Publisher’s note: In last week’s letter, we mentioned uranium is setting up to be a huge investment opportunity in 2017. To make the biggest possible gains, you need to be armed with the best possible information. That’s why we’re running an educational “Prepare to Profit” essay series on uranium. Below, you’ll find Part 2 of this series, which explains critical supply/demand factors in the uranium market.

A case for investing in any natural resource always starts with supply and demand.

When we talk about those things in uranium, we talk in terms of pounds.

Uranium is an especially unique market because there is primary production (which comes from mine production) and secondary production (uranium from decommissioned nuclear warheads and other sources such as reprocessing tails).

In 2015, 86% of uranium supply came from mines and 14% came from decommissioned nuclear warheads and other secondary uranium production sources.

As a result, a uranium investor must not only analyze mine production like he would in the copper or silver market, he must analyze nuclear warhead inventories as well.

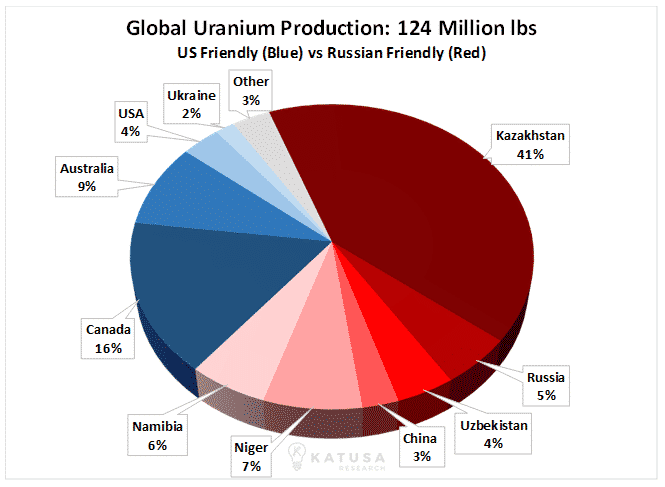

On the mine supply side, the central Asian country of Kazakhstan (yes, where Borat is from) is currently responsible for 41% of global mining production. Canada is a distant second (16%) and Australia is a distant third (8.9%). A handful of countries produce modest, but meaningful, amounts of uranium, but what goes on in Kazakhstan dominates the mined uranium market. Below is a pie chart that shows global uranium production, red represents Russian friendly nations and blue represents US friendly nations.

All of Kazakhstan’s uranium production comes from ISR (in-situ recovery). ISR is the cheapest way to produce uranium. This is because ISR involves no digging, hauling, or crushing of rock. There’s no conventional open pit mines or underground mines. You don’t need big dump trucks or mining shovels for ISR production.

ISR pumps the equivalent of soda water into porous rock that hosts elevated uranium concentrates. The water becomes “impregnated” with uranium and is then pumped out of the rock. An ISR operation is more like a water processing facility than a mine.

It’s important to keep in mind that ISR production is similar to oil and gas production. It produces a lot when the well is first tapped and then production declines. As the production declines, new wells are drilled to offset the production decline rates.

Kazakhstan is producing a lot of uranium now, but it is just starting to experience production declines. The current price of uranium does not warrant drilling new wells in Kazakhstan. It has the lowest cost of uranium production in the world, but drilling new wells is not economic at $20 per pound uranium. To bring on new production in Kazakhstan, $35 – $40 per pound uranium is required.

And logically expected, Kazakhstan just announced it plans on reducing its uranium production by 10%. When the world’s largest producer of uranium announces a 10% reduction, speculators must pay attention.

The decommissioned nuclear warhead market is dominated by Russia and the U.S. At the end of The Cold War, Russia and the United States agreed to reduce their nuclear weapon stockpiles and use their uranium for nuclear power production. As part of the agreement – nicknamed “Megatons to Megawatts” – the United States agreed to buy 500 metric tons of surplus uranium from Russia. This program lasted from 1993 to 2013.

After selling a portion of its inventory, Russia is estimated to hold 134 million pounds of uranium. The U.S. inventory is estimated to hold 260 million pounds of uranium.

Uranium Demand

On the demand side, the Big 5 consume 130 million pounds of the global uranium consumption of 182 million pounds per year. The Big 5 are: United States (30%), France (15%), China (11%), South Korea (8%), and Russia (7%). Together, these five make up around 71% of global demand.

Japan’s disaster staggered the global nuclear industry, but it didn’t knock it off track. Although some countries like Germany and Italy are moving away from nuclear energy, much of the world is moving towards it. As I mentioned last week, if you’re a country without significant fossil fuel resources and you want large amounts of safe, secure energy to power your economy, nothing beats uranium.

Giant energy consumer China currently has 29 nuclear reactors under construction. Russia has 9 reactors under construction. India has 6. The United States has 4 currently under construction.

Also, Japan has stated that it plans to get two-thirds of its nuclear reactors back online in the next four years. This means that soon, approximately 14 million pounds of uranium will be needed to meet just the Japanese demand.

Growing Asian demand and steady demand from massive current consumers (United States and France) means that uranium demand will grow to 190 million pounds per year by 2020 and to 220 million pounds per year by 2030, a growth of 20% in 15 years.

As much as any natural resource, uranium has a clear path to much greater demand over the next 15 years. However, that demand will not be satisfied with spot prices under $20 per pound. It costs the mining industry more than that to get it out of the ground.

Either the price of uranium will go up or the lights will go out.

The Cure for Low Prices…

Seasoned resource investors know one of the ultimate signs of a market bottom is when an industry’s lowest cost of production is below the current market price.

When this situation occurs, either the price of the resource goes up or the producers go out of business and the world goes without the resource. In the case of energy resources, the world always chooses to keep the cars running and the lights on. That’s why the saying goes, “The cure for low prices is low prices.”

In the case of uranium, the average production cost of North America’s conventional uranium mining industry is about $60 per pound. This is an “all in” cost that takes into account the cost of capital, labor, equipment, fuel, and insurance. The highest-grade uranium project in the world, the McArthur River project in Canada, needs about $30-35 uranium to break even. Kazakhstan’s ISR projects need $25-$30 uranium to be economic.

Uranium is sold two ways. One is through the spot market, where an end user can buy uranium whenever it wants. Two is through the long-term contract market, where end users enters into agreements with producers to buy set amounts of uranium over set periods of time.

Currently, the spot price of uranium is $22 per pound. The long-term contract price is about $31 per pound. Historically, the majority of sales are in the long-term market, but that has changed since Fukushima. Because of the flood of Japanese stockpiles, the spot market became more active. But that is now starting to change. This anomaly appears to have started to reverse and that is good news for the price of uranium. Both prices are currently well below the industry’s average cost of production.

Eventually, the laws of capitalism will exert themselves. The price of uranium must rise or companies will stop producing it and the lights will go off.

People will choose lights.

A transition to bear market to bull market won’t happen overnight. In all likelihood, a significant price increase won’t happen in the next 12 months. There is still supply overhang to work through. But demand is surging. Supplies are starting to curtail, as seen with the announcement from Kazakhstan this week. And the industry’s production costs are much higher than current prices.

This is a mixture that will send uranium prices 50% – 100% higher within three years. Since natural resource stocks are leveraged to commodity prices, deeply depressed uranium stocks could climb 5-fold during that time.

You might think these projections sound outlandish, but they are actually very conservative. Just 12 years ago, the price of uranium started on a climb that took it from $12 per pound to $137 per pound (a 1,041% rise) in just three years. Many uranium stocks climbed more than 3,000% during the rally. The world’s largest publicly traded uranium miner Cameco increased in value by 30-fold. Some smaller, more speculative uranium stocks climbed more than 100-fold.

Uranium enjoyed that stupendous bull market because supply was constrained, demand was healthy, and because fund managers speculated that the end of the U.S./Russia uranium deal would constrain supply further. That’s the situation we have now as well.

The choice of paying higher uranium prices or watching the lights go off will be put to America in a unique way. That’s because the U.S. has painted itself into a very dangerous corner… one few people know about and even fewer people talk about.

In my next “Prepare to Profit” letter, I’ll explain America’s dangerous energy position… and how it could lead to astronomical gains in uranium stocks. More to come.

Regards,

Marin Katusa

P.S. Since we began writing about uranium setting up to be a big opportunity (in December), uranium stock prices have jumped. They’re vulnerable to a short-term correction to buy now, so remember how volatile the resource market can be. Uranium stocks could suffer a large decline very soon, which would present a good buying opportunity.