Overshadowed by crypto stocks in the past 12 months, many copper stocks have quietly skyrocketed higher.

And for good reason…

A regular gasoline passenger vehicle requires 20-50 pounds of copper.

Battery-powered vehicles (like a Tesla) require over 150 pounds of copper.

With news stories about surging Tesla and electric vehicle sales, investors are bidding up the prices of the best copper companies.

One such stock many of our subscribers own, which we were first to publish on in our premium newsletter – the KRO (Katusa Resource Opportunities).

It’s a copper spinout company that rocketed to a $1.5 billion market cap from the day it went public…

- Giving shareholders well over 1,000% returns in a year.

If you like ten-baggers, then pay attention.

Another copper producer I was a founding director of and remained on the board for more than 12 years for, has risen over 800% from last spring’s market panic selloff. And twice now it’s produced 1,000% gains for investors.

Copper isn’t as sexy as bitcoin or even gold…

In the Olympics, you get a ‘mainly’ copper medal for placing third (a bronze medal is 93% copper and 7% zinc).

But the returns can be incredible – certainly better than a third place – if you understand the market, know what to buy, and when.

- I’ll share a funny (and real) story about copper miners in the past cycle…

When the copper company I was on the board of was trying to raise $500 million to build our mine, investors in the mining sector only cared about gold and silver at the time.

So, I showed the spreadsheets of how the silver byproduct from our copper mine would pay for all offsite costs (shipping and smelting) to these investors and then broke down the cash flow as a percentage of gold.

Even though the mine only produced about 12% precious metal byproducts, the cash flow from the precious metals was about 25% of the total at the time.

Investors loved it…

- The stock went up 20-fold and became Canada’s third largest copper producing mine.

In the last 15 years, the copper developer (with a PFS) and mid-tier producer sector went from over 100 companies to less than a dozen. Another interesting stat for those who care about the facts.

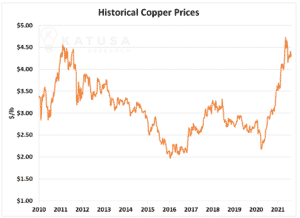

A Copper Price Surge

After nearly a decade of weakness, copper prices have regained their footing and now remain well above the elusive $4 mark per pound.

This can partially be attributed to a small supply deficit in the first quarter, which resulted in an acceleration in inventory level declines.

The bigger picture is that global economic growth expectations have ramped up, and this is driving copper higher.

The Exchanges and Days of Supply

There are three main exchanges for copper:

- London

- Chicago

- Shanghai

Each exchange reports its inventory level, which indicates copper available for delivery. Below is a chart that shows the total amount of copper held in global exchange inventories.

- It’s important to not just look at the inventory levels as a gross number but to compare it against current consumption as well.

The metric used is “days of supply”, which is global inventory levels divided by global consumption. The chart below shows days of supply for copper over the last decade.

If you were to draw a basic trendline from 2009 to today, it would be downward sloping—indicating that copper’s days of supply are consistently headed lower. I would argue that this is due in part to improvements within the global supply chain.

These improvements minimize the need for consumers to hold physical copper.

Holding inventory has a cost, so if downstream consumers of copper can minimize holding times, they will.

Declining inventories may be a factor in short-term pricing, but the long-term expectations for copper are driven by demand growth.

Copper demand has been a proxy for economic growth…

Expanding nations need copper for infrastructure, household appliances, and construction projects.

Historically, copper demand growth has averaged between 1 and 3 percent per year. It’s hard to get excited about 1 to 3 percent growth.

However, I believe the main driver for copper right now is the green future demand outlook. Political goals of “net zero emissions” require vast amounts of copper to electrify everything from power grids to vehicles. These goals have the potential to unlock considerable new demand for copper.

Below is a chart that shows projected copper demand through 2030.

By 2030, my current forecasts indicate upwards of 30 million metric tonnes of annual copper demand. This assumes that the world does in fact head in the direction of net-zero emissions.

The major growth comes from electric vehicles, smart HVAC systems, and newbuild renewable power.

In total, this brings in over five million tonnes of new demand, which represents a potential increase of 25% over this year’s total copper demand.

Billionaire Mining Corp.

Many years ago, a billionaire tech executive asked me why I was in mining.

He suggested that with my skill set, I should be in the tech sector and that I was wasting my talents in mining.

I emailed this individual the announcement of Bill Gates, Jeff Bezos, and others who were making a splash into mining.

But these billionaires are going to learn a very hard lesson in mining:

“God may have created the metal, but the Devil spread it around for his own amusement, and amusement he will have in the coming years.”

A Delicate Balancing Act – Global Supply versus Global Demand

For years, the copper supply has kept pace with demand. As the world electrifies, however, more copper will be required.

It’s possible that by the end of the decade, we will be in a real deficit. This creates the opportunity for sustainable long-term copper prices.

The chart below compiles the supply and demand analysis from the previous pages into one basic line chart. As you will see, copper is showing signs of outpacing supply by 2030.

Of course, a lot can change over a decade, but this provides a clear picture of what the roadmap could look like.

- The key takeaway is that by the late 2020s, we’re going to need more copper production.

Strong Prices = Stronger Governments

While I sound like a bit of a broken record, I’ll say it again…

- As metal prices go higher, governments are going to want to increase their take. And they will.

The nationalization of resources will continue to play a central role for investors and governments.

This is precisely what’s happening in the world’s largest copper-producing region in Chile, as a new royalty system is coming down the pipe.

Recently a congressional mining committee approved a version of a bill that would charge higher rates during times of high prices.

The original royalty agreements had a flat 3% tax on sales.

The new version adds marginal rates starting at 15% on sales derived from copper prices of between $2 and $2.50 a pound and as much as 75% on sales generated from prices above $4 per pound. At current prices, the effective tax rate would be 21.5%.

I believe we’ll see more of this type of activity in Peru and other South American nations, Southeast Asia, and even in the new mining paradise of Greenland where the billionaire technocrats are going.

These regions all contain major copper producers and governments who want to “cash in” on the copper price surge.

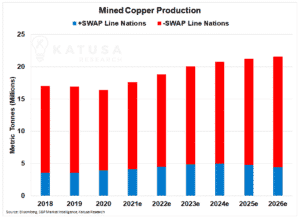

Below is a chart which shows current copper production and estimated copper production through 2026. I have separated it into +SWAP and -SWAP line nations to show the considerable reliance upon -SWAP line nations for copper.

(For an introduction to SWAP lines – click here.)

Katusa’s Copper Outlook

I have no doubt that there’s much potential for serious economic headwinds which could slow global growth and subsequently copper demand in the near term.

Yet, copper prices and copper-focused equity share prices remain strong. The long-term thesis for copper is very bullish, and so the outlook remains bullish.

Electric vehicles, infrastructure, technology – there are a LOT of uses we know of that need a lot of copper.

I’m just also cautious with regards to the potential risks still present in the current macro global economy, and the high valuations many base metal companies are already getting.

You can minimize your risk and amplify your upside when markets work in your favor.

There are many ways to get great upside in copper without paying premium prices. I am personally doing it right now myself, alongside my KRO subscribers.

If you don’t have the time to check for yourself which companies can offer this in the resource sector, don’t worry.

Consider becoming a subscriber of Katusa’s Resource Opportunities, and you’ll be able to follow exactly what I’m doing.

Regards,

Marin