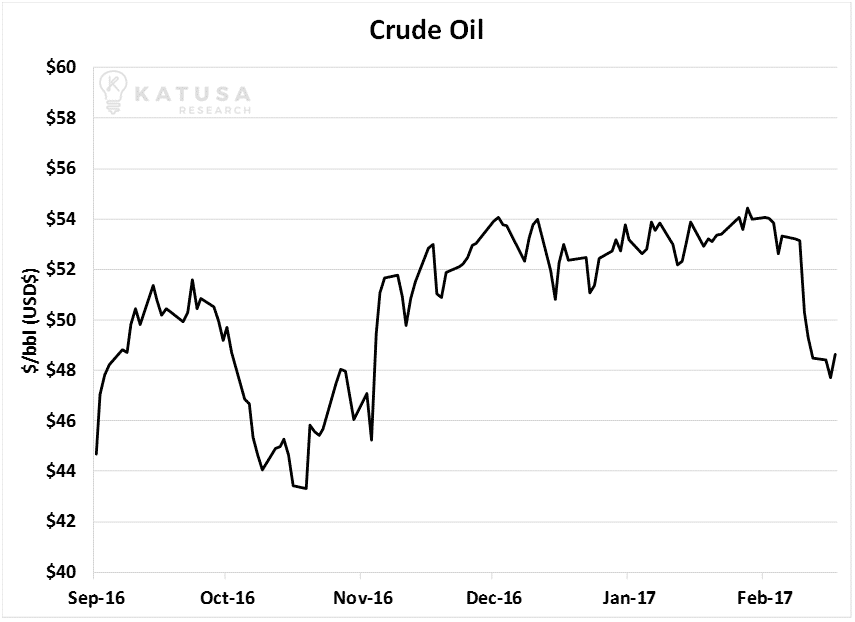

Two weeks ago, a barrel of oil traded for around $54.

This week, that same barrel traded for $48. It’s an 11% decline in value in just a few weeks. It’s a huge short-term move that shocked many people.

But should you be surprised oil has dropped below $50 a barrel?

Not if you’ve been reading Katusa Research for a while.

Back in October, I published my thoughts on the oil market that differed from the conventional wisdom at the time. At the time, many oil market players had turned bullish because OPEC announced a major production cut. It was the first time OPEC had attempted a production cut since 2008. The promise of reduced supplies sent oil prices 5% higher on the day of the announcement.

I didn’t share the market’s giddiness. I noted that while OPEC’s announcement made for a good media soundbite, it wouldn’t lead to higher oil prices over the long-term. I said oil would likely hit a ceiling in the $55 per barrel area. That’s exactly what has happened. Below is a chart for the price of crude oil since the OPEC announcement.

Contrary to what many people believe, OPEC simply doesn’t have the power it used to have. It’s a dying cartel. Its relative importance to the oil market has plummeted in the past decade.

This is because Russia, a major, non-OPEC producer, badly needs export revenue and is pumping out more than 11 million barrels of oil per day. This puts Russia in the world’s top three producing countries, alongside the United States, which is the other reason OPEC’s power is sinking.

Thanks to amazing advancements in shale drilling technology, the best U.S. shale fields can be produced very profitably with oil at just $45 or $50. It’s part of the shale revolution that has allowed the U.S. to increase its oil production from 5.3 million barrels in 2009 to 9.1 million barrels in 2017.

This huge production increase has allowed the U.S. to produce almost as much oil per day as OPEC leader Saudi Arabia. When oil climbs to $55 per barrel, U.S. oil producers can borrow huge amounts of money, hedge their future production, and make tons of money.

Here are a few other very interesting things that lead me to think oil isn’t climbing above $55 – $60 any time soon:

***A big piece of news that has received little fanfare, is a March 13th announcement from Iraq Oil Minister Jabbar Ali al-Luiebi that Iraq will reach production levels of 5 million barrels of oil per day in 2017.

Currently, Iraq produces 4.4 million barrels of oil per day. If Iraq increased production to 5 million barrels of oil per day, it would be a clear sign that Iraq – OPEC’s number two producer – is paying no heed to OPEC’s stated production quotas.

If Iraq decides it is done with the quotas and starts acting purely in self-interest, it could easily set of a chain reaction of other countries following suit.

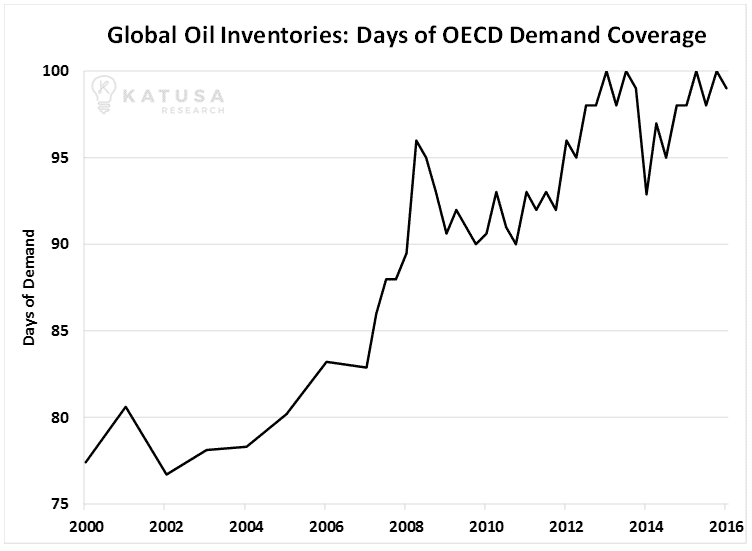

***Also, global oil inventory levels are still near record highs.

Based on the latest IEA figures, there is 99 days’ worth of OECD oil demand currently stored on land. The OECD is the Organization for Economic Co-operation and Development. It’s a group of economically-developed countries like the U.S., the U.K, Australia, Japan, Canada, Germany, France, and Mexico. The group’s demand and inventories figures are useful gauges in the oil market.

The chart below displays the number of days of OECD oil demand the world has inventoried. As you can see, inventories have surged higher in the past five years and still near all-time highs. This glut is a significant overhang on the market. It shows there is an abundant supply of crude at current prices.

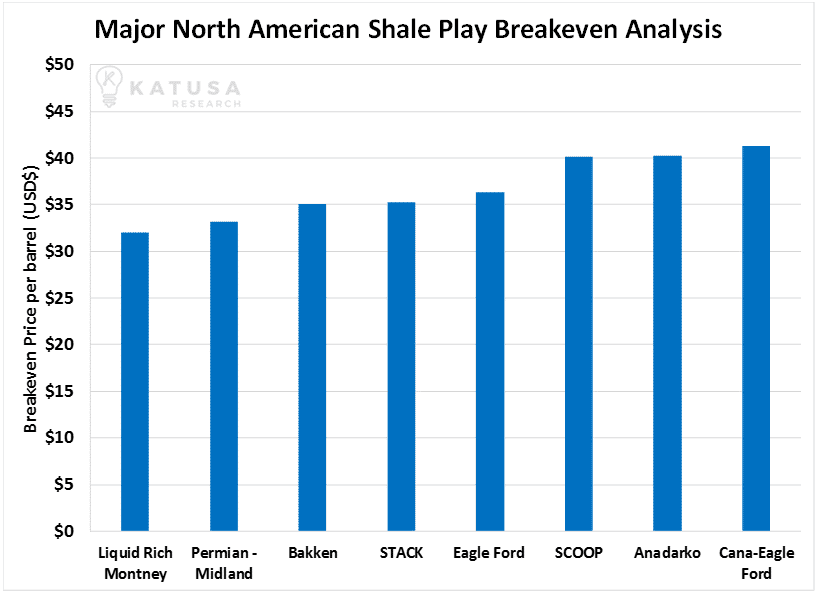

***And here’s one more chart for you…

As I mentioned, U.S. shale producers can make plenty of money with oil in the $55 area. You can see this through “breakeven analysis.”

Breakeven analysis looks at a shale field’s “all in” costs and determines at what price the shale field starts making money or losing money.

The chart below displays the major U.S. shale field’s current breakeven prices. As you can see, they are in the $30 – $40 area. (It also displays the breakeven price for my favorite spot in my favorite Canadian shale field, the Montney. Its breakeven price is even better than the best U.S. fields)

As drilling technology improves, I have no doubt these breakeven prices will go even lower… even lower than $30 per barrel.

This means U.S. shale producers can get enormous bank loans, hedge future production at profitable prices, and produce like crazy. I believe U.S. oil production will continue to climb higher for years.

Through the oil market’s recent ups and downs, my long-term take has not changed. I believe oil isn’t going north of $60 any time soon. Inventories are huge. OPEC doesn’t have nearly the power it used to. Its members will ignore production quotas. U.S shale producers will flood the market with prices over $50. Global economic growth will continue to be unimpressive.

This doesn’t mean you can’t make a lot of money in oil. You just have to be smart. Soaring oil prices won’t bail you out of dumb decisions. It’s critical for oil investors to focus on the low-cost producers operating in the best shale fields, like the Permian in the U.S. and the Montney in Canada.

Regards,

Marin