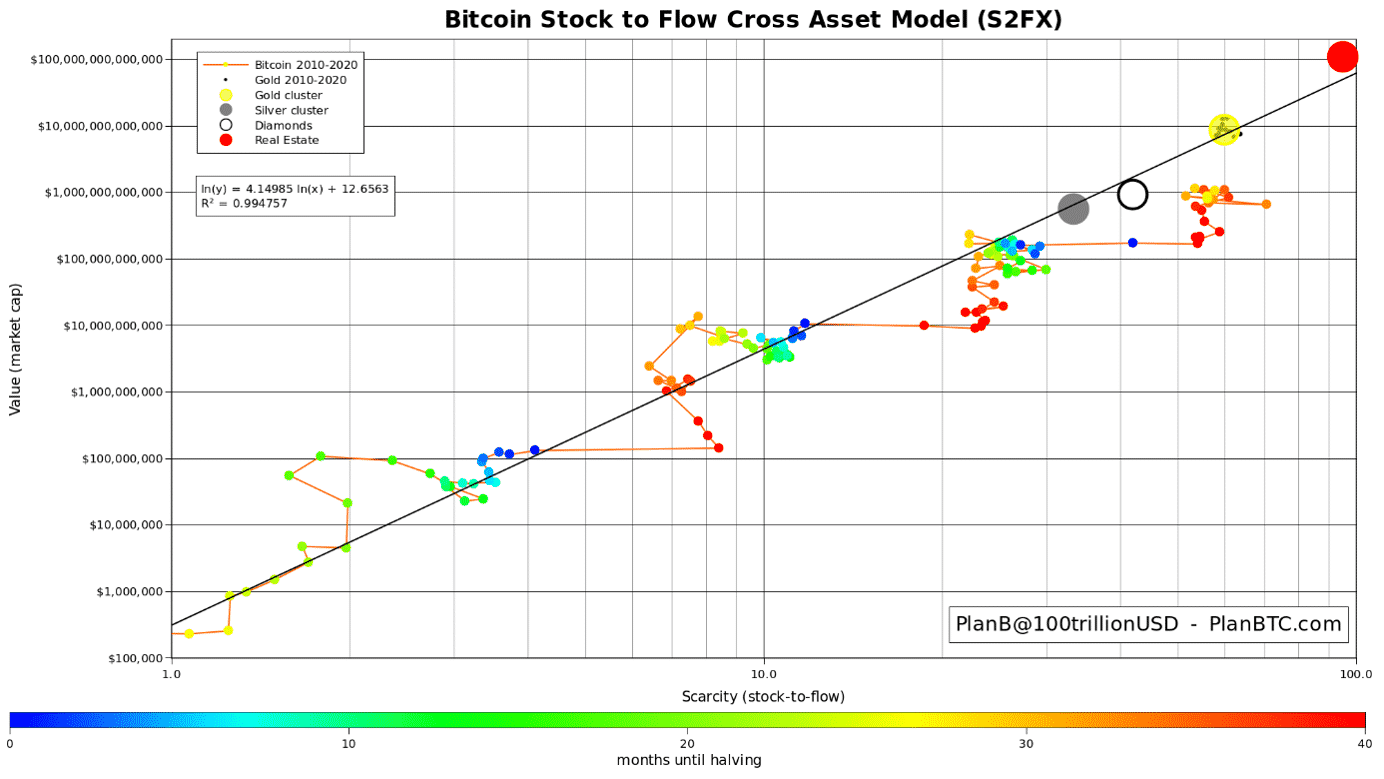

In December 2020, I wrote about a popular Bitcoin pricing model that was getting a lot of traction, the S2FX model.At the time, Bitcoin was on a tear and the sky was the limit for price expectations.And this popular model which promised investors the moon and more for Bitcoin prices caught the attention of crypto HODLers everywhere.I’ve never seen a math model garner so much enthusiasm.

This model – as I broke down in detail in my article – was fundamentally flawed.Naturally, at the time, I got a lot of hate for breaking down the math and exposing the fundamental mathematical flaws with the model the way I did.No good deed goes unpunished.

I stand by my original conclusion, which was – an asset pricing model based solely on supply, without consideration for demand, is fundamentally flawed.

As for how the S2FX model is doing these days?

Not so hot.As you can see from this recent post on the S2FX author’s Twitter, it continues to serve as a poor predictor of Bitcoin prices, despite what the logarithmic Y-axis might lead you into thinking.Logarithmic axis is the autotune for charts.The difference between what Bitcoin is trading below and what the price should be according to the S2FX model is at its biggest difference in the history of the model. That’s not good.The price of Bitcoin has rallied back to just above the $43,000.Currently, Bitcoin’s actual price is trading more than 80% lower than what the S2FX model predicts its price should be, which is around $240,000.

- On the flip side, if you’re a believer in the S2FX model, then there’s no better time than now to load up.

This would be no different than a gold bug publishing a flawed framework stating the gold spot price should be $9,000 ounce today but was at $1,800 in the open market.

To be fair, Bitcoin has until 2024 to hit the $288,000 price level predicted by the model… but I’m not holding my breath.

Cryptocurrencies are complicated assets with many unique benefits and drawbacks.To simplify Bitcoin’s pricing to a model dependent solely on a single supply metric does it a great disservice.And on top of that, there’s one major elephant in the room nobody’s been talking about yet…

The Coming Coin to Rule Them All?

Say what you will about them, but blockchains and distributed ledgers are here to stay.And there’s no question about it: they will become increasingly employed as nigh-unhackable record-keepers.Not only that, but thanks to how they can’t be duplicated or forged, they can also be used to create digital currencies.Bitcoin is an obvious example. It’s been around since 2008 and doesn’t look like it’s going anywhere.

- In fact, mining for new Bitcoin now consumes 4 times more electricity worldwide than the total yearly amount used in Switzerland.

The field is still in its infancy, and who knows how it’ll play out? But a lot of very bright minds are involved, and a lot of capital has been invested.Suppose cryptos do go mainstream and become legitimate currency alternatives?

(Now I know some crypto heads will argue with me on this one – “Bitcoin is already a legitimate currency alternative!” But if I can’t go out and do my grocery shopping, fill up my tank, and grab a burger and fries all with the same currency, it’s not a legitimate alternative. And yeah, I’m well aware there are apps that you can use, but it’s nowhere near mainstream.)

- But for this thought process, let’s live in a future Bitcoin is a legitimate, widely used mainstream currency…

Bitcoin transactions would actually boost the velocity of U.S. dollars outside of the Fed. They will also return the concept of privacy to commercial transactions.There are a lot of upsides, and potentially, a lot of money to be made from them. However, there are also some major obstacles.If you want to invest in Bitcoin and other cryptocurrencies, you ignore these challenges at your own peril.It’s far better, then, to make sure you understand these obstacles so you can make informed decisions when it comes to these types of investments.

I’ve discussed a few of these in my #1 Bestseller, ‘Rise of America’.

#1: Government Regulation

The first and biggest obstacle to the widespread adoption of Bitcoin and other cryptocurrencies is the government.

- The government does not like competing currencies, and none but the dollar is recognized as legal tender that must be accepted in trade.

So far, Washington has not moved to ban or even regulate the likes of Bitcoin, and that’s at least in part because it would be so difficult to do.Bitcoin resides on a blockchain distributed across thousands of nodes (computers). It was specifically designed so that no bad actors can gain access to and modify the chain.That doesn’t mean the authorities won’t come after Bitcoin someday if it becomes perceived as a genuine threat to the government’s monetary monopoly.An effective clampdown will be difficult, but by no means impossible, and that’s something every investor should be aware of. You need not look any further than China to see what happens when a government decides it’s had enough of cryptocurrency.

#2: Massive Pollution

Another major obstacle facing crypto is the incredible amount of pollution created by the crypto mining companies.I’ve been shocked at how investors haven’t connected crypto coins to their horrible environmental footprint. Especially with the institutional investors and millennial investors who focus on ESG.It’s relatively easy to follow on the blockchain where each coin was digitally minted, and all institutions should avoid “dirty coins.”This should also help eliminate bad actors who have set up crypto mining farms that don’t follow the highest environmental protocols.

- (If you aren’t sure what farms in the crypto sector are, crypto farms are nothing more than a large number of computers—in the tens of thousands—in one large area, all connected, working towards creating coins.)

Mining operations with poor environmental footprints would never be accepted in the gold, mining, or energy sectors in North America by investors. Why is it being accepted in the crypto sector?

The crypto universe should mandate a transition to clean.If the big oil companies can, so can the crypto world.

#3: Lack of Acceptance

Acceptance is also an ongoing issue.The viability of all money is a matter of faith. When people have faith in a currency, it endures; if they lose that faith, it can collapse in a heartbeat.For Bitcoin to truly succeed, people have to endow it with value by having faith that it’s “real” money.If that’s going to happen, it will have to show more stability than it has at present.Making a deal in Bitcoin means assuming the risk that tomorrow it may be worth only half of what it’s worth today—as has happened all too often with Bitcoin.Few people want to take that risk.The flip side is that it can also rise steeply in price, and frequently has.So, I think it’s probably safe to say that many Bitcoin owners are in it merely as a speculation.The volatility will have to decrease before it can truly become a store of value or a currency for buying things.Remember that any appreciation in Bitcoin’s value doesn’t exist outside of its relationship to a national currency like dollars (or euros, or yen, or whatever).You profit from Bitcoin only when you convert it to something else.And now to the big one—few want to discuss.

#4: The Development of “Fedcoin”

As if these three obstacles weren’t enough, there’s another one that looms even larger.For some time now, it’s been rumored that the Federal Reserve has been toying with the idea of creating its own blockchain and using it to market its own cryptocurrency.Let’s call it Fedcoin.This would be a highly logical government response to Bitcoin.

- You don’t have to ban or regulate something if you can introduce a competitor that wipes it out. That’s what Fedcoin would do to other cryptos.

It would see immediate and widespread adoption because it would have an insuperable advantage over other coins: it’d be legal tender, especially important to those on universal basic income.Expect the government to make it mandatory for companies that receive any support from the Fed bond-buying program to accept only Fedcoins.Once again, China serves as the perfect example.What did the Chinese government do last year after they banned all crypto mining and cryptocurrency transactions?You guessed it – their central bank pushed their own cryptocurrency to fill the gap, the digital yuan – or digital RMB (renminbi).And now, the Chinese government is advocating for more widespread use of its own digital currency by strongarming major domestic tech companies Tencent and Alibaba, who have been forced to add support for digital yuan transactions to their own WeChat and Alipay platforms.For years now, China’s national lottery has already been paying out winnings with digital yuan – imagine how widespread adoption would get if the government forced citizens to, say, pay taxes and receive tax returns only in digital yuan.Yes, there would still be some diehard privacy lovers who would shun Fedcoin in favor of some other crypto.But the great bulk of the population would opt for the convenience of the government’s offers.There’s a Long Road Ahead

Could Bitcoin or another crypto develop into a genuine currency that’s accepted by merchants everywhere?Does it make sense to invest in Bitcoin and other cryptocurrencies?The answer to both questions, at least for now, is perhaps.For that to happen, though, Bitcoin will have to overcome all the hurdles laid out here. If it can’t, it will lose its value as an investment opportunity.I’m not going to tell anyone not to invest in Bitcoin; however, I am going to tell you that you should pay attention to how these challenges affect Bitcoin and other cryptocurrencies.To do anything less could potentially be a very costly mistake.Regards,Marin Katusa

P.S. If you want to learn where I’m putting the bulk of my money in the markets – click here to find out about my premium research letter – Katusa’s Resource Opportunities.