To the 1 in 1,000,000 investors, like the alligators reading this…It will be the start of some of the most critical talks in the global markets.Many investors and historians could very well point to November 2021 as the catalyst date that put World War Zero into motion.The 2021 United Nations Climate Change Conference, also known as COP26, wrapped up.Held every year, this conference is where climate targets are set, countries are held to account, and companies are forced to comply.

- In 2022 and beyond, the most recognized institutions, universities and the media will be in overdrive reporting climate and net zero news.

Expect all media and the news cycle to highlight reports that the global oceans, on average, are 30% more acidic.And global temperature is 1 degree Celsius warmer than before the Industrial Revolution.Which has resulted in a 70% decline in the population of mammals, birds, fishes, reptiles, and amphibians.To add urgency, the media will highlight that the rate of change of ice loss in the Artic is 300% higher than last decade.It took mankind 250 years to produce and release 500 billion tonnes of CO2eq into the atmosphere. At current rates of emissions, it will take less than 40 years.Now I will share the statistic that got the wheels turning in my brain…

- 1 in 50-year climate events occurrence will increase 38.9 fold.

This one line in the IPCC report caught my attention in a big way. I had to re-read the whole section many times to fully grasp the significance.Because the news is the marketing machine for this…

The Insurance Greenaissance

Before you jump to conclusions and opinions, you must know that the statistic above is very important.

Backed by enough evidence and math, the results will directly affect the way the insurance sector does business.

- The insurance sector (as a whole) is one of the largest pools of capital (non-govt) in the world and the largest provider (non-govt) of capital for infrastructure projects globally.

2017 was a banner year of losses for the insurance companies:

- $140 Billion in climate-related infrastructure losses.

Dr. Stokes, testifying in front of Congress in September of 2021, stated that the cost on the US alone in 2021 would be $500 billion due to climate and weather disasters.Another well-known insurance group, Lloyds of London (over 300 years old and operating in 200 countries—they are survivors!) published their calculations…They believe their numbers prove that the 20cm rise in sea level at the tip of Manhattan, compared to 1950 water level, increased the insurance losses from Superstorm Sandy in 2012 by 30% in New York alone.In addition, over $500 Billion of coastal US property could be below sea level by the year 2100. These stats are all a major risk to the insurance companies’ operations.

You DO NOT Have to Agree With “Climate Change”…

Agree with the published data or not. It’s presented by the top firms in the world and the biggest insurance companies in the world have taken note.But it’s not just politicians that had their say at COP26.Let me explain…

The Bank of England (Central bank of the UK) is the force behind UK being a global insurance powerhouse.This editorial isn’t about insurance or actuarial science. (That’s the math that can calculate with incredible accuracy when we will each die when the insurance premiums are written).So please bear with me with on some minutia – that will really shock you. And help you understand where the flow of capital will be going over the next decade.

The Insurance Market 101

The UK is the single largest market for non-life insurance in the world (7% of global insurance premiums).These premiums are written through the London Market with almost 85% undertaken in the UK by insurers who are themselves part of groups headquartered overseas (read: everyone is connected and not an island).UK domiciled insurers rank 4th globally in written premiums and manage almost $2 Trillion in assets.The insurance business is so big that it will depend on open international insurance markets.

Hence, sector reform and legislated reform will become a key factor in redirecting/investing/lending trillions of dollars of managed insurance assets towards reducing the impact on the climate. Meaning to have access, one must abide by the rules. In addition, large infrastructure projects, real estate assets, and other assets, etc. will have to meet the criteria of the insurance companies. OR risk the potential of not meeting the coverable criteria by the insurance company because of their carbon footprint and emissions.It would be the equivalent of an obese smoker who has had a heart attack that doesn’t qualify for life insurance. Too bad, so sad.Without a plan to reduce the corporations’ carbon footprint, their portfolio of assets may not qualify for insurance coverage.

SPONSORED CONTENT

Would you invest in such a company, for example, a REIT if the portfolio of buildings did not have insurance coverage?Perhaps, but at a much lower valuation because of the risk of uninsured assets risk.

The Net Zero Movement Will Spare No One

The central banks and large insurance corporations are all getting behind a NET ZERO movement. It all comes down to the cost of capital.

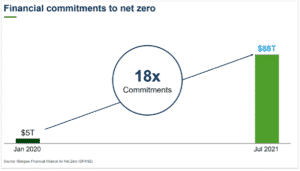

- Over $88 TRILLION dollars (WOW!) from just the financial world (insurance, pension, and specific government plans, etc.) has already lined up to commit to allocating that capital to projects/companies/assets that meet the criteria of reducing the carbon footprint.

I want everyone to think of the magnitude of this amount of capital.The total annual global energy spend is less than $2 Trillion. This is over 44 years of global annual energy this decade.In addition, the IEA recently came out and stated that the energy spend needs to at a minimum double to meet the agreed-upon goals of Paris 2015 COP.Over the past 6 years, decarbonization went from a cute idea to what will become the most highly sought-after investment theme since the late 90s tech boom.Through a concerted effort, corporations and governments around the world used the 2020 pandemic as an inflection point to move from an unsustainable emissions trajectory to a sustainable pathway.

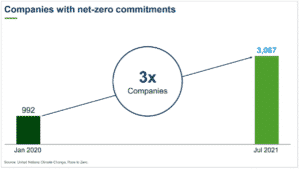

The prizes and penalties for decarbonization success and failure have never been higher.You’ll see below that since January 2020, the number of companies with net-zero commitments has tripled.

These commitments are not backed by some fluffy long-term guidance.Financial commitments to back net-zero targets have soared 18-fold to $88 trillion in the past 18 months.The corporations have committed with their balance sheets.

Some of you may still not believe in this whole “climate change and decarbonization world”, and that’s fine.Close friends of mine (like Doug Casey) have publicly stated as much.I’m not here to change your beliefs. I am here to present a very strong investment proposition, backed by a strong narrative, that has the potential to make us a lot of money.I’m not here to change your views on climate.I believe you subscribe because you want me to provide the best investment ideas.For me to do that, I must keep learning, keep evolving, and get exposed to as many possible deals that I can assess and analyze.I can never give up on a financing structure that I believe will work… and take on all forms of adversity that in the end will present unique financial opportunities to you.Once all this effort and risk is applied, I then present the best ones for your investment decision.I do this in my premium research service – Katusa’s Resource Opportunities.

And it’s read by everyone from novice investors to some of the most prominent family offices and fund managers in the world.The largest and most powerful investment institutions in the world are heading in the direction of decarbonization.And I believe the UK government will make a big commit this COP 26 and even go as far as to start legislation towards a decarbonization framework (making it law).This movement will impact all your investments

- This was a big talking point in the last chapter, The Forbidden Chapter, in my book, The Rise of America.

Corporations that are not willing to make changes simply won’t attract new investor capital. Worse, many current investors will be forced to sell out. Companies who don’t want to play by the new rules will face much higher costs of capital which in turn will render them obsolete and uncompetitive.

Aggressive shareholder activism will continue for those companies who don’t want to play ball. Again, the cost of capital goes up for those not willing to make changes. This is the new normal. Regards,Marin Katusa