Last week we profiled 3 sectors that caught our attention.Carbon, Gold (and silver) and cybersecurity were at the top of my list…With the first two at the top of my portfolio in terms of position size.This week I’ll detail several other sectors our team is researching and analyzing closely for hidden gems.

Lithium

Lithium is an interesting sector and by now most investors know this is a critical element in a net zero world.When you think batteries, you think lithium. And the world will need a LOT of it.

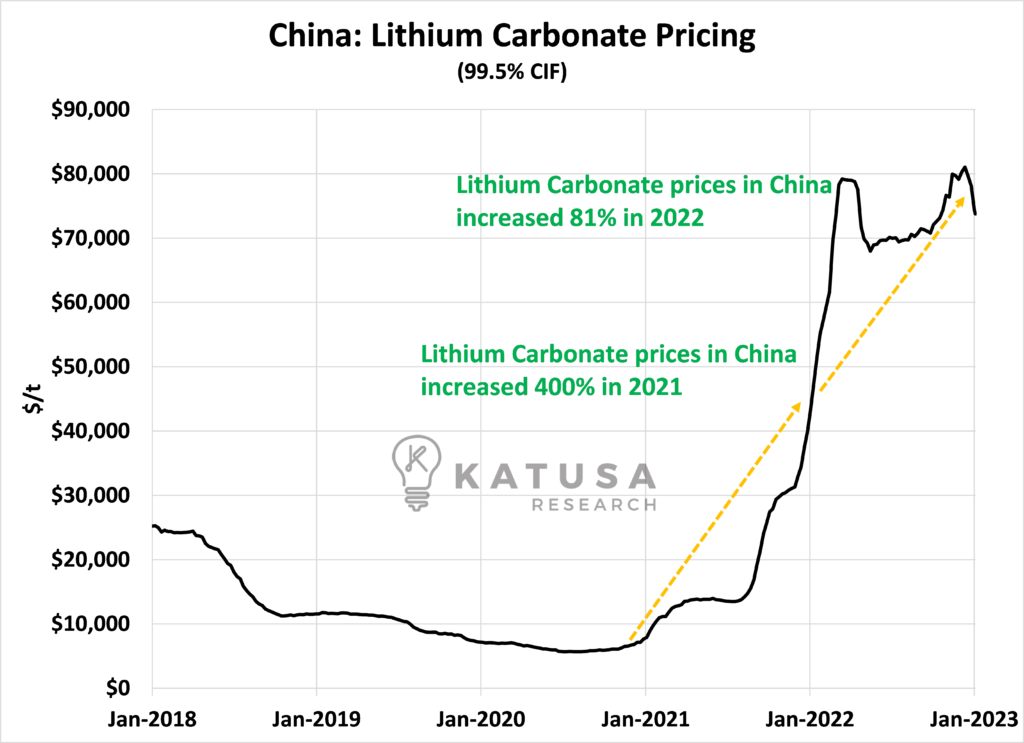

- The intense hockey stick price rise in lithium also caught the attention of investors. In 2021, lithium prices in China rose 400 percent.

Then in 2022, prices nearly doubled again, finishing the year up 80%.

And it was one of the hottest sectors in 2022 even though it didn’t catch much mainstream attention.

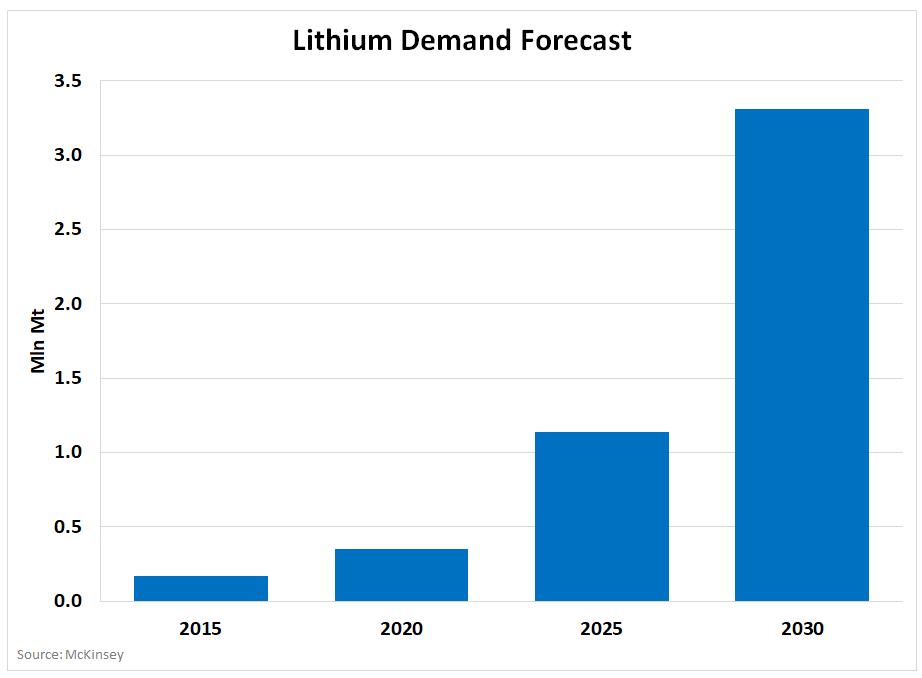

- Demand for lithium continues to soar and the projections show demand forecasts increasing up to 10x by 2030.

Elon Musk expressed his desire for easy to reach, local U.S. sourced lithium and this ignited the fire on many lithium stocks. Tesla is building a refinery on the Texas gulf coast.There are 4 major companies that run most of the world’s lithium production. But there are many companies vying for their slice of the growing pie.Why I Like the SectorBattery chemistry changes every day. But Lithium is critical as a battery metal and demand is poised to grow significantly.How I’m Playing ItMusk calls lithium refining “You can’t lose, it’s a license to print money”. Exploring for lithium and producing lithium is a different game than refining lithium and be very careful where you are putting your money.There are plenty of companies with empty promises and it could be hard for a regular investor to tell.Most lithium companies and small caps have projects that will never get permitted or never get built.Be careful and stay away from those.A previous lithium company we waited like alligators to buy, highlighted several years ago, got bought out at a significant premium. We’re well versed on the sector and have visited several projects in the Americas.I have a handful of assets on my radar owned by companies that could make sense if the price and valuation is right.What to focus on when investing in Lithium exploration:

- Management team and insiders that actually know lithium and have successful past in the sector. Avoid those unblemished with success.

- Grade is KING. Always.

- Metallurgy is Queen. Always.

- Jurisdictional Risk. Why increase your risk with political risk when there are incredible ultra-high-grade deposits in safe jurisdictions?

- Digitalization of Previous Exploration. This is not the first lithium exploration boom. It’s happened before. A proven success strategy I have deployed many times is taking the old data on the highest-grade deposits with previous work OPM (Other People’s Money) and digitalizing using modern technology to better define the exploration potential.

Green Hydrogen

This is something investors are going to see A LOT more of starting in 2023…The most abundant element in the universe (other than stupidity) is buoying for a critical spot in the green revolution.Since being used to lift blimps in the 18th century, hydrogen-based technologies have come a long way.Two of hydrogen’s unique attributes are:

- Ability to be stored and used as a clean fuel without direct emissions

- Flexibility and versatility

These properties provide an opportunity to solve the critical decarbonization issues faced in hard to abate segments.Things like cement, steel and heavy transport industries.Solving these problems has the potential to lead to a massive increase in demand.If we can get the technology right.Today, the majority of commercially produced hydrogen comes from fossil fuels, primarily natural gas and coal. In order for hydrogen to go mainstream, hydrogen production will need to go green.

- Green hydrogen is produced through a process known as electrolysis. Today this process makes up less than 1% of global hydrogen production.

Over the coming decades, I expect this to change as economies of scale and technical innovation drive costs down.According to the World Bank…

- The demand for hydrogen reached an estimated 87 million metric tons (MT) in 2020 and is expected to grow to 500–680 million MT by 2050. That’s a 500-800% increase.

Below is a chart that shows the potential growth in the market over the coming decades.

Don’t sleep on green hydrogen.As global decarbonization continues, hydrogen companies could become a new hot sector for speculative investors.We’re seeing a growing number of deals and investor decks coming our way and looking into each one of them. Not to mention the big shift in commercialized transport trucks using hydrogen.Stay tuned as this sector heats up in the coming years.

Uranium

Russia, together with Kazakhstan and Uzbekistan make up 58% of global uranium production.Yet the United States required 44% of global uranium production in 2021.

- Either the United States buys every ounce of uranium outside of Russia, or Russia has total control over the U.S.’s energy security.

The US Govt won’t let that happen and this is a major issue.And both sides of the political spectrum are accelerating funding and tabling bills to help revive the US nuclear energy industry.Did I mention that nuclear energy is critical to reduce emissions and get to 2030 net zero plans and projections?China, India and Russia are building a large number of reactors.Europe and Japan are re-starting dormant ones.Why I Like the SectorThe nuclear scare of Fukushima is over and the tide is turning quickly.The world (and investors) are recognizing that nuclear is an all important baseload form of energy with much lower carbon footprint and overall cost than other forms of energy.Demand is going to increase, big time.For example, 4.6% of China’s electricity comes from their 48 nuclear reactors. They want to get to 20 percent—which will take another 150 reactors.That’s just China (wink, wink).How I’m Playing ItI have a handful of uranium companies on my radar but I’m staying away from rinky-dink small caps on exchanges where liquidity is non-existent and the only shares that move are from paid promotions.

- You want to look for pure-play uranium companies

- That are trading on large, U.S. exchanges where big ETF’s and funds can access big positions.

Otherwise, you’re playing with a pack of matches that burn bright and fizzle faster.

Bonus Sector: Oil?

Even with a massive anti-oil push from decarbonization, oil was one of the top performing sectors in 2022.Producer diligence both in North America and abroad has led to tight supply-demand fundamentals which in turn has supported higher oil prices.Tight fundamentals are likely to continue this year and beyond as fossil fuel companies face higher costs of capital which will curb excessive spending.However, even under the most aggressive of decarbonization scenarios, oil is likely to remain a key commodity for the coming decades.The transition away is real, but we’ve been reliant upon fossil fuels for centuries and substituting away from them will not be an overnight success.A key theme for oil companies in 2023 and beyond will mitigate greenhouse gas emissions, especially methane.Regards,Marin Katusa P.S. Every month my team and I publish Katusa’s Resource Opportunities. It highlights the research and data I’m looking at, and where I’m putting my money in the resource markets. Give it a trial today.

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws.

By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim.

If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.