In a world where the S&P 500 blasts almost 20% higher in the space of two months, gold investment may seem a little boring.

Global stocks have shot higher over the last decade as newly created fiat currency entered almost every market on the planet. The price of debt and the price of stocks rose in tandem, which is a very rare phenomenon. Gold investment hasn’t been as popular by comparison.

Gold has seen a modest rise over the same time frame. Gold was trading around $920 USD an ounce in March of 2009, and in 2019 it broke $1400 USD per ounce for the first time in 5 years.

Gold investment has been a good move.

A price gain of around 52% in a decade isn’t too shabby. Sure, many other assets have done much better. But, gold offers investors something that no other financial instrument does. And that’s a long history of stable buying power.

Gold Investment Has a Long History

Gold has been money since we started keeping track of history. In fact, until 1971, gold was the basis of the Western financial system.

Alongside silver and other metals, it was used as money in ancient Rome. It’s still held as a reserve asset by many nations and central banks.

People in the Western world have mostly forgotten about gold investment. But there are some very good reasons why it is good to own a little bit of the yellow metal.

The first and most compelling reason to own gold is fiat currency. This might sound strange, but fiat currency isn’t the most stable asset out there. The fact that the fiat currency system in the US has been relatively steady for almost 50 years is nothing short of a miracle.

Have a look at places like Argentine and Turkey for more information on what can happen when fiat currency systems go terribly wrong.

Gold investment will make sure you have something of value no matter what. When a fiat currency system goes belly-up, the value of gold tends to skyrocket. More importantly, gold can always be traded for cash.

Gold investment ensures that you can buy groceries and other items you need on a daily basis.

The Investment Thesis for Gold

At this point, gold could be thought of as buying an insurance policy that could also rise in nominal terms. Even if the US Dollar-led fiat currency experiment continuities without a major crisis, gold appears to be in a long term bull market that started in 2001.

The reasons why gold has rallied from below $300 USD an ounce in 2001 to more than $1400 USD an ounce today are debatable. But the peak price of $1900 USD an ounce we saw in 2011 may not be the highest price that gold achieves. This is what looks like a multi-decade bull run.

The idea that gold investment is a good idea doesn’t seem to be lost on nations like Russia and China. Both countries are accumulating gold on the international market. China and Russia are also major gold producers. And this makes their buying habits even more interesting.

In the investment world people want to have a narrative that explains the markets. They want to know why gold will rise, or why nations outside of the US are buying up gold.

The fact is that gold has been rising in price (around 4% per year over the last decade), and major world powers are accumulating gold. Gold investment might not be as exciting as Apple stock, but it has created reliable returns for almost two decades.

That all seems pretty simple, no?

You Probably Won’t Lose Much With Gold Investment

No one knows where gold prices will be in a week, a month, or a year. However, the second major argument for holding gold is: Gold has been a very stable means of saving money for thousands of years.

Pulling up historical data tells us that gold outperforms stocks in periods of recessions and market corrections.

One example is that gold spiked in 1980 at the start of the 80’s recession, when the price of the yellow metal soared to $850 per ounce.

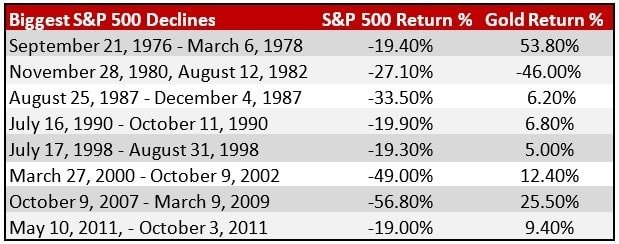

In the table below, you can see how gold tends to perform against the S&P 500 during the most extreme corrections since 1976.

The data shows that gold will perform better than the S&P 500 if or when there is a recession in the future.

Considering gold as another kind of money (like a store of value) is probably a better way to view it. No matter where you go in the world, there will always be a market for your gold.

In this way, gold is like a truly global currency that has thousands of years on its side. The price of gold in your local fiat currency will fluctuate, much in the same way that the value of fiat currencies move around on a daily basis.

Regardless of whether or not gold is rising or falling when measured against fiat currencies, gold owners have a kind of money that is accepted everywhere in the world. It can also be swapped for cash at any time.

This makes it one of the most liquid assets in the world.

Gold is Worth Owning-Period

The idea that gold investment should make up 5-10% of any portfolio isn’t new.

Now that the global financial system is wholly backed by debt, holding some gold in your portfolio seems like an even better idea. And there are many ways to gain exposure to gold. For example, buying some physical gold makes sense (I continue to buy physical gold).

If you ever need gold to fulfill its role as a currency, it makes sense to have some in your physical possession. Paper gold products like the GLD ETF may offer convenience, but they aren’t going to help you in a crisis. I personally rather buy gold and other resource stocks for their unique leverage to the gold price.

There are a lot of ways to buy gold in bullion form, without paying a big premium to spot prices.

Gold bullion coins are also made in ¼ and ½ ounce weights, and these smaller denominations are worth considering. In the event that you need to trade your gold for cash, a ¼ coin will give you the option to sell less gold at one time.

The media makes money from drama and hype.

Gold investment doesn’t get much play in the mainstream financial press, but it is one of the most stable assets there is. There has never been a time when gold was worthless.

It has been a currency of last resort for people in dire financial straits, and it has also been used to underpin the global monetary system.

Ask yourself: Do I really want to turn my back on an asset that is as good as cash globally, and has been in that position for most of recorded history?

Regards,

Marin Katusa