Gold is a unique asset class that many investors consider to be an essential part of diversified investment portfolios. If you’re wondering whether or not you should be adding gold to your own portfolio, read on to find out the benefits of owning gold, and what your options are for doing so.

Table of Contents

- 1. Why Should I Invest in Gold?

- 2. Is Gold a Safe Investment?

- 3. How Do I Invest in Gold?

- 4. Gold Mining Stocks

- 5. Why Invest in Junior Mining?

- 6. Gold Funds and ETFs

- 7. How to Invest in Gold Stocks

- 8. What are the Risks of Investing in Gold Mining Companies?

- 9. What are the Best Gold Stocks?

- 10. What’s the Gold Mining Lifecycle?

- 11. What are the Different Types of Gold Deposits?

- 12. How Do You Read Mining Drill Results?

- 13. Common Mining Terminology

1. Why Should I Invest in Gold?

Gold has long been considered an investment class of its own, separate from the stock market and even other commodities. It has a long history of value thanks to its brilliant shine and resistance to rusting and dulling, which helped it become one of the earliest forms of currencies used in history.

The earliest known gold coins were first produced around the 5th or 6th century BC – though gold was already being traded in other forms well before then.

The use of gold in physical currency wouldn’t fade until the early 20th century, finally stopping with the end of the gold standard in the U.S. in 1971.

Some people consider gold a “barbaric relic” – a remnant of a bygone age, when paper currency and fiat money didn’t exist. They think that gold’s only intrinsic value is found in jewelry, and its various industrial uses, such as in electronics.

On the opposite end of the spectrum, other people believe that gold possesses intrinsic value, thanks to its long history of use as a currency. These people believe that thanks to its distinct characteristics, gold makes for a unique investment asset.

If you’re reading this, then it’s likely that you fall into the latter camp. Although if you don’t, there’s also no denying that gold as an investment retains value simply because other people think it’s valuable.

So even if you personally believe that gold is indeed a “barbaric relic”, don’t forget that the rest of the investment industry at large would disagree. That’s why gold continues to be a hot traded commodity and should be seriously considered in any diversified portfolio.

You’re worried about inflation.

You think the U.S Dollar will fall.

You want to diversify your portfolio into something that has very little correlation with the debt or equity markets.

2. Is Gold a Safe Investment?

Physical gold is considered to be a safe investment because of its stability over the long term.

So, in short: yes.

One of the reasons gold is a popular investment in many portfolios is because it tends to perform well during times of turbulence in the markets. During periods of prolonged economic decline, gold tends to outperform stocks.

While gold isn’t immune to short term rises and falls, in the long term it has holds its value. And when it comes to physical gold, you’ll never have to worry about losing all of your investment.

If you’re looking to invest in gold funds or gold companies instead, the answer is a lot less straightforward. While the performance of gold funds and companies is closely correlated with the price of gold, there are lots of other risk factors inherent to public companies that can adversely impact the safety of your investment.

A big sell-off in the markets, like in the case of a stock market crash, might not affect gold prices, but publicly listed gold companies will still feel the heat. And just like in any other sector, there are individual factors at play as well when it comes to picking and choosing gold companies.

Even the best gold project in the world can be mismanaged into the ground by an inept executive team. So, if you’re planning on investing in gold funds and gold companies, you’ll still need to do your homework.

3. How Do I Invest in Gold?

There are several different ways to invest in gold:

- Physical gold,

- Futures and other derivatives,

- Gold stocks,

- Funds such as ETFs.

3.1 Physical Gold

High purity investment-grade gold is also known as gold bullion, from the French word “bouillon” (boiling), based on the melting houses which created the bars and coins from raw material. The term is also applied to silver, so silver bullion refers to high purity investment-grade silver.

Holding bullion is a common form of security for investors that dates back to ancient times. It historically performs well during times of financial insecurity because it’s trusted more than any currency due to its relatively finite nature.

The price of gold typically rises during times of insecurity and is often also used to hedge against inflation. Investors flock to it to help their assets weather a financial storm.

How to Invest in Gold Bullion

If you want to invest in gold bullion (or physical gold), the process itself is quite simple.

The first thing you want to do is make sure you have a good storage solution. After that, acquiring the gold and storing it can be as simple as visiting your local bullion exchange or precious metals retailer.

Ordering online is another convenient way of purchasing your bullion – even reputable and trusted gold retailers like the Royal Canadian Mint now offer their products through an online storefront.

The problem with this, of course, is the actual execution.

Take storage for instance – there’s a good chance you’ll want to store it yourself, but where exactly will your safe be? Will you place it under your floorboards, or bury it in your backyard? How many people will know where it is and what the combination is, on the off chance you’re incapacitated in an accident and unable to handle it yourself?

If you’re worried about loose lips and opportunistic thieves, perhaps you’d prefer professional storage, as well as storage insurance? These are questions you’ll have to consider and answer, based on your own security preferences.

You don’t want to end up like famed gold investor and world’s first ‘bullionaire’, Bernard Baruch.

As a general rule of thumb, small quantities of gold can be safely kept at home, or at a safe deposit box at a local bank. Professional storage is better when it comes to large quantities of gold – you wouldn’t want a large chunk of your wealth to get wiped out alongside your home in, say, a natural disaster.

Now for most people, the idea of “storing gold bullion” involves large stacks of gold bars, piled high to the ceiling. That’s what’s often shown in movies and on TV. But unless you’re a central bank or multi-billionaire, the reality of storing physical gold is a lot less exciting.

What are Good Delivery Gold Bars?

The gold bars that most people envision when they think of gold storage are known as “Good Delivery” gold bars. “Good Delivery” refers to the name of a set of guidelines issued by the London Bullion Market Association, outlining the proper requirements for the gold bars used for settlement in the London bullion market.

Nowadays, these standards have been adopted worldwide, and when you hear the phrase “central bank gold reserves”, these Good Delivery bars are usually the bars involved.

The Good Delivery gold bar weighs 400 troy ounces. In other words, they’re worth over $750,000 USD at current gold prices, as of time of writing. Most people wouldn’t be able to afford a single bar – let alone a pile of them!

Most common sizes of gold bars for consumers:

A more recent alternative standard is the gold “kilobar” – a gold bar weighing exactly 1 kilogram. These have gained in popularity since their size makes them much more manageable for use in investing and trading, but they’re still not cheap – over $60,000 USD at current gold prices, again as of time of writing.

Instead, the bars most gold investors purchase are smaller, 1-ounce gold bars – and these are small and thin enough to hide in the palm of your hand. Gold coins, ranging from a single gram up to a single ounce or more, are also popular choices for gold investors, and like bars they also come in many different weights that makes it easier to purchase a specific dollar amounts’ worth.

A more recent alternative standard is the gold “kilobar” – a gold bar weighing exactly 1 kilogram. These have gained in popularity since their size makes them much more manageable for use in investing and trading, but they’re still not cheap – over $60,000 USD at current gold prices, again as of time of writing.

Instead, the bars most gold investors purchase are smaller, 1-ounce gold bars – and these are small and thin enough to hide in the palm of your hand. Gold coins, ranging from a single gram up to a single ounce or more, are also popular choices for gold investors, and like bars they also come in many different weights that makes it easier to purchase a specific dollar amounts’ worth.

The last thing to keep in mind is that any physical gold you purchase will usually come at a premium to the current market price of gold. This gold premium is typically around 3-4% higher than the current spot gold price for one ounce of bullion. That’s due to the extra costs involved in smelting down and minting these smaller gold products, and in general, the bigger of a bar or coin you buy, the smaller the premium you pay.

There are other features that can add to the price premium of a gold bar or coin. The U.S. government, for example, guarantees the weight, content and purity of each gold coin issued by the U.S. Mint. As a result, these coins can cost more than similar coins offered by private mints.

3.2 Physical Gold ETFs (Exchange-Traded Funds)

People who want exposure to gold bullion without physically taking possession can look at purchasing Exchange-Traded Funds, or ETFs.

Physical gold ETF’s (or funds) hold gold bullion, and so their price is based on the current price of gold. Some even allow you to redeem your shares for physical gold.

Examples of those funds include the Sprott Physical Gold and Silver Trust (CEF), SPDR Gold Shares (GLD), Aberdeen Standard Physical Gold Shares (SGOL), GraniteShares Gold Trust (BAR) and the VanEck Merk Gold Trust (OUNZ), to name a few.

The fees collected by these physical gold funds are used to pay for the storage and management of the gold bullion. So, the fund’s performance isn’t a perfect copy of gold prices – but it’s pretty darn close. And it gives investors the benefits of owning physical gold without the hassle.

Some ETFs even provide leveraged returns relative to the price of gold, giving owners two or even three times the return when gold goes up. The reverse is also true as these ETFs will also go down two or three times more when gold prices fall. These products are generally more intended for short-term speculators.

3.3 Gold Futures and Gold Derivatives

More sophisticated investors can also consider derivatives such as gold futures, or options on gold futures. Such derivatives can replicate the performance of gold prices without the same capital or storage requirements, and without the fees buying an ETF would entail.

Warning Though: Derivatives and derivative trading strategies can be difficult to understand. And since it’s very easy to lose your entire investment in derivatives, this is not for the novice investor. As such, we won’t be going into any further detail here.

4. Gold Mining Stocks

Gold stocks are publicly traded companies whose primary business is related to the gold mining sector. While there are several peripheral industries related to gold such as the jewelry industry, they lack the same kind of direct exposure to gold that gold mining companies have and so aren’t usually considered by gold investors.

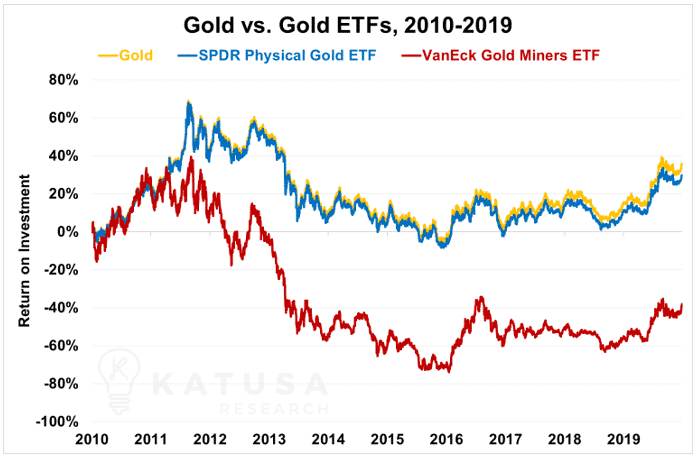

The performance of gold stocks closely tied to that of gold itself, but that performance is also usually leveraged. If gold moves up by a certain amount, gold stocks can go up by several times that amount. The reverse, however, is also true: if gold goes down, gold stocks can also slump much harder, as the chart below shows:

Gold stocks range from small junior exploration companies all the way up to multi-billion-dollar senior producers, known as “majors”.

4.1 The Majors

In most sectors, there are a handful of giant companies that dominate the industry. They own the biggest projects. They employ the most people. They have the biggest bank accounts. They have the best access to capital. And it’s no different for gold.

For example, a small group of large companies mine most of the world’s gold. These include the two largest gold miners, Barrick Gold (GOLD) and Newmont Goldcorp (NEM). Most majors have been around a long time and have relatively stable businesses.

They own a diversified mix of projects around the world. Their market caps range from $5 billion to over $300 billion. Many pay dividends. All of that means majors are less volatile than smaller companies. They’re more appropriate for conservative investors.

But majors still carry risk. A big decline in the price of gold will cause their profits and share price to decline.

There are numerous large gold miners that you can invest in. These are companies that you’ll find on major exchanges like the NYSE and the TSX. You usually won’t get any surprises with these companies because to get to the size they have, they need to have a certain amount of stability, cash flow, and a diversified portfolio.

While they can still provide excellent price performance relative to gold, the downside is there isn’t as much room to grow.

4.2 What are the Three Largest Gold Producers in the World?

1. Newmont (NYSE: NEM)

Not only the world’s most valuable gold producer, Newmont is also the world’s largest gold producer.

Newmont most recent (Q3) 2020 FY production guidance of 6.0 million Au ounces (attributable) is unchanged since their Q2 results, with an AISC of $1,015/oz.

In 2019, Newmont had an attributable global production of 6.772 million Au ounces.

Newmont has operating assets and projects in the United States, Canada, Mexico, Peru, Suriname, Argentina, Ghana and Australia – as well as two notable joint ventures with Barrick: Nevada Goldmines in Nevada and Pueblo Viejo in the Dominican Republic.

The Nevada Gold Mines JV (with Barrick) is currently the world’s largest gold producing complex in the world with three of the world’s top 10 Tier One gold assets.

Newmont has the world’s largest gold exploration budget of US$268m

2. Barrick Gold (TSX: ABX)

The world’s second largest gold producer by market cap is also the world’s second-largest gold producer.

Barrick’s most recent (Q3) 2020 FY production guidance of 4.6-5.0 million Au ounces is unchanged since their Q2 results, with an attributable All-In-Sustaining Cost (AISC – or the cost to produce the gold) of $966/oz.

In 2019, Barrick had an attributable global production of 5.575 million Au ounces.

Barrick has operating assets and projects across the United States, Canada, the Dominican Republic, Argentina, Chile, Zambia, Cote D’Ivoire, Tanzania, Democratic Republic of Congo, Mali, Saudi Arabia and Papua New Guinea. It has two JV’s with Newmont: Nevada Goldmines and Pueblo Viejo.

One of the world’s most famous gold mines, Porgera in PNG, is operated under a JV between Barrick and China’s Zijin Mining.

- Barrick has the world’s second largest gold exploration budget of US$210m.

3. AngloGold Ashanti (NYSE: AU)

The world’s third largest gold producer by total ounces is only the ninth largest gold company by market cap.

AngloGold Ashanti, headquartered in Johanessburg, South Africa, is South Africa’s most valuable mining company with a market cap of ~ $US9.975B.

It has a primary listing on the Johanessburg Stock Exchange (JSE: ANG) and secondary listings on the NYSE (NYSE: AU) and Australian Securities Exchange (ASX: AGG).

After prolonged Covid-19 related mining shut-ins in South Africa, AngloGold reinstated its 2020 FY production guidance of 3.0 – 3.1 million Au ounces (attributable) in time for its Q3 production results.

AngloGold has producing mines in the Democratic Republic of the Congo, Ghana, Guinea, Mali, Tanzania, Australia, Argentina, Brazil.

This year it sold off its remaining South African assets to Harmony Gold, including Mponeng, the world’s deepest gold mine and SA’s second largest.

AngloGold has the world’s third largest gold exploration budget of US$140m.

4.3 Mid-Tier Gold Producers

Mid-tier producers aren’t tiny early-stage businesses… but they aren’t majors. They’re somewhere in the middle. Mid-tier companies are still large companies, with market caps ranging from $1 billion to $20 billion (depending on the industry).

Mid-tier producers typically have a narrower asset base than majors. For example, a gold major might own eight large mines around the world with a couple smaller projects, while a mid-tier producer might own two or three large mines.

Mid-tier producers typically have more room for growth than majors. They are often acquisition targets.

But because mid-tier producers have less asset diversification, they carry more risk than large, diversified companies. If a mid-tier producer runs into a big problem with just one of their projects, it’ll cause a big swing in its profitability and a big swing in its share price.

Making money in mid-tier firms means doing a lot of homework on their relatively small asset bases.

4.4 Gold Development Companies

Development firms with great assets are a unique group of gold companies. These companies aren’t tiny exploration firms with no assets. But they aren’t producing any gold of their own yet either. Development firms own one or more resource-stage projects that aren’t in production yet.

Investors have to be very careful with development firms. They have great potential… but they can have major factors working against them. They can face government opposition. They can be located in remote areas of the world. They can require billions in capital to develop.

For example, a company can own a giant gold and copper deposit, but if it’s in a remote location, turning the deposit into a mine could require billions of dollars of investment.

Having said that, if you buy the right development firm at the right time, the gains can be well worth the risk.

4.5 Gold Royalty & Streaming Companies

A royalty, by the simplest definition, is when a company pays money upfront in exchange for a guaranteed percentage of future revenue or profit.

Unlike a stock investment, it isn’t tied to the perceived value of the company but instead, to what it’s actually producing.

Closely related, but slightly different from a royalty, is a stream. Like a royalty, a stream involves a company paying money upfront.

Unlike a royalty however, instead of receiving a percentage of the revenue, streams receive a percentage of the actual product produced – in the case of a gold stream, that would be the physical gold produced.

Companies that focus on building portfolios of royalties and streams are called royalty companies. Despite the name, royalty companies can own both royalties and streams in their portfolios.

When it comes to the mining industry, a royalty company often fronts the money for developing and building a mine. Once the mine is built and rocks are coming out of the ground, that’s when the royalty company will start making their money back.

Since mining is a risky business, you won’t see any royalty companies making deals with junior-stage explorers, because there’s very little guarantee that their investment will ever actually pay off. That’s why you’ll only see royalty companies stepping in to provide capital for very advanced-stage projects that have already been drilled out, with feasibility studies done, and are looking to go into production.

In summary:

- A royalty is when the company receives a percentage of revenue or profit.

- A stream is when the company receives a percentage of production.

- Royalty companies can own both royalties and streams.

4.6 Junior Gold Exploration Companies

Exploration firms are the “bloodhounds” of the resource business. They raise money and explore for resource deposits. You’ll often find them in jungles, deserts and frozen wastelands.

They’re generally less well known and traded than larger companies. Typically, funds and institutional investors are prohibited from investing in junior gold stocks for liquidity reasons.

Exploration firms have market caps that are typically in the $5 million-$1 billion range, which is tiny when compared to a major like Barrick (Barrick is several hundred times larger than most explorers).

The most common exploration business model is to find an area that might have gold deposits, raise money from investors, then start drilling holes in the ground. If the explorer finds a significant deposit, it will sell the deposit to a larger company.

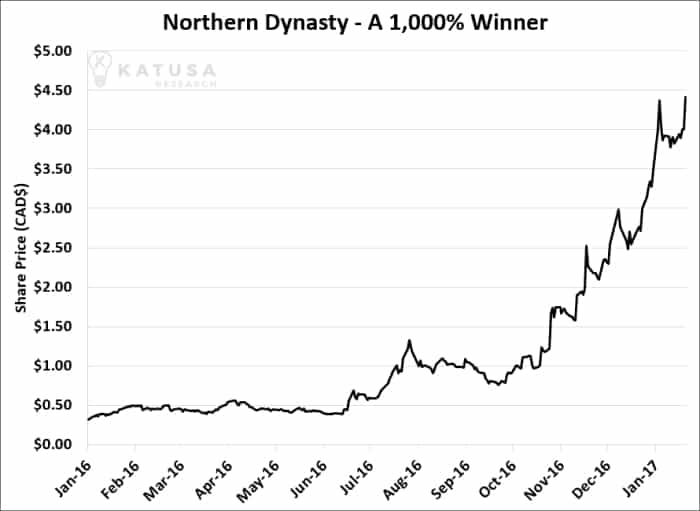

Of course, the odds of success aren’t great, and the risks are high. But if you’re looking for stocks with the potential to climb 100%… 500%… even 1,000%, you should be looking at junior exploration companies.

Juniors have much greater potential to register huge gains in a short time than larger stocks.

Take Northern Dynasty for example…

The reason is simple… It’s much easier for a $200 million junior to grow 10-fold than it is for a mature $200 billion giant to grow 10-fold.

That doesn’t mean the $200 billion giant is a poor investment, it just means that it’s not an ideal vehicle for someone looking to make giant returns in a relatively short amount of time.

Keep in mind that a $200 million junior is worth just one-tenth of one percent of a $200 billion major.

The junior has plenty of room to get much bigger. But the odds are greatly stacked against success. Less than 1% of explorers will find a significant deposit. The vast majority burn through their cash and find nothing.

However, there is a small group of people who are habitually successful when it comes to finding large resource deposits. If you invest with proven, honest operators, you can make large returns in the exploration sector more consistently.

5. Why Invest in Junior Mining?

It’s important to note that juniors can be exploration firms, royalty firms, or even firms that have current production. The label “junior” only concerns their size and is often also called “small cap”.

In addition to their potential for massive growth, juniors often have features you like to see as an investor…

Juniors are much more likely to have management teams with large ownership stakes in the company.

The management teams of juniors are more likely to have “skin in the game.” This ensures that management’s interests are aligned with ours.

This contrasts with the directors and C-suite of larger companies, who rarely have a meaningful portion of their wealth in the company’s stock.

Juniors are more likely to be the targets of takeovers by large companies.

This can result in junior companies being purchased at large premiums.

Buyouts aren’t always in your best interest (sometimes your holdings will be worth more than the purchase price), but they generally are.

Juniors have a lot less analyst coverage than large caps.

A $200 billion giant could have over 30 different professional analysts covering the stock. They’ll analyze the company inside and out. Their research will be read by the world’s largest investment managers, and the market will generally have a pretty good idea of what the company’s worth.

It’s not uncommon for a junior company, on the other hand, to have ZERO professional analysts covering it. The management at some juniors can go a whole year without fielding a call from a professional analyst.

The lack of widely disseminated information about juniors allows investors to get a big “information edge” in this market. It makes it possible to find pricing inefficiencies and uncovered opportunities. The market isn’t swarming with professionals looking under every rock.

You can think of it like this: would you rather take your child on an Easter egg hunt with 100 other kids or with 5 other kids? Your child will have a lot more fun and find a lot more eggs competing against just 5 other kids.

6. Gold Funds and ETFs

Instead of investing in individual gold companies, some choose to invest in a portfolio of gold stocks instead. They accomplish this by investing in gold or precious metals focused mutual funds and ETFs.

These might be either actively managed funds that focus on gold stocks in order to provide long term returns, or passively managed funds that mimic gold equity indices. Physical gold ETFs, mentioned earlier, generally fall into the latter.

Active and Passive Gold Investing

Active and passive are two very different approaches to the world of investing, and that’s no different when it comes to gold funds. Each has their own pros and cons and the question of which one is better depends on the individual investor’s preferences and risk appetite.

Active investing is, as the name implies, is a more hands-on approach. The ultimate goal of active investment is trying to pick the best apples in the orchard.

This usually means having someone who can actively manage which companies to invest in, such as a hedge manager. Investors who go this route are counting on the experts’ expertise in selecting the best companies in the sector.

Passive investing is generally considered a more risk averse approach. People who take this approach focus on buying the whole orchard (and hoping that the good apples out number the bad).

Active investing has higher risk/reward, while passive investing tends to offer more stability.

Freedom to choose the companies & reallocate dollars quickly.

Simpler because it doesn’t require as much attention.

Whether active or passive, mutual funds and ETFs allow people to easily invest into a managed portfolio of holdings. One benefit of investing in funds is that depending on which one you invest in, you may be able to reduce your risk exposure by not putting all your eggs in one basket, as opposed to if you were to invest in a single gold mining company.

Investing in a fund also means that you won’t have to worry about managing a portfolio of equities yourself if all you want is broad exposure to the gold sector – the fund takes care of that, albeit for a fee.

Two good examples of such gold funds are the VanEck Vectors Gold Miners ETF (GDX) and the VanEck Vectors Junior Gold Miners ETF (GDXJ).

7. How to Invest in Gold Stocks

If you want to invest in gold stocks, you’ll need to find yourself a stockbroker. Setting up an account with a stockbroker is what lets you carry out transactions on the stock market.

There are two different kinds of stockbrokers: full-service brokers, and discount brokers.

Full-service brokers, as their name suggests, are companies that provide the whole spectrum of investment services. In addition to helping you buy and sell stocks, they also provide services like portfolio management, market research and analysis, legend removals, and so on.

Discount brokers, on the other hand, generally provide none of those extra investment services mentioned above. Instead, they’re merely trading platforms that allow their clients to execute buy and sell orders on the stock market, with no extra frills attached.

That said, the reason why they’re called “discount” brokers is because, as you may have guessed, their commission fees are lower – usually a fixed, flat-rate amount, like $10.

- Regardless of whether you’re placing a $5,000, $50,000, or even $500,000 dollar trade, your fee will stay $10.

While you do save money on fees with a discount broker, the trade-off is that you end up losing access to the services provided by a full-service broker. Participating in a private placement, for instance, is a process made a great deal easier by having your full-service broker deal with things like the delivery of physical share certificates.

Among seasoned investment veterans, it’s not unusual to find people who have accounts with both types of brokers. For example, an investor might choose to use a discount brokerage account for day trades and short-term positions, while retaining a full-service brokerage account for long-term positions and private placements.

At the end of the day, whether you choose a full-service broker or a discount broker – or both – depends on your investment goals and needs. Understanding your own financial objectives will help you decide which solution suits you the best.

8. What Are the Risks of Investing in Gold Mining Companies?

When you invest in gold mining companies, it’s important to remember that in the long run, the performance of your investment is still largely tied to the performance of gold itself.

A weak gold price environment isn’t good for any gold company, and so before you make an investment in gold companies, the first thing you need to ask yourself is whether you believe gold prices will do well.

Of course, most gold mining companies won’t accurately mimic the exact price performance of gold. That’s because there are a lot of issues that gold mining companies can face when trying to build and run a mine, just like when mining for any other commodity. They might run into trouble with the local government or suffer from other geopolitical issues like a trade war. Staffing could be affected by a pandemic outbreak or even just a labor strike. They could find that the gold they’re mining is lower in grade than initially projected. The list goes on and on.

For junior gold companies, which are still exploring and developing instead of producing, there are even more risks involved. For starters, the company might not ever find economically viable gold deposits before going bankrupt! Besides that, there are other risks like the company failing to attract enough interest to fund their drill programs, weak gold prices killing interest in grassroots gold exploration, or having a weak executive team mismanage an exploration program for an otherwise promising asset.

Just as is the case with any other investment, there are many risks inherent to the gold mining industry. Make sure you clearly understand them before you commit any of your capital.

9. What Are the Best Gold Stocks?

When you’re trying to find the right gold stock to invest in, there are many factors to take into consideration.

The most important question you should ask yourself is, what kind of investment are you looking for in your portfolio? There’s no such thing as the best gold stock for everyone, because people have different investment objectives, and appetites for risk tolerance.

If you’re looking to diversify in something conservative for wealth preservation, physical gold ETFs and other large gold funds would be what you’re after. Your primary considerations in this case would be questions like how closely their holdings mimic the price of gold (Do they hold physical gold or options? Are they leveraged?), what their fee structure is like (Is the fee fixed or performance based? Is the return capped?), and how volatile the stock is.

- If you want more safety, but also some income generation on the side, then you might want to check out dividend-paying senior gold miners.

For companies like these you’d want to see how healthy their balance sheet and cash flow are, how stable their dividend has been historically, whether or not there are any geopolitical issues that might hamper their future revenues, and so on.

If you’re looking for growth, then junior gold miners would be your play. For companies like these you’d need to consider how experienced the management team is, where their assets are located and how developed they are, whether they’ll be able to fund their exploration programs or if they’ll need to go to the public markets for capital soon, and more.

Figuring out what the best gold stock to invest in can be tricky because the criteria for “best” can differ depending on what your portfolio needs. That’s why it’s important to be educated, and to do your due diligence when it comes to making investment decisions. Don’t just trust anyone that tells you what “the best gold stock to invest in right now” is, without doing some homework first.

10. What’s the Gold Mining Lifecycle?

Exploration:

The first step to starting a gold mine is finding a place with enough gold in the ground to make mining it worthwhile. Getting past this stage isn’t easy and involves a lot of geology, chemistry, drilling and sometimes luck.

First, companies start by staking a claim. Sometimes they’ll do this themselves if they have a geologist who’s already got a property in mind, and sometimes they’ll pay to buy a promising project. Either way, this location will already have been flagged as having potential, through low-level prospecting work like rock chipping or panning.

After this, the company will commence early-stage exploration work. There are several different methods here that will be used – airborne magnetic surveys, grab and channel sampling, trenching, and so on. Regardless of what kind of work is done, they all serve the same purpose – to confirm that there’s an unusual or “anomalous” amount of gold present, and to highlight possible targets for drilling.

Drilling is where fortunes are made or lost. Drill rigs are nicknamed “truth machines” because there’s no arguing with what your drill results tell you. Of course, your drill rigs won’t tell you anything if you’re drilling in the wrong places to begin with, which is why the work preceding the drilling is just as important.

Once enough drilling has been done, companies can then use their drill results to construct a model of their deposit in order to get a 43-101 mineral resource estimate. Often, companies will continue drilling even after they’ve established an initial resource estimate, in order to further prove out their deposit.

It’s been estimated that fewer than 0.1% of prospective sites actually end up as a productive gold mine, and only about 10% of the gold deposits in the world have enough gold to warrant development.

Keep in mind that throughout the exploration stage, companies aren’t making any money – and without cash flow, they must rely on outside sources like private placement financings to fund their exploration programs. You’ll often see companies raise money multiple times while they’re still drilling out their properties.

Development:

If the company has a sizeable resource and things are looking good, they can proceed to the next step – a preliminary feasibility study, or prefeasibility study, for short. This is where basic work is undertaken by the company to see if it’s potentially worth turning the project into a full-fledged mine, and significant issues and other potential challenges are flagged.

Following the prefeasibility study, the company can choose whether they want to keep advancing the project or abandon it because it’s not economically feasible. If they go with the former, they’ll move on to the feasibility study, which is a much more in-depth report than the prefeasibility study that lays out all of the logistical, technical, and financial requirements of building an operating mine on their deposit.

If you’re wondering why a prefeasibility study is even necessary before the feasibility study, it’s because feasibility studies are very expensive. They can represent 1%, or even more, of the total cost of building a mine. As such, the prefeasibility study is there to ensure companies have good information to work with when they’re considering whether to go forward with the much pricier, full-fledged feasibility study.

After the company gets a positive feasibility study, secures the funds necessary, gets all the appropriate permits and licences they need, and greenlights the construction of a mine, this is where the physical work begins. Generally taking between one and five years, this is where the construction of the physical mine, as well as the infrastructure needed, actually takes place. If the feasibility study was properly conducted, there won’t be any major surprises at this point, but it’s not uncommon to see minor hiccups along the way here.

Operation:

Once the development stage is complete, mining companies can move into the operation stage and begin extracting the ore that will be processed and refined into gold. The amount of ore that’s mined often depends on the price of gold. When the price of gold is high, lower quality ore, or ore that’s more costly to mine, may be worth producing, while when prices are low it might not be.

Depending on the size of the deposit, mines can remain operational for up to 30 years, or even longer. In many cases, a company will also keep developing a deposit even while it’s being mined, to see if there’s more gold beside or even below their mine that could be feasibly extracted later on.

Decommissioning:

After all the gold that’s profitable to mine for has been removed, a mine must be decommissioned. This involves dismantling infrastructure and rehabilitating the land, a process also known as land reclamation. Often a mining company is required to monitor the site for years after the mine has closed.

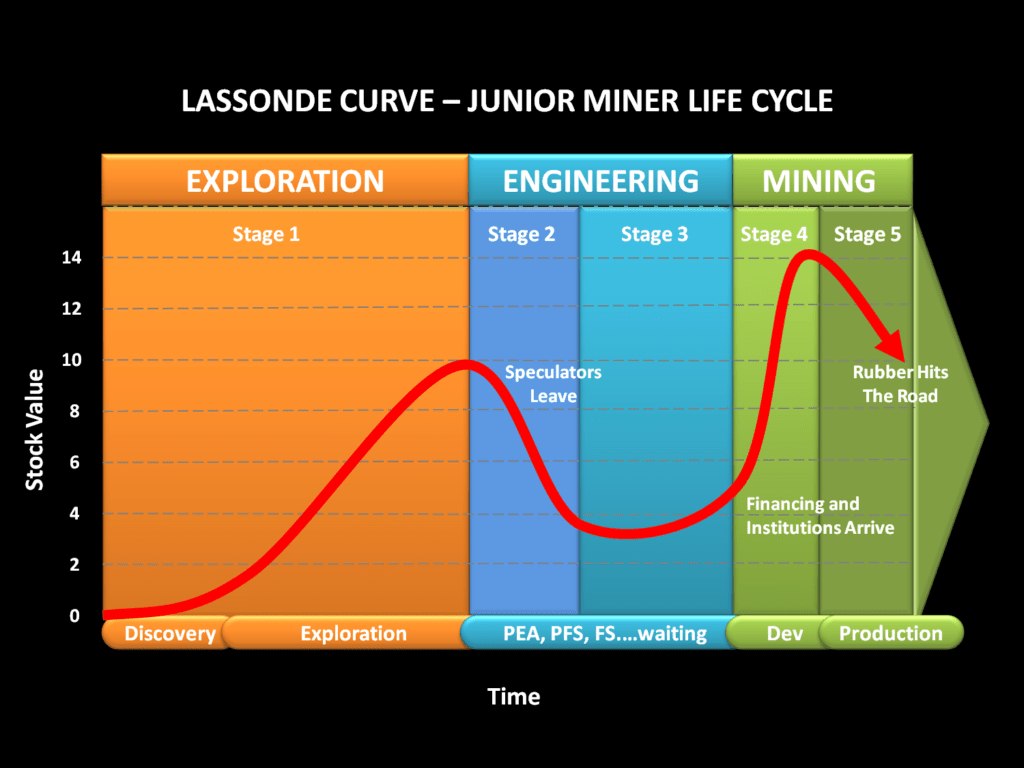

Named after Pierre Lassonde, the founder of the royalty giant Franco Nevada, the “Lassonde Curve” is a chart that represents the life stages of a mining company.

It’s very intuitive, and yet it’s pretty simple. I regularly refer to it to help my subscribers understand the context of an investment opportunity I’m proposing.

The “Lassonde Curve” is definitely one of the these “sector basics” you’ll want to grasp.

Finding deposits, building the mine, and then eventually extracting the resource takes years and hundreds of millions, or even billions of investment dollars.

As companies evolve through these stages, they tend to grow in size and decrease in risk.

In many ways, these stages are similar to a human lifecycle. We start out as a child, grow awkwardly through puberty to become a teenager, then a young adult, and eventually a mature adult. Well…most of us, anyways.

And at each of those stages, people tend to take less risks. It’s similar with resource companies.

These are the four basic lifecycle stages: junior explorer, junior developer, mid-tier producer, and large-cap producer.

11. What are the Different Types of Gold Deposits?

There are many different types of gold deposits, each with their own characteristics. Some of the most well-known and prolific types of deposits include:

- Placer deposits,

- Epithermal gold deposits,

- Carlin-type deposits, and

- Copper-gold porphyries.

Concentrations of similar types of deposits often occur in large regions that have undergone the same geological processes over a widespread area. The massive Witwatersrand Basin of South Africa, most prolific of all the gold-producing regions in the world, is thought to have formed from placer deposits.

The Carlin trend of northeastern Nevada, named for the town of Carlin it runs through, is home to the eponymous Carlin-type deposits that have propelled Nevada into becoming one of the top gold producers in the world.

If you’re examining at a specific company’s gold project and want to better understand its geological characteristics and any challenges the company might face in developing it, it can help to look at other gold projects of the same type of deposit – particularly if they’re in close proximity – to learn more.

12. How Do You Read Mining Drill Results?

When it comes to gold drill results, there are a lot of different factors at play. The first thing you’ll see is the length of the drill intercept and the grade – but that’s only scratching the surface.

In general, the longer the interval, the lower the grade needs to be. Finding a small zone of extreme high-grade mineralization like say, 20 meters of 5 grams per ton (g/t) gold, is effectively the same as finding a large area of low-grade mineralization, like 100 meters of 1 g/t gold. However, this is where the depth of the intercept comes into consideration.

Although the contained gold may theoretically be the same, it’s much easier to mine out a deposit that’s 20 meters wide at 5 g/t gold than it is to mine out a deposit that’s 100 meters wide at 1 g/t gold, since there’s less ore to remove.

This doesn’t matter much near the surface, where cost-effective surface mining techniques like open pit mining can make lower grade deposits economic to mine. If the drill intercept is deep underground, however, the higher costs of underground mining can make lower grades very unattractive.

Gold prices play a significant role here as well – if the price of gold goes up, then previously uneconomic gold deposits may suddenly find themselves economically feasible. That said, any mines whose grades are so low that their operating costs are on the razor’s edge between profit and loss should be avoided.

- As a general rule of thumb, 100 meters of 1 g/t gold – 100 gram-meters (length times grade), or the equivalent, can be considered an excellent drill result.

- If the drill intercepts are shallow and near-surface (within 300 meters of the surface), however, a shorter interval or lower grade between 0.5-1 g/t gold can still be promising.

- If the drill intercepts are at depth (300 meters or more from the surface), you’d want at least 5 g/t gold, ideally with a thickness of more than 5 meters.

For the most part, anything lower than 0.4 g/t gold is nothing to get excited about. By the same token, beware of extremely short high-grade intercepts – 10+ g/t of gold may look stunning on the news release, but if it’s a 0.5 meter interval of 10+ g/t gold within a 5 meter interval averaging 2 g/t gold at depth, then depending on the deposit type it might warrant follow-up work in a future drill program, but it’s not promising anything by itself just yet.

Speaking of the deposit type, that’s also very important to take into account. In Carlin-type deposits or copper-gold porphyry type deposits, lower grades in the ballpark of 0.5 g/t are the norm. However, these deposits tend to be very large and near surface, which makes these deposit types still economically feasible to mine.

With vein-type gold deposits like epithermal gold deposits, however, you might find an extremely high-grade vein north of 10 g/t gold that’s only 2 meters wide but extends for hundreds of meters.

- There can be other things to consider as well – for example, is this a step-out hole, or an infill hole?

If it’s an infill hole, are the results in line with surrounding drill holes’ and do they create continuity in the orebody? If it’s a step-out hole, is it down trend from previous zones of mineralization or is it a new target?

If you see drill results that you aren’t sure how to interpret, make sure you ask the right questions. Never simply take drill results at their face value!

13. Common Mining Terminology

Adit

Alloy

Apparent Width

Assaying

Base Metal

Bedrock

Borehole

Bulk Sample

Byproduct

Capital Expenditure

Carlin-type deposit

Claim

Core Samples

Concentrate

Deposit

Development

Diamond Drilling

Directional Drilling

Drilling

Drill Intercept

Drill Program

Drill Rig

Environmental Impact

Exploration

Feasibility Study

Flotation

Geochemistry

Geological Survey

Geophysics

Grab Samples

Grade

Heap Leaching

Infill Drilling

Karat

Leaching

Life of Mine

Metallurgy

Miller Process

Mineralization

NI 43-101

Open Pit Mine

Ore

Orebody

Outcrop

Overburden

Placer Deposit

Precious Metal

Prefeasibility Study

Private Placement

RC Drilling

Reclamation

Recovery Rate

Refining

Reserve

A reserve is a subset of a resource that’s known, usually via at least a prefeasibility study, to be economically viable to recover. You’ll often see these referred to along the lines of “NI 43-101 Mineral Reserve Estimates”, indicating that they’re compliant with the NI 43-101 standard. Mineral reserves are broken down into two categories: Proven and Probable.

• Proven (or Proved) reserves are reserves that are economically feasible to extract with a high degree of confidence. Losses that naturally occur when the deposit is mined are accounted for.

• Probable reserves are reserves that are economically feasible to extract with a reasonable degree of confidence. Losses that naturally occur when the deposit is mined are accounted for.

If you’re an investing veteran, you may have seen the term Possible reserves used before. Possible reserves are not used when reporting mineral reserves. However, the oil and gas industry use Possible reserves in lieu of a resource to denote reserves that have a low chance of being economically feasible to extract.

Resource

A resource is the amount of mineral or other desirable material in a deposit that’s considered to be reasonably extractable. You’ll often see these referred to along the lines of “NI 43-101 Mineral Resource Estimates”, indicating that they’re compliant with the NI 43-101 standard. Resources are broken down into three categories: Measured, Indicated, and Inferred.

• Measured resources are resources estimated to exist with a high degree of confidence. These resources have usually been proven out thoroughly with lots of drilling.

• Indicated resources are resources estimated to exist with a reasonable degree of confidence.

• Inferred resources are resources estimated to exist with a low degree of confidence. It’s usually inferred from a deposit’s geological characteristics, without having been verified by drilling or similar work.