Would you like to know how Katusa Subscribers just returned a +170% profit… in less than 45 days?

If you got in on this pick, you could’ve turned $1,000 to $2,700…

$2,500 to $6,750… and $5,000 to $13,500.

Some folks would need an entire year – or more – to double their positions in size. But a small group of Katusa’s Resource Opportunities subscribers have done that and more in less than 45 days…

Better yet, this is just one of many plays we’ve locked in – as certain markets are in turmoil.

And this presents an opportunity to make calculated high-risk, high-return bets.

But, I’m getting ahead of myself. Let me give you the background…

The Opportunity

Long-time subscribers know that I have been bearish natural gas producers.

My argument has always come back to this: There is no shortage of supply domestically.

Back in April, the Saudis announced they’d begin a major development for natural gas at their largest oil field.

The majority of natural gas producers both in Canada and the United States have consistently underperformed for years.

For example…

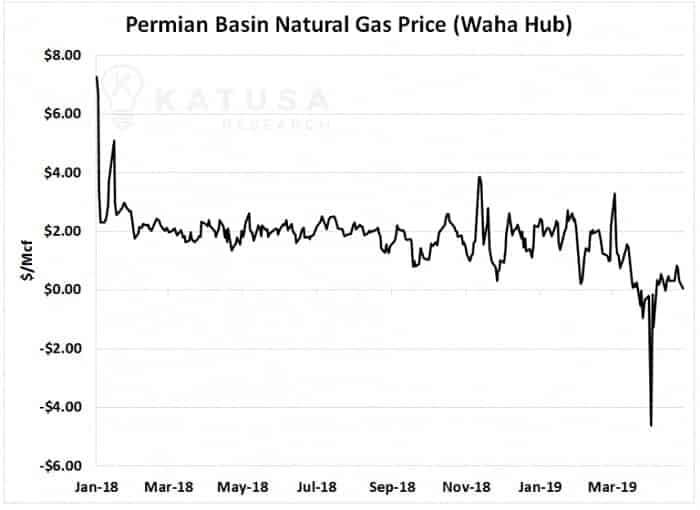

There’s so much natural gas being produced in the Permian that the regional pipelines and processing faculties are chock-full of natural gas.

This caused the regional price of natural gas to go negative.

And it means producers have to pay to have the gas taken away.

Recently, our proprietary algorithm and triggers detected highly uncommon market moves in the natural gas sector.

Rocking the Algo for Our Advantage

The trade idea was to short natural gas producers who are highly in debt. And who are exposed to the spot price of natural gas and natural gas liquids.

Without going into too much detail (and to be fair to my paying subscribers), two of the many triggers we look for were flashing red. This means the timing was right for a trade…

I’ll reveal two of the triggers here today:

- Weak natural gas pricing

- Weak NGL pricing via WTI linkage + rising inventories

Katusa subscribers not only made +170% gains (or more), but we sent out an alert for all subscribers to lock in their gains and close the position out on the options trade.

Not only do we do open market buys and Private Placement ideas, but we also publish option trades in our service.

The Play

EQT Corp (EQT:NYSE) is one of the largest pure-play natural gas producers in the northeast United States. The company has a market capitalization of $5 billion.

The company has over $5 billion in debt, on which it pays over $200 million per year in interest payments.

In each of the next four years, a substantial portion of the company’s debt will mature.

All kinds of alarms went off when the company started selling off key assets and infrastructure to fund its business operations.

And that’s never a good sign.

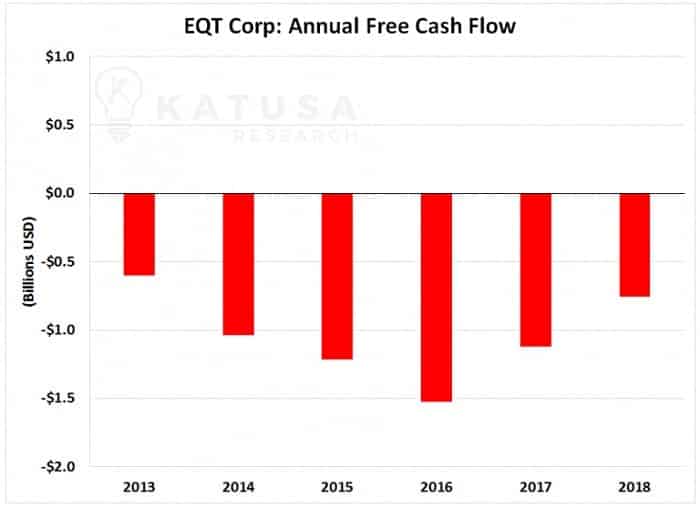

I began to dig deeper and found out that the company has not generated a positive cash flow within 5 years…

Some investors may not have touched this play with a 10 feet pole. But naturally I became more curious, and noticed…

The 30-day volatility was at around 37, whereas the peer group had a volatility of 45.

This is fancy talk for the market becoming very complacent. And it did not expect any surprises with regard to this company. (This is the kind of level of detail you can expect in your monthly issues of Katusa’s Resource Opportunities).

Also, the company hedged approximately 60% of its 2019 natural gas production and none of its natural gas liquids production.

By comparison, many of its peers have hedged 100% of production for 2019 and large portions of 2020.

This leaves material exposure to the spot price of natural gas.

Did I think the company was going to zero?

No, but I did believe selling pressure was high.

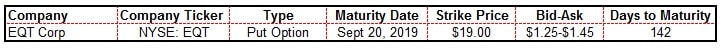

Which is why we published an option trade to Katusa subscribers:

To make a long story short…

We closed the position a few short weeks later for a quick +170% profit.

What’s the learning lesson here?

You may have heard that I’d like to think of our elite circle as alligators waiting in the trenches for the right opportunity.

Sometimes we like to wait when the markets tell us to…

And sometimes we pounce and lock down our score, especially when the markets are in turmoil.

Based on the signals that our algorithms and data systems gave us and with more in-depth research, we pulled the trigger on this option trade.

The math worked in our favor and we saw very little drawback in this play.

Here’s the Thing Though…

These are not plays you’ll easily find anywhere online.

Chances are, you haven’t even heard of this company before anywhere on mainstream media. By the time you hear about plays like this, it’s too late.

Venture and resource markets can rise, fall or go sideways… but there are always ways to make money if you’re cashed up and can take action quickly.

With gold breaking above $1,400, many of our gold picks have risen sharply (our top gold company is up 69% YTD).

With Christine Lagarde expected to take the reigns of the ECB, expect more loose monetary policy for Europe. Basically, this means more financial heroine for the Eurozone.

Throw in Japan that is already hooked on Financial Heroine and needs more and slowing of the global economy…

And gold couldn’t have a better set up if the narrative was written by the original gold bug himself, my friend Mr. Dines.

The gold bull market is not something you want to miss out on. You can find all of my current gold and silver stock buys in my premium research service – Katusa’s Resource Opportunities.

Best,

Marin