If you feel like you’ve seen this movie before, you’re not wrong.

The big question is this – is debt now irrelevant?

It might sound crazy to think about, but in a world of near-zero interest rates, does debt really matter anymore?

Right now, down in Washington D.C., politicians are squabbling over the debt ceiling:

Should The Debt Ceiling Rise, or Not?

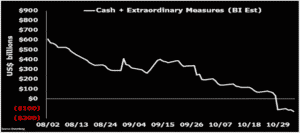

If there’s no agreement, theoretically the U.S. government could run out of money by the end of the month.

It would lead to immediate credit downgrades and missed payments by the U.S. government…

Can you imagine the carnage?

Below is a chart showing this projection.

Will it happen? Not a chance.

Really though, all this talk about the debt ceiling is just posturing.

We all know it’s going to go up.

Because let’s be real – there are 2 things politicians love: spending money they don’t have (debt) and spending taxpayer dollars (your money).

Most of Washington couldn’t hold a candle to the Wall Street Fixed Income departments when it comes to managing debt finance, but that’s beside the point.

The debt ceiling in the U.S. and around the world will continue to trudge higher.

And why not?

- At today’s ultra-low interest rates, the cost of funding said debt is near all-time lows.

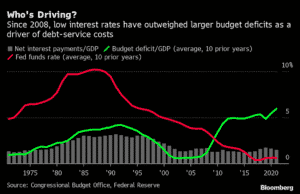

The chart below shows the relationship between the Federal Funds interest rate, the budget deficit to GDP, and net interest payments relative to GDP.

As you can see, the substantial decline in interest rates outweighs the extra debt taken on to stimulate the economy:

- Budget deficits are going up, but the cost of funding that deficit is going down.

Get Stimulated

You would think that having enormous amounts of cheap capital in the system would create a highly stimulative economic environment.

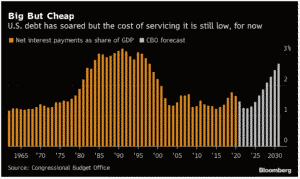

A picture is worth a thousand words, so let’s look at a chart on this idea.

The chart shows current and future net interest payments as a share of GDP.

- It’s forecast that over the next 5 years that net interest payments, as a share of GDP, will be some of the lowest on record.

Lowest on record. And from a politician’s standpoint, that means more room for debt.

As GDP recovers and trudges higher post-coronavirus, interest payments remain low thanks to ultra-low rates.

This allows the government increased financial flexibility and spending power if they so choose (and they will). Big, but Cheap.

However, both you and I know that there’s no such thing as a free lunch.

Eventually, the chickens will come home to roost.

Debt to GDP is One to Watch…

As you see in the previous chart, by 2030 interest payments are forecast to be back at 3% of GDP, That’s the same level as it was in the late ‘80s and early ‘90s.

A central bank buys bonds from the government to inject capital into the system. And when the economy begins to overheat it sells bonds to pull money out of the system.

In September, the U.S. Federal Reserve outlined its plans for tapering its bond purchases.

This means the Fed will begin to slowly rein in the amount of capital it’s injecting into the system.

This type of policy is still considered highly accommodative, but the world we now live in is used to extreme amounts of financial heroine (I call it Financially Transmitted Diseases).

It’s not just the U.S. that has such accommodative policies in place either…

Europe, Japan, Canada, Australia, and of course China are all running highly expansionary policies.

These accommodative policies are fanning the flames of a global economy that’s rapidly transitioning away from under-capacity to overheating.

Commodities Heating Up… and Crossflation

Last week we showed you how natural gas and coal prices are skyrocketing. Ditto for uranium recently.

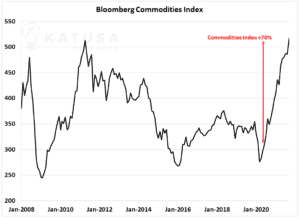

Real-time data analysis using commodity prices or food inflation paints a far more drastic inflation picture.

After all, commodities are the backbone of everything we build and consume on a daily basis:

I don’t know how often Jerome Powell or Janet Yellen go grocery shopping themselves, but if they do, they’ll notice that prices have gone up.

A lot.

It’s simple math that if the prices of inputs go up, some or all of that cost is going to eventually get passed on to the consumer.

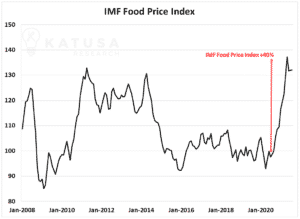

Here’s a chart of the IMF’s World Food Price Index. As you can see, post-pandemic, the index is up 40%.

These high input costs, which translate directly to higher food prices, are now impacting the consumer’s bottom line.

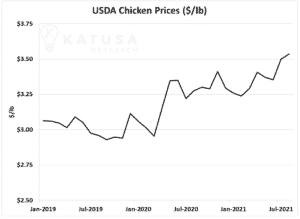

The following chart shows the price of chicken in the United States, up 20% since the pandemic:

A true story: I asked my local butcher why they didn’t have any beef tenderloin the other day.

His response?

In my book The Rise of America: Remaking the World Order, I wrote about “Crossflation.”

It’s a term I coined to describe how some parts of the economy would see inflationary pressures while others would see deflation.

Technology continues to play a deflationary role, while input costs such as oil drive up the price of all commodities which is inflationary.

The global capital markets are at an incredible inflection point.

- I’ve just sent a note to my KRO subscribers this week on how to get in on the largest investment opportunity I’ve ever come across.

This isn’t some rinky-dink dice roll exploration play on a metal you’ve never heard of…

This is the biggest, most de-risked wealth changing opportunity I’ve seen in my career.

There are tens of trillions of dollars being invested into this sector, but right now it’s still flying under most investors’ radars.

If you want a shot at financial freedom…

And the ability to protect yourself and your loved ones no matter where food prices, or other basic commodity prices, end up…

Consider a subscription to my premium research service (the KRO) to learn more.

Regards,

Marin