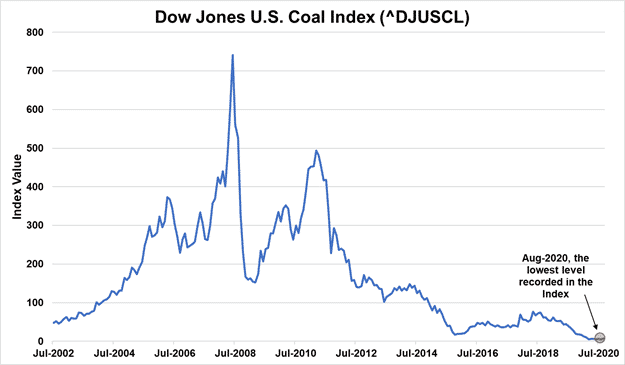

Since March 2011, the value of the Dow Jones U.S. Coal Index has plummeted 99% to a record low last August.

It had only recovered 2.7 points from there before the Index was discontinued by S&P Global on September 18, 2020.

Talk about an extinction.

This phaseout has led to major losses for investors and bankruptcies for companies.

It just further proves the point that you always want to be onside with the “big” money.

It’s critical to watch where big money is flowing and where it’s incentivized.

Like water, capital follows the path of least resistance.

Now, this fact might come as a shock to you:

- Solar power and wind power are now cheaper than energy derived from old, conventional fossil fuels.

This fact is causing tectonic shifts in the electric power business.

On December 20th, 2015, sustained winds of 20 – 30 miles per hour allowed Texas to produce 13.9 gigawatts of electric wind power.

It set a record for single-state wind power production… and briefly allowed Texas to fulfill 45% of its electricity needs from wind power alone.

- In 2020, 22% of Texas’ power generation came from wind.

In my recent article about the Texas energy crisis earlier this year, I outlined how the whole thing could have been avoided.

Falling costs have allowed solar-powered electric plants to reach or exceed “grid parity” with fossil fuel plants in 10 U.S. states.

“Grid parity” is when one power source costs the same as another.

Investment bank Deutsche Bank predicts that solar-powered electricity will be at grid parity in up to 80% of the world’s electricity markets within a few years.

I’m telling you all this to drive home an incredible point…

- Cheap, widely available renewable energy is not just some tree-hugger’s fantasy anymore.

It’s real. And it’s happening right now.

Every day, more and more profit-conscious corporations are choosing renewable energy.

It’s simply a better deal now.

This Mega-Trend Will Only Accelerate…

To be clear, I’m not saying renewable energy is the cheapest source of electrical power in every country.

Some places don’t receive enough wind to make it a viable fuel source.

Some areas don’t receive enough sunlight to make it a viable fuel source.

I’m simply saying solar energy and wind energy have become cheaper and thus, more attractive in many countries.

This means incredible amounts of clean, renewable electric power are now available to us.

It means an epic transition away from dirty electric power to clean electric power.

It means a reordering of a trillion-dollar-plus industry.

And when one industry is on its way out the door, there will be a surge in new industries taking its place…

Or even a new hybrid model that will allow the previous industry to survive… but in a fashion that’s checked all the boxes to be environmental and social, with proper governance.

But the best part?

We’re going to make a boatload of money being fashionably early… Investing in the new masters of the clean energy universe.

To see the sectors that I’m watching in this space, click here to learn more about my premium research with Katusa’s Resource Opportunities.

Subscribers just saw two stocks in our portfolio jump to new multi-year highs in the clean energy space.

- One ticker is up as much as 342% as of this writing.

The money is moving.

Are you preparing your portfolio for what’s coming?

Regards,

Marin