You’re living through one of the most pivotal times in the financial markets.

I’m not talking about volatility…

Nor am I talking about crashes.

Influencers and the madness of crowds can move mountains previously thought to be extinct (AMC is a perfect example).

And today, the voice of the shareholders matters now more than ever. Like I wrote previously…

Exxon is a perfect case study. One of the world’s largest oil producers had its board of directors defeated by a small but outspoken fund. And this example is just the tip of the iceberg.

- It’s just a matter of time before the U.S. SEC mandates all publicly listed corporations to disclose their carbon emissions like they do their financials.

On July 28th, 2021, new SEC Chairman Gary Gensler expressed his views on the subject.

I’m sure many of you didn’t even notice. But I did.

And you should know what impact such a move would have on the financials of all publicly listed companies.

Coming Soon: Mandatory Emissions Reporting

The next step is for corporate valuations to include the cost of carbon emission reduction and offsets in their valuation models.

This will be the basis for all ESG investing and green bond participation.

Probably the most clever moment in my career was being the first in the finance industry to incorporate the cost of carbon offsets and carbon footprint reduction costs into the project and corporate valuation NAV and IRR models in 2019.

I was initially mocked by the brokers and analysts at the brokerage firms (they’re called brokers for a reason—because they’ll make you a little more “broker” after you do business with them).

In the next few years, expect major financial valuation write-downs across the board.

Subscribers to Katusa’s Resource Opportunities know we’re ahead of the curve on this…

And have already created our list of companies that we will avoid for that reason.

So, who are some of the names to keep an eye on?

Let’s get to it…

Market Size: Breaking Down the Dirty 30

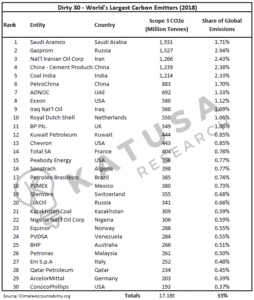

Currently, 33% of global carbon emissions are created by 30 corporations…

Next, let’s break the list down between +SWAP and -SWAP Line nations.

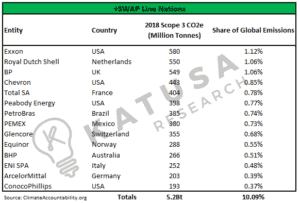

And of course, we have to incorporate political risk into all of our analyses. The +SWAP Line Nation Big Dirty CO2e emissions list includes 14 corporations that makeup 10.09% of global CO2e emissions:

A very important aspect of the above list is that of the 14, only PEMEX is state-owned (meaning no shareholders other than the state).

13 of the 14 are currently publicly listed which means shareholder votes matter more now than ever before.

- Those votes have been cast and the management and board have been directed to lower emissions. Exxon is a perfect example.

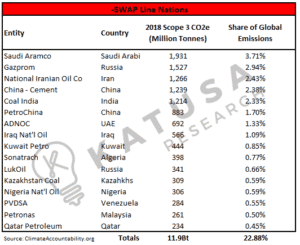

The -SWAP Line Nation Big Dirty CO2e emissions list includes 16 corporations that makeup 22.88% of global CO2e emissions.

Only 4 of the 16 (25%) Big Dirty in -SWAP Line Nations are owned by shareholders. The other 12 are state-owned.

- Just over half of the world’s Dirty 30 are public. Those companies are the ones that will face public scrutiny and shareholder revolts if they don’t clean up their act… literally.

Relying on technology that’ll get invented 30 years from now doesn’t solve the immediate problem.

For corporations, both a short-term and a long-term approach to decarbonization is necessary.

Carbon offsets provide an immediate emissions abatement which sets a path forward for the company. In fact, I’d say they’re mission-critical to many publicly traded companies today. Especially those in hard to abate sectors.

Even if we assume only 50% of the Big Dirty public companies in +SWAP Line nations attempt to reduce their emissions by 50% by 2035…

- That alone is an over 10x increase in offset demand in the voluntary market.

Let’s take this a step further, as the math matters.

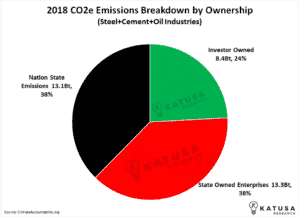

In the steel, cement, and oil industries, 24% of CO2e emissions globally are controlled by shareholders like me and you.

That group currently emits over 8.4 billion tonnes of CO2e emissions annually.

Reductions are coming in a big way. Whether you personally agree with the change or not is irrelevant.

It’s coming.

So, prepare yourself accordingly.

“Greenium” – The Green Premium

Investors around the world are rewarding companies with a “greenium”.

Greenium is the combination of higher share prices and lower costs of debt. These greeniums will be magnified in heavily polluting industries.

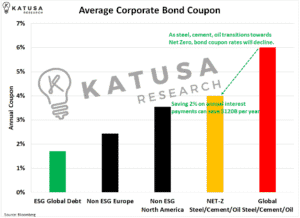

Below is a chart which shows the average coupon payment made by companies in the dirty sectors (oil, steel, and cement).

You’ll see that today, those companies pay much higher coupon rates for debt.

However, because green and sustainability-linked bonds are issued at lower coupons, these heavy emitters can reap these cost savings.

Lower priced debt improves the company’s income statement and should result in improved valuations, leading to higher share prices.

You can see that globally, ESG debt issues significantly lower coupon rates.

I’m not saying that all the dirty debt will become completely ESG friendly.

I’m simply saying that it’s reasonable to expect a 2% decrease in coupon rates for dirty companies going net zero. And this would still be well above the average coupon payment of regular non-ESG debt.

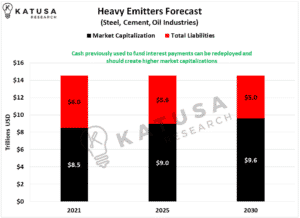

This decrease in interest payments equates to $120 billion a year in cost savings for those companies.

- Just based on these savings alone, this has the potential to add over $1 trillion in market capitalization to the sector over the coming decade.

$800 Million Real-Time Case Study

Recently the government of Canada announced that it’s putting up CAD$400 million of taxpayer money to help ArcelorMittal switch its steelmaking facilities from Blast Oxygen furnaces to Electric Arc Furnaces.

By switching to Electric Arc furnaces, ArcelorMittal believes it can reduce its emissions by 62.5%.

But this is the second foray into financing emissions reductions by the Canadian government.

The Canadian government also awarded $420 million to Algoma Steel to convert to Electric Arc Furnaces.

Now let’s assume every government in the world will be as generous as Canada’s and finically contribute to the steel sector’s emission reductions.

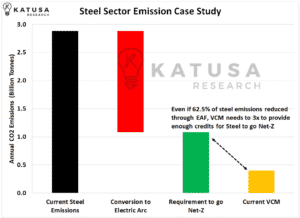

Globally, the steel industry emits 8% of all CO2 emissions, which equals 2.88 billion tonnes of CO2.

Assuming everyone converts to Electric Arc furnaces, steel-related CO2 emissions will fall by 1.79 billion tonnes, implying an annual emittance of 1.1 billion tonnes of CO2.

- To get to Net-Zero, the steel sector still would need to offset 1.1 billion tonnes of CO2.

- This means the Voluntary Carbon Market (VCM) would need to grow by nearly 3x just to cover those residual steel emissions.

Below is a chart which shows the progression from today’s emission levels, to the reduction through conversion to Electric Arc furnaces and the final requirement to get to Net Zero.

This is JUST the steel sector. AFTER Government subsidies.

The takeaway here is this…

Even if the government gets massively behind all the heavy emitting industries to help them transition, enormous amounts of carbon credits will still be required.

If you still think climate change is b.s… that’s totally fine.

But don’t get left behind when the carbon markets take off without you.

You’ve been warned.

Regards,

Marin