This week a major winter storm ripped across most of the eastern United States.

It caused major electrical blackouts and endangered the lives of millions of Americans.

Texas, normally home to mild to mid winters saw temperatures dip below freezing and major snowstorms hit most of the state.

Demand for heat and power soared, while the grid lagged behind. This sparked major rolling electrical blackouts across the state.

Texans without power were forced to warm up in cars, or run propane heaters in their houses.

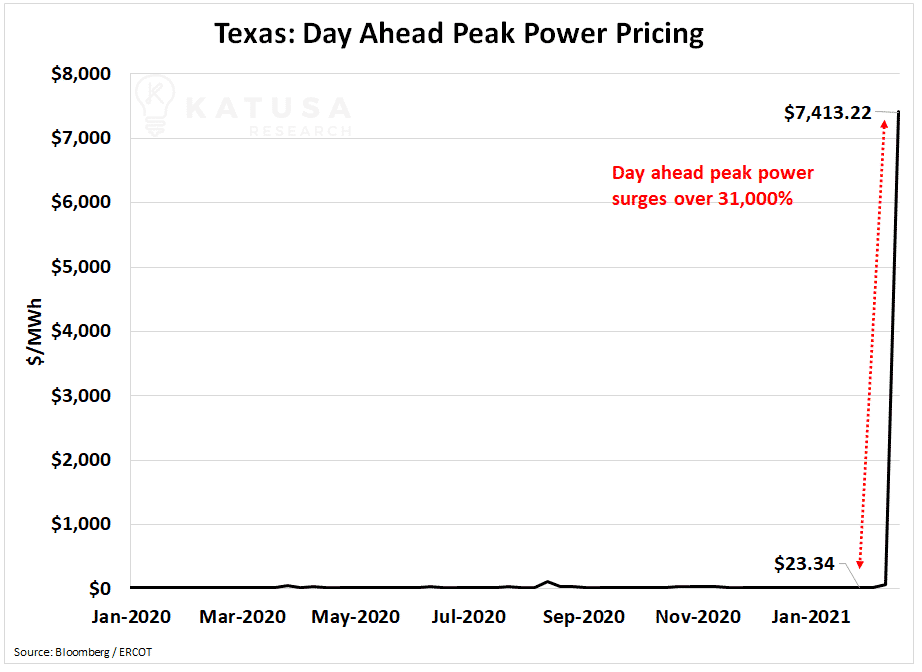

As the grid failed, power prices to surged from $23 per MWh to over $7,400 in a matter of days.

- At current electricity prices, it will cost the average Texan nearly $300 a day to heat their house, that’s not including any Bitcoin mining going on.

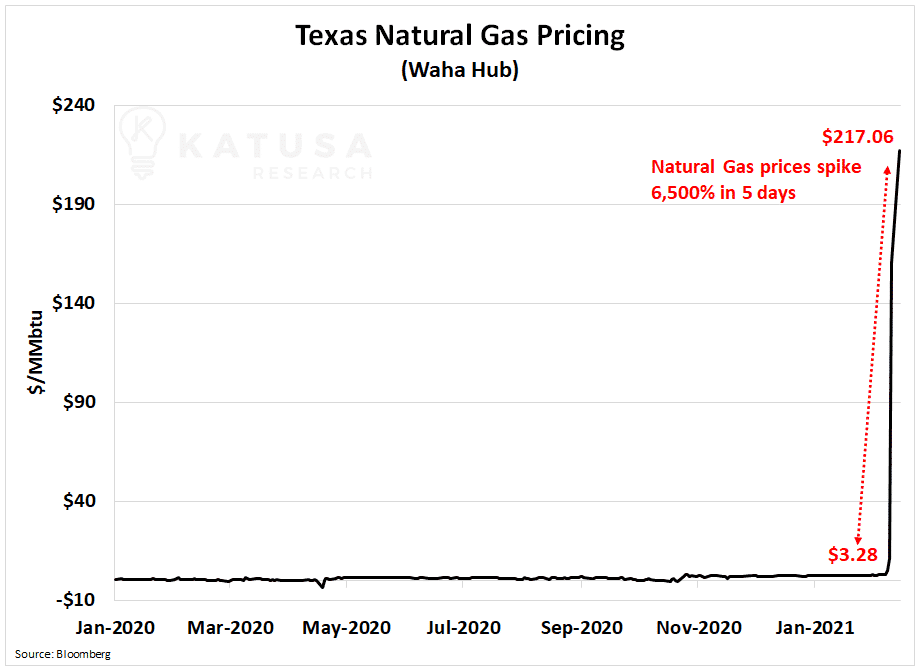

Natural Gas Surge

Alongside electricity prices, natural gas prices skyrocketed, rising from $3.16 to over $160 per MMbtu.

What Happened to Texas’ Power Grid?

Texas operates and manages 90% of its electricity through ERCOT (Electricity Reliability Council of Texas).

- Wind power is responsible for 23% of Texas’ electricity generation. Under normal conditions, this makes for cheap, intermittent electricity for Texas.

However, right now, roughly half the turbines are frozen, which means they cannot generate electricity.

Even on a regular day if this happened there would be an issue, but during a major snowstorm where power generation is mission critical, the current system cannot handle the strain.

It’s times like these which provide a “gut check” to our ever increasingly euphoric world of 100% renewable energy and zero carbon policies.

It’s a kink in the design that will need a solution engineered in next generation turbine design.

Don’t get me wrong…

I support President Biden’s mission to decarbonize and re-electrify America. And you should too.

- #DoYourPart and #NETZERO will be major taglines of the future (yes, I have trademarks on both).

Anyways, Elon “The Green Savior” Musk has become the worlds Richest Man by doing things—saving the world, right?

Whether you believe in the climate issues or you don’t, the fact is, the science is showing that it is an issue.

Recall, I just mentioned Green Savior became uber rich from being part of the solution.

You too can make a fortune by #DoYourPart.

And you don’t even need to become a disciple of the Green Savior and convert the unholy, I mean unGreen.

A Coming Crisis – and Major Profit Opportunity

In my 20 years, and I’ve had a pretty good career to this point…

I’ve never seen an investment opportunity as incredible as solving the climate issue. Many will have great intentions, but like all investments, meaning well won’t be enough.

You need the right variables. Like a legitimate business plan, management team, cash and the know how to disrupt the world in a positive way.

Love ‘em or Hate ‘em, the government is the best financial backer you can ask for—and again, The Green Savior used it to his advantage on his way to the worlds richest man.

I do not mean The Green Savior as a negative connotation; I mean it with the utmost respect. I’m not comparing Elon Musk to Jesus.

What I am doing is highlighting what Elon has done for the Climate Movement.

- By making Electric Vehicles and green energy cool, Elon put an electric shock into the climate movement.

So many before him tried.

But Elon has captured the imagination of all generations and being the world’s Richest Man helps that movement.

Pay Attention to Net Zero

In President Biden’s quest for “Net Zero”, he focuses on wind and solar being the dominant forms of electricity production.

While all coal fired plants will be rapidly eliminated and eventually natural gas plants are phased out as well.

While this sounds good on paper, it’s not that easy…

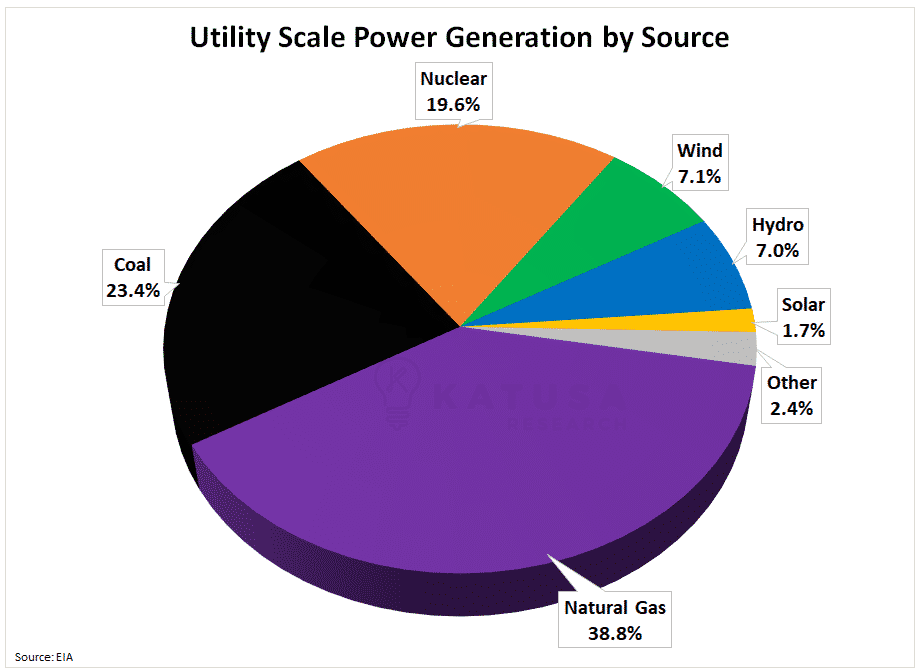

For starters, according to the US Energy Information Association (EIA) there is over 200 gigawatts of coal fired production still in operation.

- These coal plans are responsible for 23% of US electricity generation, while natural gas accounts for 38.8%.

Far behind are renewables, with wind and solar accounting for less than 10% combined.

Below is a chart which shows the breakdown of power generation by source in the United States.

It’s not that simple to just “switch”…

More importantly, this is baseload power, which means it can supply electricity 24 hours a day, not just when the wind blows or the sun shines.

You can’t charge your Tesla or pay for something in Bitcoin when the power is out.

Now let’s talk about the much-disliked red head stepchild of the green movement—Nuclear

Nuclear Power Play

Nuclear power is zero emissions base load power when operating. Nuclear reactors provide the same 24/7 stability of burning fossil fuels for power generation, without the harmful emissions.

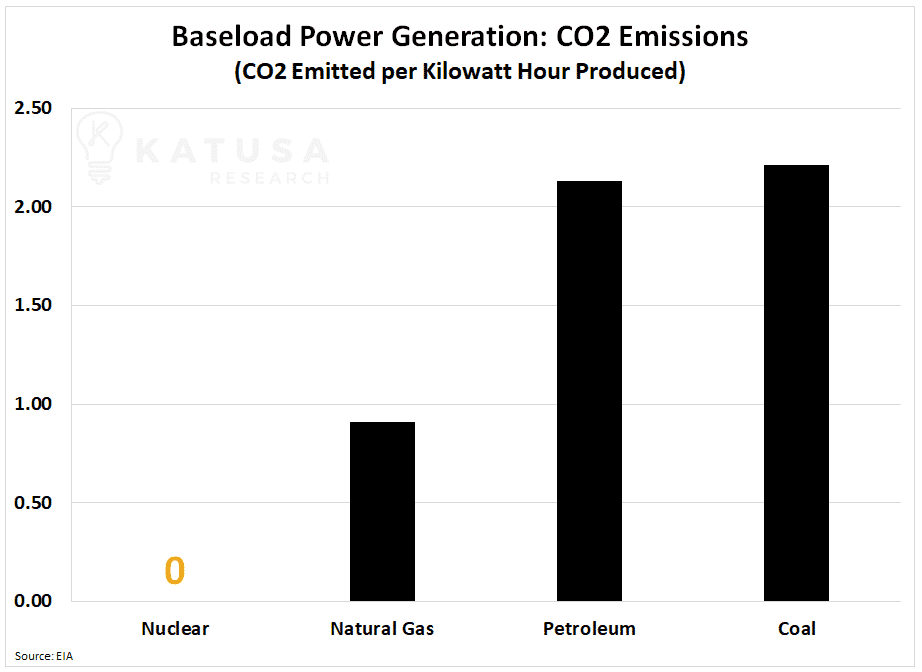

Below is a chart which shows the CO2 emissions for each major form of baseload power.

As you can see, all other fossil fuels contribute significantly to our CO2 emissions.

Making no mistake, solving the world’s electricity generation issue is a multi-trillion-dollar opportunity.

Why are Uranium Stocks Popping?

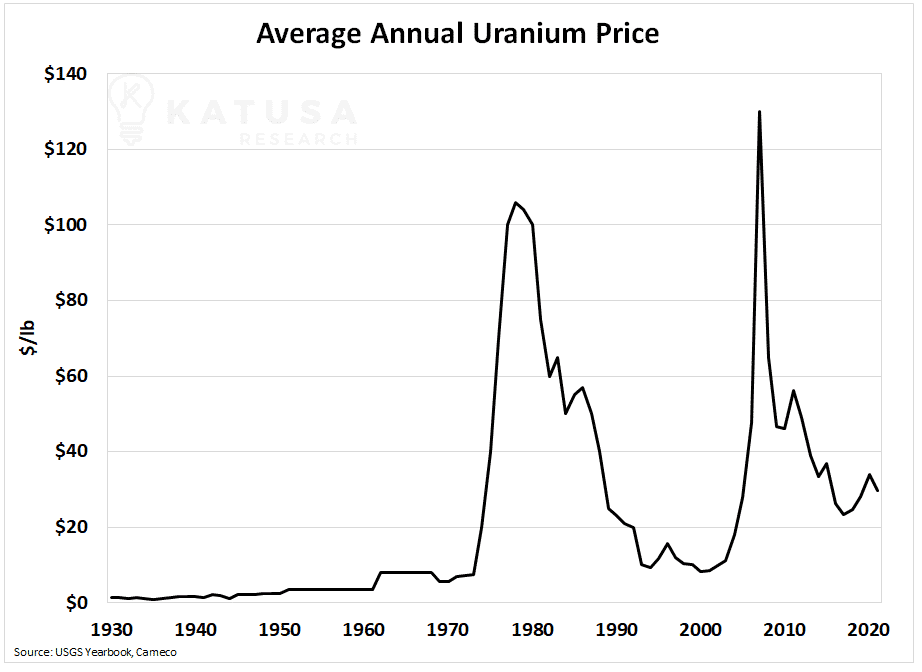

Uranium prices and stocks have been a terrible bear market since the early 2011s.

Yet in the last 2 months, share prices have sprung to life again on the global goal of “Net Zero”.

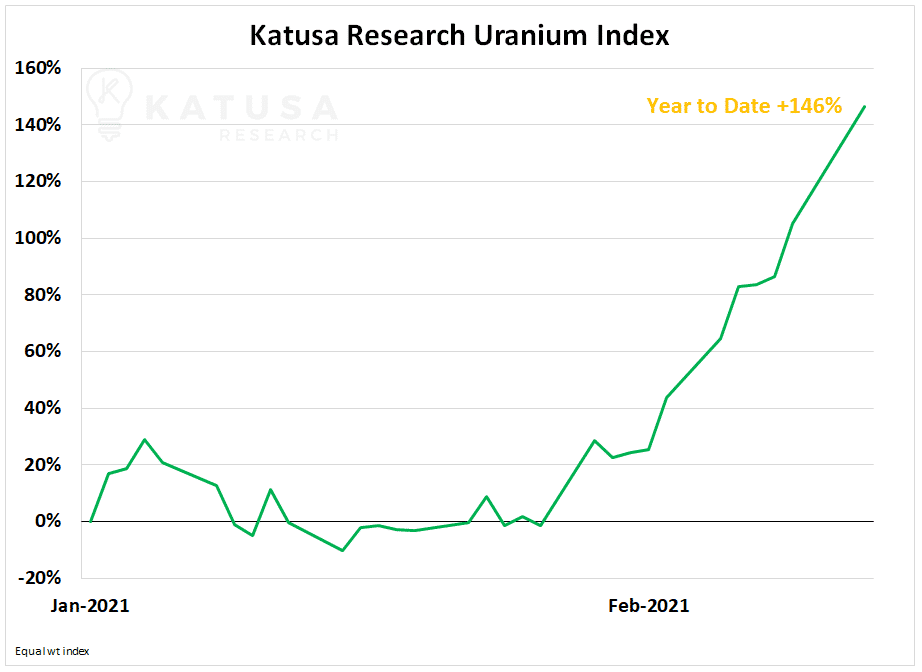

The Katusa Research Uranium Index is up over 140% year to date…

Uranium is a niche segment that has incredible booms and busts.

Just look at the price of uranium since 1930…

Catching one of the uranium bull markets can make even the most impressive crypto currency returns look paltry by comparison.

What is the Next Uranium Catalyst?

If I were part of the Biden Administration…

I would be advocating for allocating a percentage of the Biden Green Agenda to nuclear power.

It makes all the sense in the world to combine zero emission baseload nuclear power with intermittent renewable energy from wind and solar. Not to mention, the U.S. is already the worlds largest consumer of uranium globally for electric power.

Nuclear power’s Achilles heel is the significant upfront construction cost and lengthy permitting timeline.

- Over the past few decades, the timeline for construction and construction costs has gone parabolic.

The key to success likely lies in smaller, more modular reactors which can be constructed for regional level demand. Bill Gates is getting behind this in a big way.

Elsewhere around the world, nuclear reactors continue to play a role in global electricity production.

Over 10% of global electricity production comes from nuclear reactors.

- Today there are 50 reactors in construction, which will take operable reactors to nearly 500 worldwide and increase nuclear power generation by 13%.

I have been investing in the uranium sector for 20 years and have travelled to all the major operations around the world.

The Katusa’s Resource Opportunities portfolio is always going to where the puck will be, and our track record has proven that. One of our uranium picks is up 165% since we alerted our subscribers.

Click here to find out more on how you can join the next opportunity.

Regards,

Marin