Getting on the right side of a bull market can change your life forever for the better.

Recently, subscribers to my premium research service, Katusa’s Resource Opportunities (KRO), had the opportunity to be part of a stock that – at its peak – was up over 1,547% last week since our entry. (More on that later).

In fact, over a dozen subscribers wrote in that they made 6 figures on that trade in less than 22 months.

Hundreds of others have sent in positive comments to us on the gains they made on just a few of our most recent recommendations. – and we’re truly grateful for all the kind words!

Fortunes like that are made making risk adjusted bets for asymmetric gains.

Risk Adjusted bets for Asymmetric Gains: doesn’t that sound good and sophisticated? Do you know what that even means? Let me explain.

Getting cocky and over leveraging can lead to financial ruin in all markets.

Before you invest, you must understand the mathematical risks associated to the position and the upside of the gain for the risk you are taking.

And then determine, does the pay off warrant the risk.

Right now, the commodity market is incredibly volatile with some sectors nearing their yearly lows.

Meanwhile, other sectors are firing on all cylinders with no signs of slowing down.

Let’s get you up to speed on what I am watching closely right now.

Gold Action

Gold dropped below $1,800 per ounce last week and hit as low as $1,732/oz which sent precious metal stocks abruptly lower.

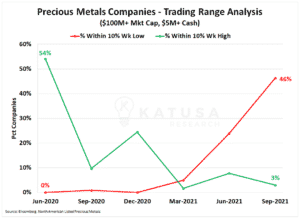

- A simple indicator I like to use is the percentage of companies trading new 52-week highs and lows for the sector.

As you can see from the chart below, the number of companies near 52-week lows has jumped to nearly 50% in the span of a few months.

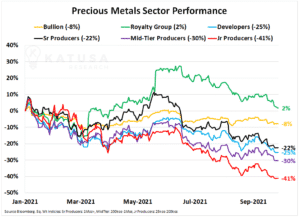

The gravitational pull towards the 52-week lows has caused the gold producers and developers to far surpass the declines of bullion.

I have long said that strong balance sheets, scale and margins are rewarded in the gold sector these days, which is proven by the significant underperformance of the junior producers.

Furthermore, passive funds love exposure without operating risk, which again is proven through the royalty group’s dominant outperformance.

The KRO subscribers have been positioned in both the number one performing precious metal royalty company and the number 1 performing energy royalty company in the world.

Considering gold is down 5.4% in September, our precious metal royalty company is up over 25%, and the most liquid and most traded royalty company in its peer group.

Heading in the opposite direction of the precious metals market is the energy market…

Watch For Europe’s Cold Winter: The Colder War

Natural gas, oil, coal and uranium have been on a tear.

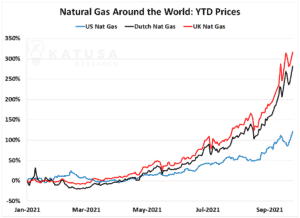

Energy prices are soaring around the world. Underinvestment and supply bottlenecks have sent the prices of natural gas and coal skyward in rapid fashion.

- Natural gas inventories in Europe are low and in true Putin fashion, Russia has yet to play all their cards and has left Europe in a tangle.

Watch Gazprom very closely and you will see Putin making some strategic geopolitical moves this winter.

If it is a cold winter, this will further drain natural gas inventory levels and send the prices of natural gas and coal higher.

You can see that natural gas prices have soared in Europe in response to these low inventory levels.

Soaring gas prices mean that it can be economically viable for the socialist green Europe to burn coal to generate electricity. Which is precisely what they are doing.

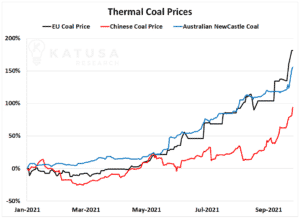

The price of coal in Europe has gone up 150% this year and is now selling at a 13-year high.

Australian Newcastle coal is up 250%, flirting with 2008 highs. Low Chinese stockpiles coupled with a political fight with Australia has sent domestic prices up 100% for the year while stockpiles remain low.

This week China’s state electricity council stated they would procure coal “at any price”. You can see the price rises in coal below…

There are multiple derivative affects of high natural gas and coal prices.

For one, industries which use natural gas as an input such fertilizer producers are seeing their input costs skyrocket. CF Industries one of the world’s largest fertilizer producers even went so far as to shut down a UK production facility. Average selling prices for urea, an ammonia-based fertilizer have increased 50% since the summer.

Manufacturers will try to pass these costs on to the farmer, who will in turn pass the costs down onto you, the consumer.

Carbon Coming Alive

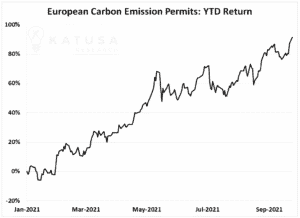

With more coal being burned we are seeing the price of pollution go skyward.

You can see this through the lens of the European Union Allowance permit, which is compliance market carbon credit. This year we’ve seen prices soar by 80% and by 20% just in the last month.

Note: Many people are asking where to get Carbon prices. The best free resource is www.carboncredits.com and their Carbon Pricing Dashboard.

In North America, carbon is getting more attention…

This week CIBC, one of Canada’s largest banks completed its first successful transaction facilitating a trade between the Nature Conservancy of Canada and a UK commercial bank. I do believe this is just the tip of the iceberg for the carbon market.

Net-zero targets have soared, with over 3,000 companies and over $88 trillion now committed to net-zero emissions.

Take a moment, to consider the magnitude of that dollar figure and the significance of the number of companies pledging these targets.

- KRO readers can look forward to an in-depth outlook on where the puck is going in the carbon market in the coming October issue.

The KRO was the first newsletter in the world to cover the carbon sector and subscribers are sitting on triple digit gains already.

Uranium Breather

Elsewhere in the baseload power sector, life is being breathed into the uranium market. Uranium prices touched $50 a pound; a level not seen since 2012.

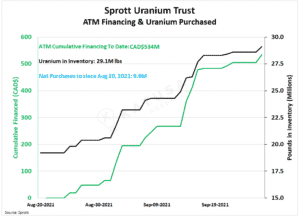

The Sprott Physical Uranium Trust continues to build its uranium stockpile and chew up spot market inventory.

To date the trust has raised in excess of CAD$500 million and acquired nearly 10 million pounds of uranium in the spot market.

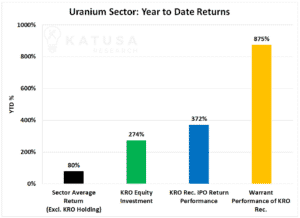

This major move in uranium has sent the share prices of many uranium stocks ripping higher.

And KRO subscribers have been positioned in the number 1 uranium stock year- to-date…

The commodity markets are experiencing incredible volatility these days.

Markets are moving quickly and its critical to stay on the cusp of what is happening if you want to be successful. I’ve been laser focused on the natural resource sector for over 20 years. Spent millions of dollars and learned painful lessons on patience and especially what to avoid.

As a professional fund manager, I’ve had had countless big wins but I’ve learned many hard lessons along the way.

Right now, I believe I am on the cusp of some very big scores just like our big bets in uranium…

And we are very, very early in one of the most exciting sectors of my lifetime.

It all comes to ahead in exactly one month from today, where World War Zero will start.

I get it that not everybody can afford my research. I come from humble roots, was a teacher early in my career and that’s why I go out of my way to provide research for free.

Here are two very valuable research reports that paying subscribers have had access too.

- The exclusive interview between me and a gold legend – David Garofalo.

- Your Education Primer on the Royalty Business – featuring Gold Royalty Corp (GROY.NYSE)

Use them. They are valuable and they may help you make money.

Regards,

Marin Katusa